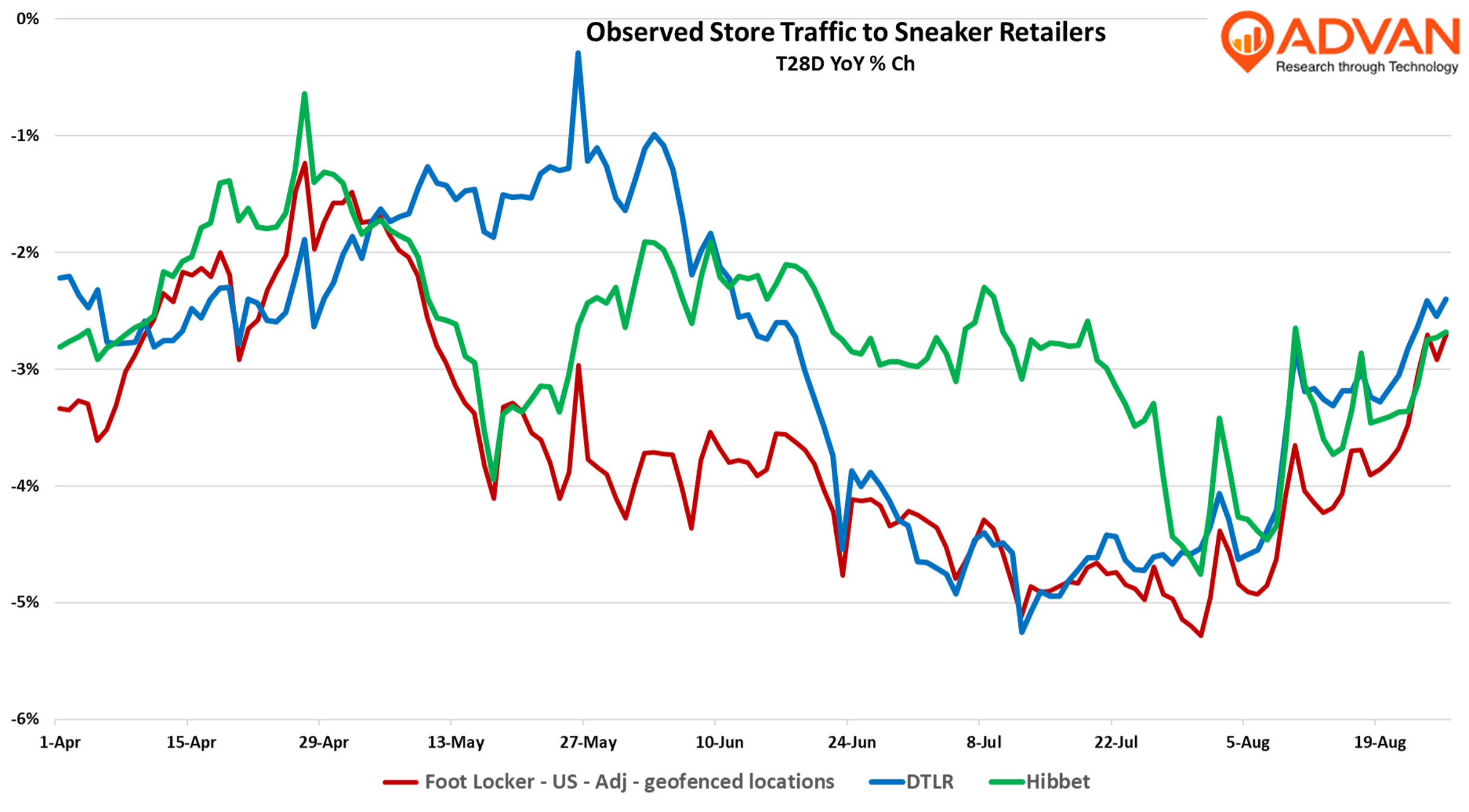

Lots going on in the sneaker space with Dick’s Sporting Goods set to close on Foot Locker on September 8th and fiscal quarter results showing sequential improvement for the major retailers (save WSS which is weighted to the low- to moderate-Hispanic consumer). Part of the better sales is lift was due to the broadly strong back-to-school season that we’ve been reporting on, the other part of it is tariff cost pass-through are driving comp-ticket; average transaction increased +4.8% for Foot Lockers’ Q2 (Advan). As it relates to retailer results, Foot Locker reported a +1.4% increase in North America comp-sales. If one were to strip away WSS, the region’s comp would be +2.6%. JD Group reported a comp-sales decline of -2.3% for North America, was better than last quarter’s -5.5% decline; the earnings release cited stronger performance by the DLTR and JD banners. The release did not comment on Hibbett, which our data suggests did better than the industry. As to the footwear brands themselves, the Adidas brand reported +15% growth for North America in calendar Q2, On Running +24%, HOKA grew modestly, and **Nike **is expected to post a high-single-digit decline in sneakers for the June – August period.

WSS comp-ed -8.1%. That was worse than the prior quarter’s -3.3% decline. Obviously, immigration policy is weighing heavy on its core customers’ economic engagement. Given the pending acquisition, Foot Locker didn’t host a conference call this quarter and the release said little Last quarter, CEO Mary Dillon said, “[W]e saw our WSS customers be cautious with their discretionary dollars into December and January as they contend with ongoing inflation as well as impacts from the Los Angeles fires. Our WSS team continues to position the banner with compelling assortments with an emphasis on value, **including below $80 footwear **as well as global football and workwear as they support the local communities and neighborhoods they serve. Nonetheless, we will continue to take a prudent approach to capital with the WSS banner in 2025 when it comes to new store openings. As such, we are planning for one new store opening in 2025 for WSS as we shift investment into other real estate projects that are driving higher returns. Longer term, we still believe in the unit growth potential of the WSS banner, but we do believe a more conservative review in the near term is the right path.”

Dick’s Sporting Goods fiscal Q2 comp-sales performance of +5.0% was very similar to the prior (+4.5%). The 5.0% breaks done between average ticket (+4%+) and comp-transactions (<1%). Like for Five Below, Target, and Walmart, trading cards drove customer excitement, traffic and sales. CEO Lauen Hobart, “We have excitement in the license category, and we’ve got small tests going on with trading cards that are doing very well. There is excitement. I think it speaks to the fact that the consumer and sport and culture are intertwined in ways that have never been this powerful and the consumer is very, very interested in newness that is the lifestyle of sport and the performance of sport and we’re carrying those products.”

On its customer, Hobart shared, “We are not seeing any signs of slowdown with the consumer. In fact, one of the most exciting things about the quarter that we just delivered is the broad-based nature of the growth that we saw. We saw growth across all of our key segments… I would say, if anything, if you look to the assortment and the partnership that we have with our key brands, there is a trend toward innovation and newness in the products that are coming down the pike that are keeping the consumer really, really energized and they’re responding very well to some of that technicity that’s all in the product, both again, hardlines and softlines… We did just take our comp assumptions up for the back half.”

On their plans for Foot Locker, CEO Lauren Hobart said, “We see a tremendous opportunity with the Foot Locker business… And the more time that we spend in our – with the Foot Locker team, both at our various headquarters and also in the stores with the Stripers, we are increasingly optimistic… We plan to invest in stores. We plan to invest in marketing, and we know that there are opportunities from a core merchandising standpoint. We’re excited about apparel opportunities and also bringing in a new assortment of products.”

On the **House of Sport **format, CFO Navdeep Gupta said, “We are very happy with the performance that we are seeing, actually excited also about the fact that even some of the smaller markets are able to support the House of Sport locations very, very productively. So that actually expands the opportunities for us to think broadly about the House of Sport strategy as we look to the next few years.” As a reminder, they are effectively doubling the format to 35 locations by year end.

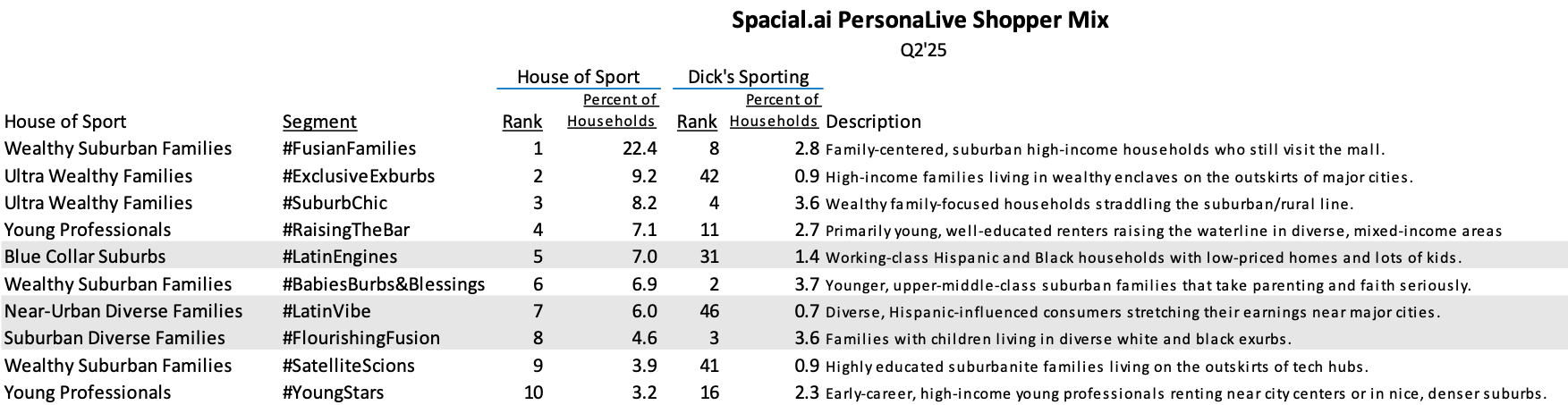

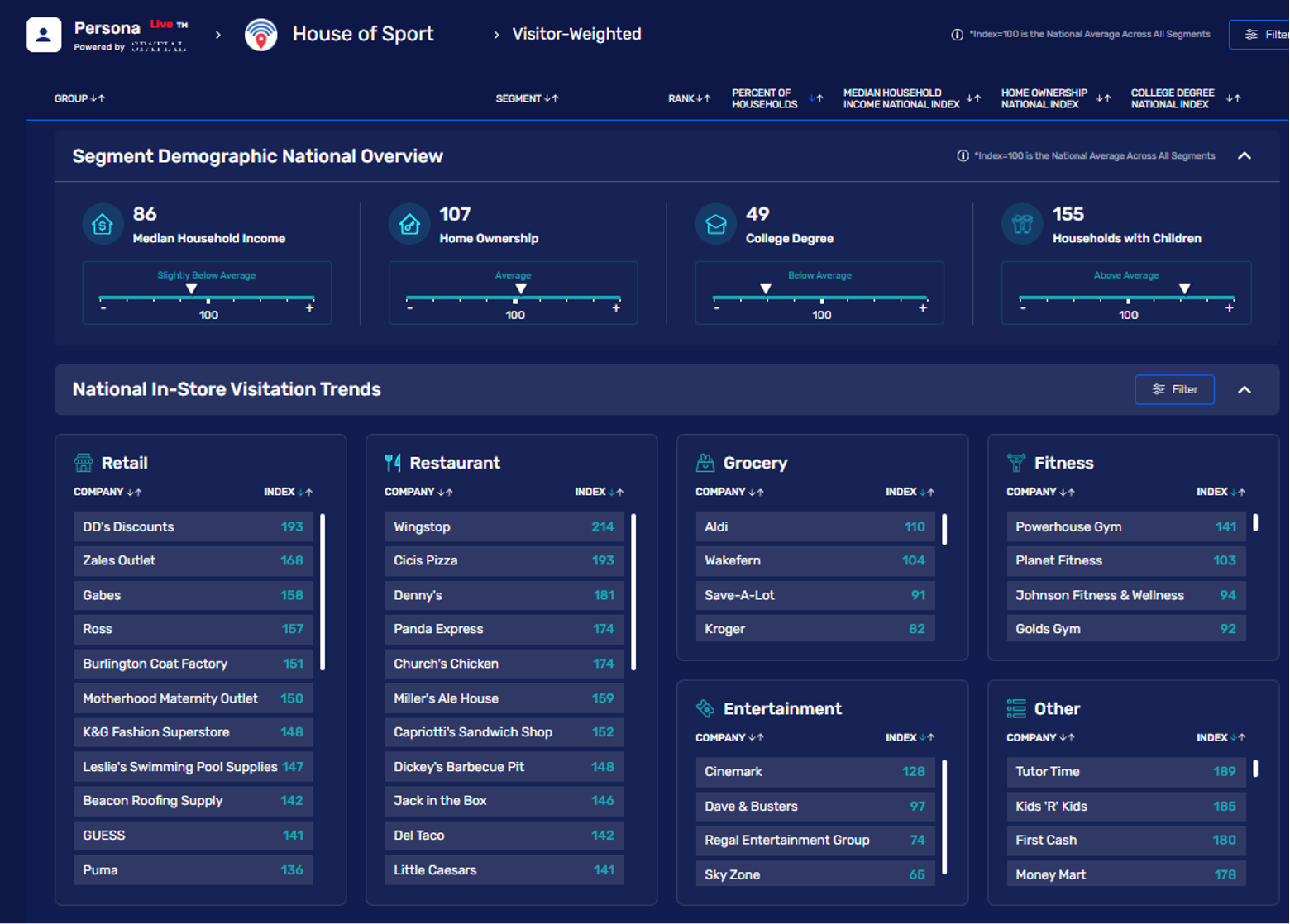

Looking at Advan’s data, the House of Sport continues to bring in more than 60% visitors than the average Dick’s location and 47% more visits, which is up 170bps YoY. Moreover, those improvements are happening on a large number of locations and the smaller markets as Gupta shared. The table below shows who’s shopping the House of Sport vs. a traditional Dick’s Sporting Goods location is demonstrated in the chart below. We expected a more idiosyncratic mix for House of Sport given the massively fewer number of locations. We also expected that high-affluence segments would be weightier as the table does demonstrate. However, we are surprised by the high weighting for ethnic segments, something that may have influenced management in their decision to acquire Foot Locker. For example, LatinEngines is its #5 segment vs #31 for Dick’s (out of 80 segments). We show the full LatinEngines description below. Maybe House of Sport has found a formula (or routine) to pull an outsized amount of spending from these segments, i.e. a superior way of catering to their needs, with the plan now to deploy some of that formula to Foot Locker’s 670 US locations and Champs 380 US locations.

LOGIN

LOGIN