By Thomas Paulson, Head of Market Insights

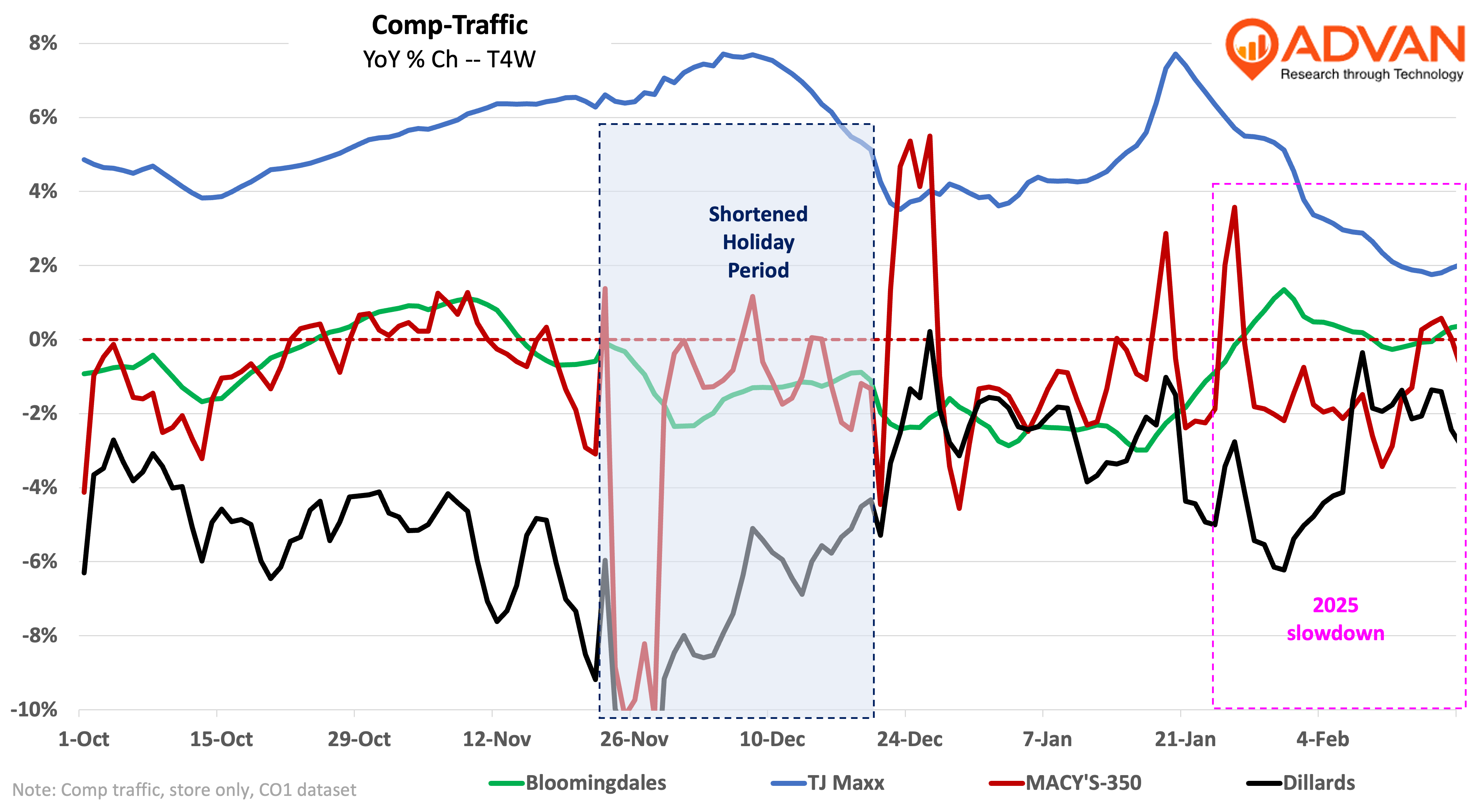

Macy’s Inc. reported improved holiday results as Advan previewed . Macy’s go-forward 350 reported a comp-sales decrease of -1.6%, roughly in-line with Dillard’s (-1%), and Bloomingdale’s reported a comp-sales increase of +4.8%, roughly in-line with Nordstrom banner’s +5.3% increase. Versus 2019, Macy’s comp (-7%) was similar to FQ3’s and better than the 1H’s. Bloomingdale’s improved to +18% from mid-teens in the prior three quarters. Guidance for FQ1 and 2025 was soft as has been the case across retail for this reporting season. However, as shown in the chart below, Macy’s 350 has experienced traffic that’s largely been consistent since early December; moreover, the trend for Bloomingdale’s has even firmed a bit, i.e. they’ve avoided the slump experienced by others.

On the consumer, CEO Tony Spring said, “The consumer health in our opinion remains very similar to what we saw in the latter part of 2024, under pressure, navigating food prices and the cost of housing and the stubborn inflation rate and yet wanting to indulge at times on things that make consumers happy. And I think that we are in that retail therapy business, a place of escapism, an opportunity to get away from all of the political noise that happens every day and we have to lean into that.” These observations align with the chart’s traffic trend.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN