AutoZone reported solid sales results, offset by some gross margin contraction. The commercial side particularly improved to again post a double-digit increase. CEO Phil Daniele has been in the job for just over a year and improving commercials was one of his key objectives. Daniele said, “While the macro environment and the uncertainty around tariffs have forced customers to be cautious with their spending, the consistency of our failure and maintenance businesses continued this past quarter. We saw an improving trend in our maintenance and failure categories on a year-over-year basis. Discretionary categories, the smallest part of our business, have been under pressure for several quarters now. Historically, when our consumer is under pressure, our maintenance and failure categories begin to outperform discretionary categories. Our DIY comp was up 6.2% in the first 4-week segment, 2% in the second and up 1% during the last segment…. The variation being driven by …cooler wetter weather and the Easter holiday shifting into our last 4 weeks versus last year falling in the middle 4-week segment. Our commercial comp on the other hand, was more consistent over the 12 weeks of the quarter. This consistency was very encouraging as we built towards future commercial sales growth.” Of note, the volatility in traffic is driven by the DIY business, which comp-ed +3% in the quarter, relative to traffic increasing +1.7% (per Advan). Management said DIY comp-transactions were up +1.4%, i.e. very close to the traffic figure per Advan. Inflation added +100 bps to the comp-ticket.

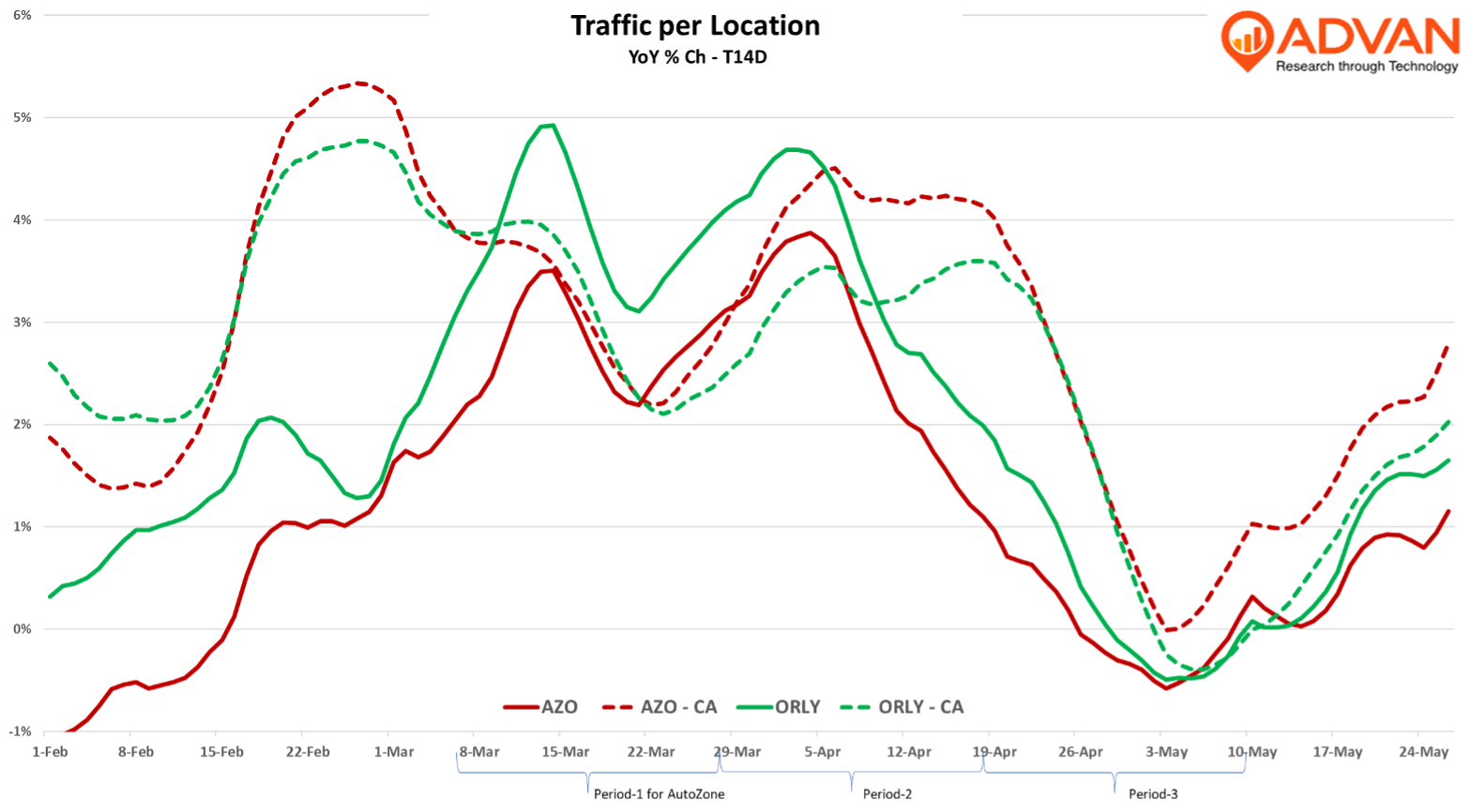

These patterns are what we show in the chart below.

The stronger trend in California likely reflects Advance Auto dropping out of the market. On market share, Daniele, “I think we’re seeing share gains across the board, all across the country in both DIY and commercial. And I would say, yes, there’s obviously some macro that’s going on, but we feel like the vast majority of our growth is coming from the initiatives we have in place. Improved execution, driving Hub and MegaHubs into our markets, continually improving our assortments …. And we think those are helping us improve on all elements of our operations and causing us to gain share, both on the DIY side and faster share on the commercial side.” For Advance Auto’s results, sales were down -7% and that is expected to worsen to -10% for the July-ended quarter due to the exit from California. As such, AutoZone (and O’Reilly) should be picking up a lot of commercial and DIY share. As a reminder, Advance is 65% commercial / 35% DIY. Assuming that AutoZone captures half Advance’s lost share, that’s 250bps to AutoZone’s comp-sales increase. AutoZone reported a -77 bps decline in its gross margin rate, which by historical standards is a large contraction – the decline suggests that AutoZone was aggressive in trying to win the Advance commercial accounts in play.

LOGIN

LOGIN