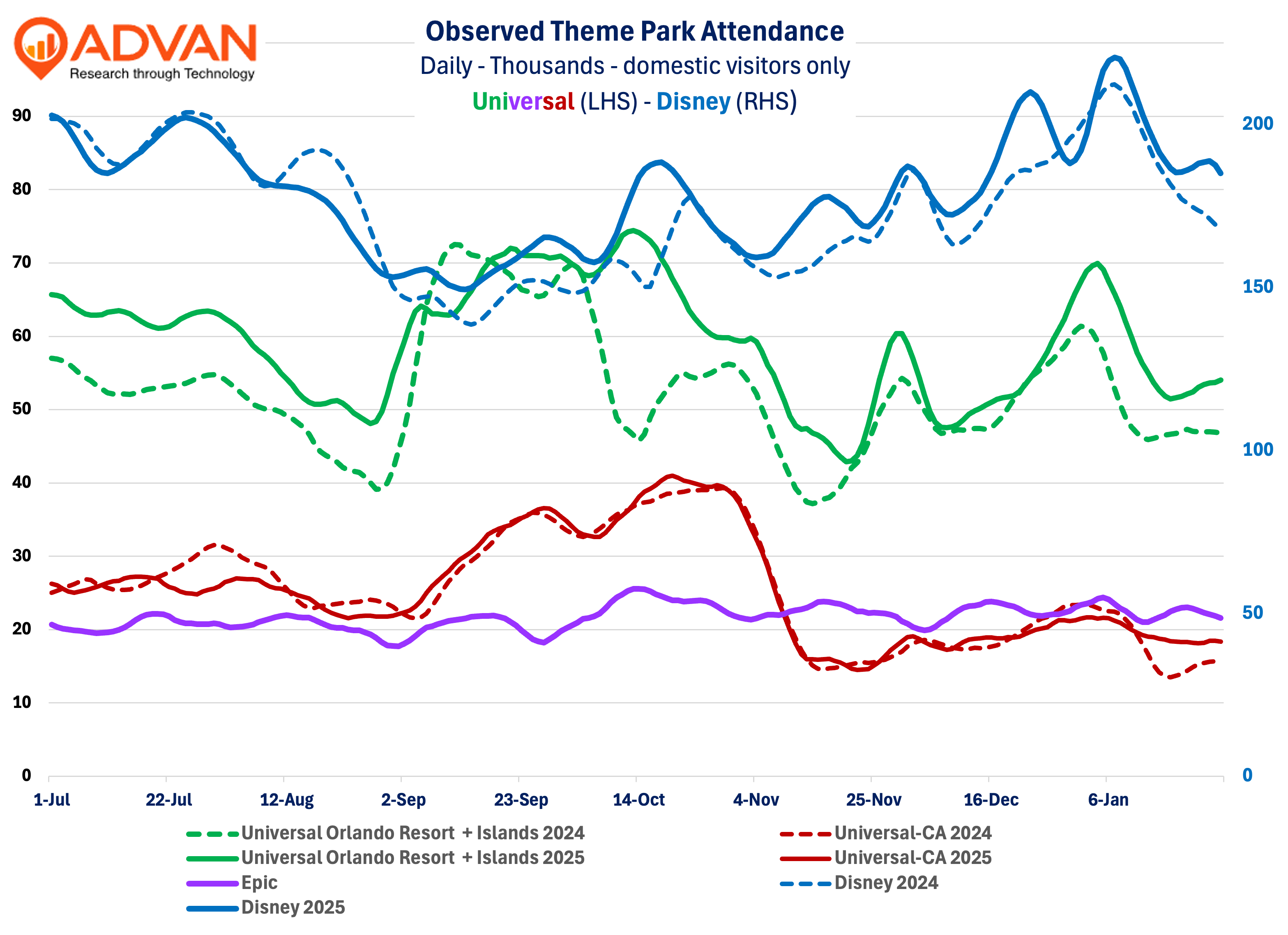

- Comcast’s Q4 results showed strong gains at its domestic parks. Advan estimates that Orlando was up at the legacy parks and that the new Epic Universe was up QoQ in attendance (despite what is a slower season period). Universal’s Halloween event was particularly successful, both CA and FL.

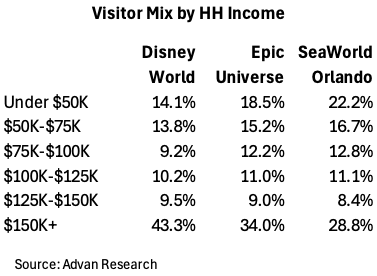

- The success at Universal was not a detriment to Disney’s attendance and Advan estimates that Disney’s attendance also strengthened from Q3’s pace. For Disney, we attribute the improved pace to strong offers in the market for consumers, its compelling storytelling and attractions, and its leverage to more affluent households – these are the households that picked up their pace of spending in the 2H.

- However, not all is fun and games in Theme Park land. SeaWorld Orlando and others had a soft Q4.

Comcast / Universal reported strong Q4 results with revenue and earnings up 22%+, fueled by the new **Universal Epic Universe **theme park, and ahead of Q3’s +19% / +13% revenue / profit growth. (Nearly 40% of Universal’s revenue is international; as such, the revenue growth for its domestic operations is far above +22%.) As the chart shows, Universal Orlando had a very successful Halloween event, and Epic attendance improved +6% QoQ. Advan estimates that Universal’s overall domestic attendance increased +39% for Q4, above the +25% rate in Q3, the result of more capacity and tickets being available at Epic. Universal’s success didn’t hamper Disney, with Disney attendance largely above 2024 since September; for the quarter, Disney domestic attendance should be up +L-MSD vs. down slightly in CQ3 (-2% per Morgan Stanley). Disney strengthening pace, in our opinion, stems from its strong offers in the market to consumers, its compelling storytelling and attractions, and its high leverage to more affluent households – those are the households that picked up their pace of spending in the 2H. Per Advan data, Disney’s visitor mix of affluence is far above Epic and SeaWorld, as shown in the table below. We don’t know if rate, or discounting, by Disney, drove its stronger attendance; if so, that could be problematic for other smaller operators in the market. SeaWorld Orlando’s observed attendance was down sharply in the quarter (-5%).

Comcast CFO Jason Armstrong said, “This performance was driven by strong results at Universal Orlando. We’re really pleased with what we’re seeing from Epic, which continues to drive higher per cap spending and attendance across the entirety of the resort.” Comments that align with the trends shown in the chart.

Comcast CEO Michael Cavanagh said, “We couldn’t be more pleased with Epic. It was a big swing, as everybody knows, the biggest park opened in the country and maybe beyond to the world in 25 years. Lots of excellent technology. The theming is incredible. So to sit here and look back on the achievement that the team made of getting it successfully opened and ramping it with more ramp still to go as we head into 2026. And by the end, I think, of this coming year, I think we’ll be fully ramped up in that park. But I think you said it well, and it was in my earlier remarks, the point of it was to lift all of Orlando, and that’s, in fact, what it’s done.” (Note he said, “all of Orlando.” Specific competing attractions are feeling encroached upon.)

As Comcast further opens ticketing in 2026, Disney’s 2026 new attractions come on line (a lot of them this year), and more cruise capacity hits (+9% for the Caribbean region per Gemini), in an economic environment where the less-affluent consumer are spending cautiously, that’s likely to make 2026 another difficult year for other theme park operators.

See our last write-up on industry trends here and here , and CMCA’s prior earnings report .

LOGIN

LOGIN