Given that it’s Halloween, we are going to use its darker tone in this story. In August, Amazon launched same-day delivery in perishables in 1000 cities and while the year-end target of 2000 cities was bold, with Q3 results, CEO Andy Jassy shared that they have lifted the target to 2300, which tells us that Amazon really likes what it’s doing for the overall business. He stated that the offering is “really changing the trajectory and the size of our grocery business,” which hitherto was self-stable / center-store categories. This $100B business (excluding Whole Foods) makes up about 16% of Amazon’s overall North American gross merchandise sales (GMV), is 50%+ larger than Alberson’s grocery business, nearly as large as Kroger’s, and 7.5% of the market per the BEA’s food-at-home figure. Using the BEA figure and assuming 2.5% consumer spending growth and 15% growth for Amazon, that would imply that Amazon is capturing 40% of the industry’s growth and leaving the remainder with only +1.6% growth. Should the 15% figure be 25% (which was the rate in the 1H), then the remainder’s growth falls to only 0.9%. Like with Costco and Walmart, Amazon is a tough customer for suppliers, and one that is delivering 15-25% growth, an emboldened one. And so, this is what the national packaged brands are facing and it’s a big and very rapid change in the market; moreover, it’s not the only one. We remind readers of the share of consumption, especially for center-store, that is shifting from conventional grocery to club and supercenter. Then there is the share-of-stomach that is shifting to private label and the retailers that excel at it. And then there is the shift to better-for-you eating (calories from center-store to the perimeter) and fewer calories eaten (GLP-1 drug usage). Our loyal readers will know that the GLP-1 secular trend is soon to get a lot worse. (More on that later.) Lastly, and the near-term, is the lapse in SNAP ($8B in monthly food assistance). All told, that’s a lot of shifting going on, and no doubt and it’s keeping food companies’ executives awake at night. And so, what did we hear from them this week?

- Kraft-Heinz: Declines for Q3 in US organic sales -3.8%, volume -4.2% and gross margin by -230bps.

- Mondelez: Declines of US organic sales of -0.3%, volume -1.8%, and margin -10.1 ppts (no typo).

- Kellanova: Declines of US organic sales of -2.6% and volume -1.7%.

And so, what are the scares and tricks that Jassy had for the conventional FAH executives last night:

- “We also have Whole Foods Market, which is the pioneer in organic foods, which is also growing at a faster clip than most grocery companies with an attractive trajectory on profitability, and we’ll expand our Whole Foods physical presence over the coming years. And I’m also very excited about this new concept, the Daily Shop that we have, which is a smaller version of Whole Foods in urban settings, which we have three that we’ve launched that are off to very good starts that you should expect to see more of as well.” (This is the first mention that we’ve heard of a renewed expansion of Whole Foods. Jassy’s excitement on Daily Shop was especially pronounced.)

- But the one that we are most excited about is what you referenced, which is the ability to provide perishable groceries with same-day deliveries. And if you think about how many of our customers are buying from us multiple times a week and who are buying things like shampoo or detergent or paper cups or water, where the ability to add milk and eggs and yogurt and other perishables to their order and have it live in the same shop in cart and then show up a few hours later, is very compelling. And we started with a few markets about a year ago, and we were really taken aback at the adoption, not just the number of people that started buying perishables from us very quickly but how often they came back downstream to buy perishables and groceries from us in the future. And so we’ve now expanded that to 1,000 cities around the U.S. and will be in 2,300 by the end of the year. And it’s really changing the trajectory and the size of our grocery business.

- I also believe that this many years tradition of the weekly stock-up grocery stock up is changing. And I think we’re a big part of that. (See the CPG company results cited.)

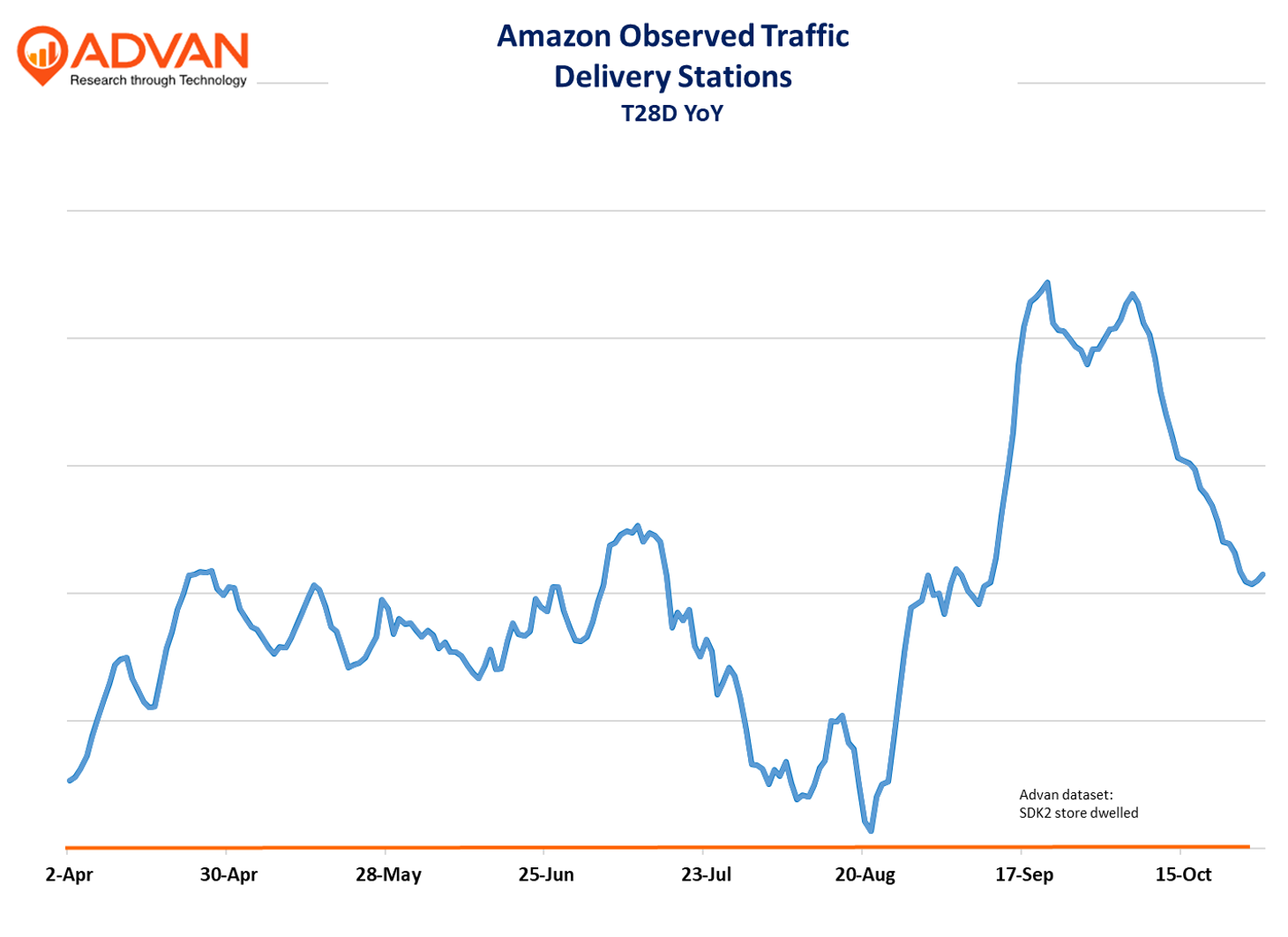

What does Advan’s data show? We have not geofenced specific same-day perishable fulfilment locations, but we suspect they are a subset of the delivery stations that we track (303 POIs in total). As shown below, there was a meaningful increase in activity in the 2H of August that has persisted. We also want to point readers to our story on Sprouts’ softer Q3 sales and outlook.

Per GLP-1s, Eli Lilly’s Q3 results showed 45% revenue growth in the US, driven by 60% volume growth (the delta being lower prices on GLPs to improve access); Zepound revenue increased 184%. Revenue growth was above expectations and management increased its revenue guidance for the year. Phase 3 trial results on its oral form are still expected this year, along with an FDA filing for approval.**Zepbound prescriptions tripled YoY. **Manufacturing capacity expansion continues.

LOGIN

LOGIN