Following our note on **7-Eleven **and its new store prototype and potential to improve its inside-the-store contribution to sales, in addition to our story about drive-through coffee and QSR, here we touch on the strong Q2 results from **Casey’s General Store **and the improving trend for Circle K (Alimentation Couche-Tard).

Casey’s CEO Darren Rebelez, “We saw positive traffic growth as guests responded well to our innovation and promotional activity in the prepared food and dispensed beverage category. We also experienced margin expansion, driven primarily by the grocery and general merchandise category… Same-store prepared food and dispensed beverage led the way as sales were up +5.6% or +10.2% on a 2-year stack basis, with an average margin of 58%… What we’re seeing is more units purchased in the basket (UPT), which is really helping to drive the sales as well… We also brought back our most popular [limited time offers] with the Barbecue Brisket pizza and whole pies were a growth driver for the category.” Readers will know that we are highly attuned to improvements in UPTs as signifies strong execution on merchandising and it proceeds an improving traffic trend.

As a reminder, Casey’s Prepared Food & Dispensed Beverages business is roughly a quarter of gross profits, and they benchmark its performance against the fast food industry*, i.e. QSR. This business delivered a +5.6% comp-sales increase for the quarter, well above the industry’s +3.7% rate. For the quarter, inside-the-store gross profit was $0.77 per gallon of fuel sold, full margin was $0.41 per gallon. The strong sales and good margin performance resulted in a strong 20% increase in profits.

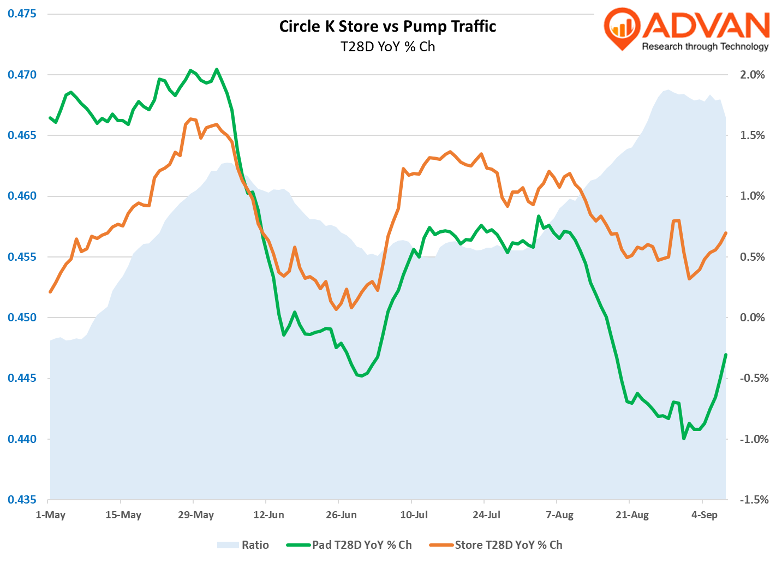

Circle K’s quarterly results were less punchy, but improving. The US region made $0.48 per gallon on inside-the-store sales and a $0.45 per gallon fuel margin. Inside comp-sales increased only +0.4%, which still left the 2-year stack down, at -0.7%. Operating profit growth was flat YoY. CFO Alex Miller said, “This positive performance of same-store sales in our U.S. market was a first in many quarters, and we continue to see positive momentum building up… The Roller Grill offer was our top performer alongside bakery and breakfast sandwiches.” The trends shown below support Miller’s view; inside-the-store traffic is outpacing pad traffic and its ratio to pad traffic is steadily improving. (The slump in June likely reflects the month’s adverse weather.)

On the escalating competition with QSR, Finance VP, Filipe Da Silva said, “We believe that our food program is really resonating to our customers when you see the evolution of the value meals and the quantity of that we have been able to sell. And you have seen also the GP profile. So we are able to do that, executing better, delivering higher food gross profit. So yes, very confident that we are in the right direction and that we’re winning in our industry, actually.” And Miller said, “I think you will see us lean into value everywhere we see the opportunity to do it. We believe we fundamentally found something in food that enables us to show real value that’s resonating with consumers… I can tell you, we will lean into value everywhere we see the opportunity to do that in a compelling way that resonates with the customer.”

In terms of what’s next, Miller said, “In our win in food strategy, we have been laser-focused on execution and SKU rationalization. We have significantly reduced the number of items freshly prepared in our stores to enhance operational excellence and ease while optimizing our assortment. And as we focus on execution, value and simplicity, we are also dialing up the fun, flavor and innovation with an exciting new collaboration announced just this morning. We are partnering with Emmy award-winning chef and food network personality, Guy Fieri, best known to many from his popular Diner, Drive-In and Dives TV show to launch 11 flavor town-inspired menu offerings. The initial rollout this week in hundreds of our locations in 10 states across the Northern U.S. includes unique exclusive items such as Mac & Cheeseburger, Sweet Heat fried chicken and waffle sandwich, and candy chaos cookie.” Relative to Casey’s leading inside-the-store margin per gallon, Circle K has a large opportunity in front of it.

*Here we are defining and measuring the industry as the limited service industry (NAICS 722513 – 15) and the Census MRTS report .

Other pieces on the C&G industry can be found here and here .

LOGIN

LOGIN