By Thomas Paulson, Head of Market Insights

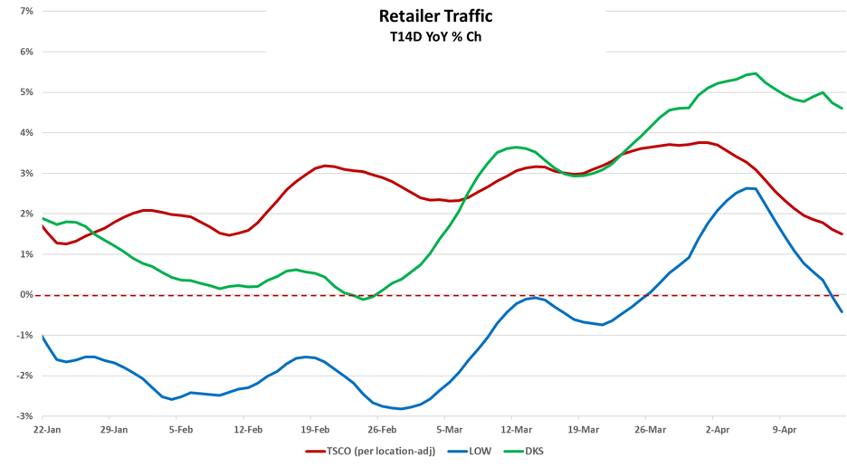

As anticipated, March was a strong month for retail sales per the Census Bureau’s Advance Monthly Sales report, and no, it wasn’t all due to pull-forward effects and pre-buying ahead of tariffs as we showed earlier . Yes, there was pull-forward in auto, furniture, and electronics but the month was also better for other general merchandise categories and apparel as well. We attribute that improvement (beyond pull-forward) to warmer temperatures after a harsh February and early March, and an overall strong spring selling season despite Easter’s timing. Building materials & garden supply dealers experienced an improvement in trend of +340 bps, sporting goods +600 bps, clothing stores +370 bps, and food service & drinking places’ +210 bps improvement. Advan’s foot traffic also shows the improvement for retailers in these categories. Additionally, Advan’s data also shows a nice increase in conversion rates for late in March and April for Lowe’s and Dick’s Sporting Goods and that implies pull-forward. (Recall that Costco reported very strong comps in March on an adjusted basis of +7.2% for the US.) We also looked at Best Buy and Apple; for these two we saw less of a lift in traffic, and so, the reaction there may have been more digital orders than at the store.

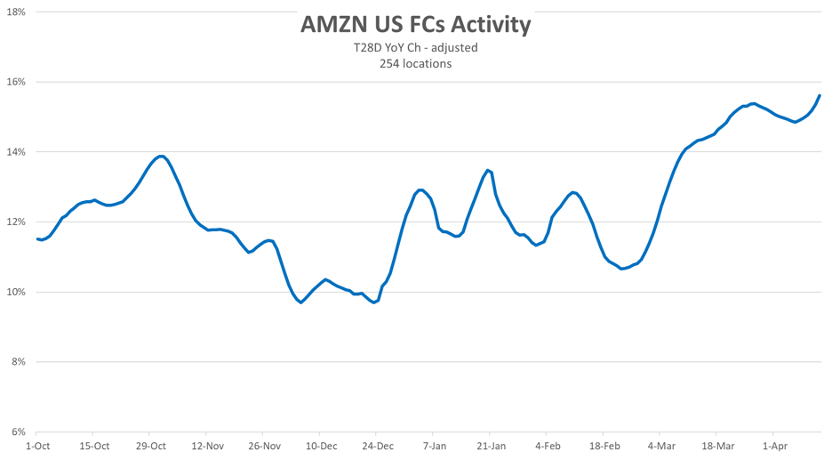

Another category where we also expected the pull-forward to produce an acceleration was ecommerce, especially as we saw a nice step up in activity at Amazon’s fulfillment centers in late March, as shown below, and which continues. Census reports the category accelerated by +200 bps MoM (the non-SA figure) affirming our read on Amazon activity.

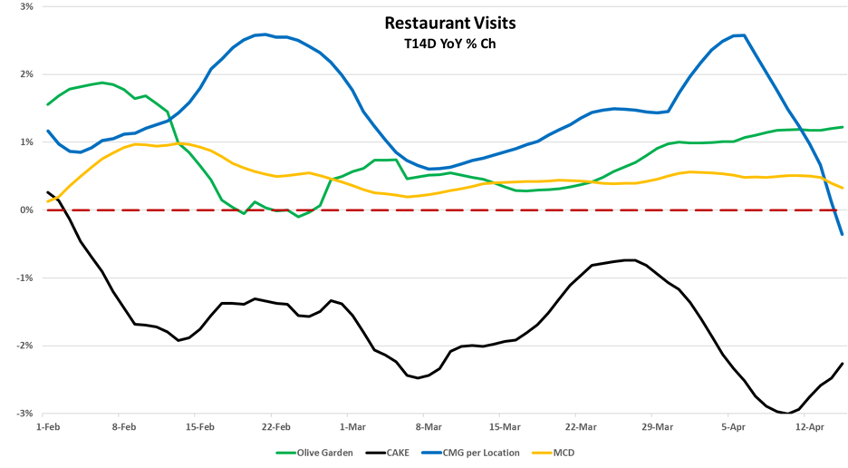

In our opinion, the level of improvement in food service by Census is suspect as it may reflect YoY anomalies such as the shift in Easter out of March which could mess up Census’ statistical model. As shown in the chart below, traffic trends to multiple different restaurant chains were little changed in March. Additionally, Advan’s data shows that the increase in average check for March was similar to February’s.

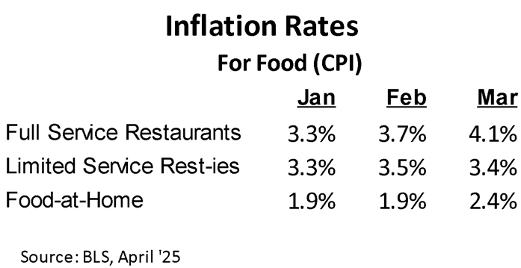

One last comment, in the Census report, full-service for Jan / Feb has been outperforming limited-service; in March, inflation for the category again stepped up a lot (see table below), particularly for full-service, we will be watching to see if there is any adverse impact on traffic for April.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN