· Chipotle once again reported soft comp-store sales and guided for more of that in 2026.

· While consumer aversion to Chipotle’s higher menu prices may be one factor for the deterioration in sales growth, Advan’s data and Chipotle’s actions (in terms of menu innovation) suggest that the rapid update of GLP-1 drugs by more affluent households (which Chipotle’s out-indexes in) looks to be the larger driver, i.e. changing consumer needs in how much and what they want to eat.

Chipotle’s comp-sales declined again (-2.5%) due to softer comp-transactions (-3.2% and -240bps QoQ). The 2-yr CAGRs of -sales and -transactions deteriorated, but the 3- and 4-yr CAGRs were little changed. Management guided for flat comps in 2026. Observed traffic was similar QoQ (-10bps) and January is in the same range. And so, what explains the difference between the erosion in comp-transactions (-240bps) and observed traffic (-10bps)? A decline in 3P delivery could be one contributor; management didn’t discuss it on the call, and so we are left wondering: are some of Chipotle’s customers also cutting out delivery orders (maybe because they are eating differently / less)?

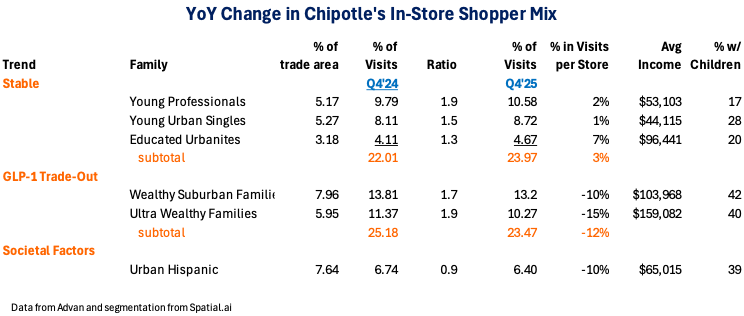

Looking at the change in Chipotle’s customer mix provides a clue to the question (but not a definitive answer); however, the data aligns with a series of webinars that we did last year with other consumer insights providers for UBS’ institutional clients on the impact of GLP-1s on the restaurant industry. The conclusion from that series is that certain limited-service brands were experiencing a decline in volume due to fewer calories consumed by GLP-1 users, including Chipotle. Moreover, the series also concluded that the GLP-1 impact would become more pronounced with greater adoption, especially given the significance of the uptake. Well, Chipotle’s traffic declines in the cohorts Wealthy Suburban Families and Ultra Wealthy Families are quite meaningful at 25% of visitors, 1.8X the population living near its locations, and pronounced, at a -12% decline. Moreover, we suspect that these same cohorts are likely to out-index in delivery. A 12%+ decline in deliveries to these customers (maybe 1/3 of the delivery business) would go a long way toward explaining the gap between comp-transactions and observed traffic.

CEO, Scott Boatwright’s statement “Our path for further success lies in leaning into what differentiates our brands, accelerating innovation into new offerings and occasions that are of growing importance to our guests…” A comment that indicates that the brand needs to change to meet consumers’ changing needs; what’s changed most meaningfully in the food space, in our opinion, are GLP-1s and price fatigue by consumers. As it relates to Chipotle, the Wealthy Suburban Families and **Ultra Wealthy Families **cohorts are less likely to be “price fatigued.” Moreover, other than Hispanics, the data show no other meaningful decline for other cohorts. Moreover, a pullback by younger urban college-educated doesn’t appear to be Chipotle’s problem (at least for where we have data, we don’t have data for locations in urban canyons like Manhattan).

Boatwright went on to say, “A perfect example of this is the recent rollout of our high-protein line, which highlights our extraordinary value across a range of price points, starting with a single taco with 15 grams of protein at just $3.50 to double protein bowl with over 80 grams of high-quality protein also includes a new high-protein cut for around $3.80 and is aspired by hacks that our guests rely on to boost their intake and offers a solution to those looking for smaller portions, which is a fast-growing trend with the adoption of GLP-1s.” This acknowledgement demonstrates that management is on top of the issue, but it’s not an easy / overnight fix. (Darden has made a similar acknowledgement .)

See our last write-up on category trends here , and Chipotle’s prior earnings report and the protein bowls .

LOGIN

LOGIN