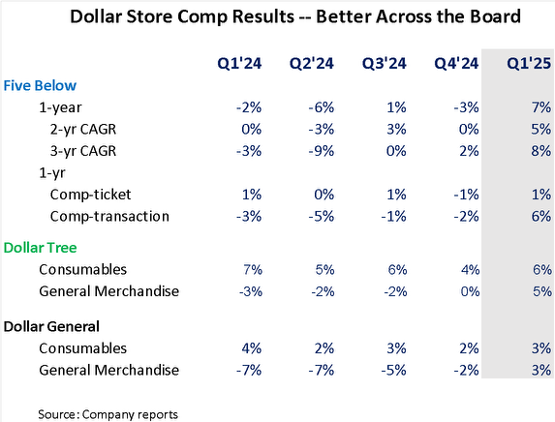

Despite dismal sentiment about the low-end consumer and consumer confidence, Dollar Tree, Dollar General, and Five Below blew past Wall Street expectations on comp-store sales, with both comp-ticket and comp-transactions driving a material improvement in the 2- and 3-year comp-store sales trend as shown in the table below. With Dollar General’s results, we wrote about the upside stemming from trade-in, share-of-stomach gains from the fast food channel, and better retail execution / fundamentals. However, with Dollar Tree and Five Below also showing marked improvement, especially in general merchandise, we suspect something more is contributing to the improvement, or better said, “something much-much less, like less advertising spend by Temu / Shein.”

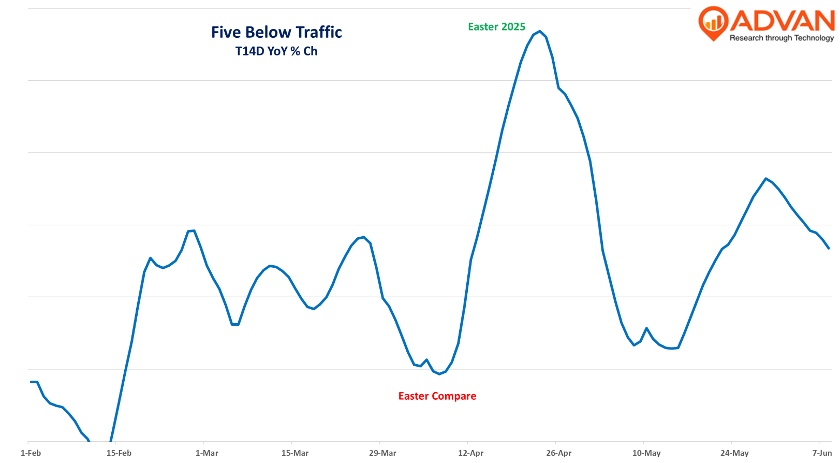

Ahead of Temu no longer selling China-direct (May 5th), both Temu and Shein substantially cut their advertising ahead of that as was known from the results and commentary of Meta and Google (i.e. the advertising platforms that the Chinese retailers built their business on). For context, Temu spent around $400M in the first 4 months of 2024 and e-Marketer estimates that 35% of US shoppers made at least one purchase monthly at Shein and Temu in 2024. CNBC recently wrote a piece on the pullback, with the quote, “Temu and Shein’s decline in US ad spend was also noticeable in April, as spend decreased by 40% and 65% YoY, respectively,” said Seema Shah, Vice President at Sensor Tower. (Anybody remember Temu’s 2024 Super Bowl ad?) Temu / Shein not bidding up advertising spots on TikTok, Instagram, etc. allowed Five Below (and others) to get significantly more on their ad spend than last year. Moreover, the better advertising ROI then allowed them to move much of their media mix to social. This was especially true for the quarter’s seasonal events, like Easter, which spiked for Five Below this year. Five Below’s CEO Winie Park said, “We also had the benefit of great storytelling that started again in social and walked its way through to the site, all the way through to in-store execution with our floor sets that were really terrific… [We] didn’t increase our level of spend. But what we did do was actually look at the channels and we did really invest in social media and greater content. And with that investment and redirecting the spend in that direction, we thought we were doing the right thing by the customer in terms of starting their journey where most customers start today, which is on social and in digital and connecting that journey through to what they saw in stores. We were very specific about where we invested.” Separately, the benefit of less consumer spending on Temu is on the come. (To be clear, they still have a US e-commerce store / marketplace. They just are not offering the China-direct values that they did before.) Like what we saw with Costco, and other durable goods retail, there was a large consumer pull forward of shopping to get ahead of higher prices from tariffs and other matters. This is also true for Temu / Shein, as consumers flocked to the sites ahead of the de minims change. Advan’s Spendview transaction data shows spending on Temu increasing by +27% in April, following a +30% increase for Q1 (to a massive $5.4B). Spending on Temu is down strongly, with the 2H of May declining -32%. Per research from investment bank Morgan Stanley, the Temu customer wasn’t just lower-income, 20%+ of households with incomes above $75K had made a purchase from the platform in Q3’23, and what also marked Q1 dollar store results is that all three called out that they were gaining higher income consumers, i.e. the trade-in. The share-of-stomach shifters are also going to include higher-income consumers as well, and so, there are two likely drivers to that higher-income customer / consumption capture. Additionally, it wasn’t just the dollar stores that were hit by Temu / Shein, it was also the craft stores, secondhand / thrift stores, and department stores. For fiscal Q1, the department stores produced surprisingly better results , as did the secondhand stores . Back to Five Below, and its results and comments. CEO Park said, “What differentiated this past quarter was our heightened focus on the customer and working as a tight-knit multidisciplinary team from merchandising, planning and allocations to marketing, store operations and supply chain. We made great strides on one, sourcing amazing product focused on Easter, spring break, trend-right beauty, novelty, food and candy as well as relevant cultural Five Guys moments like Minecraft [and Lilo & Stitch]; two, amplifying these products with end-to-end storytelling that started with social media through to compelling in-store floor sets; three, ensuring better in-stock positions with tight alignment between our teams at WowTown, our ship centers and the store fleet; and four, continuing to benefit from investment in labor hours and operating efficiencies….” And so, there is the call-out on the amplification of its social media increased working efficiency (i.e. less Temu), combined with opportunities from box office hits, better in-stocks, and improved store standards and service levels, i.e. retail fundamentals and “back to basics” as is the improvement program at Dollar General and Dollar Tree. That improved execution shows up in Five Below’s improved traffic, conversion rate, dwell time, and basket size. The increased dwell time reflects the higher basket size. Advan’s data shows that the improved conversion rate increased comp-transactions at a 400-500 bps faster rate than comp-traffic. On Five Below’s quarterly cadence, Park said, “February, we had bad weather throughout the country, which definitely impacted traffic in comp. And then we have a shift in Easter timing. We consider March and April together in terms of a year-on-year comparison. But again, coming out of the holiday, we have continued to see nice growth.” Those trends match what we see in Advan’s data, as shown below. As we move into the Summer seasonal holidays and the 2H’s, we expect to see even more comp improvement as Temu and Shein are not distorting advertising and consumer spend. The same is true for the other impacted brands as well.

LOGIN

LOGIN