By Thomas Paulson, Head of Market Insights

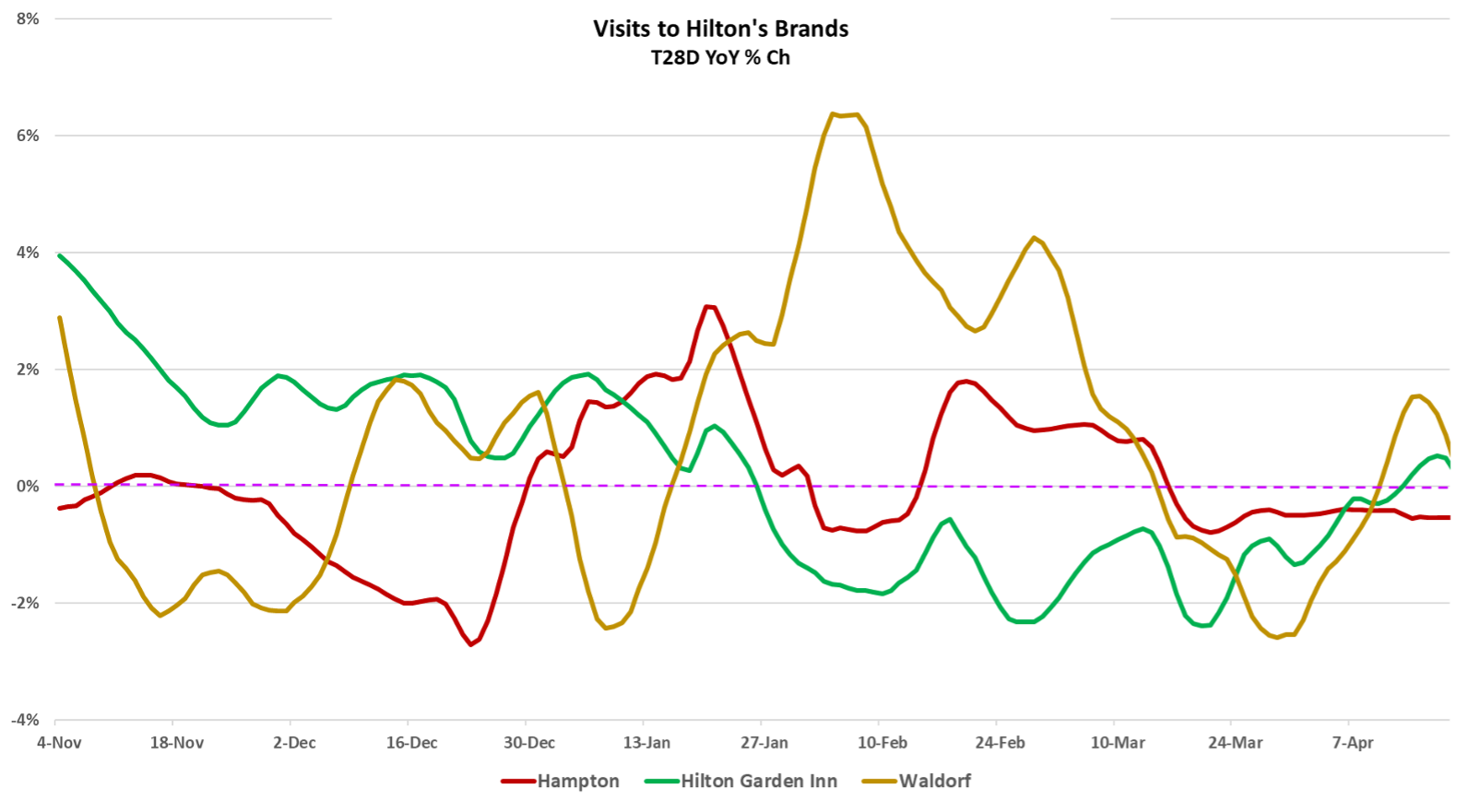

Given the recent news from the airlines that bookings were dropping and the deceleration in longer-term visits to Hilton’s brands as shown in Advan, it wasn’t surprising to hear Hilton cut guidance for the year. CEO Chris Nassetta said, “We reported system-wide RevPAR growth of 2.5% year-over-year, driven by strong momentum from the end of last year that carried into 2025 and supported solid performance in both January and February. However, broader macro uncertainty intensified in March, which pressured demand, particularly across leisure… Weaker trends have continued into the second quarter, with short-term bookings roughly flat year-over-year. We believe travelers are largely in a wait-and-see mode as the rapidly changing macro environment continues to unfold. …For the full-year, our system-wide RevPAR expectations are flat to up 2%, with the midpoint assuming current trends continue.” (Which is down from the prior +2-3%.) As can be seen below, these monthly and brand dynamics are clearly visible with Hampton and Hilton Gardeen inn settling in lower YoY; we’d characterize it as a “measured slowdown” as apposed to anything dramatic or abrupt. Obviously, slower demand leads to lower room rate prices and that feeds into the RevPAR. (RevPAR is revenue per available room.) Waldorf’s visitation is more affected by drinking and dining visits than the other two brands – thus the higher volatility.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN