MGM Grand has a broad portfolio of premium (Aria, The Cosmopolitan, MGM, and Bellagio) and mass properties (Luxor, Excalibur, New York, etc). Its Las Vegas Strip Resorts reporting segment showed a -8% decline in room-rate, a -5% decline in casino revenue, and a decline in food & beverage sales. Within the portfolio, stronger trends at its premium-end properties were offset by declines in the remainder, i.e. their rate of decline was worse. MGM CEO Bill Hornbuckle said, “And this summer, we heard from some of our guests around value in Las Vegas, and we responded by making adjustments to ensure a rationalized premium value (an interesting way of putting it) experience across all of our properties. We also partnered with the destination on a fabulous 5-day sale during which we sold over 300,000 room nights, nearly double our typical pace, reflecting the strong demand that exists for our experiences. There are additional factors pressuring the current visitation dynamic, including international visitation, particularly from Canada, Southern California drive traffic… (both of which skew to visiting the less spendy casinos)… We don’t expect the dynamic to be changed overnight; we are proactively working to create initiatives and draw incremental visitation… As we look to the fourth quarter, we see signs of stabilization as the luxury market segment continues exhibiting strength.”

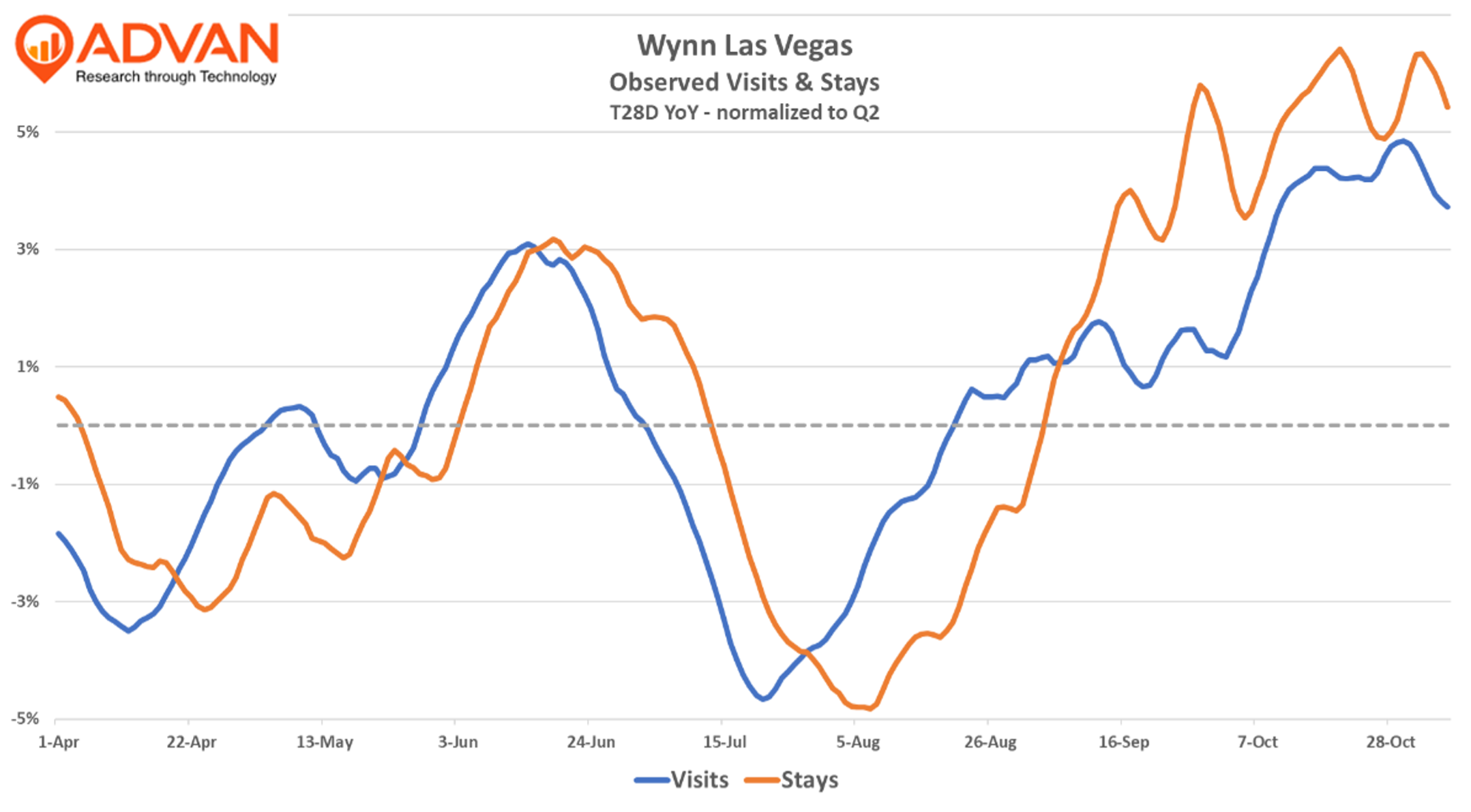

On the premium of premium end, Wynn also spoke to the improving luxury trend, CEO Craig Billings, “Demand in the casino was healthy throughout the quarter with solid increases in… casino revenues that were up 10%. Hotel revenue was flat at $187 million, demonstrating that our plan to accept slightly lower occupancy in order to preserve ADR and maximize EBITDA paid off during the quarter. In fact, in August, the property set an all-time monthly EBITDA record… Wynn Las Vegas continued to see notable gaming market share gains in the quarter…” And CFO Brian Gullbrants, “More recently, business in the fourth quarter has seen continued momentum with drop and handle both up versus the same prior period last year… So with the fourth quarter off to a strong start…” Food & beverage spend improved by +700bps QoQ. Table drop remained very strong (+12% YoY) and slot handle strengthened +130bps QoQ. For the quarter, observed visits and stays were similar QoQ, but as the chart shows, the quarter strengthened in the back half, and that’s continued in October. (As a reminder, Advan sees that “luxury momentum” building across consumer consumption categories – see our stories on Hermes and Louis Vuitton .)

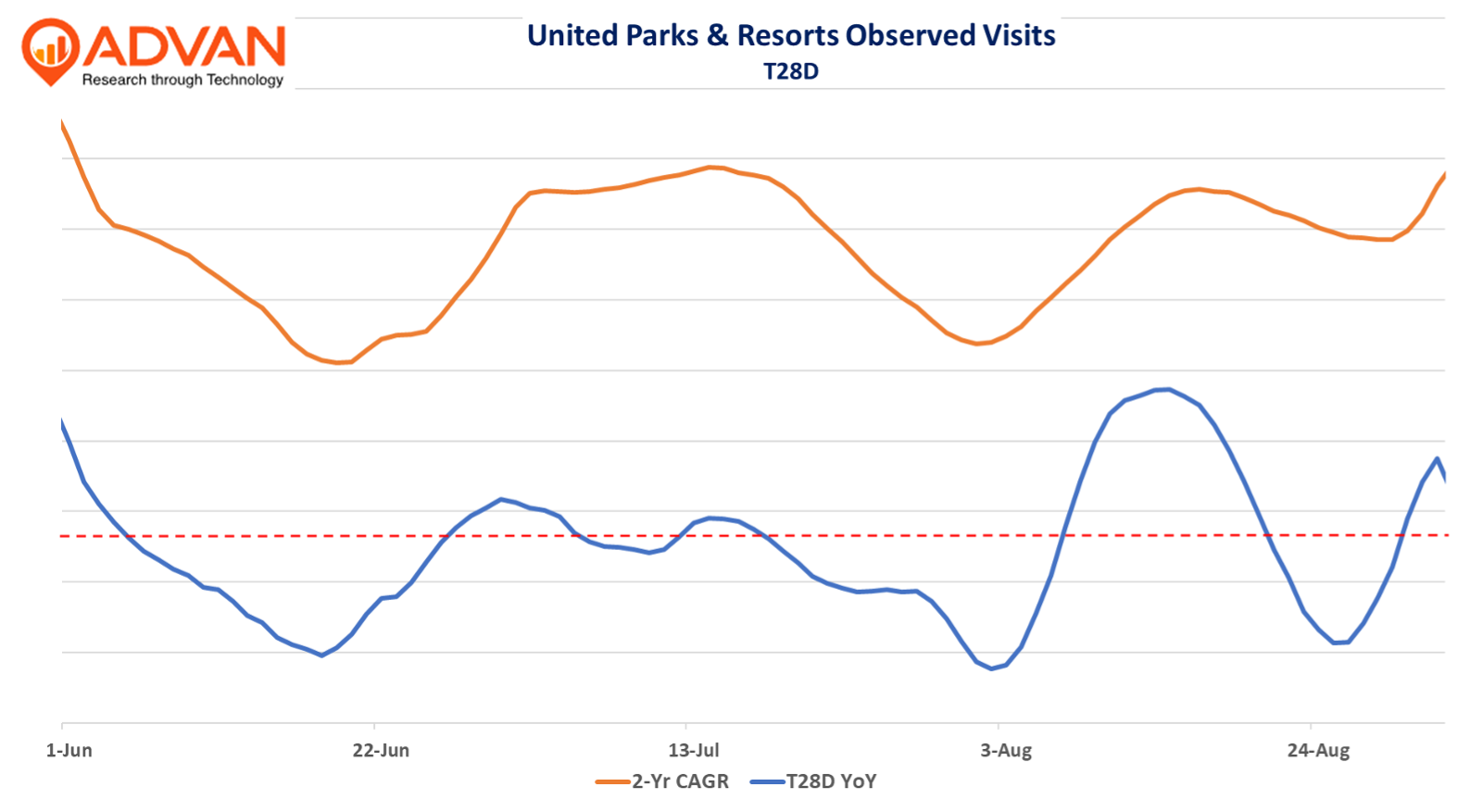

What’s happening in Vegas, isn’t staying in Vegas. It’s happening in restaurant-land, those that cater to the non-affluent need to offer more promotions and are increasing marketing to drive volume, and have little to no pricing power to offset cost inflation. It’s also happening in theme parks; **Universal **was able to drive admission price higher with its fancy new park– Epic Universe. (And we expect Disney will as well.) By contrast to drive attendance, SeaWorld (United Parks & Resorts) needed to discount by -6% to hold admissions near flat (-1.8%). Similarly, Six Flags to hold admissions levels, they needed to discount by -8%. (See our prior industry story and Universal ). As shown in Advan’s data, the season (Memorial Day to Labor Day) was generally flat 1H vs. 2H for United Parks, both on a 1-and 2-year basis, but the trend was down on a 2-year basis.

United Parks’ CEO Marc Swanson said, “Performance during the quarter was negatively impacted by an unfavorable calendar shift, poor weather during peak holiday periods, a decline in international visitation, and less than optimal execution. The consumer environment in the United States appears to be inconsistent as has been outlined by a number of other leisure and hospitality businesses. Nonetheless, we can and expect to do better.”

Swanson, “[The decline in] international attendance is, as you noted, more of an impact to the Florida market and Orlando. So the fact that we’re up year-to-date at SeaWorld Orlando with that headwind, I think you could view that as a positive.“ Advan’s interpretation of this comment / results, is that United Parks did what it could in pricing, promotions, and marketing to drive the growth at SeaWorld Orlando and attendance, i.e. volume; that was the priority outcome, and it matches what’s happening in Vegas and limited-service restaurants.

Six Flags CFO Brian Witherow, “The quarter began on a strong note. Combined attendance in July and August increased approximately 2%… However, following Labor Day weekend, we saw a downturn in demand trends as attendance for the month of September declined approximately -5%… [To make the season and drive park results] our initiatives included increasing both operating expenses and select promotions, including changes to ticket prices and bring-a-friend offers. Based on past experience, these investments often yield immediate results in attendance growth. Unfortunately, in other cases, it can take time to see a change in consumer perception and growth in demand.”

LOGIN

LOGIN