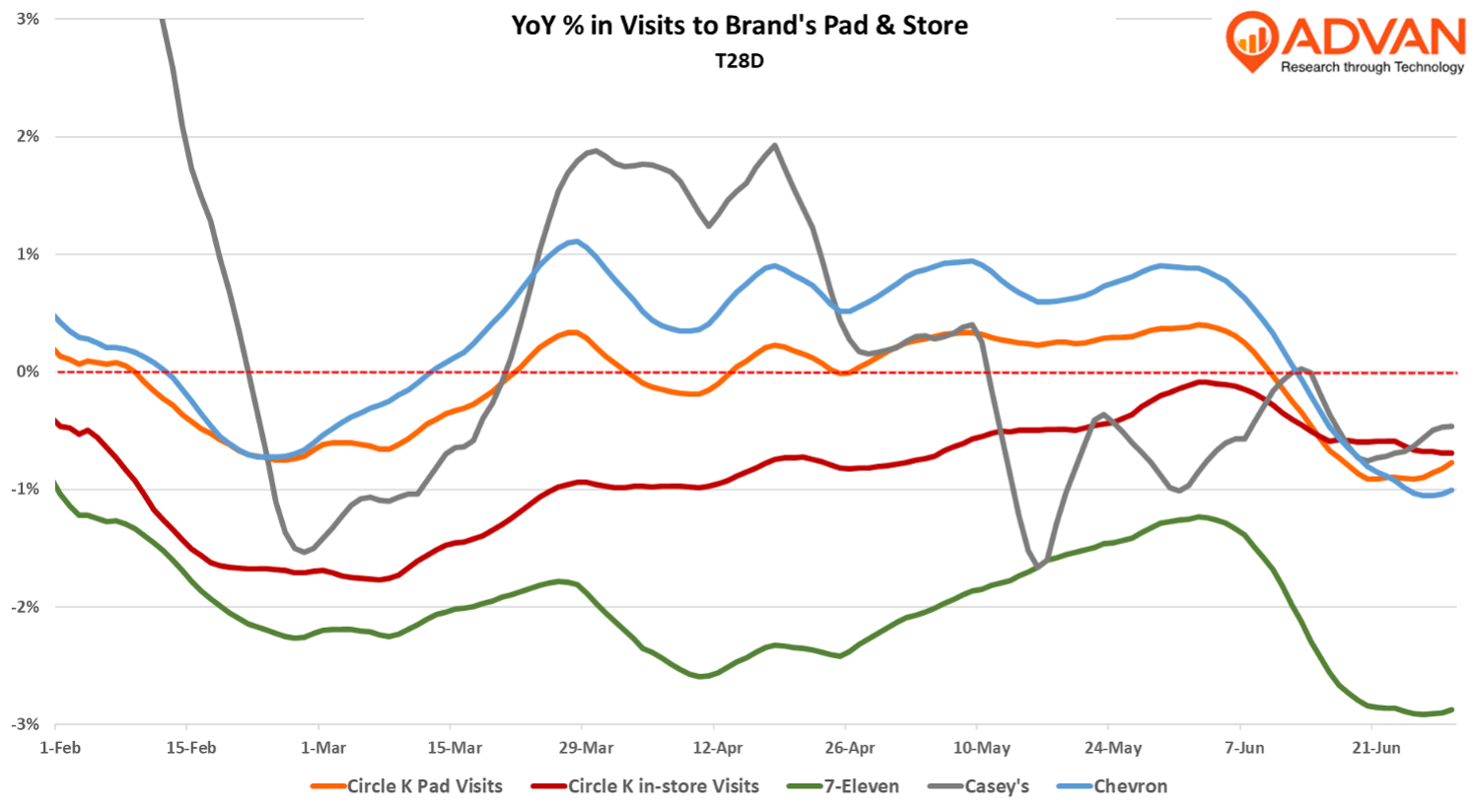

With the battle for Seven-&-i and its US business ongoing and our recent story about weight loss drug usage hitting fast food, we took a look at recent trends for Convenience and Gas (C&G) retail. As a reminder, the industry has been facing a cyclical economic challenge as fewer motorists are enter the stores to purchase a snack, a six-pack, etc. For the industry, those inside the store visits are where the money is; for example, **Casey’s General Stores **makes $0.75 gross of its “inside sales” for every gallon pumped at its stations vs. $0.39 in fuel margin. To drive the unit economics even higher, Casey’s and others have been investing in better prepared meals and adding assortments beyond pizza and hot dogs. For Casey’s fiscal 2025, prepared food comp-ed up +3.5%, whereas grocery & general merchandise was up only +2.3%. Its prepared food results were driven by freshly made hot sandwiches and barbecue brisket. Industry-wide, the enhanced food offerings have in turn, allowed C&G to take share-of-stomach from fast food. What this all looks like is shown in the three charts below. The first chart shows YoY visits to each of four brands. Of note, Chevron has outperformed year-to-date on a same-store basis. Casey’s visits benefit from 9% more units and are not a comp-measure. (Fiscal 2025 was the largest store growth year in the company’s history with 35 new builds and 235 units acquired.) For the last twelve months, Casey’s reported a comp-sales increase for gas of -4%, with volume flat. By contrast, Chevron reported a +5% increase in sales for the locations that it operates (franchise owners operate the majority of its locations). Seven-&-i’s suitor and operator of Circle-K, Alimentation Couche-Tard, reported flat gallons sold. Seven-&-i reported gallons sold per location in the US at down -1.5% for the Mar-May period. As such, all of these reports align with Advan’s estimated visits.

The first chart also shows how Circle-K visits into the store consistently trail the gas pad visits (i.e. parking visits). The YoY change in the ratio of those two is shown in the chart below. On this measure, Circle-K’s year-to-date lags its peers. We suspect that the improvement in the 1-year trend during June reflects an unusual comparison period and accommodating weather patterns. We also suspect that Casey’s figures are distorted by the large number of new store openings. Over the past year, we have shared that the decline in the conversion rate has badly hit CPG brands, taking away a high penney-profit purchase from them. (The trend to more prepared meals is a headwind as well.) As such, should the conversion rate push higher throughout the summer, that would be a welcome relief to PepsiCo, especially for its Frito-Lay business. To that end, on its earnings call (June 10th), Alimentation’s CEO said, “We were soft at the end of Q3 and soft at the start of Q4, and that improved over the final periods of the quarter. And we have seen the start of this quarter kind of trend with more towards the end of last quarter.” And, Casey’s management gave the impression that its grocery trend was improving as well.

On that Casey’s call, CEO Darren Rebelez said, “What I’d say overall is, I would say the consumer is really hanging in there. And continuing to visit our stores as frequently as they have historically. We’re seeing good strength from the higher-income consumers, those making over $100,000 a year. And then even on the low end, we are seeing that traffic hanging in there. They are modifying some purchasing behavior. I think what’s interesting that as we dug into this, there’s two types of low-income consumers. I think there’s a cohort of consumers who perhaps have a family and they’re really stretched to make ends meet. But we’re also finding in that low-income cohort, those are a lot of younger folks that are early on in their careers. And so they are lower income, but they don’t behave like folks that are really stretched to make ends meet. So think more Gen Z and younger millennials. And so the purchasing habits for those folks are very different than what you have for some other maybe more mature people in that income cohort. And so it’s up to us to make sure we have the relevant assortment in the stores to meet the needs of both. And I think we’re doing that pretty effectively right now.” (i.e. Meaning they weren’t, but are now improving on merchandising.)

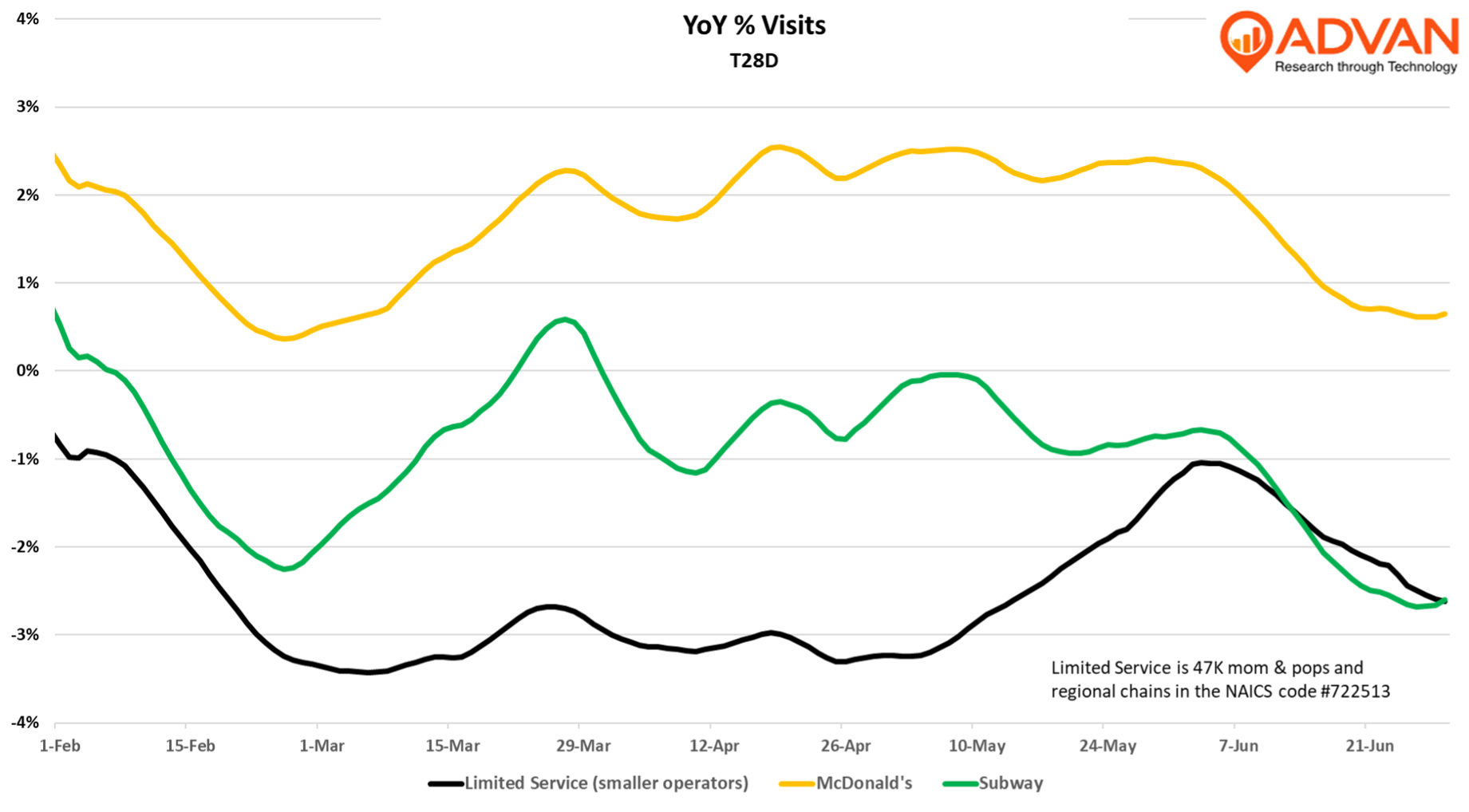

As it relates to fast food, the chart below shows McDonald’s outperforming is doing fine (in aggregate); **McDonald’**s is driving outperformance by pushing its value offerings aggressively ($5 meals and the lowest price chicken sandwich – the McCrispy sandwich), as well as catching a strong lift from its Mindcraft promotion which started in late March. By contrast, given the inroads made by C&G and other headwinds, **Subway **is having a difficult year, but better than the mom-&-pop locations and regional chains. With the industry needing to take more pricing to offset mid-single-digit+ labor / cost inflation, the challenges to these smaller operators are intensifying.

LOGIN

LOGIN