By Thomas Paulson, Head of Market Insights

McDonald’s US “comp-sales” declined -3.6%, or roughly -2.6% excluding Leap Day. The -2.6% figure was below expectations (+0.7%) and Advan’s estimate* (-1.2% +/-0.8%) – as such, something in the “environment” changed (that’s why you have errors in forecasts such as this that are based upon-ML). Advan also shows that McDonald’s traffic decelerated further (-20 bps) and that average check also softened. We’ve been writing about the weak year-to-date trend for the limited-serve industry and put out stories on misses by Chipotle and Domino’s . Others such as Shake Shack and more have also reported misses.

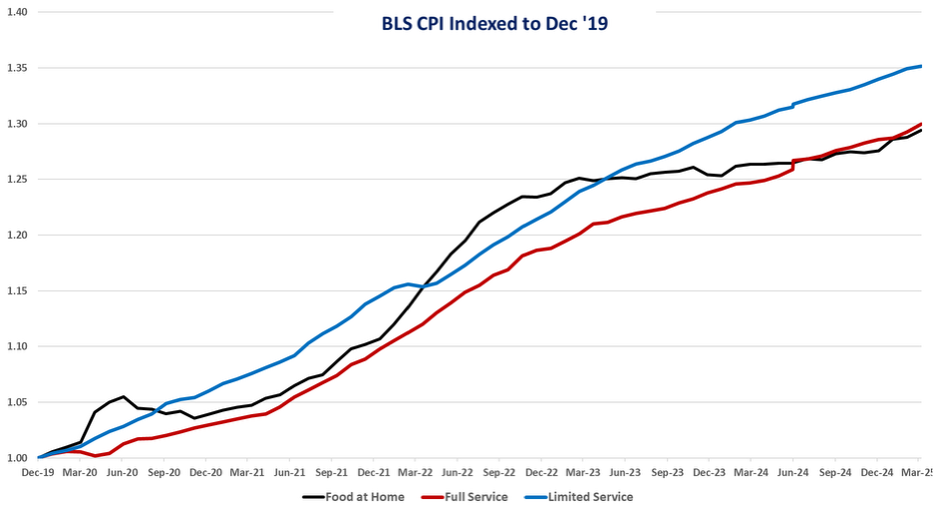

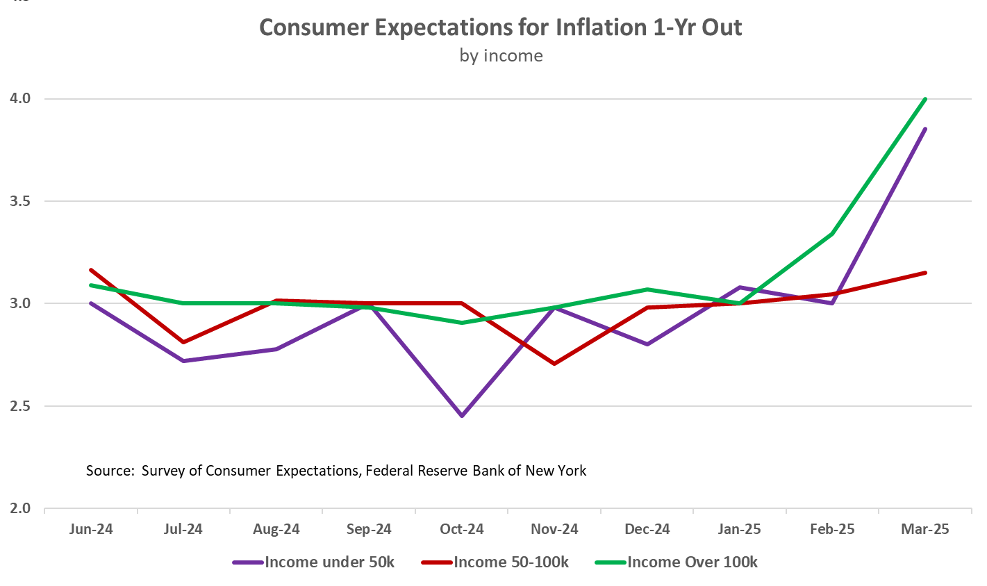

In our opinion, what has changed is the widening spread between inflation for the category and food-at-home as shown in the chart below, with more-and-more households finding themselves burnt out from compounding inflation, along with rising uncertainty about another burst in inflation brought on by tariffs. (They now understand how that feels after getting burnt in ’22 and ’23, “once burnt…”)

On the results CEO, Chris Kempczinski said:

“We entered 2025 knowing that it would be a challenging time for the QSR industry due to macroeconomic uncertainty and pressures weighing on the consumer. During the first quarter, geopolitical tensions added to the economic uncertainty and dampened consumer sentiment more than we expected. In the US, overall QSR industry traffic from the low-income consumer cohort was down nearly double digits versus the prior-year quarter. Unlike a few months ago, QSR traffic from middle-income consumers fell nearly as much, a clear indication that the economic pressure on traffic has broadened. However, traffic growth from the high-income cohort remains solid, illustrating the divided US economy, where low- and middle-income consumers, in particular, are being weighed down by the cumulative impact of inflation and heightened anxiety about the economic outlook. We know that leadership in value and affordability is paramount in an environment like this, and we have been expanding and refining our value proposition to meet the needs of our consumers, especially our low-and-middle income cohorts as well as families internationally.”

Said differently, the environment has gotten worse.

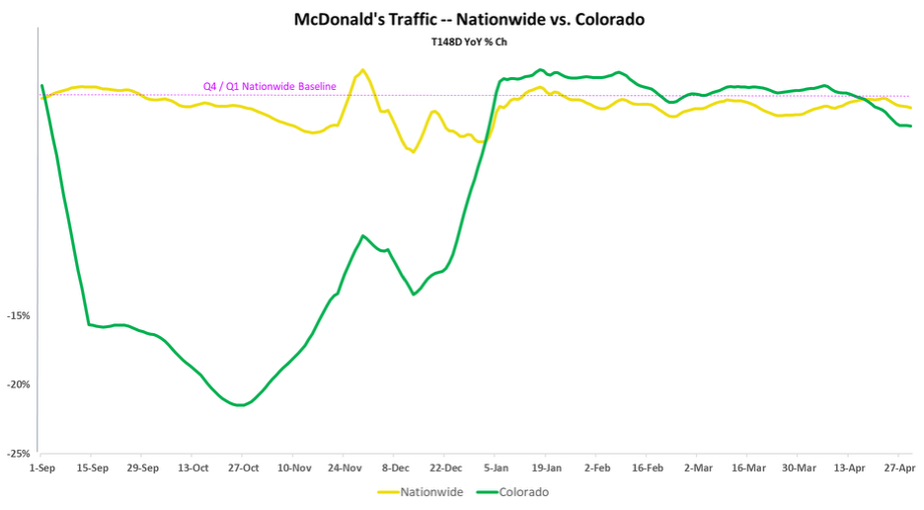

On last fall’s e-coli incident in the Mountain states, CFO Ian Borden added:

“As we said in our last call, expected in Q1 this year that the impacts of the food safety incident would be fully behind us. They are, we’ve fully recovered. But if you just think of the sequence of activities that we’ve had in the US business, obviously, the disruption of the food safety incident, full focus on an effort on recovery, then we’ve spent Q1 really getting the McValue brand equity and platform embedded and emphasized.” Advan’s data confirms Barden’s statement about the recovery, as shown in the chart below. As is clear, that incident was severe with traffic in Colorado down over -20% from the nationwide trend, but now, it’s above the nationwide trend, i.e. recovered.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN