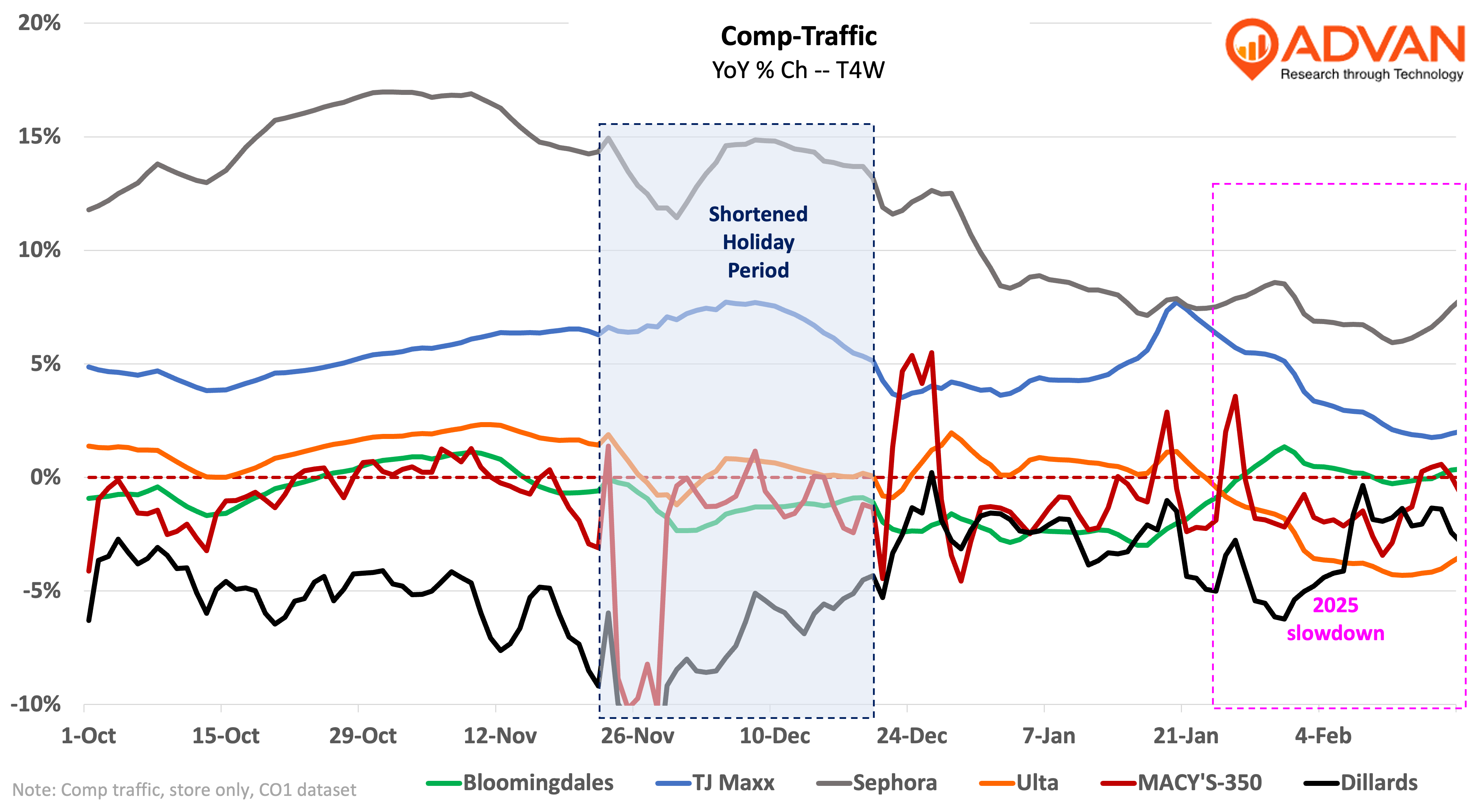

Dillard’s is the first of the traditional department stores to report in the earnings cycle, providing a glimpse into the past few months of consumer demand. Dillard’s comp-sales decline of -1% was the most muted of the year, but that leaves the business only 5% above 2019’s level (on a comp basis) which is below the 8% level in the 1H’24, i.e. things are not getting “less bad” on an underlying basis. Moreover, comp-traffic (Advan) was down for most of the period. Looking at just the Dillard’s top-50 locations shows a -4% decline in visits on a TTM basis, or similar to what the chart shows. The 2H of January and February have been marked by bad weather and traffic deterioration which we wrote about in our TJX results story . That slowdown is broad and macro in nature. Some of that macro is simply bad weather, but more broadly its consumer uncertainty, as captured in the decline in consumer confidence measures , stemming from the rising number of corporate layoffs, the dynamics in Washington DC, and egg prices (yes, egg prices).

Dillard’s doesn’t do an earnings call or provide guidance and so the only sentiment that we have from them is the release’s quote from William Dillard saying, “With sales down 1%, we worked on controlling expenses but lost some steam in gross margin,” as well as the release’s sentence on categories, “Stronger performing categories were home and furniture and cosmetics. Weaker performing categories were men’s apparel and accessories and shoes.” The better home and furniture results is a new call-out, but that is a macro as Williams-Sonoma, RH, and Arhaus have all noted stronger demand and reported a strengthening in trend. Dillard’s average ticket (Advan) increased 3%, which likely reflects the business mix and the strength in home and furniture. The call-out on cosmetics is consistent with recent quarters.

As it relates to derivative reads from Dillard’s for Macy’s and Kohl’s, Macy’s and Bloomingdale’s were able to better hold their traffic volume. Macy’s generated a slight increase in average ticket and has a much larger furniture and home business than Dillard’s, thus it will be a more weighty cyclical tailwind. Macy’s also has a high degree of confusion in their store portfolio with cohorts at different stages of remodeling, re-merchandising, and re-platforming, and other “nuances.” This creates more complexity for external tracking of the business. The Advan model* is forecasting a -2.3% comp-sales decline (inclusive of all three banners), with a 150 bps Moe and an 89% correlation. However, given the traffic and Dillard’s results that seems too punitive. However, there are 66 Macy’s locations that closed in February and those can create large distortions on the consolidated growth rate as they were likely short on inventory during the holiday period. It’s the go-forward 350 locations that are critical to watch. (Advan has created a list and cohort.) As the figure above shows, traffic to the Macy’s go-forward 350 closely mirrored Bloomingdale’s for the period, which is a favorable sign for Macy’s go-forward business.

Advan estimates* that Kohl’s had a terrible Q4 with sales down -14% (Moe 110 bps, 92% T6Q correlation). As a reminder , Kohl’s has a new CEO– Ashley Buchanan who had been CEO of Michaels Companies since 2020 and, prior to that held roles at Walmart and Sam’s Club. Separately, historically Kohl’s sales have been very sensitive to adverse weather and February’s will influence their guidance on Q1 and the year (should they issue one). The new CEO is also likely going to set the bar low on guidance so that he can confidently exceed that low bar. We will be listening closely to their commentary of the Sephora at Kohl’s business and what the plan is to stabilize Kohl’s market share in apparel.

Speaking of beauty and Ulta, they report earnings in two weeks. Advan estimates* a difficult Q4 with revenue (excluding last year’s extra week) increasing only +1.9% (Moe 60 bps, 96% T6Q correlation). That subdued level of growth would imply a slight decline in the store comp-sales. Comp traffic for the quarter has flirted around flat, especially during the critical holiday season. Recall that Ulta is facing two competitive encroachments – the Sephora at Kohl’s expansion and Amazon. Last week, we were at a large industry conference (CAGNY) where we heard from e.l.f. Beauty, Coty, and L’Oréal. Our takeaway from those presentations and discussions was that the mass color segment remains under pressure and the lux and fragrance segments are continuing at their historic rate (vs. the higher inflationary-driven rate experienced in ’21 – ’23). All presenters talked about robust growth at Amazon (both on the mass and lux side.) and e.l.f. and L’Oréal have an amplified new product program for 2025 (we expect that Coty and Estée do as well.) Those programs should stimulate industry growth in the months ahead. Ulta’s results should affirm these takeaways. Lastly, recall that Ulta also has a new CEO – Kecia Steelman, previously president and chief operating officer of Ulta Beauty. More on that in a couple of weeks.

‘* Utilizing the Maiden Century model.

LOGIN

LOGIN