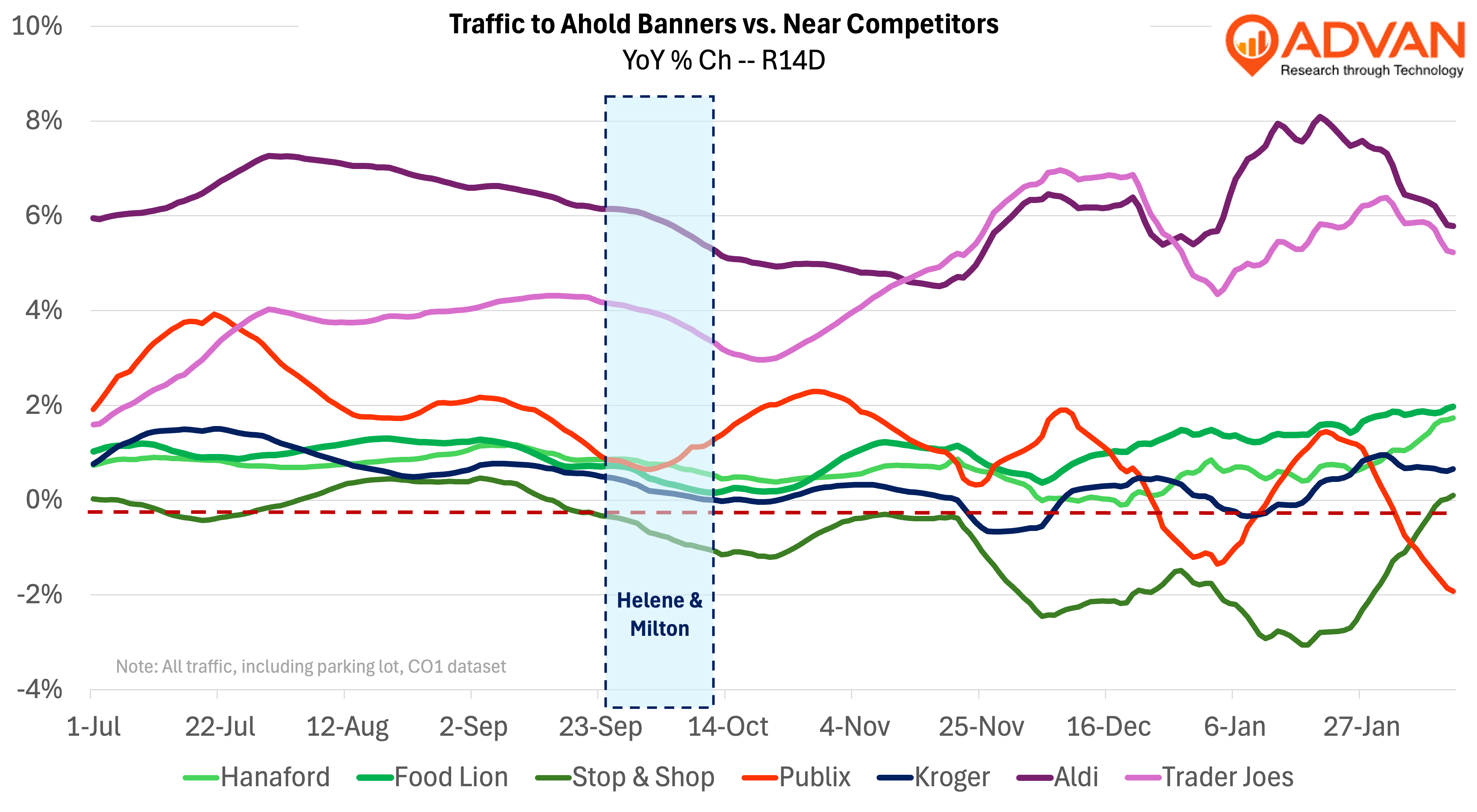

Ahold reported a stronger set of figures for Q4. Per Advan Research, traffic is even better 2025-to-date, including for its Stop & Shop, as shown in the chart below. The improvement is on both a 1-year and 2-year basis for all Ahold brands. On its results, management noted that volumes for the U.S. business had finally turned positive and that consumers were responding to its price investments in the market (i.e., lowering prices and increasing the promotional cadence and depth). This reverses the trend that they were facing of fewer visits and fewer items in the basket per visit. The fewer items per basket has been an industry trend and it reflects consumers shopping multiple grocers (or banners) to find the best deals, i.e., stretching their dollars to get the calories that they need; more on this later. Ahold’s management expects more improvement in 2025, with price investment continuing. The price investment cost them a full point of margin with Q4 operating margins for the U.S. segment at 4.2%, down from last year’s 5.2%. Management also noted a strong holiday season, which shows in the traffic data for Food Lion. Store remodels, DoorDash home delivery, and pharmacy (GLP-1 drugs) were also a boost to traffic and comps. CEO Frans Muller said, “And we also can confirm that we see positive upticks for Stop & Shop in the start of the year with the price investments we already made and will make further also in the year.”

For the industry and the U.S. consumer, the pandemic years were about trip consolidation and little price elasticity response to the high inflationary pricing, i.e., consumers just paid whatever was asked. 2023 was about the consumer cross-shopping multiple banners to seek out deals and collect app-based loyalty promotions, and trialing and repeating shopping value retailers, like Walmart, Sam’s Club, and Aldi. 2024 was still about cherry-picking promotions, but in the 2H, the cross-shopping began to fade and those retailers with the best value and best private label offering pulled ahead. These consumer trends have challenged both conventional grocery retailers and their national brand suppliers. To retain visits and build household “share-of-stomach” retailers have needed to further invest in price, thus, the margin rate decline at Ahold and its Stop & Shop banner. (National brands have yet to meaningfully budge on price, more on that below.)

Ahold’s earnings release quotes Muller, “Creating value for customers and catering to their local circumstances and specific needs continues to be a tangible differentiator for our business. The great thing about being a grocery retailer is that we are in constant connection with our customers. Through our steady and growing market shares and strong relative brand strength indicators, we can see we are clearly doing the right things for them. This gives us confidence as we look to accelerate growth and earnings momentum in 2025.” On the “value” statement and “constant connection”, i.e., the app, we addressed these above; moreover, Muller stated, “In the U.S., our brands delivered 12 billion personalized offers for the year – a 1 billion increase relative to 2023.” On “catering to local circumstances,” this is a trend in both consumables and non-consumables, both for retailers and branded manufactures; it’s known as locally tailored merchandising or “micro-merchandising.” Smaller, locally owned operators have historically been advantaged in micro-merchandising; however, new AI tools and geolocation data, like Advan, have allowed national organizations to do micro-merchandising more effectively and efficiently, and it is increasingly part of their growth strategy as heard on conference calls and at industry presentations.

National brands are losing share-of-stomach in two ways: (1) to private brand-led retailers like Trader Joe’s, Aldi, and Costco, and (2) to the private brands of Publix, Kroger, etc. As shown in the above chart, the traffic gains by Trader Joe’s and Aldi are stunning, including on a 1-, 2-, 3-, and 4-year basis. As to Ahold’s private brands, Muller said, “In the U.S., a major focus has been on raising the awareness of own brand quality and price relative to national brands. During the last quarter, U.S. own brand sales growth outpaced the rest of the store in both dollars and units.”

How all of this is affecting national food brands can be seen in this week’s results from The Kraft Heinz Company. For Q4, reported organic sales decreased -3.1%, including a -3.6% decline in its North America segment. The North America segment also experienced a -4.5% decline in volume/mix, putting the level down -10% to ’22, and -14% to ’21 and ’19. (Yes, down -14% to ’19). However, it’s not just the food-at-home channel that’s a drag on results with the release reading, “Unfavorable volume/mix was primarily driven by continued shifts in consumer behavior due to economic uncertainty and a decline in U.S. away-from-home.” That away-from-home decline reflects the share-of-stomach lost by the QSR-burgers & fries category, a topic of ours earlier this week where we wrote about McDonald’s. That said, Kraft isn’t sitting still on its high exposure QSR-burgers & fries; CEO Carlos Abrams-Rivera said, “As part of our Mexican food strategy, we have expanded our Taco Bell partnership, providing our consumers with restaurant quality experiences at home. In 2024, this led to dollar sales growth of 24 percent.” (Yes, Kraft has a company-wide growth strategy entirely devoted to Mexican food.)

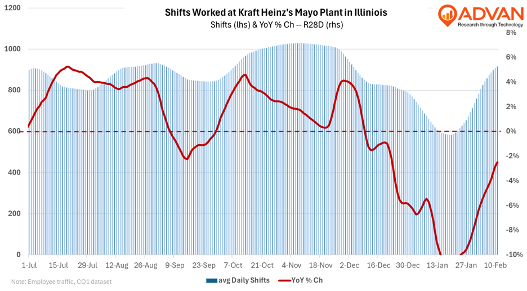

Looking forward, Kraft’s management doesn’t expect a near-term improvement in trend as they guided 2025’s organic sales to decline of -1.25% (range: -2.5% to flat), with Q1 and the 1H far below that level, and volume worse, i.e., they are trying to hold onto price waiting for a better consumer environment at the lower-end (too hopeful?). Separately, management shared again that the softest products for the year were Lunchables, Mac & Cheese, Kraft Mayonnaise, and Capri Sun, but new product innovations for these brands, like Jalapeno Mac & Cheese, were showing early signs of consumer trial and engagement. Kraft Mayonnaise is made at its plant in Champaign, IL and Pickle Mayo is a new flavor extension. Advan shows shift activity down at the Champaign plant early this year, which may reflect lower orders by retailers and grocers; however, the pace of decline is quite moderate here in mid-February. Watching for an uptick at Kraft Heinz’s plants that produce the softer categories is a means to get an early read on customer ordering intentions and, by extension, consumer interest in the innovation and these Kraft Heinz brands. More on this in the weeks and months to come.

LOGIN

LOGIN