By Thomas Paulson, Head of Market Insights

Kohl’s: Quarterly sales were “less bad” at a decline (-9.4%) than our preview (we said -14%). In our preview, we also forecasted that incoming CEO Ashley Buchanan would set a very low bar on forward expectations, he did. Revenue for 2025 was guided for a decline of -5 to -7%. The operating margin target for the year was also significantly down (2.2% to 2.6%). Should this outlook come to pass, sales will be down nearly 25% from pre-pandemic levels and profits down to $350M from $1.4B. That lowered bar put the stock down -25% on the day.

In his assessment of what needs to change, Buchanan said the following:

-- We need to reprioritize our initiatives to deliver on … key tenants to better serve all our customers, both new and existing. When examining recent performance, we have fallen short of fully delivering what our customers want and expect from Kohl’s. Most of what we need to do is in our control and can be achieved by setting a clear vision and holding ourselves accountable to executing at a higher standard. As you will see from the financial guidance we’re giving today, I want to set the expectations that this turnaround, while very achievable, is going to take some time.

-- Recently our focus has been heavily weighted on new products to attract new customers, and we have deemphasized our products and categories that our core customers love. Kohl’s began to recognize this in 2024 and immediately began to refocus attention on categories where we have lost traction…

-- We will also continue to prioritize our key growth categories that are resonating with our customers, including Sephora, Home Decor and Impulse…. We are working diligently to find the right balance within our assortment, and we’ll deliver what our customers want and expect from Kohl’s.

-- … Reestablish ourselves as a leader in quality and value by offering great products at great price and enhancing our promotions to drive even more value. We will start by rebalancing our assortment to match customer needs by elevating our focus on our proprietary brands. These brands provide quality, value and exclusive reason to shop at Kohl’s. They resonate with our core loyal customers, and we have an opportunity to reengage this customer by unlocking the full potential of our proprietary brands… They serve an important purpose in our value proposition, offering lower price points on great products for our customers…. We will also look for opportunities to introduce new products that fill a purpose for our customer and drive productivity with our merchandise portfolio…

-- Promotions have always been a key part of our value proposition. Over the years, our list of excluded brands on our coupon has grown too large with the percent of sales that are excluded from coupons reaching an all-time high in 2024. This has created confusion and frustration with our loyalist customers. We’re in the process of reversing some of these exclusions to simplify the experience and allow our customers to shop with our promotional coupons more consistently.

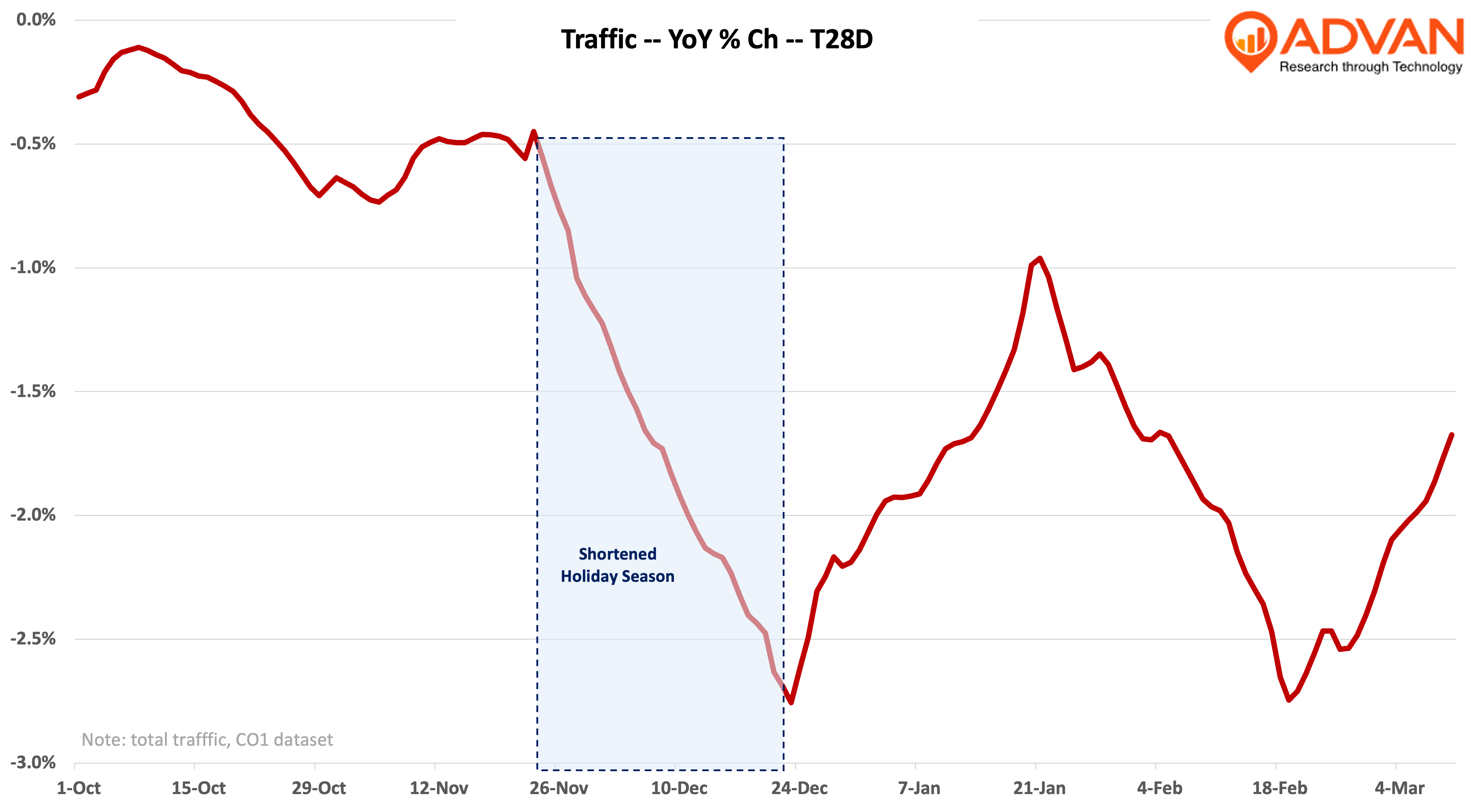

The point of sharing the above is that everything needs to be worked on. That takes time even if the execution is impeccable. And yes, it does sound like too large of a challenge; however, look at the chart below. Traffic was not as horrid as implied by the comp-sales decline. In fact, stripping off the -13% decline in ecommerce sales, store comp-sales were down -3.1%. Advan shows comp-traffic down -1.4%. Advan shows store comp-ticket flat YoY, suggesting just a modest erosion in the conversion rate (the delta may also reflect the impact of Amazon returns on traffic). Had Kohl’s shoppers in mass rejected the merchandise assortment, we would see a larger discrepancy between traffic and comp-transactions and a much sharper decline in traffic. CFO Jill Timm shared, “Nearly all lines of business improved their comparable sales performance versus Q3. Sephora continued to be a strong sales driver with comparable beauty sales increasing 13%, an acceleration from the third quarter. Fragrance, bath and body and skin care continued their outperformance in the quarter (+9%).” And so, yes, Buchanan set a low bar for 2025 expectations as we previewed.

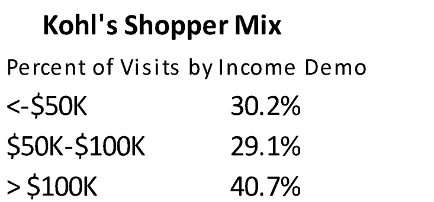

On the health of Kohl’s consumers, Buchanan said, “I think from a macro perspective, you see a pretty decent bifurcation among income levels. We don’t see it too much geographically per se. But when you look at income level, if you’re making less than $50K, that consumer is pretty constrained from a discretionary standpoint. If you’re making less than $100K, it’s also pretty challenging. And you see that very clearly in the numbers. And obviously, we hear the inflation numbers, they’re coming down or 2% to 3%, but they’re still pretty elevated from – particularly from a grocery and rent perspective over the last few years because they haven’t actually deflated. So – and I’m not sure wages have kept up with that. So, in that – if you’re in that income cohort, which we do have a decent portion of our customer base in that, it’s a headwind from a macro perspective. You definitely see that in them. They’re seeking out value. You see it in the mix of the product we’re selling. You see it in the promotions that we are doing. They’re definitely seeking value.”

When we look at Kohl’s shoppers by income, Advan shows that over 41% of them are from household incomes above $100K. Given that these households likely spend 1.5X to 2.0X, or more, than those below $100K, that puts the sales mix at 55%, or more, or the >$100K cohort. Reflecting back on Bachanan’s comments, that’s the group that her initiatives are trying to steady; that makes sense given that they are over half the business. These households, by in large, are also not facing budgetary pressures. And so more effectivity serving these households and growing wallet share is how Buchanan is trying to stabilize the business. That’s a pivot from prior CEO Michelle Gass’ strategy a few years back of trying to attract a multi-ethnic Gen Z and Millennial female. And so, we’ll see; we know how to track it.

*Utilizing the Maiden Century model.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN