Walmart’s FQ3 – The K-shaped economy is becoming more pronounced

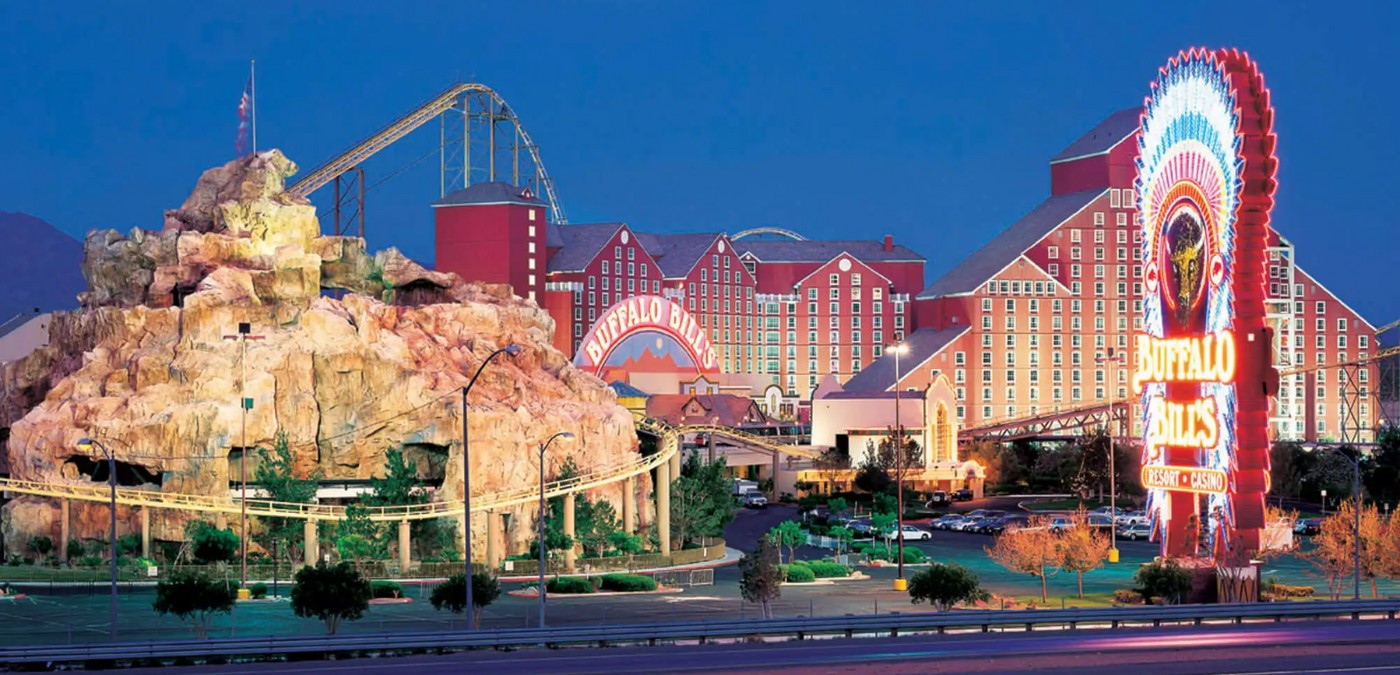

With FQ3 results from Walmart, Targe t, Home Depot , and Lowe’s, it is clear that our K-shaped economy is becoming more pronounced , and its “pronouncement” is now undermining aggregate consumer expenditure and the retail industry (and CPG). In response, retailers and brands are focusing even more on affordability and being more tactical in any price increases in response to tariffs or cost inflation. (See our story –What’s happening in Vegas, isn’t staying in Vegas) That, in turn, is pressuring margin rates and profits.

4 minutes

LOGIN

LOGIN