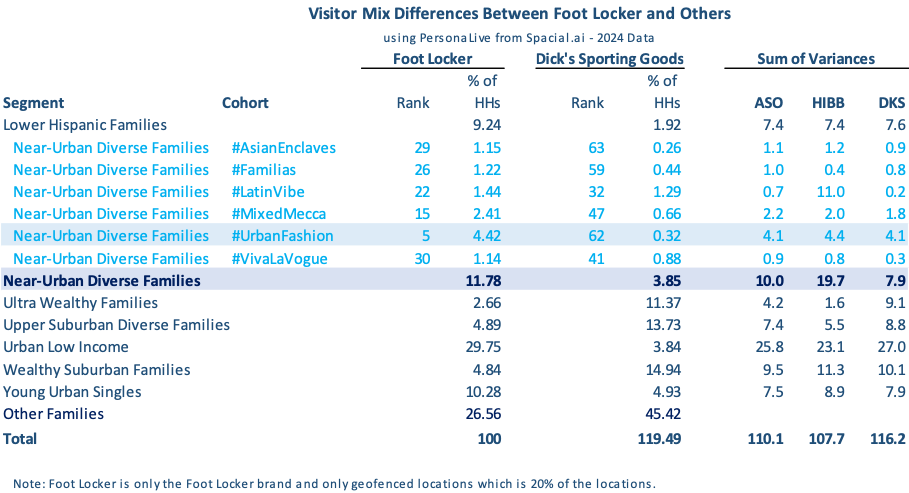

Dick’s Sporting Goods acquiring Foot Locker was unexpected, and despite management’s claim that it would be accretive to earnings, along with a preliminary fiscal Q1 results where comp-sales were above estimates (+4.1% vs expectations of +2.6%), the stock dumped -15%. Our quick thoughts and then our data. First, the near-term accretion was simple math, ahead of the news Dick’s traded at 10.1X EV / EBITDA on a NTM basis, above Foot Locker’s 8.5X. However, the market is not only concerned about Foot Locker’s NTM, but also the five years out EBITDA. Would Foot Locker be able to grow earnings over the next five years, or was it a disrupted business that would have suffered a persistent decline in profitability? In 2022, it produced a 14% EBITDA margin, the last twelve months (LTM), is down to 5%. How is that 5% going to stand up as the higher cost of tariffs hit COGS? And so, the -15% (or -$2.6B in market cap) is pricing in execution risk on this $2.3B in market cap acquisition. (Yes, you read that correctly, DKS lost more market cap than the entire market cap of the bid up FL.) However, doesn’t this deal increase the chances that it can move the margin rate higher? Certainly, the central and publicly traded company expenses can be rationalized – that’s a half+ pt of margin alone. It would larger but the intent is to run Foot Locker independent from Dick’s (at least for now). Longer-term that intent may be slowly rationalized away. Second, the combination will give Dick’s even more clout over the upstream industry – Nike, Adidas, Hoka, OnRunning, etc. The press release announcing the deal reads, “deliver between $100 to $125 million in cost synergies in the medium-term achieved through procurement and direct sourcing efficiencies.” That works out to an additional 1 pt+ of margin. The combination will be dominant in big-format (Dick’s) and small-format (Foot Locker, etc.), which is different that JD’s acquisition of Hibbets, and as such, it generates a lot more clout and influence. Dick’s and Foot Locker serve largely different consumers. Dick’s likely found Foot Locker’s success in expanding its business with Brooks, OnRunning, and Hoka (after the Nike debacle) to be interesting. Where and how brands are positioned with the US consumer will largely be in the combination’s best interest. On the topic of Nike, Dick’s Chairmen and founder Ed Stack said, “Foot Locker was really – a big part of Foot Locker under pressure was what the relationship they had with Nike. Nike moving into DTC and away from wholesale partners a while back hurtful – hurt Foot Locker pretty significantly. Nike has changed their position really leaning back into wholesale. I think Elliott (Nike’s new CEO) and his team are doing a great job, and we’re pretty excited about what’s going on with Nike. Foot Locker is going to be a beneficiary of that move back to – from a wholesale standpoint.” On the complementary nature of the combination in the U.S., Lauren Hobart, CEO of DICK’S said, “Foot Locker has a real estate portfolio that is highly complementary to ours with stores in different markets that serve different needs and demographics from DICK’S…. And with macro trends like the growing convergence of sport and culture, an increased focus on health and wellness and a widespread shift towards casual wear, we believe the long-term industry tailwinds remain strong and that this expanded platform is well positioned for long-term growth… As a combined company, we will have complementary concepts that address the needs of the full spectrum of consumers. Foot Locker enables us to reach more sneakerheads and lifestyle-focused shoppers, a great addition to the performance-focused consumers who are key customers for us. Not only will we reach different types of consumers, but we’ll continue to focus on engaging with them wherever and however they want.“ And third, Foot Locker gives Dick’s visibility into trends overseas and an established platform to expand OUS. The release quotes, Hobart said, “Sports and sports culture continue to be incredibly powerful, and with this acquisition, we’ll create a new global platform that serves those ever-evolving needs through iconic concepts consumers know and love, enhanced store designs and omnichannel experiences, as well as a product mix that appeals to our different customer bases.” Additionally, the release’s bullet points on the merit of the combination reads “Create a global platform within the growing sports retail industry – The transaction will better position the combined company to serve consumers worldwide and expands DICK’S addressable market opportunity. By combining with Foot Locker, DICK’S will be poised to serve consumers not only in new locations in the U.S. through Foot Locker’s complementary real estate portfolio, but also internationally for the first time.” Focusing just on the merits of the deal for the US-side, above we wrote “largely different consumers” because our data shows that only 3% of Dick’s visitors went to a Foot Locker* in the LTM and only 12% of Foot Locker’s visited a Dick’s. Not a lot of overlap in that “venn.” Less overlap, or venn, means less cannibalization and more ability to segment, and “monetize” clout. The 12% number for Foot Locker is also influenced by Dick’s having a broader assortment like golf, baseball, hunt, etc. That broader assortment creates more visit-frequency which is 38% higher than Foot Locker’s. Additionally, given that breadth, we’d expect Dick’s visitor dwell-time in the stores to be longer than Foot Locker’s, but it’s only marginally (5%) longer. Looking at customer segmentation using our PersonaLive data and adding in Academy and Hibbets. The table below shows that the geofenced Foot Locker locations are more distinct from Dick’s than Academy and Hibbets. The Near-Urban Diverse Family segment is 11.78% of Foot Locker’s visitors, meaningfully above Dick’s 3.85%. Within that segment, the #UrbanFashion cohort is ranked #5 out of 80 cohorts, but its 62 for Dick’s. This analysis is limited to the geofenced locations of Foot Locker. That limits the analysis to only 125 of its 679 locations, as such, it’s a narrowed view; however, it’s also a more apples-to-apples view as the missing 554 locations are in dense urban markets and deep inside indoor malls – generally outside of Dick’s trade areas.

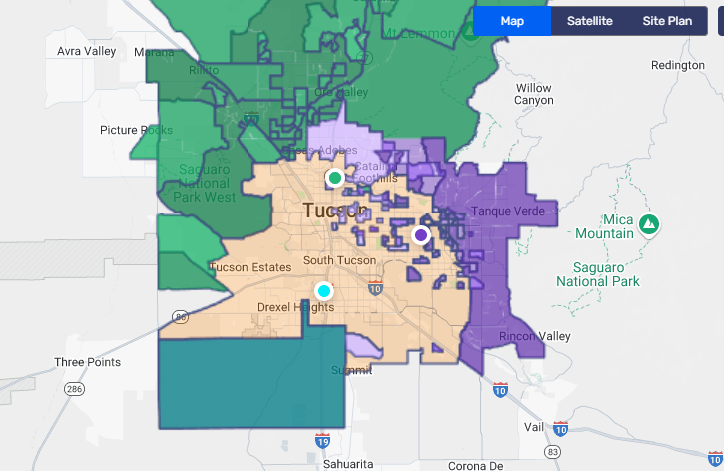

Looking at a single example of the 125 is Foot Locker’s location on the Southwest side of Tucson (a market that we know well). Dick’s doesn’t have a location in this part of the market. The overlap between this location and the Dick’s location on Broadway only has a 21% customer overlap. The overlap to Dick’s location on Oracle Road is also low at 24%. The Foot Locker pulls in a higher income visitors than its trade area and a larger amount of Latino’s than the trade area.

* Isolated to Foot Locker’s geofenced locations.

LOGIN

LOGIN