Comcast CFO Jason Armstrong, “We’re really pleased with the early results from Epic, which are driving higher per cap spending and attendance across the entirety of **Universal **Orlando. We remain focused on expanding ride throughput as we build to run rate capacity and expect Epic to continue scaling over the next year with higher attendance, stronger per caps and improved operating leverage.”

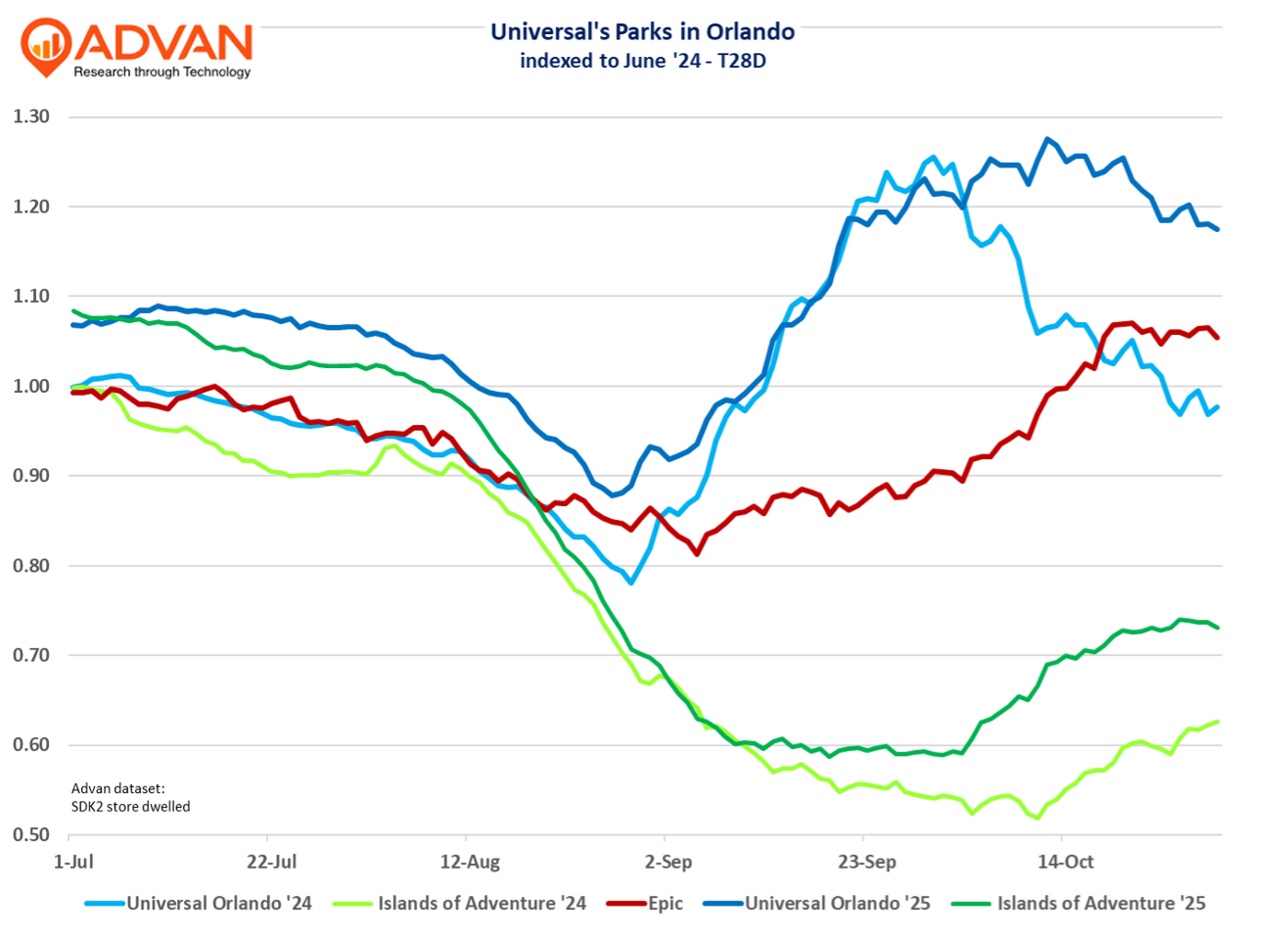

Advan estimates that Epic is doing about 30% of the attendance that Universal Studios Orlando does. The data also confirms that Epic has been a halo for Universal’s other two parks with both Universal Studios Orlando and Islands of Adventure consistently higher in observed attendance than last year. Moreover, the Halloween Hour Nights season was especially strong, as it was for Epic Universe too, i.e. little cannibalization is evident. For the September quarter, Florida and international grew revenue, whereas California declined. September 2025 also laps last year’s very disruptive hurricane; as such, the lift is against an easy compare (driving the T28D trend higher in October as well). Importantly, given the abnormality of Hurricane Helene, naturally means that our estimates will have a wider range of error.

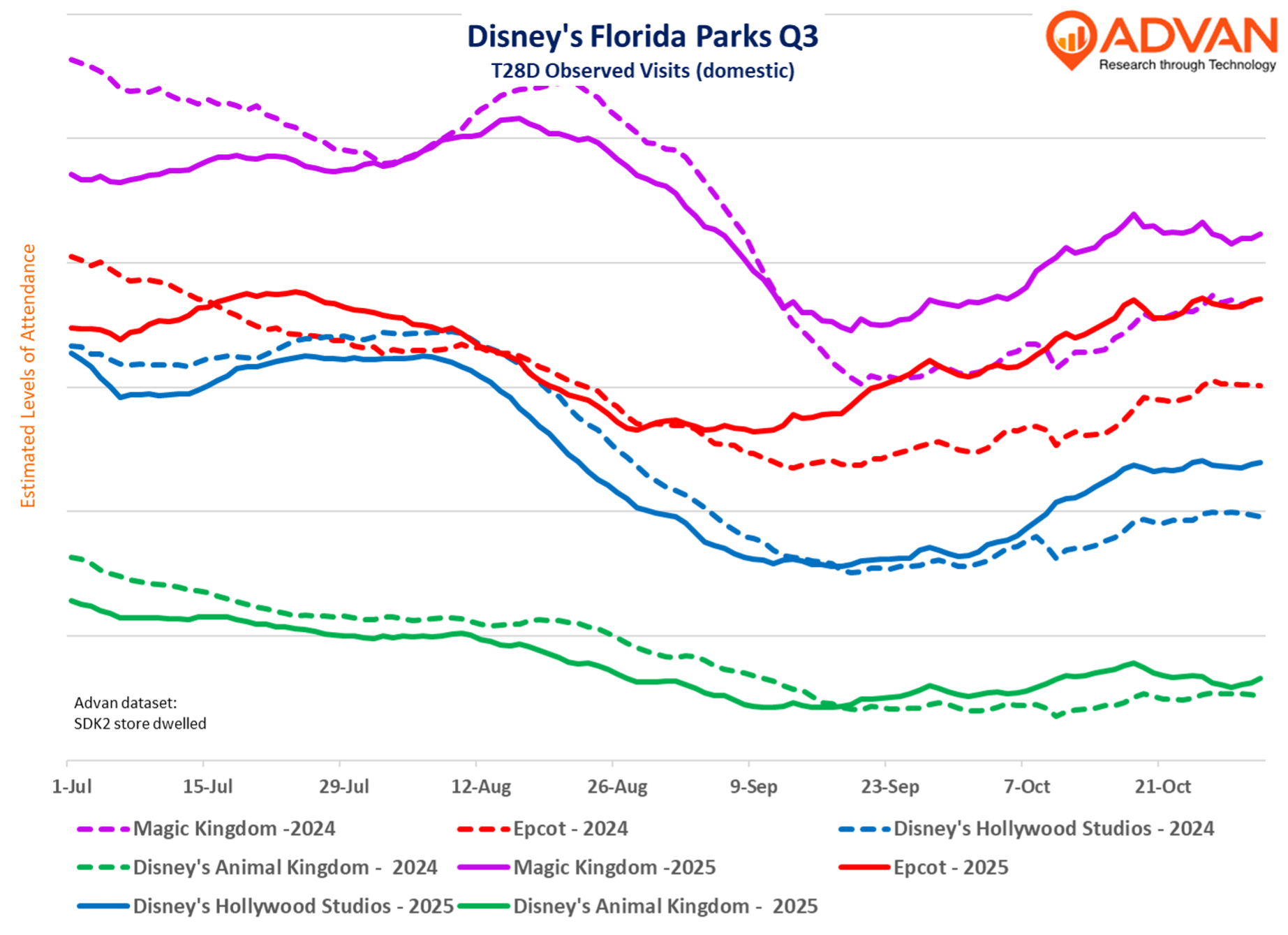

How did Epic impact the other destination theme parks in Orlando? Well, it appears to have been a win for them as well (following a soft July). For the quarter, observed visits (Advan) of **Disney’s **Florida parks grew slightly (+0.5%), and international visitors will enhance that figure. Rival SeaWorld Orlando was up similarly. We also see support for our view that Epic (as well as increased investments and marketing activity from Disney and PRKS) has supported the overall Orlando travel market in the MCO statistics. Orlando International Airport passenger deplanements improved for both domestic and international visitors. With the June / July / August trend for domestic at -2% / +1% / +4% and international at +4% / +7% / +5%. (September statistics haven’t been released.) As the chart below shows, Magic Kingdom and Epcot led growth. Moreover, the Halloween events also drove particularly strong YoY growth in September and October. Readers will recall that we’ve flagged a strengthening in discretionary spending by the more-affluent, starting in August, with the catalysts being growing confidence in policy and the economy, and the strong stock market.

LOGIN

LOGIN