Avis’ Q2 results allow for a glimpse into travel trends during this current period of softer demand, especially for big-ticket travel like Vegas and destination resorts . Rental Days for Avis’ Americas segment increased by +1% and rate fell by -2%. The volume increase drove an improvement in the fleet utilization by 50bps to 70.7%. That, combined with lower fleet unit cost (-14%), led to a strong increase in EBITDA (+18%). The release also stated, “While revenue was slightly down compared to prior year, the year-over-year variance improved sequentially throughout the quarter, with June finishing down less.” Leisure volume increased mid-single-digits; commercial fell. On the macro trend, CEO Brian Choi stated, “I think demand is firming up post the passage of the Big, Beautiful Bill. For us, leisure is stronger than commercial right now, and pricing is more challenged than volume. And this is true in PRASM for airlines. It’s true for like RevPAR for hotels and Revenue-per-day for us. But we do think that there are signs that things are firming up for the summer and then think its off to a good start. I think one of the reasons for that and kind of why you’re seeing some of these issues on the DPU side, where I think you may have expected slightly stronger [volume] maybe this quarter and in guidance is that we’re dealing and having to navigate with two big issues here. That’s tariffs and recalls. So let’s just start with tariffs. The uncertainty around auto tariffs, of course, that’s lifted the used car market. That’s been a clear benefit. And when you look at the asset base, the vehicle asset base that we have on our balance sheet, like it is meaningful.” (I.e. they will realize a higher yield / price on the cars they dispose of into the used market.) With the results, Choi spoke about the new premium service called Avis First. The announcement was a surprise to us because we don’t associate Avis with the power elite; however, the table below shows its customer mix is more affluent than Hertz. The table uses Personal.live segmentation and Advan’s data. The Ultra Wealthy Family is +110bps larger for Avis vs. Hertz; within that family, the SuburbChic segment is nearly a third larger. Persona.live describes that segment as “wealthy family-focused households straddling the suburban/rural line. Their retail patterns revolve around kids, health, and entertainment: visiting places like the Goddard School, CycleBar, Clean Juice, and Country Clubs. You’ll find them consuming sports and conservative, business related news sources. They are willing to spend their money on fitness and the outdoors.” Avis First is currently live in a dozen markets and is expected to expand to over 50 markets by 2025-end. To conclude, our assumption about Avis’ brand was just plain wrong.

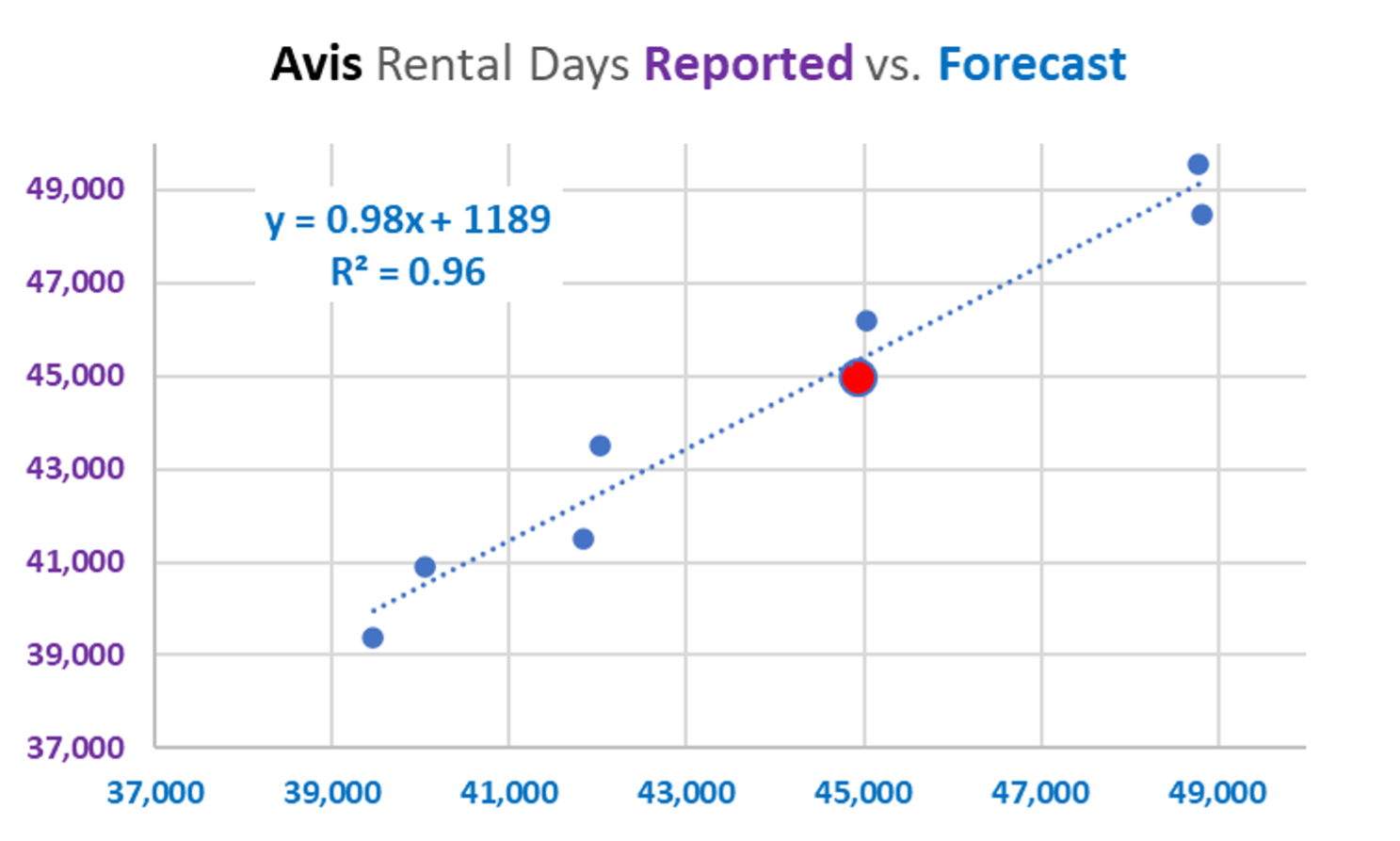

Looking forward, not only will be able to track the success of Avis First on the brand’s customer mix, but we can also track their overall rental volume. The chart below shows reported rental days to a forecast model (by Maiden Century) that leverages Advan visits data. Q2’s results were marginally below the forecast and displayed as the red dot. The model’s accuracy has been +/-1.3% over the past 8 quarters; for Q2 it overestimated by 0.07%, i.e. darn-darn close.

On Avis First, CEO Brian Choi said, “You arrive at the airport, grab your bag, walk out the door, and find an Avis First concierge is already there waiting for you. He comes over to take your bag, hand you a bottle of water, and walk you all of 8 steps to get to the car at the curb. It’s exactly what you asked for, latest model year and low mileage with that new car smell. It’s 90 degrees and humid outside, but it’s a crisp 68 degrees in your car because it’s been preconditioned with the air on and the seat coolers running. The concierge makes sure that your phone’s Bluetooth connects seamlessly and the car play screen pops up on the dash with your map and playlist ready to go. Before you leave, he reminds you to save yourself the hassle of filling up the tank. We only charge for the gas you use at pump rates, so just drop the car off curbside with your concierge and walk into the terminal when your trip is over….This isn’t just a new business line. It’s a category-defining product for the rental car industry…Today’s traveler is more discerning. Brand alone isn’t enough. Customers expect clear differentiated offerings within a brand just like they do when they’re flying. Everyone knows Delta is more premium than easyJet, but Delta customers also understand the difference between Main cabin, Comfort+, First Class and now Delta One. The airline industry figured out that the post-COVID traveler is happy to pay more for certainty, for quality and for experience. It’s not just about the lowest price. It’s about the value received. Avis First addresses that expectation head on. And while a first-class flight from New York to L.A. can cost thousands of dollars more than an economy flight, and Avis First upgrade per day cost as much as a couple of Starbucks lattes.”

LOGIN

LOGIN