By Thomas Paulson, Head of Market Insights

Yes, the stock market and economy are in a tempest, and investors have been de-risking their portfolios and cutting exposure to cyclical companies and those that have too much debt; that change in preferences favors consumer staples and utility stocks. How about telecom? After all, few households can risk cutting their wireless subscription to save money, (unless they’re planning to escape the potential calamity by riding out the next two years on a deserted tropical island.) Are wireless businesses a safe haven and what does Advan show as it relates to Q1 results from AT&T, Verizon, and T-Mobile? Moreover, what will we be watching for in guidance and the year? (To be clear here, we are speaking to only the businesses and not the stocks.) Looking for historical precedents, only the 1H’19 and COVID are relevant periods of economic pain. 2019 because there were broad fears in late 2018 that the U.S. would hit a recession and consumption (PCE) did slow to +1.4% in Q1’19. Despite those fears, the wireless industry produced solid new customer growth, churn fell, and service revenue grew at a faster rate (+3.9%). COVID was a boon for subscriber growth, but that was fueled by Federal subsidies, and as such, it was ephemeral. Net-net, the “wireless world” should be fine in the coming period. Better yet, expectations are low for the coming Q1 results and the year, with AT&T and Verizon both guiding soft growth in 2025 and nudging down Q1 guidance intra-quarter.

For Q1, industry net subscribers (including cable) are expected to have grown by only 1072K, down from last year’s 1,753. Seasonally, Q1 is the lowest quarter for the year, but the 1072K is far below Q4’24’s 2,764K. Advan’s traffic data also supports a softer quarter, but not to that degree. The pace of traffic was 200 bps lower than Q4’s rate, which implies a mid- to high-single-digit YoY decline in gross new subscriber additions, which is far less than the -30% decline expected by the Street.

Looking at just Verizon, it warned that subscribers will be down for Q1, blaming competition; however, they have far more seasonality to their business than T-Mobile and AT&T, which suggests that their marketing strategy pulls demand forward in Q4, leaving Q1 with an “air pocket” and their position vulnerable. Evidence of that is also shown in Verizon’s traffic which inflected the most, from a gain in Q4 to a -7% decline in Q1. Cross-visitation between Verizon and T-Mobile / AT&T was also lower in Q1, which highlights that Verizon is showing up less to competitors, and as such, it’s getting fewer of the gross additions AND higher churn, i.e. it’s a brand-heat issue, not solely higher promotions from competitors. On March 26th, Verizon executive Frank Boulben said, “What we observed is at the very beginning of January, when we dropped out of our holiday promotions like we do every year, for the first time, … our competitors didn’t follow. So they’ve been more aggressive since the very beginning of the quarter… and so, we’ve seen a lot of switching activity as a result.” And so, watch gross ads and churn carefully; if churn did not meaningfully increase, Verizon’s issue is more gross ads / brand than more competition.

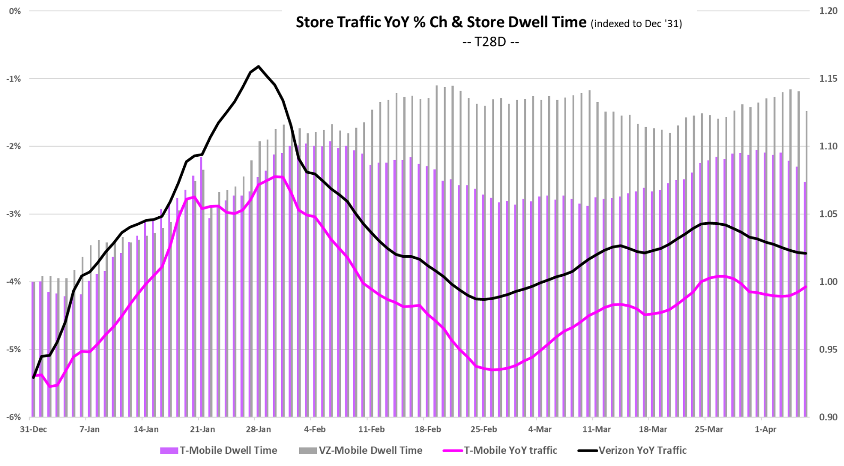

Boulden continued, “So typically January, February, less demand; March, more demand. So you see us changing our promotional portfolio.” March is a 5% larger month for Verizon and as the chart below shows, Verizon was able to expand store dwell time starting mid-February and that built for a month. By contrast, T-Mobile shows the opposite (but a similar YoY trend). By contrast, Verizon’s trend in the prior year (Q1’24) was largely flat (i.e. holding at around 1.00). Longer dwell time is correlated with new contracts being written. In contrast to Verizon, T-Mobile shows a more even YoY trend (with a stronger quarterly exit rate). As such, Advan’s dwell time data aligns with Boulden’s comments that March was much stronger and that it was Verizon that was more aggressive, not the other way around. Of note, Verizon should have been aggressive in its pricing, given that wireless revenue is a monthly contract and that those added in the quarter represent only around 3% of its subscriber base, it is impossible in the near term to see a deficit in revenue growth resulting from lower contract prices. As such, one needs to rely on the reported gross and churn figures and data like Advan’s.

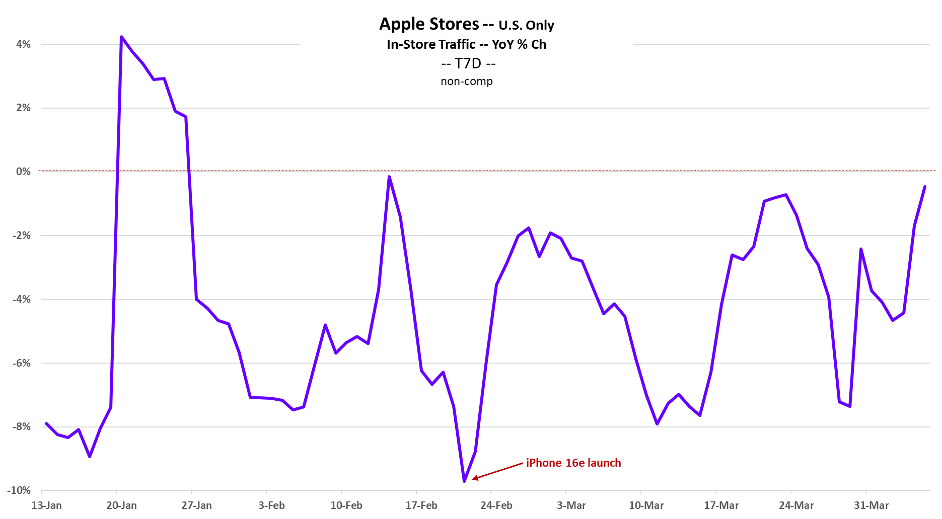

In terms of the overall wireless ecosystem, one factor that has suppressed activity this past quarter was the lack of compelling new introductions of iPhone. As shown below, Apple’s biggest launch was the iPhone 16e on February 19th. The launch sparked a brief bump in the trend, but that lasted only two weeks. There wasn’t a comparable launch in 2024, and so, a launch against a “flat base period” and yet that didn’t spark YoY traffic growth. (Unrelatedly, at this time, we don’t know what caused the January 20th spike.)

There was an uptick in traffic for Apple at the end of March, which may have been from savvy consumers upgrading their iPhones ahead of any tariff-induced price hikes. How the wireless operators intend to deal with any price hike will be the big news from the earnings results. Typically, they “eat it.” However, given an estimated price increase of $700 at retail, that would be a very large bite to swallow. To offset it, do the wireless operators require stricter and longer contracts, do they ask for a higher monthly service fee, or other? Moreover, does this shift market share from iPhone to less pricey Android-based phones, i.e. consumer / operator trade down. (Fears that the iPhone has gotten too expensive have been persistent.) Android has been losing share in the US since 2015 and is now down to 43% share. Is this moment Android’s big opportunity to reverse the trend? As such, there are also vital decisions that Apple and Android (i.e. Alphabet and Samsung) need to make as well.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN