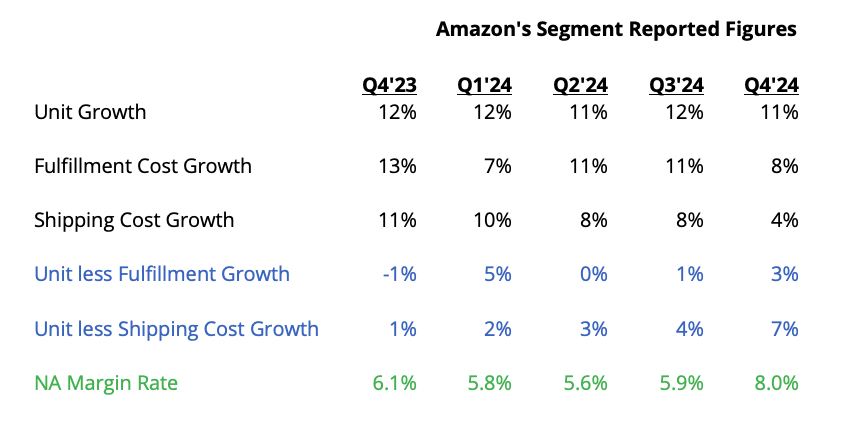

What struck us about Amazon’s Q4 results was the significant upside in its North America margins and profits; margins hit 8.0% vs. the expectation of 6.5% (BBG) and EBIT hit $9.3B vs. the expectation of $7.4B. Amazon has worked diligently to lower the cost to serve since early 2023 by staging more of its inventory close to the consumer using predictive inventory planning and is regional delivery stations. On the call, CEO Andy Jassy said, “Our speed of delivery continues to accelerate, and 2024 was another record-setting year for Prime members. We expanded the number of same-day delivery sites by more than 60% in 2024, which now serve more than 140 metro areas.” More same-day is effectively less handling and less miles (or “stem miles”) and more savings. More automation and more items per shipment have also been key enablers of efficiency.

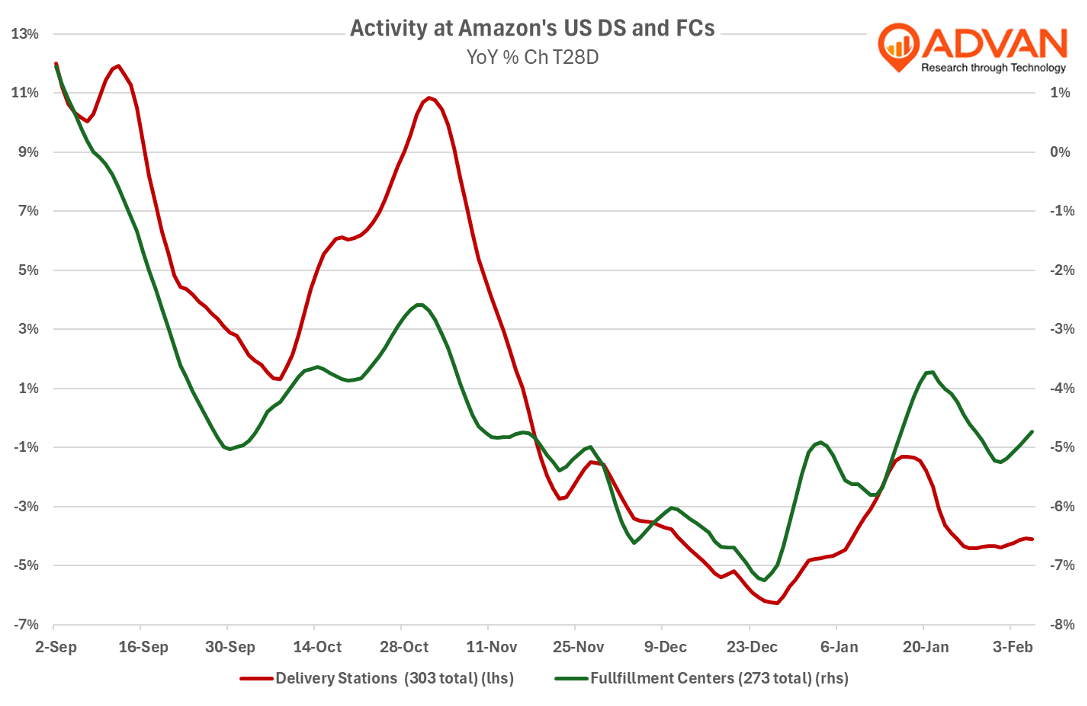

The table below shows the improvements in efficiency both in fulfillment and shipping costs. Assuming an average order value of $30, the savings on that order would be 7%, or $0.86. We see strong evidence in Advan’s data that Amazon continues to drive efficiencies in the new year with activity at both the delivery stations and fulfillment centers down YoY as shown in the chart below. Looking at Q1’25 expectations of 7-8% margins, should the cost growth remain at +6% and the sales growth at +10% then margins will hit 9.2% with EBIT-$s well ahead. Given the lower activity for January, that +6% estimate appears conservative given that activity on a YoY basis is well below Q4’s rate. Jassy also shared, “As we look to 2025 and beyond, we see opportunity to reduce costs again as we further refine inventory placement, grow our same-day delivery network, and accelerate robotics and automation throughout the network.” In other words, they aren’t done with margin expansion.

LOGIN

LOGIN