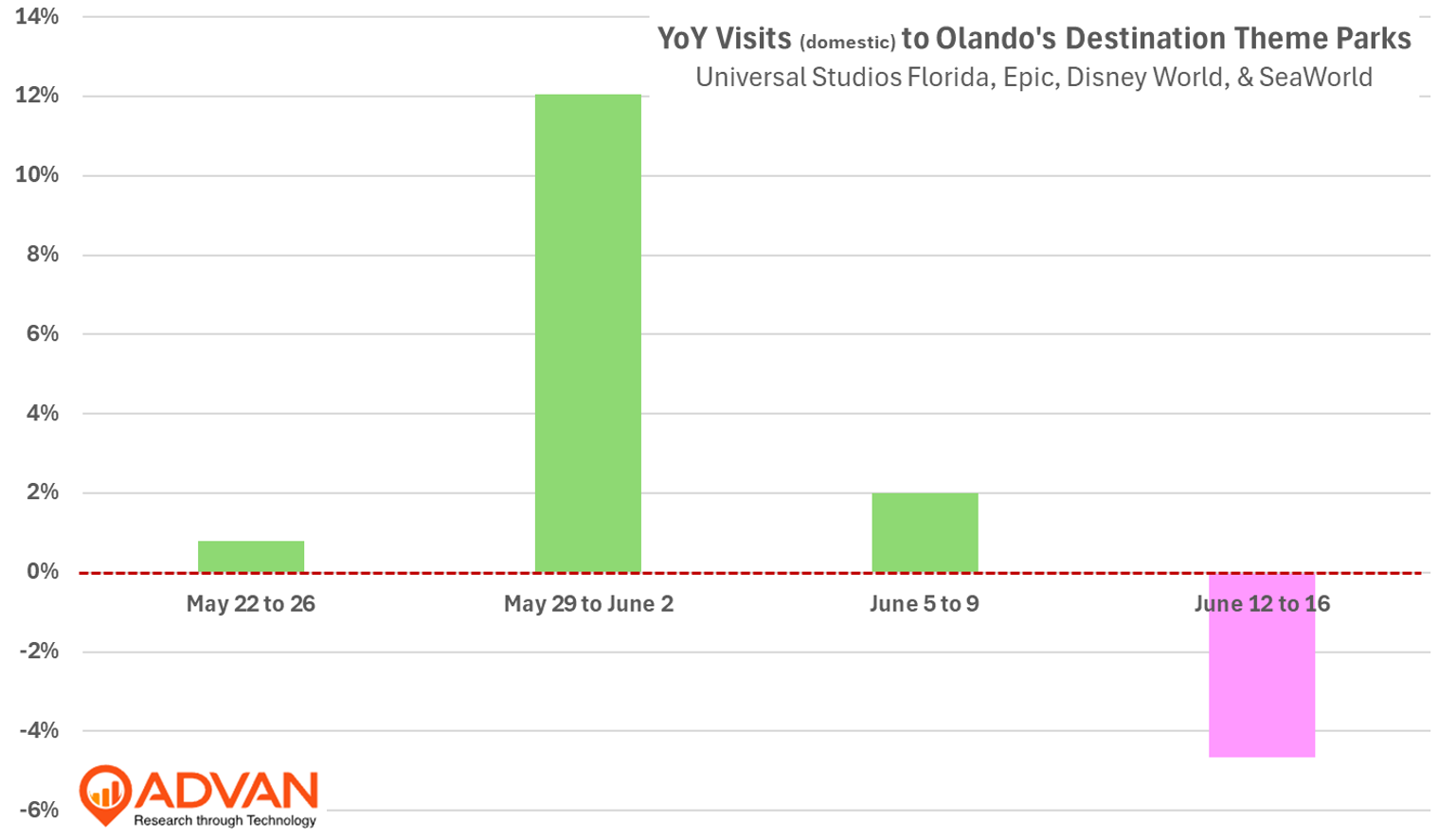

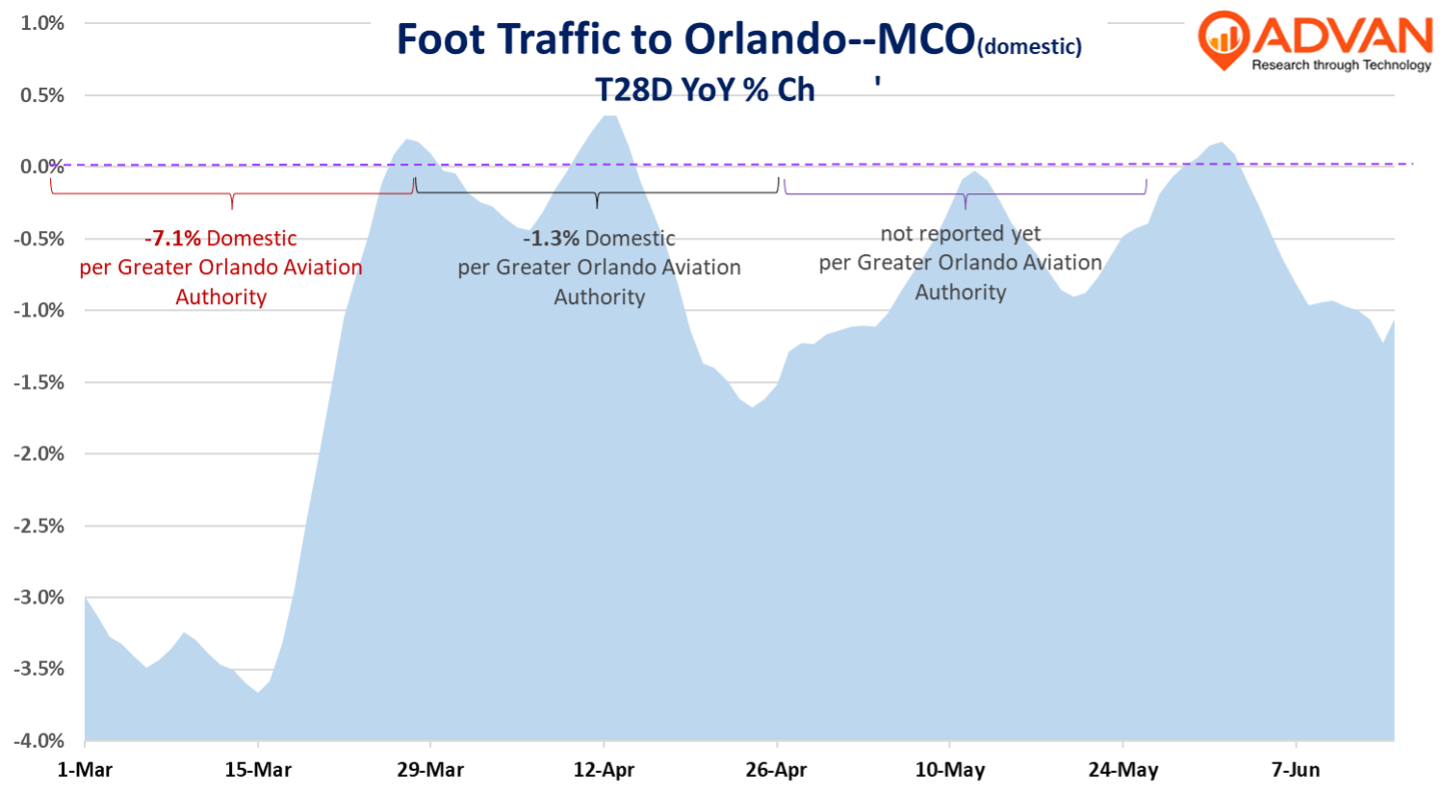

Universal’s Epic Universe opened in Orlando on Memorial Day Weekend to great fanfare by the press. Since then, the trade press has been less favorable, and so, we looked at Advan’s visitor and spend data to see how Epic is impacting sister Universal Orlando and the other destination theme parks in Orlando. What we see broadly is softness, despite the new park. While our data is preliminary because of the way we are cutting it (Thursday – Monday), the conclusion is supported by our measure of traffic to the Orlando airport (MCO), which shows a slightly better trend in May than the prior months, but nothing that would suggest that a new $8B theme park just opened in the market. For the past four weeks, Advan’s foot traffic data suggests that Epic has yet to grow the market in Orlando; domestic visits to all the parks are up only +2%. Importantly, we are showing just domestic visitation. MCO fly-in (deplaned) international visitors in April were up +16% YoY, to 14% of the total, and outperforming domestic, which declined -1.3%. As such, we expect international visitors to add 200bps+ to Disney World’s and Universal’s attendance figures.

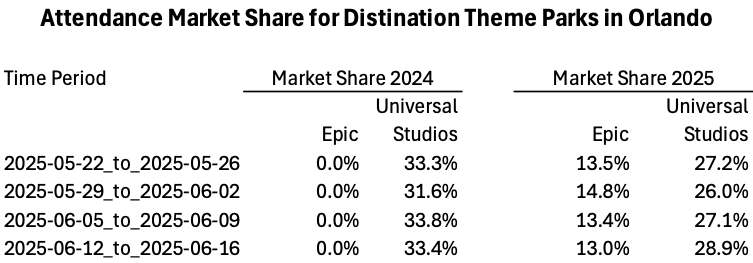

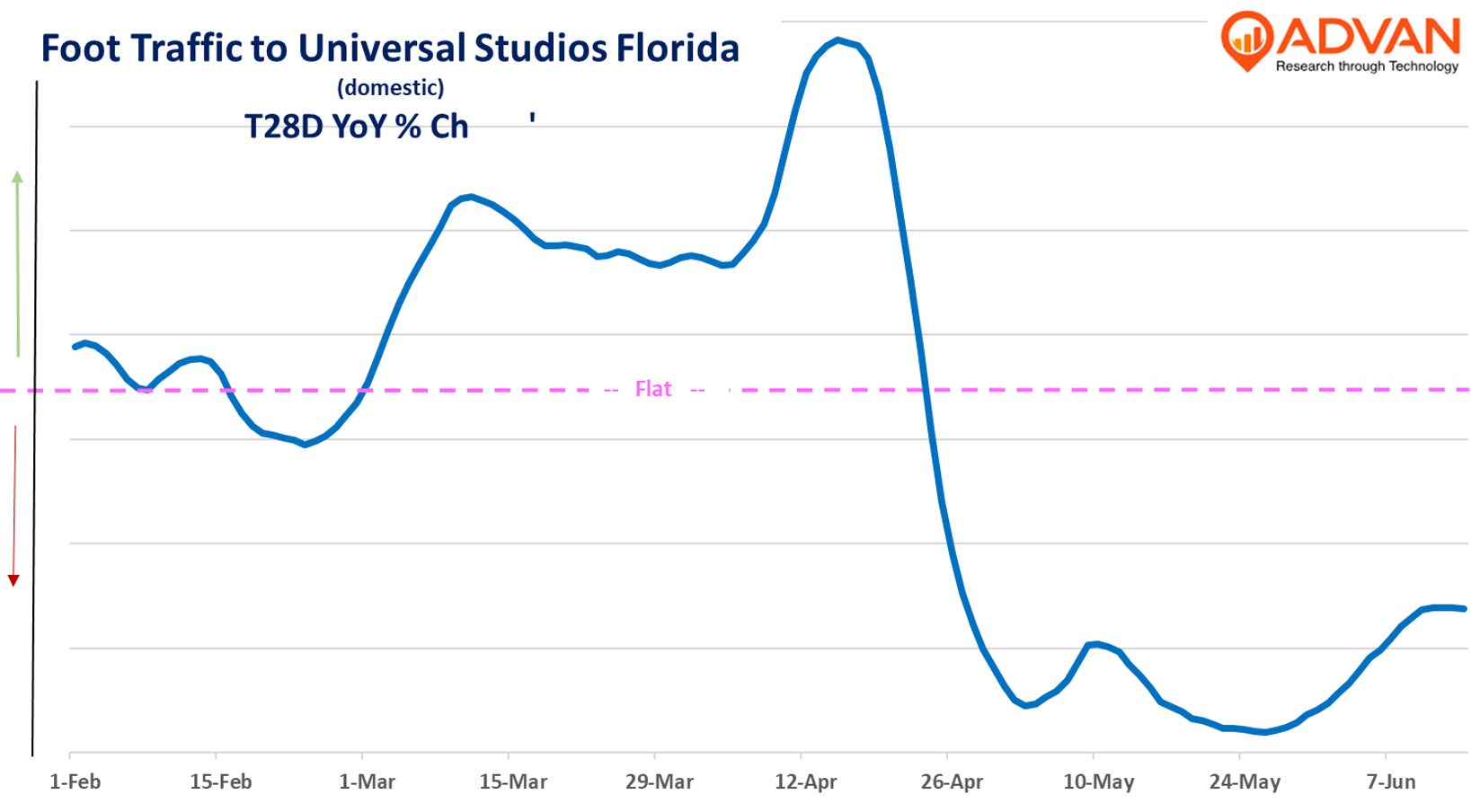

For the first four weeks, domestic visitation to Disney’s World’s three parks is DOWN high-single-digits and Universal Studios Florida and SeaWorld are down mid-teens. (For reasons that we explain later, we suspect that the Universal figure is better than down mid-teens.) Overall visitation to Epic, inclusive of staff and suppliers, is 50% of Universal Orlando. Combining Universal’s market share for both parks shows a figure meaningfully larger than last year’s 33%-ish.

Below is Monday’s reading from Thrill-Data. We are not vouching for their numbers, but 70% available capacity is “interesting.” Going to Universal’s webstore, we can find single-day adult tickets ($179/day) for all but three days running through July 31st. Additionally, the ticket packaging incentivizes three-day visits with two days at Universal’s other parks. As such, the mid-teens decline for Universal Studios is even more striking.

The opening of Epic was a large and atypical event. As such, the traffic changes shown for Universal Studios are not likely to be the sole result of attendance. We suspect that cast, service, and other employees moved to Studios ahead of Epic’s opening for final training. Then with the opening, management must have known that Studios would be appreciable down in attendance, and as such, they transferred staff on a temporary basis to Epic so that they could balance labor expense. As the theme park season is now in full motion, we see better attendance trends + returning staff are contributing to a “less bad” trend from the very steep decline in late May.

Why isn’t the Orlando market up more? We offer three possibilities. First, the category has been soft for some time due to budgetary pressures for many households. For some, this meant taking a cruise vs. visiting the parks as that offered a better value. The managements of both Disney and Comcast (which owns Universal) have spoken about both factors over the past couple of years. Second, as these parks are generally a “booked” experience, potentially the volatility in the financial markets and concerns about the economy stemming from trade policy created an air pocket in close-in bookings. And third, maybe some theme park fans (especially super fans) are just holding off for a few months to allow Universal to fix the growing / opening pains. A lot of the complaints that we’ve read are about longer than expected wait times for the attractions, despite the lower attendance.

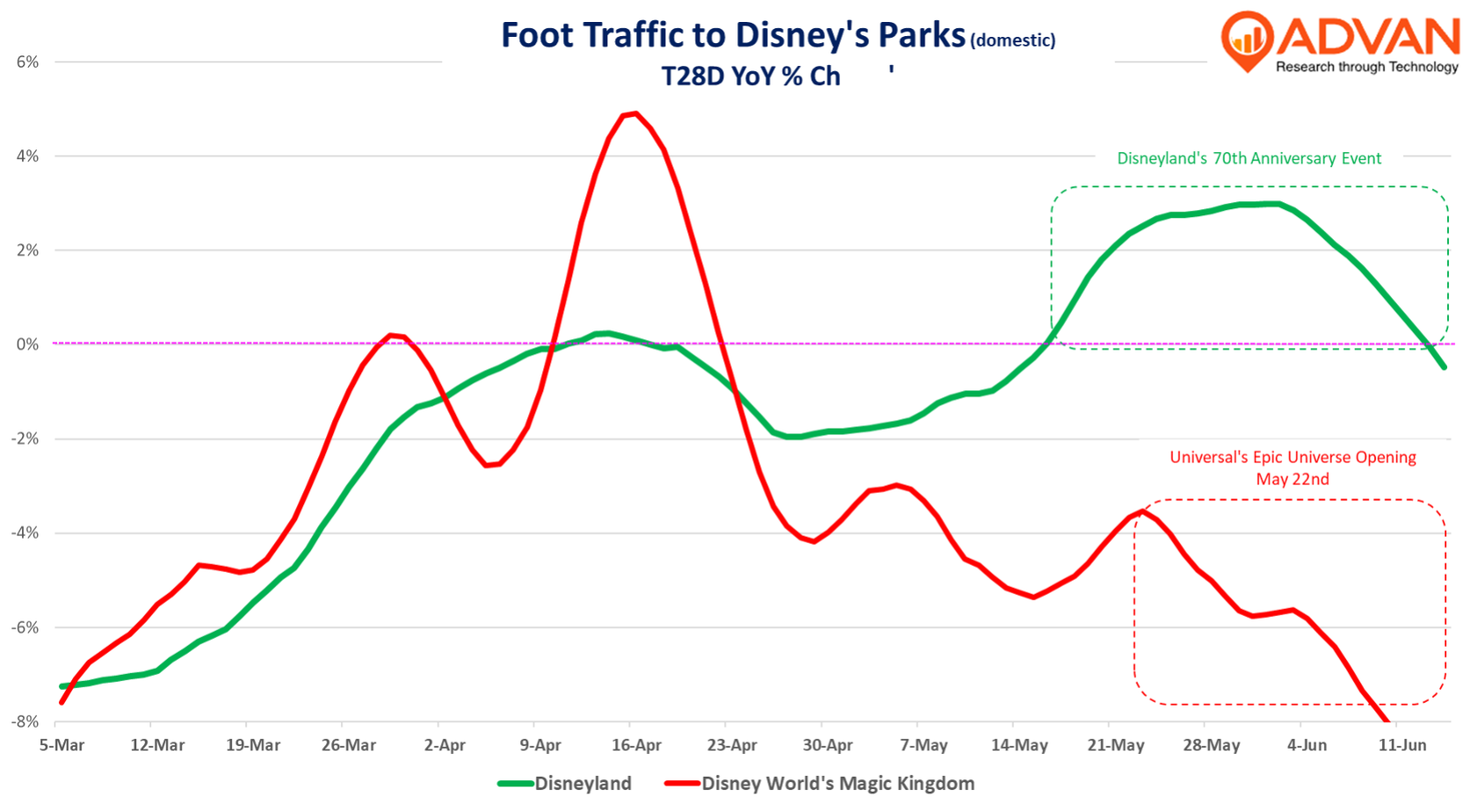

Looking at the other coast to help with the above question, as shown above, traffic for this quarter to Disneyland has been stable to improving – the improvement in mid-May reflects the 70th anniversary celebrations. Given the stability at Disneyland, which is more drive-in vs. fly-in than Orlando, that adds support to the above second and third hypotheses. If true, that suggests that overall attendance in Orlando should improve throughout the summer. We look to hear about that during the upcoming earnings calls discussing Q2 results.

LOGIN

LOGIN![Epic Universe Discovers “it’s a small[er] world after all” Epic Universe Discovers “it’s a small[er] world after all”](/mobility-insights-blog/images/epic.jpg)