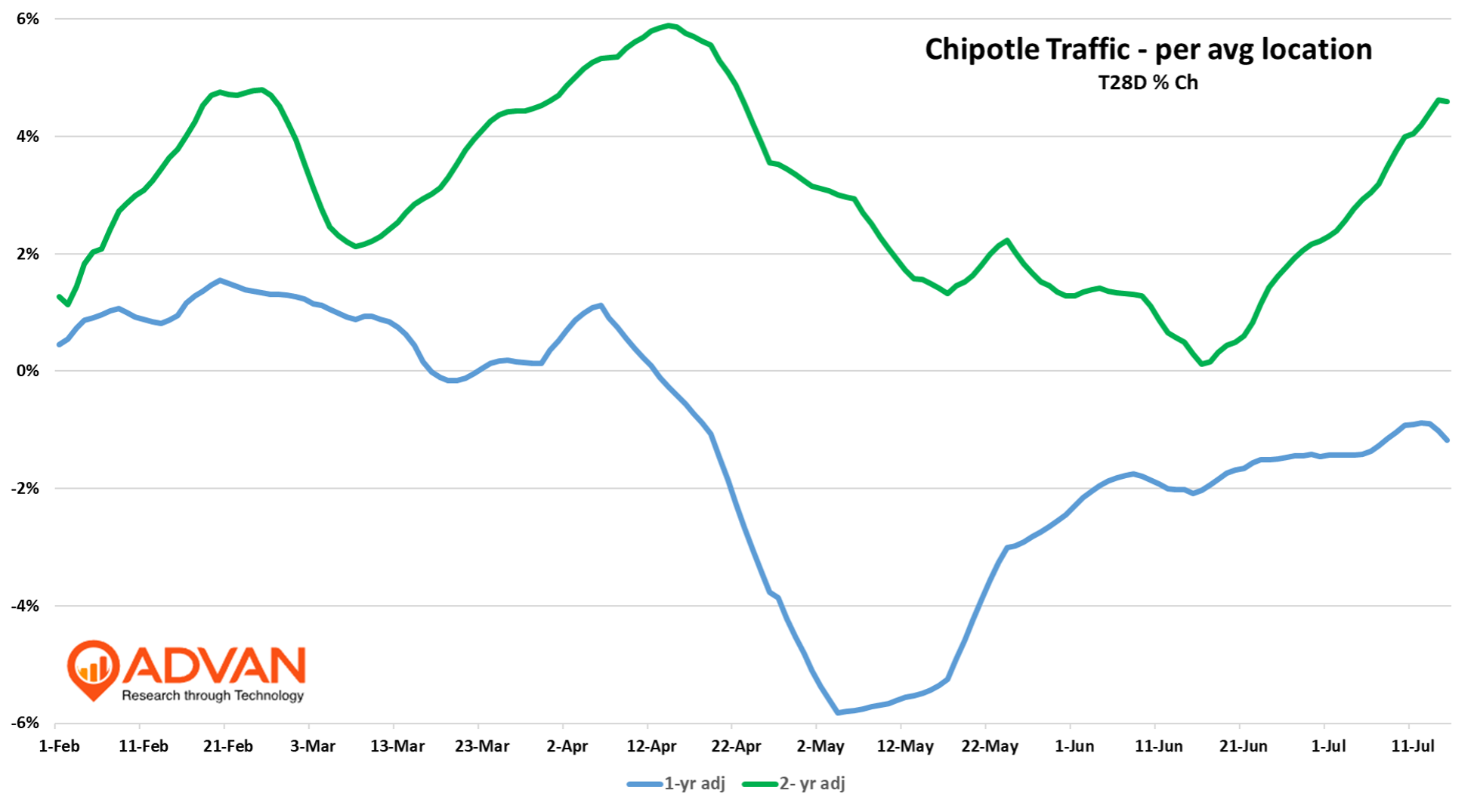

As anticipated, Chipotle reported soft results for Q2, including comp-transactions declining -4.9%; total revenue of $3.14B was marginally above Advan’s $3.11B estimate, i.e. darn close. (The -4.9% is -260 bps of deceleration QoQ; Advan’s visits estimate decelerated -245bps QoQ, or roughly the same.) As a reminder, the fast-food industry is facing cyclical and secular pressure on sales – a topic that we presented to UBS’ clients this week, where the cyclical is consumption shifting to less expensive channels like food-at-home and convenience , and the secular is fewer calories consumed due to weight loss drugs (Ozempic, Wegovy, etc). In terms of the quarter’s cadence, CFO Adam Rymer said, “In May, we saw a step down in our underlying transaction trend, followed by a reacceleration in June as we rolled out our summer marketing initiatives. Comparable sales and transactions* turned positive in June and this trend continued into July…”

In terms of new units, 61 locations were added during the quarter and new store productivity remained a robust 80%. Annualized store-level store volumes remained stable at $3.14M which also demonstrates that the new stores are meaningfully producing. Like Domino’s , Chipotle experienced pressure on store-level margins (-160bps). Chipotle expects ongoing pressure to margin rate as it intends not to fully pass input cost inflation onto the consumer (meaning that competition is fierce and the price elasticity / calorie substitution is high).

Management lowered its annual guidance for comp-sales from +low-single-digits to “flat.” Flat still embeds a +2-3% comp in the 2H; however, unless they take more pricing, getting to +2.5% demands a significant improvement in the 1-, 2-, and 3-yr traffic trend. As shown in the chart above, the 2-year has improved from May’s level, but it’s still below where it needs to be. And so, what tricks does management have up its sleeve to move that higher?

Incremental growth drivers for the 2H, and beyond, include: a new COO, Jason Kidd – recruited from Taco Bell, to improve throughput time, more labor and food tech for the stores, expanding more seriously into catering, increasing marketing spend, putting more value into its loyalty program, increasing the limited-time-offer cadence, and menu innovation. As to the message for the marketing, CEO Scott Boatwright said, “I don’t think we’re getting credit with the consumer today. And so what I’ve talked to the team about internally is how do we better communicate our value proposition and center around the core equities of the brand… How do we do that in a unique way that is authentically Chipotle that is not targeted at the competition, and that is not price pointed? I think we’ve got to figure out a way we can communicate value for the consumer and showcase the value we are to QSR and fast casual, I think there’s more work to do there, and that’s what we’ll lean into….”

‘* Note he said “transactions” and not “comp-transactions.”

LOGIN

LOGIN