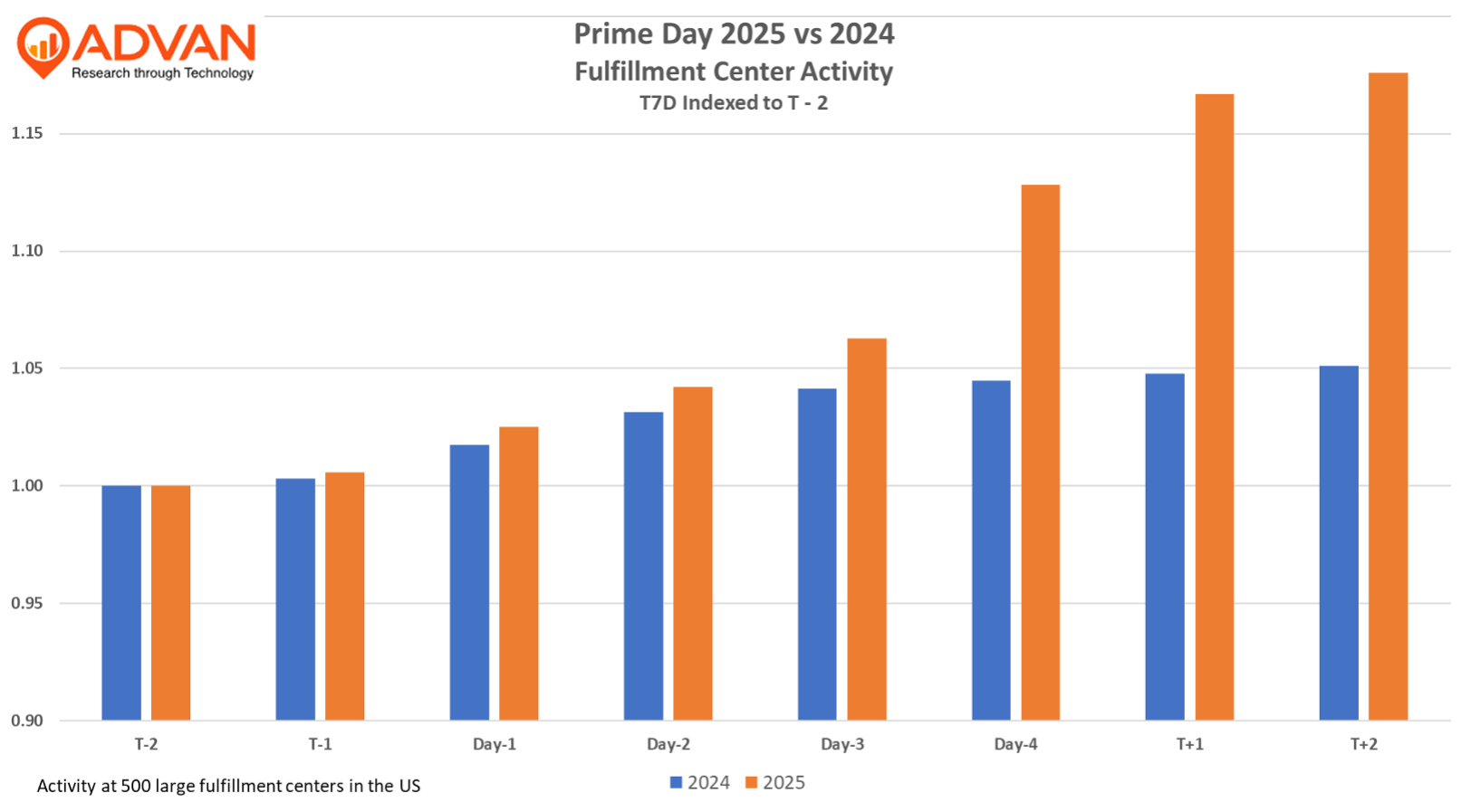

The chart below shows trailing 7-day visits to 500 large Amazon fulfillment centers in the US, indexed to two days prior to the event in 2024 and 2025. Obviously, it’s the days trailing the event that are the busiest, given that’s when the orders are packed and put into delivery-station trucks. As such, it’s 2025’s large increases in Day-4, T+1, and T+2 that are really impressive. Why such a consumer response? We think that it reflects our Thrifty K-Shaped economy (a frequent topic of ours) and Amazon’s ability to put really good deals in front of its Prime members.

| Amazon’s press release on this year’s event read, “Prime Day 2025 was its biggest Prime Day event ever and that customers saved billions on deals across more than 35 product categories, more savings than any previous Prime Day event. This year’s Prime Day event was bigger than any previous four-day period that included a Prime Day event, with record sales and more items sold during the four days… Independent sellers… also achieved record sales and a record number of items sold. Assuming “billions” is $3B and $10 in savings per item, that’s 300m items purchased on-deal. Assuming 500 FCs, 3K shifts worked per FC per day in a normal period, 8 hrs per shift, and 4 days, that works out to 6 more items per shift per day (which would be done by adding labor hours for the event). As shown above, Prime Day 2025 looks to have exceeded that level. |

LOGIN

LOGIN