By Thomas Paulson, Head of Market Insights

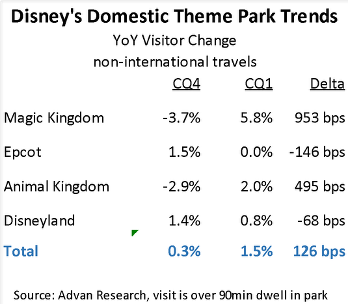

At a time when many are concerned about a recession and a cutback in consumer spending, Disney once again demonstrated that it is a special place in consumers’ lives and an exceptional business. Domestic park attendance inflected by +300bps to +1% growth. Advan data in the table below shows that the Orlando parks, especially Magic Kingdom, drove the acceleration as hurricanes weren’t disruptive in the period, like the prior quarter. Additionally, the Los Angeles fires, which significantly depressed attendance at Universal Studios Hollywood, were too far north from Disneyland and not “called out” as a deficit to results. Per-capita park spend decelerated by -200bps to +2% growth (which aligned with Advan’s credit card data spend trend). Per-capita park spend is positively correlated with dwell time in Advan; dwell time decelerated -300 bps QoQ, or similar to reported results. (Note: Disney reports growth of visitor attendance to its domestic parks, that includes international visitors and some fractional accounting for season pass holders and ticket packages. Advan visits also include “cast members” and other employees and suppliers. As such, there will be some difference between the reported attendance and visits per Advan.)

CFO Hugh Johnson said, “Looking to the remainder of the fiscal year, we are closely monitoring the macroeconomic environment, however based on what we are currently seeing - including in our second half bookings at Walt Disney World remain solidly above prior year… Bookings are up in the summer right now. So certainly, feeling positive.”

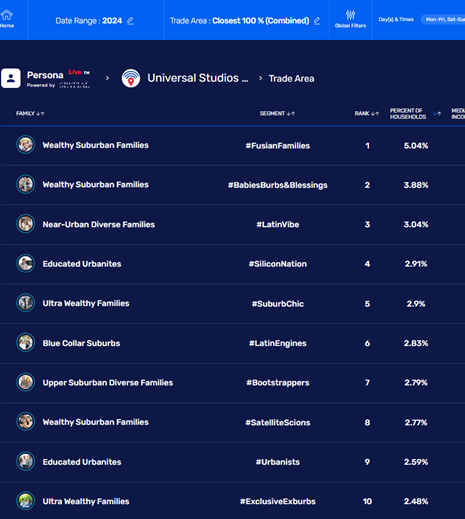

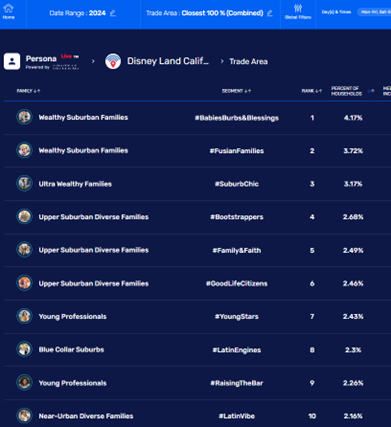

One aspect of Disney’s business that keeps it exceptional and less cyclical is a devoted and different consumer rather than the generalized false belief that it has a higher-income visitor. For example, Universal Studios Hollywood’s visitor median income is higher at $94.2K than Disney’s $90.2K; moreover, 64% of Hollywood’s visitors have household incomes above $75K vs. Disneyland’s 59%. Shown in the table below, Young Professionals are in Disney’s Top-10 vs. not in Universal’s.

Looking forward, it will be very interesting to analyze what type of visitors go to the new Universal Epic Universe theme park in Orlando. The previews of Epic have been stupendous , and so, we guess it will attract visitors of all walks of life. And so, for summer bookings to Disney World being up is “interesting” and demonstrates that Disney remains “special” even when there is an epic disruption in the market.

_Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN