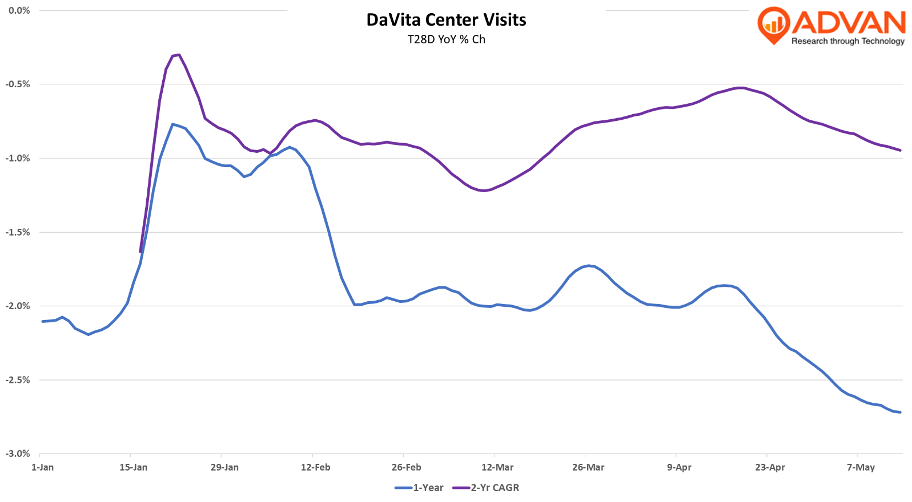

DaVita, the dialysis treatment company, had a soft Q1 as volume (treatments per day) in the US declined -0.6%, which was below management’s plan due to a number of external impacts. The KPI also decelerated QoQ by -30 bps, which compares to visits (Advan) slowing by -40 bps on a days-adjusted basis. Dynamics impacting Q1 were a harsh flu season and disruptive weather in Jan / Feb which resulted in missed treatments. The harsh flu season also resulted in more flu deaths, which will be a headwind to volume for the remainder of the year. However, as shown in the chart below, Q2 has started worse and that stems from a cyber attack on April 12th which disrupted business operations and volume. While most of its operational systems are back up and running, not all. Based upon all of these factors, management lowered its guidance on US annual volume to roughly a -0.5% YoY decline. DaVita’s business and US volumes are typically very smooth with low-single-digit volume growth, and so this is a deviation to the historical cadence. I will be watching for improvement.

LOGIN

LOGIN