Two developments of importance this week to the eating / food industry that we wanted to weigh in on, Albertsons’ quarterly results and General Mills’ investor day. The net-net is that the underlying cyclical and secular headwinds are intensifying for both the grocery and the limited-service restaurant industries.

Albertsons Companies delivered a +2.3% comp-sales increase for all its banners. However, excluding inflation and GLP drugs (weight loss), grocery sales on a “real” basis fell -2.7%. Albertsons‘ e-commerce sales (curbside and 3P delivery) were again a robust +23% and make up 12% of total grocery sales. Observed store visits (Advan) also increased +0.2% for the fiscal period; however, to the negative, units per basket (UPT) decreased 4-5% (our estimate), which is -100bps worse than last quarter’s decline; moreover, observed shoppers to the Albertson’s banner declined -3% in September. We suspect that there are two principal drivers to the decline in units and shoppers: first, the non-affluent consumer is more economically challenged (the prominence of the pay cycle is growing), and second, lost stock-up trips to Walmart, Sam’s, and Costco. The visits data suggest that the lost stock-up trips are being matched by fill-in trips and trips to buy promoted items. As an Albertson’s shopper, we’ve noticed an increase in the frequency and depth of promotions, most of which are for center-store national brands (more on this below), which are generally funded by those brands. Management confirmed this consumers are going to more retailers to increase savings. Albertsons’ press release touted +1.4M more loyalty members; however, grocery sales per member were only $3.83 per day vs. $5.03 two years ago; excluding inflation, the figure has declined by -28%; that’s a lot of lost stock-up trips. (Unrelatedly, a lot of stock-up is for center-store items, with that going for Kirkland Signature, and the like, which is also greatly undermining national CPG brands’ volume, sales, and profits.) In terms of observed traffic by Alberstons Companies banners, Pavilion’s outperformed, growing +5.7%, and Vons underperformed, declining by -1.8%. Pavilions’ outperformance likely stems from its affluent / artisanal positioning.

On consumer trends, CEO Susan Morris said, “What we’ve seen from the consumer is a continued focus on value, a shift to trading down, maybe it’s smaller package sizes, a focus on Own Brands, hence, why we believe we have an incredible upside opportunity, increasing our penetration well above 25%. We see an increased usage in coupons. We see them sticking closer to their shopping list, maybe not buying that extra item, that extra bottle of whatever. They’re kind of shortening their list (see our comment on UPTs above) and sticking to it. On the other side of it, too, we’re still seeing a lot of impacts from healthier eating, whether it’s just – I think it’s an overall awareness of making better choices, categories like functional beverage, protein shakes, protein-enhanced milks and those kinds of things, supplements, all of those continue to grow. We’re seeing a nice – and what we enjoy about that is those are the categories that also include things like fresh meat, fresh produce, and they’re margin accretive for us. So we see some positives there… So what we typically see with the GLP customers is that there might be an additional an additional dip in their purchase size, but we see that recover fairly quickly. And then as they expand their basket once again… they are leaning into some of the categories and protein supplements, chicken, beef, and fresh vegetables.”

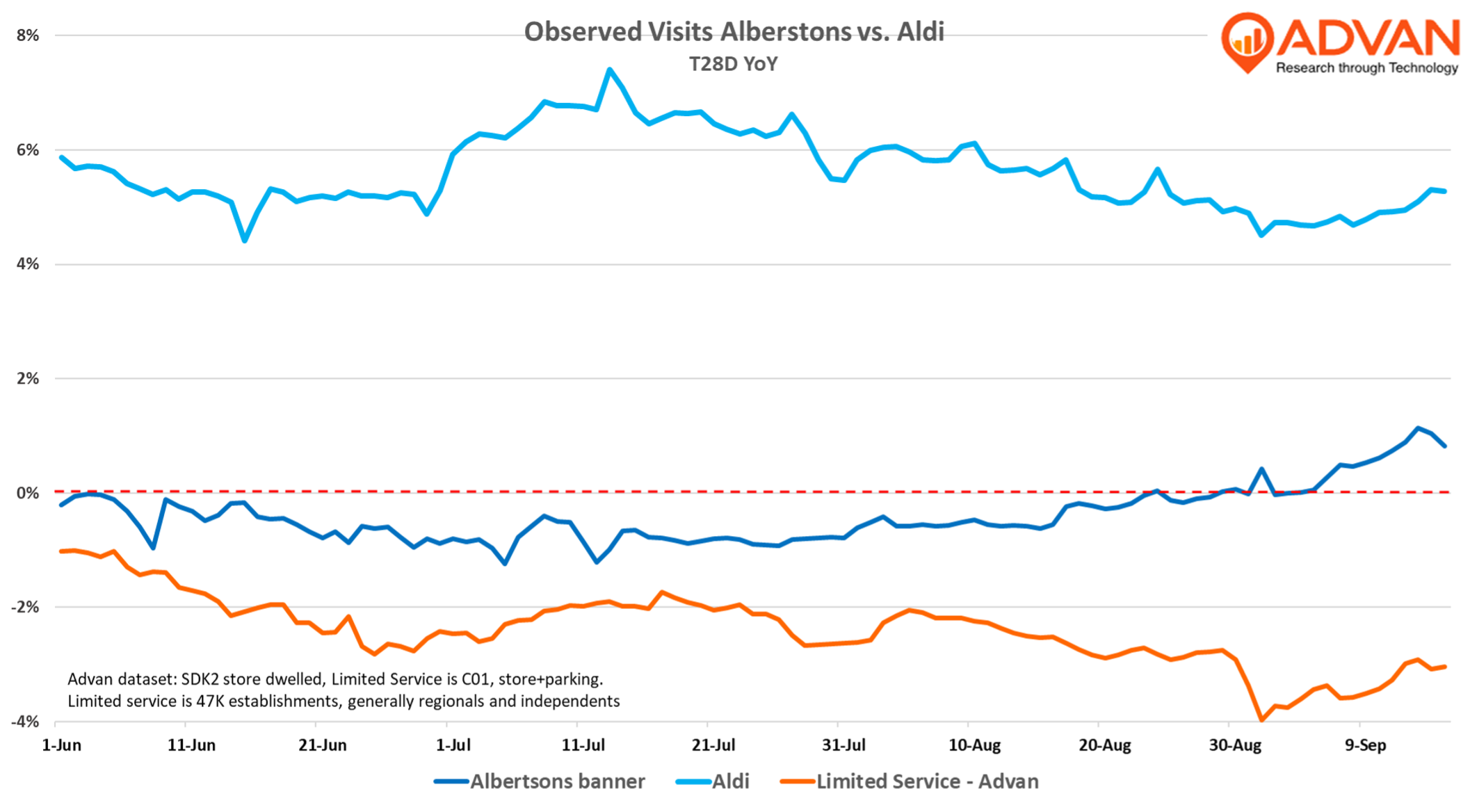

We suspect that the Albertsons’ better traffic trend (shown below), starting in August, is share-of-stomach gains by at-home from away-from-home, particularly limited-service restaurants. We draw that conclusion based upon industry commentary, PCE data, and the traffic data from Advan’s limited-service index, which has deteriorated coincident with Albertsons’ stronger trend. In terms of at-home consumption, the share-of-stomach shift to private brands and the retailers that excel at it (a macro theme of ours) shows no diminution (Aldi > Albertsons). Additionally, the T12W trend for center-store categories (i.e. packaged food) volume per NielsonIQ scanner declined -1.9% overall. Within that decline, private label is up +0.5, whereas national brands are down -3.5%.

The impact of the rapid uptake of GLP-1 drugs on the grocery and limited-service industry is a frequent topic of ours, as shared above, and it’s one of the drivers of share-of-stomach moving from center-store to the perimeter (fresh produce and prepared foods). General Mills’ investor meeting delved into the topic, which to our knowledge, is the first packaged food company to fully address the topic. (Limited-service has not.) Of the two slides shared below, we were surprised by the high 12% figure (that includes users for both weight loss and diabetes). While 12% is a high level, as oral-dose formulations hit the market in 2026, along with lower prices and expanded insurance coverage, the penetration number is going to move meaningfully higher. Yesterday, we wrote about Domino’s Q3 results. One topic from their conference call was its move to offer smaller pies, both to offer lower price points, but also to have smaller portion sizes that are to appeal to consumer trends (i.e. GLP users). Darden / Olive Garden is doing the same .

General Mills executive Dana McNabb shared, “The latest research indicates GLP-1 usage among U.S. adults is around 12%, and it’s expected to grow. And our own studies indicate that users are generally split into two groups. One group that largely eats the same foods they always did, just in smaller quantities and portion sizes; and one group that makes more significant changes to their diet. They look for specific product attributes such as protein, for muscle mass and fiber for digestion. In fiscal ‘26, we’re taking action to help address the most critical GLP-1 user needs, leaning into categories that over-index with these consumers like soup, snack bars and cereal. A positive is that many GLP-1 user needs overlap with the needs of our 55-plus consumers. This means the protein innovation and the portion-controlled offerings I just mentioned are going to benefit us with GLP-1 users as well. “

LOGIN

LOGIN