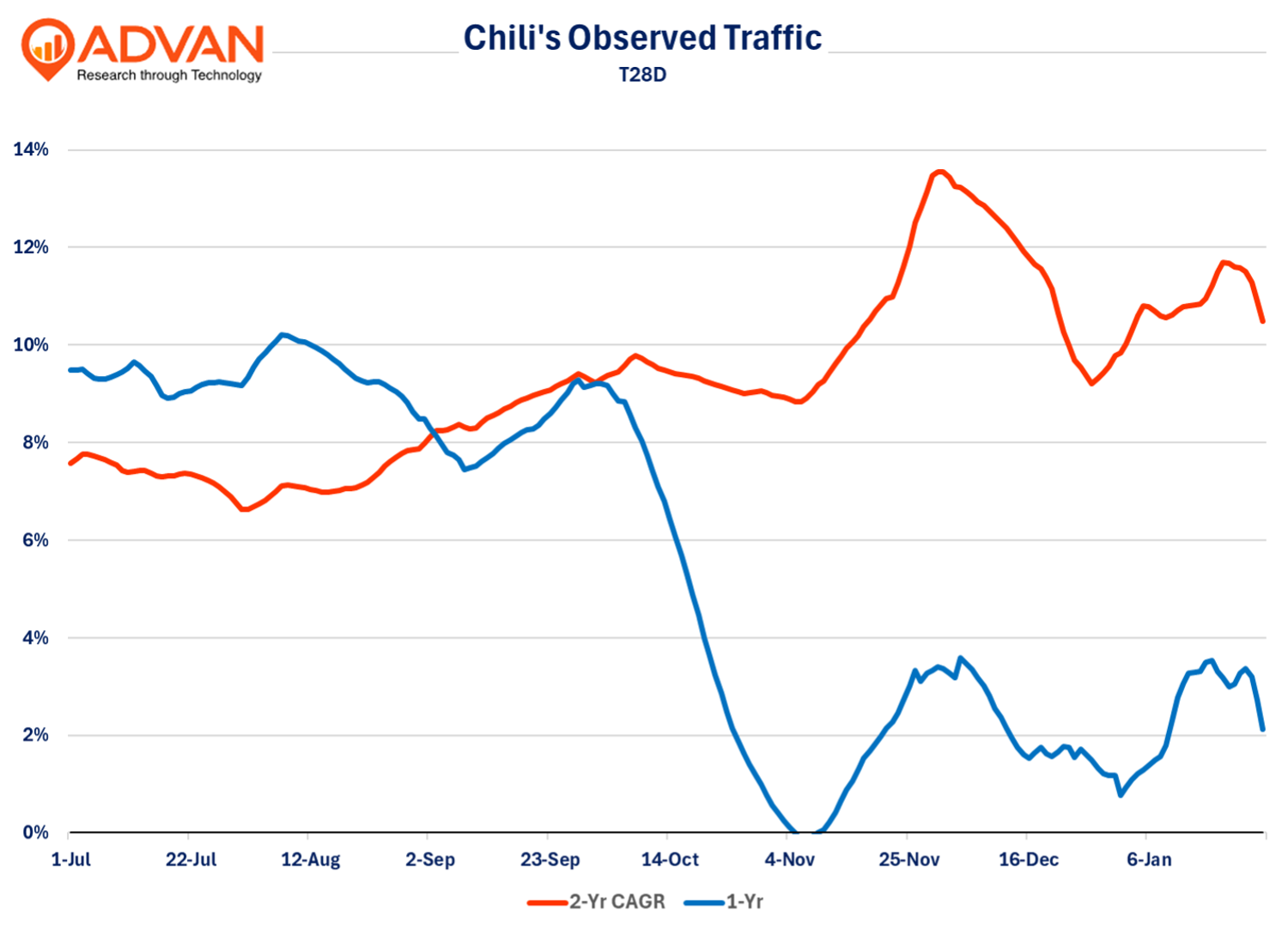

- Chili’s comped- the comp and sales are now 62% higher than four years ago. Current QTD comp traffic is running above guidance (per Advan).

- Chili’s continues to win the “moment of truth” in where consumers choose to dine due to its brand standing for greater value (bang-for-your-buck); Chili’s intends to reinforce that perception and will underprice inflation and competitors in 2026; most will be forced to raise menu prices to offset beef cost inflation.

Brinker’s quarterly results were again spectacular for Chili’s with its comp-sales increasing +8.6%, on top of a +31.4% increase last year. The much smaller Maggio’s comp-ed -2.4%. With the better results and strong January trends, management raised its full-year fiscal guidance (two more quarters to go). Observed traffic (below) also shows a strengthening in the 2-year traffic trend since November. Per Advan, weekday traffic growth was stronger than weekend and the dinner period was stronger than lunch.

Chili’s comp-traffic was +2.7%* (Advan +1.7%) and comp-ticket (excluding delivery mix) was +4.4% (Advan +4.5%). Lastly, delivery / catering added 150bps to comp-sales. The traffic increase was above the industry (-0.7%). Similarly, Chili’s +11.0% 2-year CAGR is far above the industry (-0.9%). CEO Kevin Hochman said, “This was our 19th consecutive quarter of same-store sales growth with a 3-year cumulative comp of 50% and a 4-year comp of 62%. The Chili’s turnaround is real, it is sustaining, and we have no intention of taking our foot off the gas, which means we will continue to be focused on improving our food, service, and atmosphere as well as continue making Chili’s more fun, easier, and more rewarding for our team members.”

Hochman, “When we started this turnaround, third-party syndicated data placed [Chili’s] at the bottom or near the bottom of our competitive set in all 7 of their key metrics that correlate to future sales growth. In the last quarterly snapshot of these metrics, Chili’s is now in the top 3 of all those metrics: quality, value, service, atmosphere, taste, cleanliness and overall experience. Yes, there’s still room for meaningful gains, but our guests’\ experienced progress through our operational improvements is very encouraging. The other important takeaway from this data is where we have repositioned ourselves on value, which allows us a long runway for growth. In the past 3 years, we have captured value leadership in casual dining and the broader restaurant industry… Our per person check average is still more than $3 less than our direct casual dining competitors and more than $4 less than casual dining as a whole. Simply put, Chili’s has been repositioned to win for the long term, and that’s exactly what this team is going to do.” Per Advan, Chili’s observed average check is $51.63, in line with Applebee’s $51.11, but far less than Texas Roadhouse ($68.14).

As noted, management raised guidance for the fiscal year. For the 1H of calendar 2026, they expect food cost inflation to be +MSD due to rising beef prices; Chili’s expects +4% menu price inflation to largely offset the higher costs. +MSD going to be hard for most restaurant brands to pass along to consumers, as such, we expect many brands to “eat it” leading to continued margin pressure (see CMG ). Obviously, Texas Roadhouse, with beef at 50% of COGS, will especially feel the beef inflation in lower margins. (Average check was +2.5% for TXRH.) Chili’s expects to produce ongoing market share wins, and it’s playing its position of strength and favorability (value) in consumers’ eyes. CFO Meka Ware, “We remain confident our plans will enable us … continue to significantly outperform the industry on sales and traffic at Chili’s.” Management expects underlying traffic at +1% or better; as the chart shows, they are currently running in the +2%+ range.

See our last write-up on category trends here and EAT’s prior earnings report .

‘* others estimated traffic at +5.7%, which is far off from the reported figure.

LOGIN

LOGIN