- Apple won the Holiday in consumer electronics due to compelling new products (largely the iPhone) and a highly competitive US wireless industry. The industry’s strong offers on handsets to subscribers (subsidies), is putting more money into Apple’s coffer.

- Given the high spend on Apple’s products this holiday season and the vast number of retail brands that sell the iPhone, that crowded out consumer spending in consumer electronics and at Best Buy. Apple took over 200bps in market share in consumer electronics and Best Buy’s holiday result was very soft.

- Give a newly fired up Verizon (vis-a-vis incoming CEO Dan Shulman), the wireless industry competitive fervor is intensifying, and Apple is a large beneficiary of that.

As we previewed in our pre-ICR holiday season wrap-up presentation , Apple had a very strong holiday and took meaningful market share in consumer electronics (over 200 bps per our estimate*). One sees that in its very strong quarterly results (Americas’ revenue up $5.9B YoY), in the large increases in equipment revenue at Verizon, AT&T, and T-Mobile (likely over +$2.5B YoY once TMUS reports), and the improved Q4 foot traffic trend for the three and Apple. As Apple products are sold directly to consumers and via a broad swath of retailers, including wireless, Walmart, Target, Costco, etc., and not just Best Buy, that diluted Best Buy’s ability to capture sales this past holiday. For the November + December period, Advan estimates that Best Buy’s foot traffic was flat YoY, and that average check / sales declined -3% / -7%. The decline in the average check is a mix of category deflation** (-2.6%) and sharp deals this past season (see our Black Friday takeaways ). For Apple stores, average check increased +7% and visits were flat (a +400bps improvement from the prior six months).

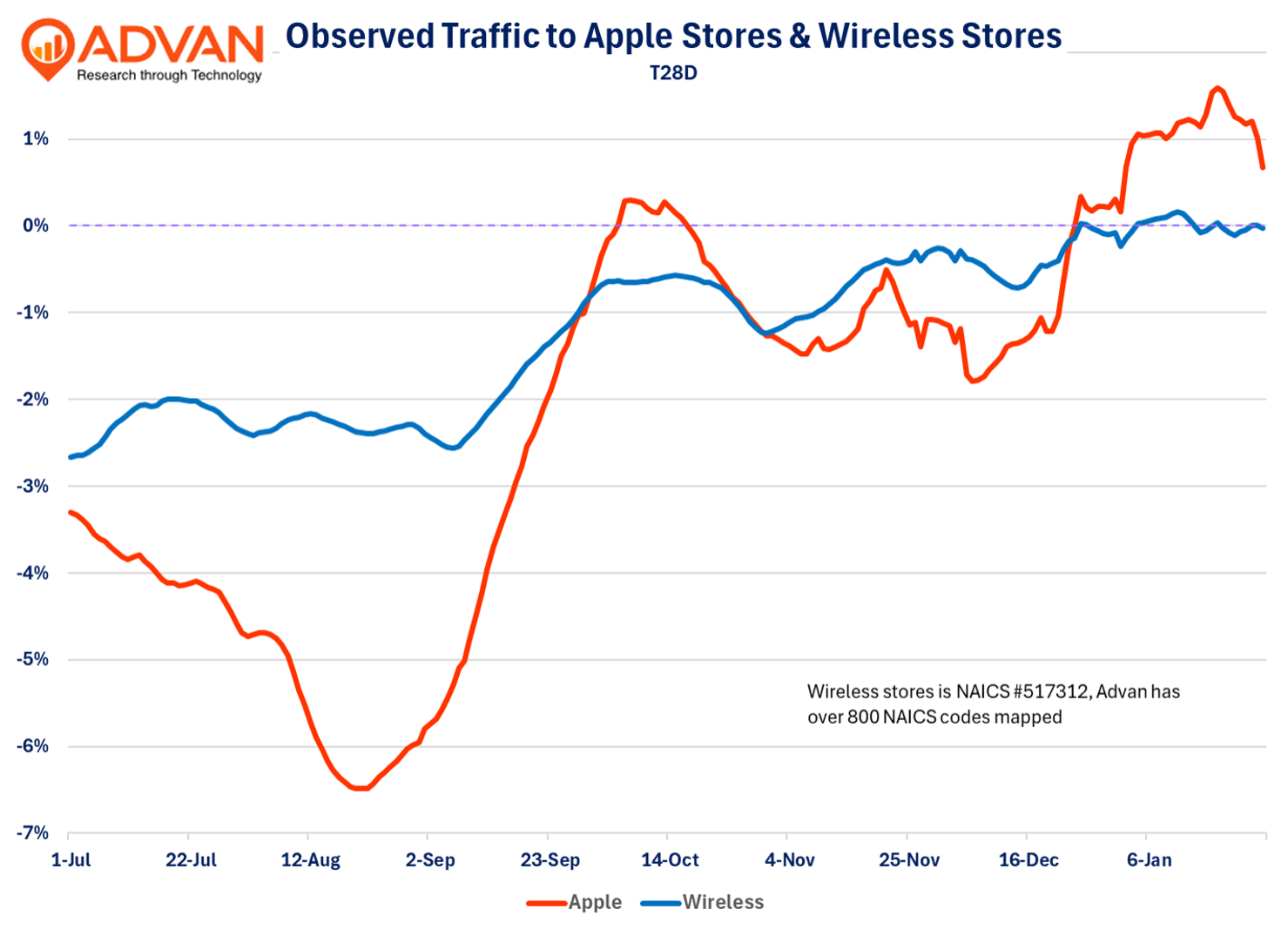

As shown in the chart above, the pace of Apple’s foot traffic quickened with its September new product releases. The iPhone 17’s strong appeal also drove an improvement in foot traffic for the wireless industry. For the industry, that foot traffic was a lot of switching activity. Verizon and AT&T reported roughly flat net postpaid phone additions in the period, but a meaningful step up in churn – a favorable outcome for Apple, less so for the wireless industry (as it absorbs a lot of the handset cost). Per the chart, as Christmas approached, one can see a further surge in Apple’s foot traffic; that “closer to need” surge was true across retail, which we wrote about here .

CEO Tim Cook said, “This is the strongest iPhone lineup we’ve ever had and by far, the most popular. Throughout the quarter, customer enthusiasm for iPhone was simply extraordinary. Users were incredibly excited about everything it enables them to do… They feature the best ever performance in battery life on an iPhone, the most advanced camera system and a striking design. iPhone Air, our slimmest and lightest smartphone yet, packs powerful capabilities into an ultra-slim and sleek design…. In retail, we continue to bring a magical experience to our customers all around the world, and we were thrilled to have our best ever results in retail during the quarter.”

On the higher switching in the wireless industry, AT&T executive Jeffery McElfresh said, “It’s no surprise that the wireless industry itself is penetrated and very mature. And so you do see a lot of switching activity that’s occurring between competitors. Are there macro factors that are slowing incremental new entrants into the traditional postpaid voice? Certainly, there is some aspect to that … (likely referring to lower-income households and immigration). We still don’t have the share we aspire to have in some value-conscious price-sensitive segments. I think 55-plus 1- to 2-line accounts and as well in the small and medium business segment, both of which we’re seeing some success (i.e. T-Mobile’s turf). …we plan for the competitive intensity to continue.” Relatedly, the growing convergence between broadband and wireless is amplifying the competitive intensity (see our story ) and Apple is a direct beneficiary of that rising intensity.

Relatively new Verizon CEO Dan Shulman said of the outlook, “We are targeting a range of 750,000 to 1 million postpaid phone net adds, approximately 2 to 3x our 2025 total and the highest since 2021.” And so, lots of competitive intensity ahead for the wireless industry and lots of switching, as such, we expect to see a good pace for foot traffic during 2026 and a good year for iPhone sales. Apple CFO Kevin Parek said, “We expect our March quarter total company revenue to grow by 13% to 16% year-over-year, which comprehends our best estimates of constrained iPhone supply during the quarter… [based on] a continuation of the strong cycle” -thus, aligning with our viewpoint on iPhone sales for 2026. (In the December ’25 quarter, Apple grew overall revenue +16% and iPhone revenue rose +23%.) See our last write-up on the wireless category trends and Apple . ‘* BEA, Table 2.4.5U. Personal Consumption Expenditures by Type of Product, Jan 22nd release ‘** BEA, Table 2.4.4U. Price Indexes for Personal Consumption Expenditures by Type of Product, Jan 22nd Release

LOGIN

LOGIN