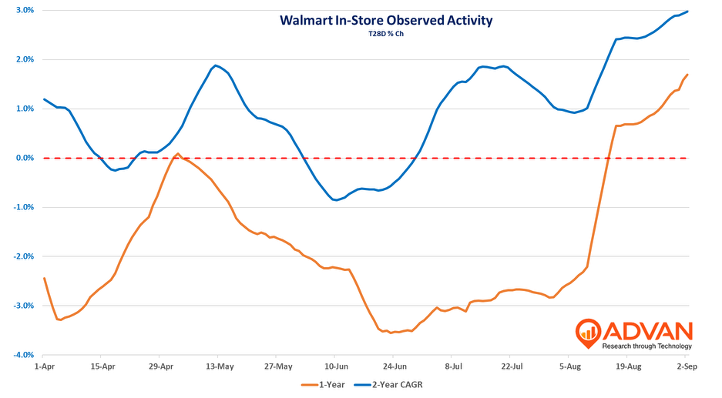

Like the seasons, in the “investor world” following Labor Day, each year brings two dueling must-attend investor conferences, the Barclays’ Back to School Conference and Goldman’s Global Retailing Conference. The conferences are really not about the webcasted presentations; it’s the management 1:1 time that draws in hundreds of buysiders to each event. How a buyside investor chooses is typically determined by the “weight of their book.” (In the future, maybe this provides another opportunity for “digital twins.”) We didn’t attend and so all we can do is the webinar (and look at the stock price moves). The following are the comments that we found to be new news, or weighty in importance, and how Advan’s data illustrates the comments / insights. One caveat is that we did not listen to all the webinars, or obviously any of the breakouts / 1:1s, and we had other things to attend to; as such, we just checked in on the largest names. Walmart: On the consumer, CEO Doug McMillon, “But generally speaking, people have held up really well, and we expect the same thing to happen for the balance of the year, and this quarter started off in the same strong fashion on the top line. So we’re continuing to see what happened in the second quarter spill into the third quarter.” His statement is supported by the chart’s stronger foot traffic trend both on a 1- and 2-year basis. Additionally, Advan’s transaction data shows a slight increase in average ticket size (0.5%), which is likely tariffs and basket size (UPT). As a reminder , the larger reported average ticket increases are a function of channel mix and sales mix (GLP-1 drugs). Also, adding to in-store traffic are curbside and store delivery, which substantially contributed to the Q2 comp (+280bps per Advan). If we assume the Q2’s average ticket and e-commerce contributions, Walmart US would currently be comp-ing around a +7%. Wow! However, we don’t believe that they’ll report +7% for the quarter, because we expect a pause following the Back-to-School season. We’ll be back on that expectation in early October.

Home Depot & Lowe’s

As it relates to housing and housing-related consumer demand, CEO Ted Decker said, “Short of the large project that tends to be financed, the engagement in smaller projects and repair projects is as broad-based as it’s been in several years now, frankly, in terms of geographies, in terms of merchant departments, which Billy can hit on the number of departments that we’ve seen positive traction… So we have an employed, healthy core customer who’s now starting to reengage in home improvement.”

Lowe’s CEO Marvin Ellison was a bit more guarded in his view, “So we’re cautiously optimistic that the consumer, specifically our homeowner consumer, is a healthy consumer and that they’re willing to spend, especially when they can get a value. But we’re also cautiously optimistic that hopefully, we’re going to see some trends beginning to shift in a more sustainable way, but it’s just too early to call that. I think you probably heard pretty consistently today that the back half of this year will be more focused on managing tariff cost-related challenges that we’re all going to face. We’re preparing for that. We’re tracking it daily. We’re very aware of the elasticity of our consumer and of our product categories, but we have to wait and see how the back half consumer responds to this tariff environment before we can have a definitive point of view that we’ve hit an inflection point or there’s light at the end of the tunnel or whatever analogy you’d like to use. But we feel great about our business. And overall, we feel great about the health of the consumer, which happens to be a homeowner that really serves us on a day-to-day basis.”

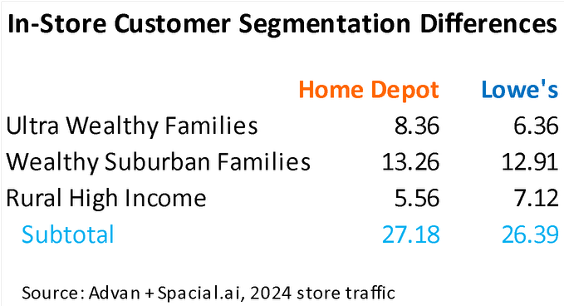

Recall that Home Depot and Lowe’s have different metro portfolios, with Depot in denser and more affluent trade areas. Home Depot’s in-store shoppers have a 7% higher median household income than Lowe’s, per Advan, and a different segmentation as shown below. Importantly, Home Depot’s affluence is understated here as it has a much larger Pro footprint and those store visitors, on average, likely have a less-affluent profile. Additionally, for both, as the affluent spend more than the non-affluent, the sales mix weightings to these segments are likely twice (or more) to what is shown in the table. (See our write-up on their Q2 results here .)

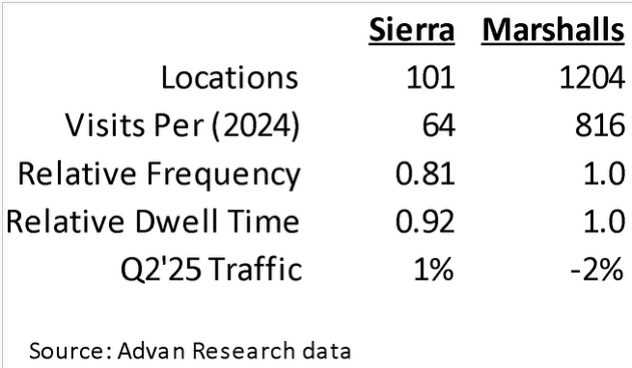

On “why” the recent series of acquisitions into the large-Pro market, Decker said, “What we always knew was with the Pro customer, depending on the size and the complexity of their project, we were either getting the vast majority share of their spend. So a smaller Pro might be giving 100% of their spend to the home center channel or thankfully Home Depot, but the larger Pro would be spending their principal purchases with wholesale distribution. While they shopped at Home Depot, they might have a $2 million spend and Home Depot might get $50,000, or $75,000. That was for emergency fill-in pickup. We obviously opened late at night and weekends, but their principal purchases were with distribution. And what we said is, well, we have the product, we’re in your geographies and you’re already shopping with us, why would you spend more with us? And they all love Home Depot, thankfully. They’re like, yes, we love your brand. We love your product. We love the brands you sell, but you need to develop these capabilities to get that share of wallet. I mean we’re not going to pay for a window package on a Visa card three months before it’s delivered. That’s just not – that’s not how we operate our business. And we’re not going to come and pick up a truckload of shingles, those have to be delivered to the job site. So we set about to build the capabilities to capture more share of wallet with that customer. And we’re not just getting the share of wallet because we’ve entered the game, we have to offer value to them. And the value we’re offering is we can simplify their business. Turn times and cycle times is the principal profit engine for our Pros, a remodeler, a builder, large builder, small builder, how quickly can I get this project done? That is where they make their money and how many projects can I turn…. We can bring digital tools, technology, fewer points of contract and speed up that cycle time of your build, do we have a right to win more share of your spend? And they said, absolutely, and we’ve worked with them on what those capabilities need to be, what they need to look like, put them in place in front of the customer, test them and modify – so the organic efforts remain the most important. I think it’s a $250 billion white space for existing customers’ share of wallet as we build out these capabilities. And M&A is an accelerator to that effort, but not necessary.” TJX and Sierra Trading Post TJX typically shares very little about its Sierra Trading business other than to say “comps were good” and signals as much as the store counts consistently grows. The chain exited 2019 with 46 locations and it will hit 120 by the end of the year. At Goldman, management shared that they look to expand to over 325 in time, particularly in the South. While incremental, given the metrics shown (Advan), the business’ revenue is far smaller than its sister Marshalls. As such, to the total TJX enterprise, Sierra’s expansion will add basis points, not percentages. That said, we suspect that Sierra’s offering is resonating with consumers in our Thrifty K-Shaped moment and that was management’s inspiration to broaden the footprint. Sierra also gives TJX insights into trends and those inform the merchandise decisions at Marshalls and TJ Maxx.

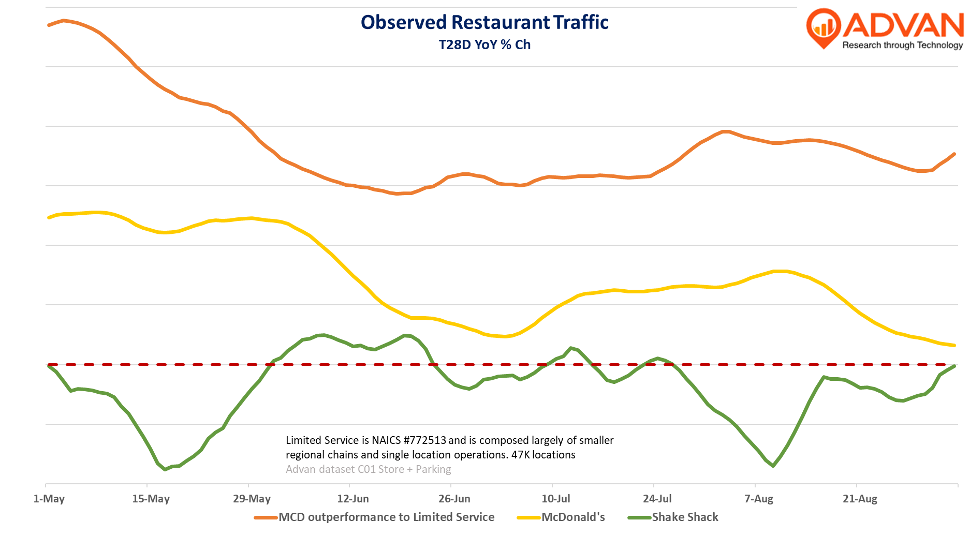

McDonald’s and Shake Shack Readers will recall that the fast-food segment is facing cyclical and secular pressures. Fast food is losing share-of-stomach to more at-home occasions and gas & convenience, and losing calories due to less consumption – GLP-1 usage for weight loss and better-for-you eating. McDonald’s management met with analysts this week and shared their plans to help offset the cyclical, which is to offer more value. Management admitted that its value leadership gap has narrowed to peers in recent years and it wants to restore the gap to its historical level. The chart below demonstrates that McDonald’s is consistently outperforming the industry; however, the outperformance has lessened since May, thus the launch of the Extra Value Meal. Starting September 8th, McDonald’s will launch its Extra Value Meals across its eight popular combo meal at a 4-5% lower price than the current; for example, the $8 Big Mac Value (with medium fries and a medium soft drink). On a temporary basis, it will also offer financial support to the franchisees until incrementally takes hold; i.e. they themselves believe the need to show more value is serious enough that they are willing to take a hit on their own P&L to get alignment with franchisees and make it happen..

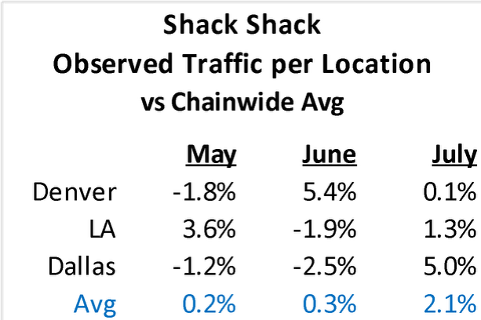

Shifting focus to the premium side of burger and fries, Shake Shack CFO Katherine Fogertey said, “We are definitely seeing a much bigger pickup in share gain and momentum in markets outside of New York and D.C… It’s Denver, Los Angeles. We have Dallas, Houston, Miami, Orlando, just very, very broad-based. As many know, we have a larger concentration in New York and D.C. relative to the industry average. And there’s really been some unique pressures in New York and D.C., in particular, around international tourism is down in these markets. Macro pressures in D.C. have also been kind of weighing on broader demand.” Advan looked at these better-fairing markets, and as the table shows, traffic in these markets is outperforming. Importantly, our national average doesn’t capture many locations in New York and DC, and so, the table’s average will be stronger than the total company metrics.

Separately, traffic also improved in July from the 1H’s levels due to Shack’s promotions, including the Summer BBQ and Dubai Chocolate Shake. Fogertey, “Dubai is a very exciting shake. This was a menu innovation. We actually have had several of these where it was born in the international markets, and we were able to port it over to the U.S. and have great success… With the shake, we’re seeing guest acquisition, more digital app acquisition as well on the back of it. And it does tend to skew a little bit younger in demographics.” Finally, despite industry pressures, Fogertey and company expect to open 100 new units in 2026 (+15%) as part of its 1,500 LT TAM

LOGIN

LOGIN