- Amazon’s in-line results were marked by management signaling that the company was entering another large multi-faceted investment cycle and that the P&L efficiencies that the retail business has enjoyed over the past two years has come to a close.

- Amazon’s grocery business gained meaningful market share in 2025. Share gains will continue in 2026 and Amazon expects to open 100 new Whole Foods locations in the coming years. This added competitive intensity will further pressure conventional grocers and survival will be dependent on the incumbents delivering exceptional store locations, standards, and service levels, and differentiated on-target merchandise assortments.

Amazon’s in-line results were marked by management signaling that the company was entering another large multi-faceted investment cycle (listen to the call for the detail on that) and that the P&L efficiencies that the retail business has enjoyed over the past two years has come to a close. For perspective, the North American retail business closed out 2023 with a 3.8% segment margin; for 2025, it was 6.9% – a massive expansion, but in Q4, fulfillment and shipping costs increased at a faster rate (+10%) than retail-related revenue (+9%) as Amazon broadens its service areas for same-day perishables / grocery delivery and next-day service (to more and more smaller communities). (We flagged this lack of leverage as likely in our holiday wrap presentation .) Amazon’s domestic grocery business (including pantry items and Whole Foods) is now $150B, up $50B YoY, and the increase marks a meaningful grab of market share (+325bps per our math*).

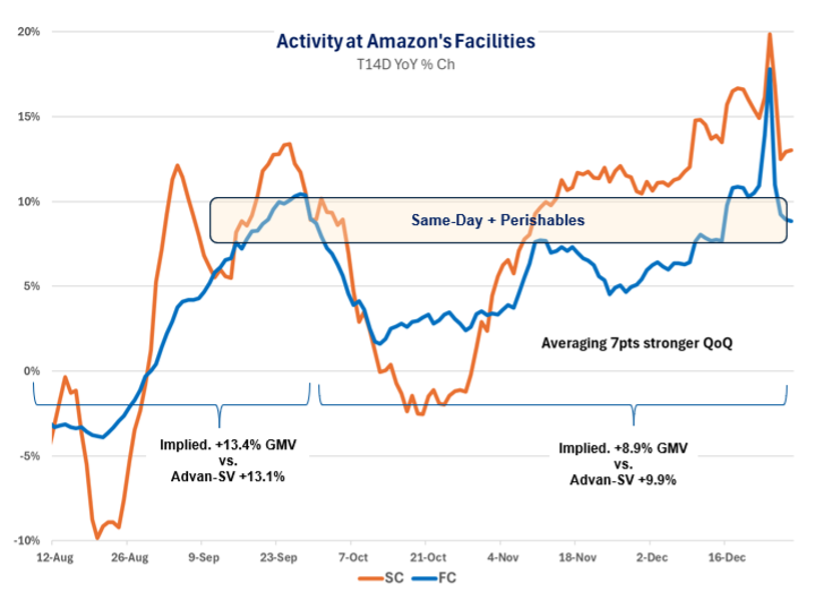

The chart above shows observed activity at Amazon’s domestic fulfillment centers (FC) and smaller regionalized sortation centers (SC) – the ones that allow for the next-day and same-day delivery. As shown, those SCs were busier than the FCs (as is the business strategy). Separately, as shown, the implied GMV growth for the North American Retail business is closely aligned to Advan’s SpendViewTM data (transaction data).

On fast delivery, CEO Andy Jassy, “In the U.S., we delivered nearly 70% more items same day than the year before. We also continue increasing speed for rural customers with nearly 2x more average monthly customers in rural areas receiving same-day delivery year-over-year. Same-day is our fastest-growing delivery offering and nearly 100 million customers used it last year in the U.S.”

On grocery, Jassy, “We continue to see strong customer response to Everyday Essentials and grocery. In 2025, Everyday Essentials grew nearly twice as fast as all other categories in the U.S., representing one out of every three units sold in our store.” Loyal readers will know that Amazon’s encroachment in the everyday essentials category has been acutely felt by grocers and packaged food CPG (and here ). On Whole Foods, Jassy said 100 new locations are to come in the years ahead.

Not unexpectedly, Amazon announced a massive $200B cap-ex plan for 2026 (same as Alphabet), along with lower-than-expected earnings guidance given the investment cycle (and other 1-off factors). As it relates to the US retail business, management did not indicate any slowdown or change in the consumer.

On the evolving consumer experience and agentic commerce, Jassy said, I’m very optimistic about the customer experience that will ultimately be what customers use for Agentic shopping. And I think it’s good for customers. I think it’s going to make it easier for them. It’s a big piece of why we’ve invested as significantly as we have in our own shopping assistant in Rufus. And if you haven’t checked out Rufus recently, I really encourage you to do so. It’s gotten much, much better and keeps getting better every month. And we have about – we have 300 million customers who used Rufus in 2025. Customers who use Rufus are about 60% more likely to complete a purchase. And so you just – you’re seeing a lot of usage of it and a lot of growth, and I think it’s very useful. And I think at the same time, we will have relationships with third-party horizontal agents that can enable shopping as well. We have to collectively figure out a better customer experience. It’s still – these horizontal agents don’t have any of your shopping history. They get a lot of the product details wrong. They get a lot of the pricing wrong. And so we have to try to find a customer experience together that’s better and a value exchange that makes sense for both parties… I think you’re going to have to look at as time goes on, which types of – which shopping agents are consumers going to use. And it kind of reminds me in some ways of the early days of kind of all the search engines that were referring traffic to retailers. And it’s still a relatively small portion of the overall traffic and sales. But of that fraction, you have to ask how many consumers are going to prefer using a horizontal agent where it’s kind of a middle person between the retailer and the consumer versus wanting to use a great agent from that retailer that has all its shopping history and that has all the data right there and makes it easy if you’re just spearfishing for something to shop for it right there or if you want to do discovery, you can do it there, and it’s got the best data on shopping. I think a lot of customers are ultimately going to choose to use a great shopping agent from that retailer. Because if you think about what consumers really want in retail in a retailer, they want really broad selection. They want low prices. They want really fast delivery. And then they want a retailer that they can trust and that takes care of them. And I think horizontal agents are pretty good at aggregating selection, but retailers are much better at doing all 4 of those items. And so I’m very optimistic that people will use our shopping agent.”

Walmart is in this game already and other larger retailers are making gains – for smaller / regional brands, what can they do? Back to retail fundamentals: exceptional store locations, standards, and service levels, and a differentiated on-target merchandise assortments. Advan’s accurate shopper and trade area panel can help with the latter. (See our latest thoughts on agentic here ).

‘* Food-at-home BEA Table 2.3.5U. Personal Consumption Expenditures by Major Type of Product and by Major Function, Jan 22nd release

LOGIN

LOGIN