As we saw in Starbucks’ results , Dutch Bros. (BROS) also reported an improvement in its transaction trend with comp-transactions increasing 6.8%, taking the 2-year +430bps higher, and the 3-year +220bps higher. Systemwide sales increased 21% to reach a $2.3B annualized run-rate. Systemwide unit growth of 14% took the count to 1081 locations. These are especially impressive growth given that direct competitor 7 Brew Drive Through Coffee is growing at an even faster rate (150%) on a high level of sales ($1.9B annualized).

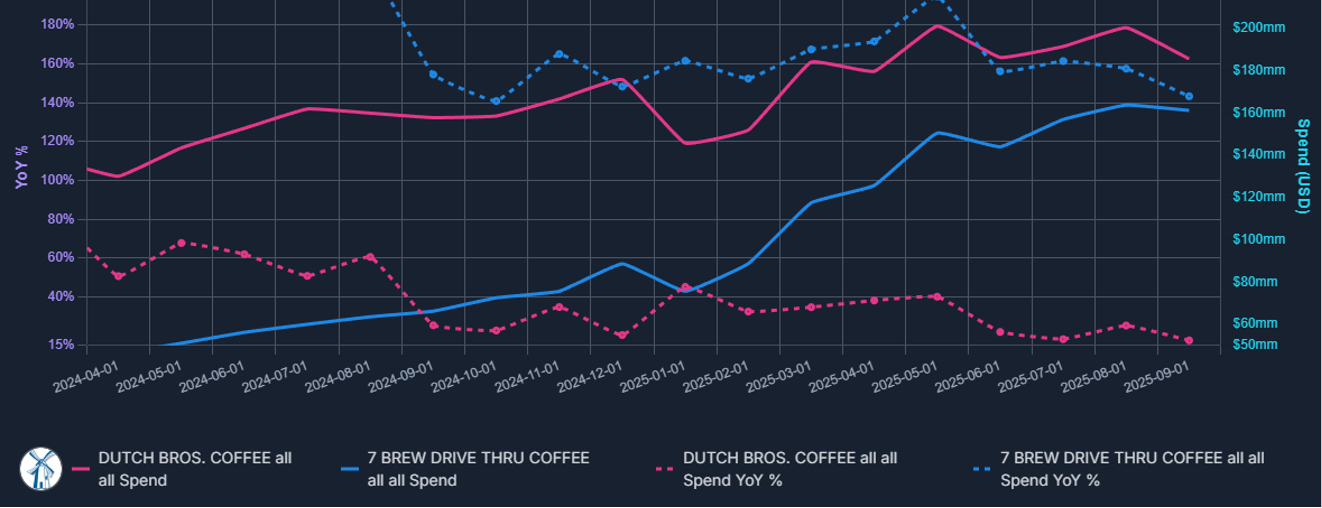

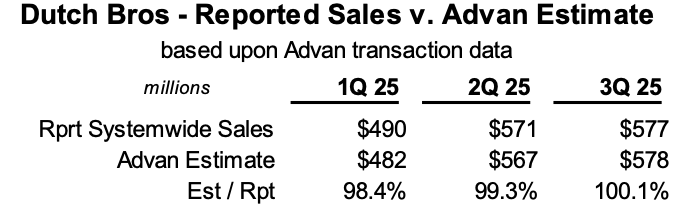

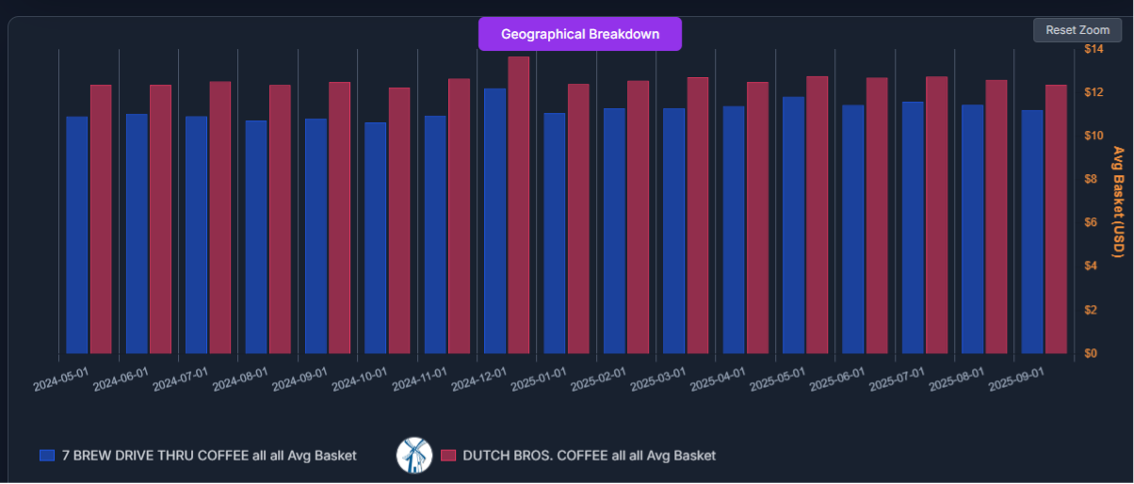

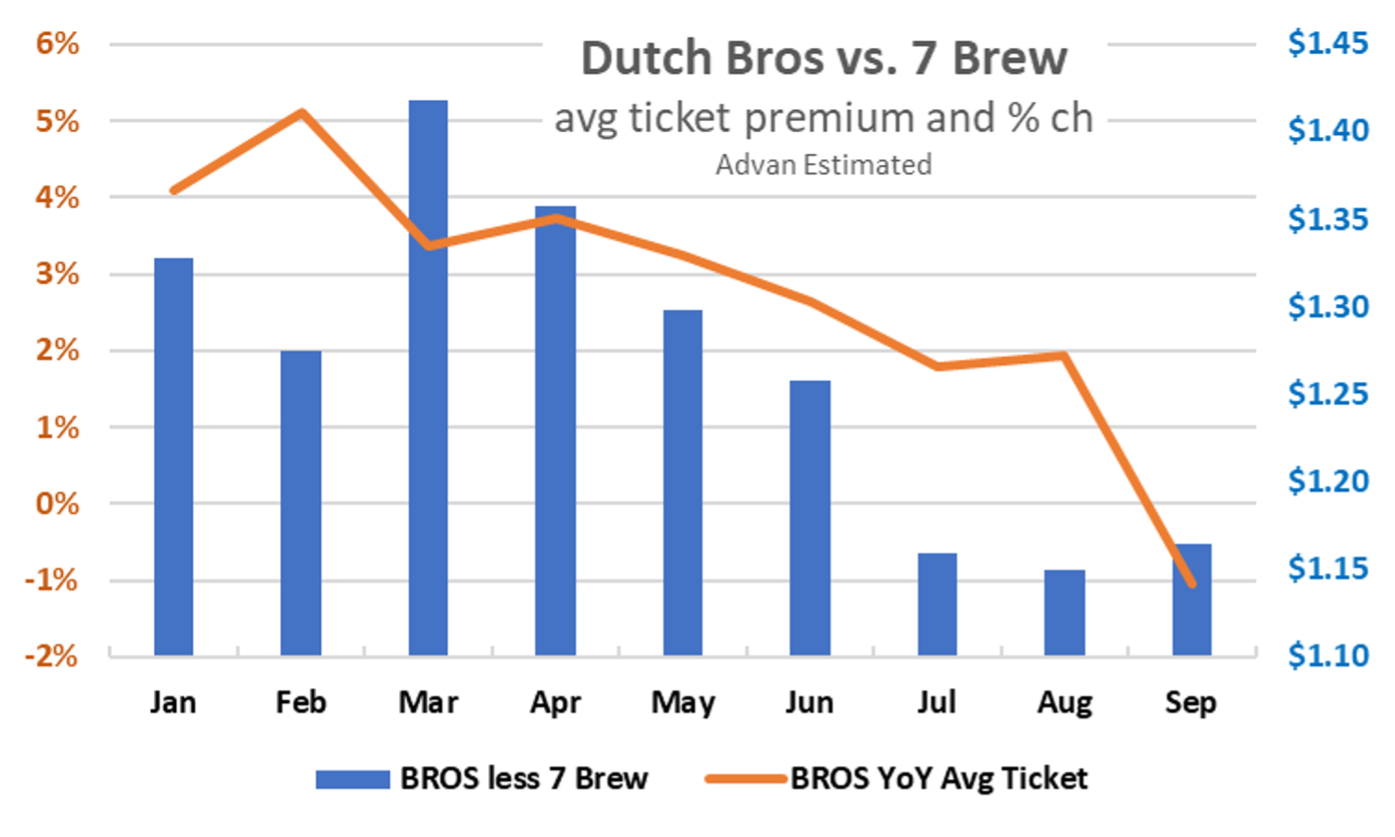

Using Advan’s SpendView data, the first graph below shows monthly sales for the two chains; while the rate of growth is mellowing, each’s level of revenue keeps pushing higher. However, the second graph shows that each brands’ average ticket growth has flattened out, especially BROS, and the final chart shows that BROS premium to 7 Brew has stepped meaningfully lower since June. BROS’ financials also show evidence of that competition in gross margin pressure (-60bps YoY) and occupancy cost deleveraging (-60bps). (Greater competition for good locations?) As a reminder, it is our view that Starbucks’ objective for reclaiming that “third place” is to step away from the high transaction-ality that these two brands are pushing, and given the trends / results trends that our story featured, the strategy and execution are working.

Veracity of SpendView Data

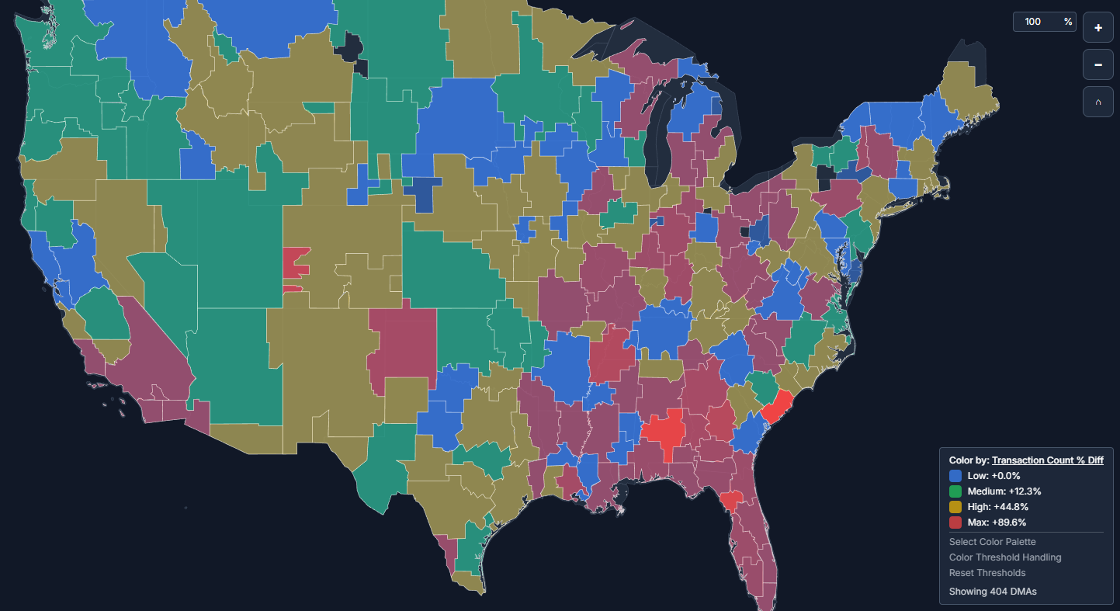

For the quarter, BROS maintained a strong pipeline of menu innovation, including three new beverages in July and a fall lineup in August. BROS also highlighted progress on its food program, which is designed to strengthen the brand’s beverage offerings by driving the morning daypart without slowing down the line. Looking ahead, BROS expects to roll out food more broadly throughout 2026 following positive pilot results. On rewards, 72% of system transactions in 3Q were on the program +5 ppts YoY. On the call, CEO Christine Barone said, “We continue to see consistently long lines and strong customer demand as we expand into the Midwest and Southeast. These results underscore the broad appeal and portability of our brand across diverse geographies. Our long-term system shop opening cadence remains firmly on track and we remain highly confident in our goal of 2029 shops in 2029. We’ve successfully expanded into six continuous new states this year, including five in the third quarter, bringing our total presence to 24 states.” Her claim is substantiated by SpendView data (chart below) as a heat map for growth shows high rates in those regions.

Dutch Bros Sales Growth by DMA – Aug ’25 vs. Aug’24

LOGIN

LOGIN