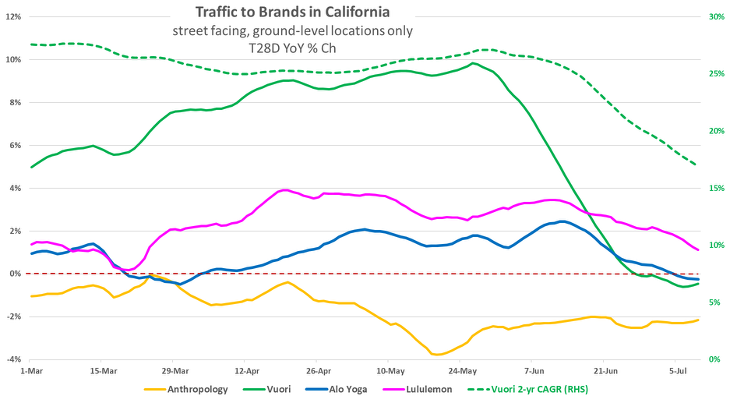

Tuesday’s article previewing June retail sales, along with some hypotheses for why the month appears to be a deceleration from May’s pace, solicited some questions about the athleisure category. For athleisure, there was also a slowdown starting June 12th, similar to what we shared yesterday. Vuori’s deceleration is most abrupt. Lululemon and Alo Yoga have drifted back to their March pace; perhaps the bump they experienced in April and May was pull-forward with consumers securing coveted items before tariffed goods hit the shelves. The general soft, but consistent pace for Anthropology suggests no material macro change for this consumer demographic; and so are there idiosyncratic contributors at work?

Looking at things on a nationwide basis also points to a slowdown for Lululemon in June vs. May, both in traffic and spend, with spend slowing more. All three athleisure brands source(d) a large amount of their goods from Vietnam, China, Sri Lanka, and Cambodia – all tariffed countries; apparel imports from China were down 30% in May. And so, that fact engenders an additional hypothesis for these brands’ slowing, beyond our earlier thoughts; this category depends upon a lot of newness, and so, maybe all of the discombobulation around what was being tariffed and the shifts in sourcing to less expensive countries created a delay and sluggishness in the pace of newness. Perhaps the discombobulation also resulted in lower fill rates on product and “out-of-stocks” on key items and sizes. Our article on June’s slowdown pointed to an appreciable slowdown for all three major off-price brands. For Ross Dress for Less and T.J. Maxx, the deceleration in transactions was about 300 bps worse than traffic. That points to a deterioration in the conversion rate, with the likely cause being a less compelling assortment; that, in turn, points to discombobulation in sourcing product. Recall that off-price’s inventory turns are far higher than conventional retail. TJX and Ross Inc turn inventory 6X per year, which is 2X what apparel retailers typically turn at; and so, they are more in need of a lot of newness to drive traffic and sales – something that discombobulation impedes. As such, this supports the discombobulation hypothesis as an additional contributor to the athleisure slowdown.

Adding to the trade policy discombobulation is another recent policy and community stress. Both Alo and Vuori are headquartered in the Los Angeles region – a region (where they have their warehouses) that has experienced a lot of disruption recently from policy changes. Goods don’t move themselves out of shipping containers and onto store racks and shelves. A lot of people-touches happen to get the goods from the containers, stored in the warehouse, staged in the warehouse for shipment to stores, and then to store shelves, and everything in between. For Alo and Vuori, there may have been disruption here as well. Looking at Ross Dess for Less (which has a large business in the Los Angeles region), the stores in Oklahoma outperformed the Los Angeles region in Traffic by 12 ppts in May and 5 ppts in June. Prior to May, Los Angeles was consistently up in visitors and visits. We appreciate that this last reason may be a stretch, but given that Lululemon’s traffic has recently outperformed Alo and Vuori, it deserves some consideration.

LOGIN

LOGIN