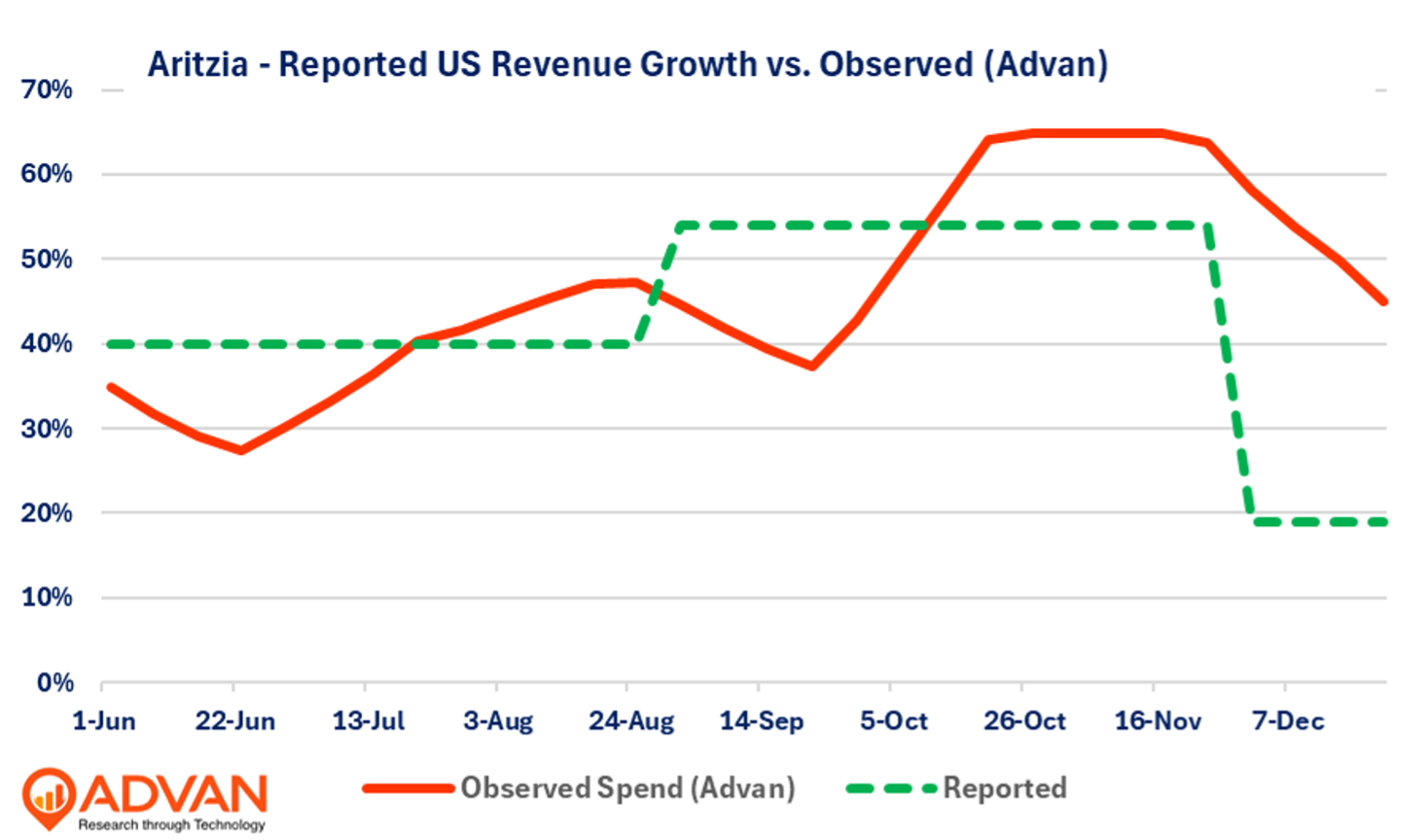

- Aritzia reported very strong sales growth for its fiscal Q3, +54% for the US region, and while management guided for a slower rate for FQ4, Advan’s transaction data points to ongoing strength (+50%) suggested a lot of conservatism in that guide.

- Aritzia is driving strong growth in both established regions (New York, Chicago, and Los Angeles) through strong digital sales and store-level comp-sales increases, and new markets, ahead of having a physical store in them. Strong digital sales proceeds where the eventually open a store (such as Salt Lake City).

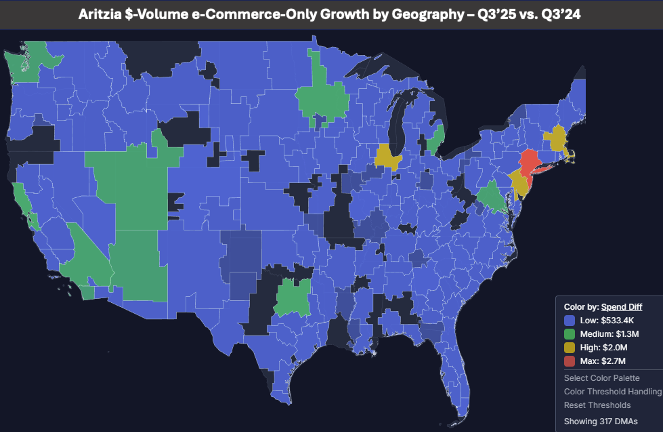

- Aritzia plans 10 new openings per year in the US (on a base of 71); based upon large e-commerce-only $-growth in Phoenix, Fort Worth, and Detroit, these three are likely to be of 2026’s store openings.

Last week, we presented our learnings on this year’s holiday season to Morgan Stanley’s institutional investor clients. In that, we highlighted Walmart, Dick’s Sporting Goods, Five Below, Ross, and specialty brands American Eagle, Gap, and **Aritzia **as having a very strong season. On Friday, Aritzia reported fiscal Q3 results (November period end), and yes, FQ3 and holiday results were very strong. Revenue growth for the US region accelerated 14 ppts QoQ to +54% YoY. Management guided to FQ4 revenue growth of “high-teens” with the implied outlook for the US to be in the 20s. That’s conservative; as shown below, observed spend for December was in the 50% range and December represents over 50% of fiscal Q4. Where is Aritzia growing?

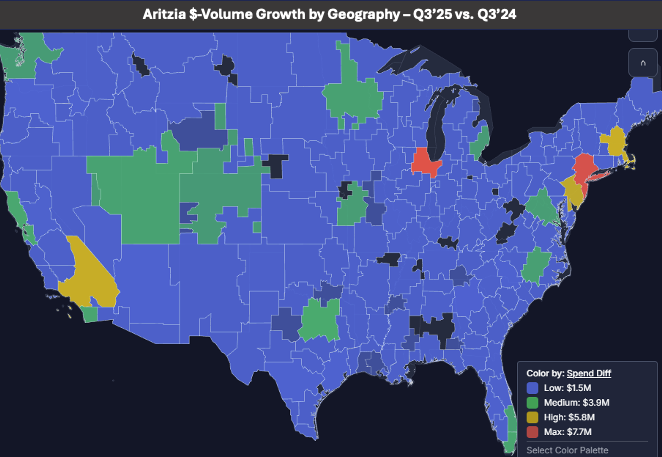

The graphic above shows that Aritzia is finding the highest $-volume growth (+42%) in Chicago and New York, followed by Los Angeles, Boston, and New Jersey. Additionally, the 42% growth’s composition is +31% growth in customers and +10% growth in per-customer spend. For New York City, the region’s +21% growth can be broken down between +12% in customers and +9% on a per-customer basis. The company had 5 locations in NYC at the start of the period and ended with 6. The graphic also shows strong growth (green shade) where Aritzia doesn’t have store locations (they call them boutiques), with that growth driven by strong e-commerce growth, which grew by +54% overall in the US for the fiscal period. Aritzia’s revenue mix is (65 / 35 stores / online). Separately, the boutiques delivered “outstanding comparable sales growth,” per management, with that growth being traffic / transaction driven. Company-wide, comp-sales increased by +34%, with the US above that rate.

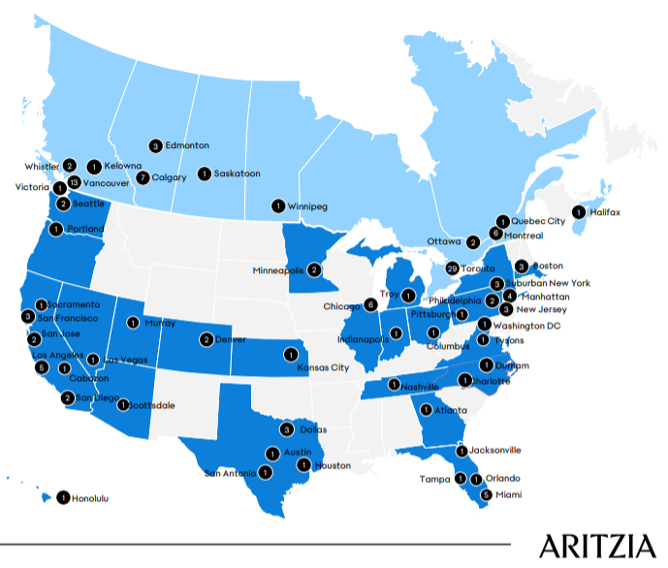

In terms of expansion, Aritzia currently has 71 locations in the US, with plans double that per the two graphics shown below from their investor deck. In terms of new locations, they are targeting 10K sq-ft and the ability to generate over $700K per ft in sales. As the average store does $1.3K, the maturation from $1K produces drives a lot of comp growth. Four recent openings were in Scottsdale Fashion Square, Park Meadows (Lone Tree, Colorado), Las Vegas North Premium Outlets, and Southdale Center (Edina, Minnesota). (See our recent story on Southdale Center and why getting a space there shows well.) We trust that success in a market with e-commerce only proceeds selecting a market for a new boutique. For example, over the past year, the Salt Lake DMA added over +$4M in annualized sales. Aritzia just opened its first location in Utah at the Fashion Place mall south of Salt Lake City in November.

Back to the topic of strong e-commerce-only markets proceeding getting their first boutique. 10 new locations are planned for 2026. The graphic below shows YoY $-growth Q3’25 vs. Q3’24 by DMA for Aritzia’s e-commerce business alone. (Annualized the growth would be 4X). Three markets stand out as likely for their first boutique - Phoenix, Fort Worth, and Detroit.me

LOGIN

LOGIN