By Thomas Paulson, Head of Market Insights

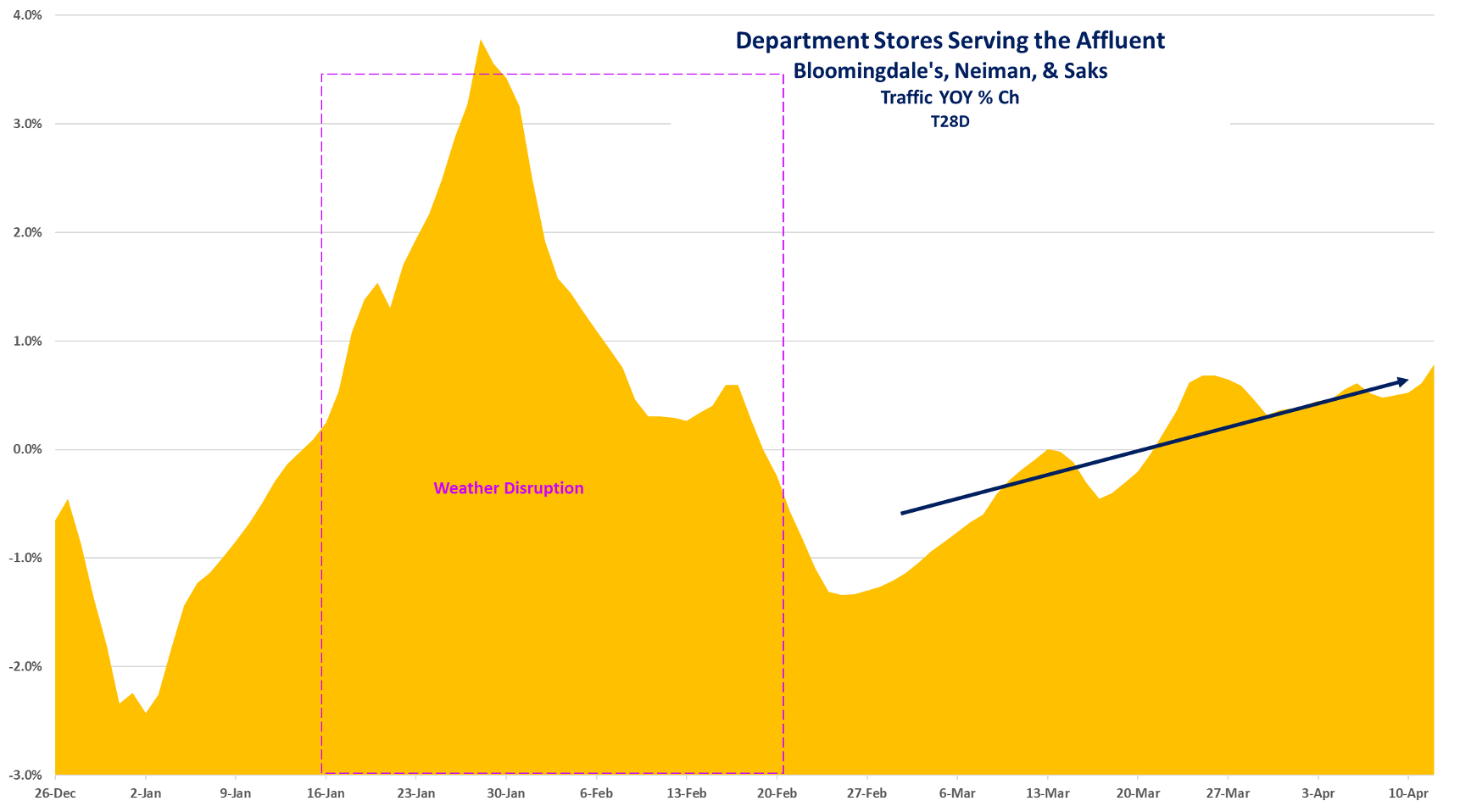

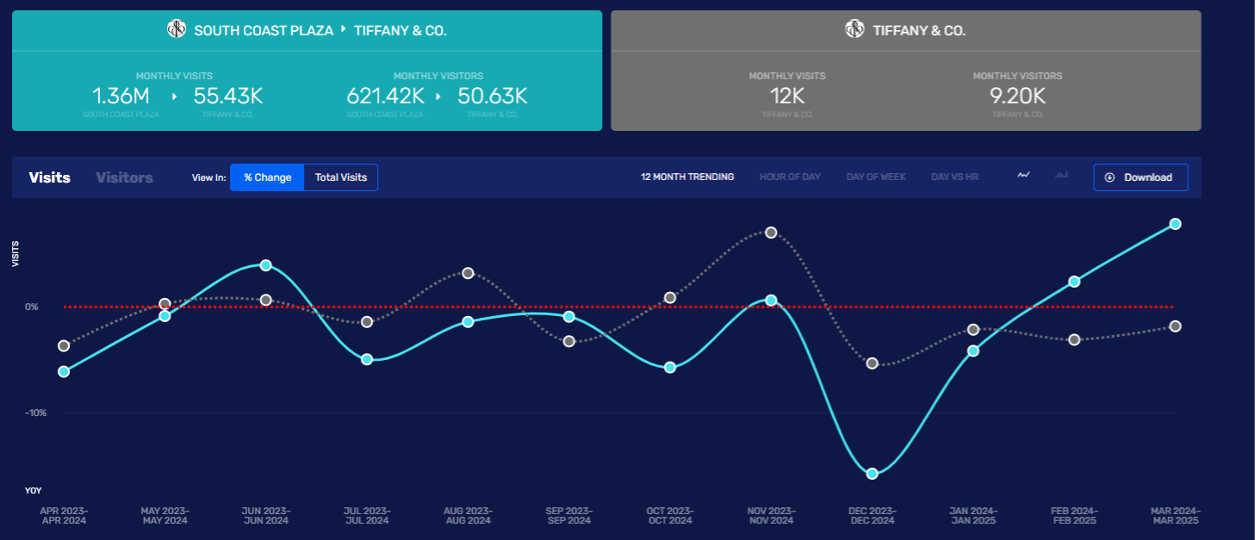

Following comments from RH two weeks ago that high-end buying patterns had softened, do we see more of that with LVMH reporting a surprisingly soft Q1 sales result? LVMH’s revenue in the US was down -3%, a -600 bps deterioration from Q4’s rate, which itself marked a period of broader strength in performance than the year’s prior periods, i.e. we went from “better” to “worse.” And so, is the high-end consumer cracking? Most Louis Vuitton’s retail locations in the US are not geofencible; as a proxy, we look at visits to Saks, Neiman, and Bloomingdale’s. As shown below, traffic has been volatile given disruptive weather in what’s a lower-volume shoulder period. However, the exit rate from March was strong and we see an improvement in average ticket size for all three brands. These data align with LVMH’s comments that their soft- and hard-luxury businesses are stable with CFO Ceclile Cabanis saying, “[ex-beauty and spirits] it was holding pretty well and sometimes sequentially better than last year’s [2H].” In the chart below, we show that traffic to Tiffany’s South Coast Plaza location and on a nationwide basis have been nominally stable, which again supports management’s characterization of the business. Cabanis, “We are seeing continued very good progress on Tiffany’s transformation plan.” And so, how does one explain the -600 bps of deterioration, which is -$304M in revenue contraction? If the high-end isn’t cutting back per management, what gives? Well, Sephora and non-VSOP Cognac are “aspirational luxury” categories and not fully supported by the affluent. Sephora is a large business in the US which can meaningfully move the US region’s aggregated numbers. Separately, Cognac is still a drag on the region, say roughly a -$75M hit to growth, leaving

Sephora inflecting to negative growth this year (from plus-double-digits in Q1’24 and plus-mid-singles in Q4’24) is a category thing, which reflects Amazon’s expansion into prestige beauty (i.e. more competition) and a slowdown in overall category growth due to inflationary pressures on the consumer, which we’ve recently written about. (Management shared on the call that Amazon has been aggressive on price.) The -$230M swing for Sephora in the US would be 11 pts of growth. Last year, Sephora’s Q1’24 sales also benefited from additional Sephora at Kohl’s locations; adjusting for that moderates the -11% decline to a mid- to high-single-digit rate. While that’s still not good, it’s neither indicative of the long-term potential for the business (one that is over 50% larger than it was pre-pandemic) nor of some burgeoning brand blemish. And that’s what we also heard in management’s tone on the call. Nevertheless, it certainly suggests that Ulta Beauty is going to report another soft quarter in a month from now. That too is a macro thing, beyond just beauty, and the aspirational consumer needs to recover her discretionary spending power before there is any improvement in trend; higher prices (potentially) on a broad range on imported consumer goods pushes the time frame back on that. Nuts! That said, we’ll keep looking at our data to spot an inflection to “less bad.”

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN