By Thomas Paulson, Head of Market Insights

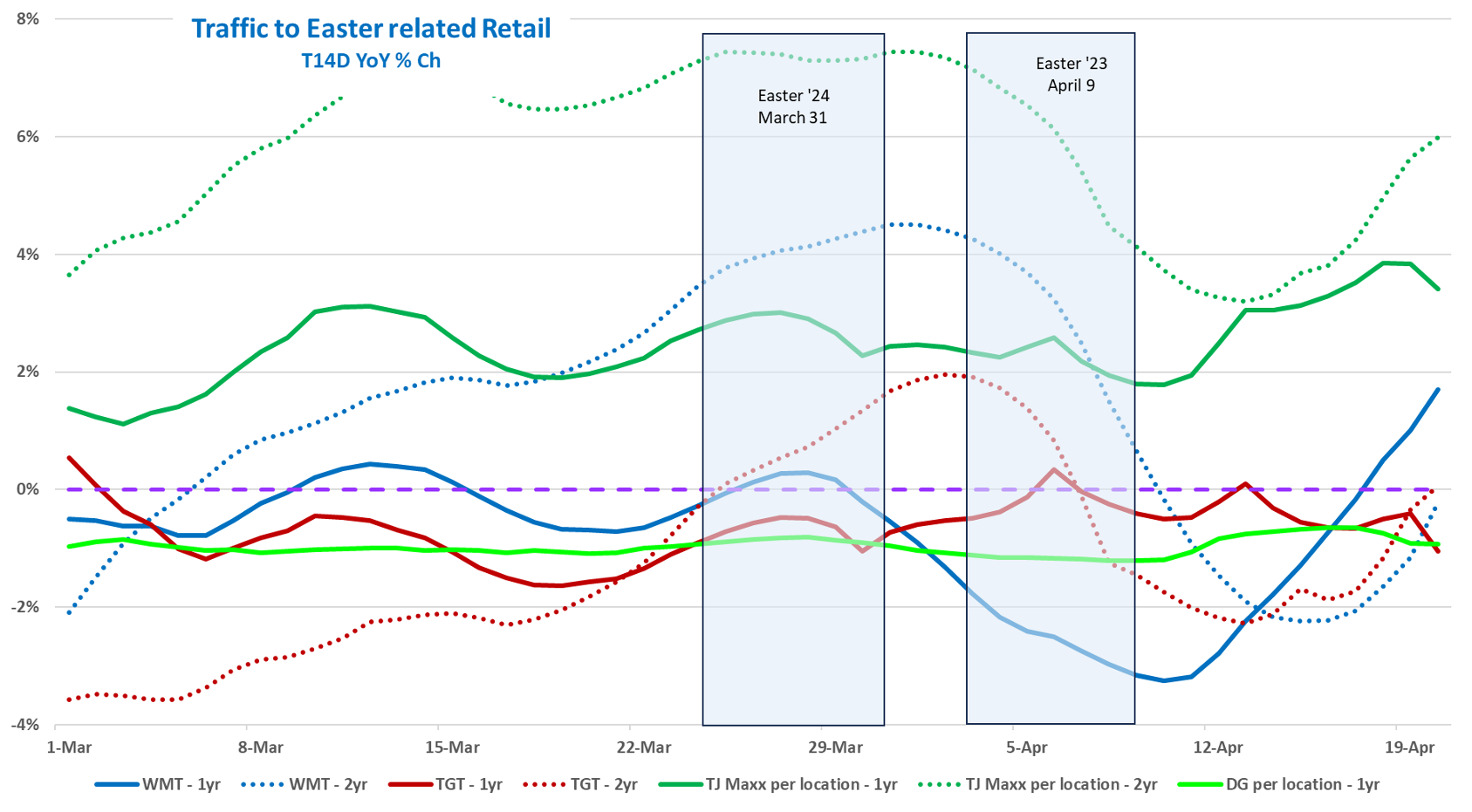

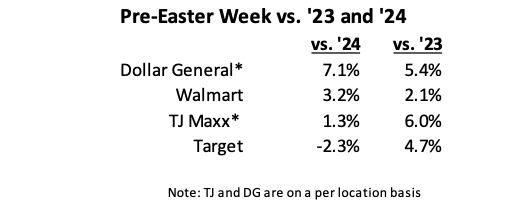

Traffic trends going into Easter Sunday 2025 demonstrated that households planned to celebrate the holiday this year and that the “outside environment” didn’t diminish their enthusiasm and preparations. (Generally, holidays are largely immune from anxieties about the economy; it’s the shoulder periods between seasons that suffer.) As it relates to foot traffic, interpreting this year’s trend is complicated by the late timing of Easter vs. the early year in 2024. As such, we’ve shown 1- and 2-year trends in the chart below. Our read of the chart is that while Target’s and TJ Maxx’s pre-Easter traffic picked up slightly vs. the pre-holiday period, the lift was principally due to the timing of the holiday vs. say “stronger Easter sales.” By contrast, while Walmart and Dollar General have been a bit more volatile, they also enjoyed a stronger lift from Easter. We draw that conclusion by comparing the 7-day period running into Easter to that of ’24; more on Dollar General and Walmart outperformance in a minute.

As to how the “outside environment” and how economic anxieties may be impacting consumer spending, we’ve also listened to dozens of earnings calls this past two weeks and we’ve heard of little disruption in spending by the more affluent. You can read our takeaways from LVMH’s results here and March retail sales . However, those earnings calls also noted some concern about spending by the less affluent (something that we also highlighted in our story on LVMH and as of late in our blog). Relatedly, in our data we do see that traffic is notably weaker in QSR restaurants (traffic down -30-40 bps YoY), which reflects softer consumer spending by the less affluent and that softness is what we read into the visits decline at Dollar General for the broader period shown in the chart above, i.e. it’s macro and not DG specific.

Over the years, we’ve learned that economic malaise amplifies seasonality as it relates to traffic and sales, with the holiday peaks higher and the shoulder periods broader and deeper; moreover, that “shifting” has become especially pronounced for retailers that serve the less-affluent. And so, the pulses in demand by less affluent households and the distortions to the base-periods is what’s behind the volatility in traffic at Walmart and Dollar General shown above. Moreover, those consumer pulses are why the lifts shown in the table are stronger for Walmart and Dollar General than TJ Maxx and Target. In Advan’s transaction data, we also see that the holiday timing is also swinging around the spend that’s coming from the visits to Dollar General and Walmart, with larger lifts in spend-per-visit for the seven days prior to Easter. Looking forward and exiting the spring season, there aren’t any notable seasonal events outside of Mother’s Day and Memorial Day and so we expect to see a slower trend again. Retailers have brought in more inventory to get ahead of tariffs. Should traffic soften, which seems likely, retailers may grow uncomfortable with their inventory levels and that will lead to higher promotions to clear the goods. And so, this is setting up for an interesting next couple of months and especially for the retailer earnings season starting in three weeks from now.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN