It’s been quite a challenging period for fast casual restaurant operators and their investors; that’s the result of a smaller “pie” and more mouths at the table. The pie is smaller due to shifts in consumption to gas & convenience and at-home as consumers seek out lower-cost calorie consumption, as well as fewer calories consumed (Wegovy, Ozempic, and Zepbound). More mouths at the table is the result of the high unit growth in the industry (+7% for the larger publicly-traded companies). For the Q2 results, Chipotle , Shake Shack, Sweet Green, and **Cava **all disappointed. For example, Cava reported a +2.1% comp-sales increase, down from Q1’s +10.8%. What all four have in common is a relatively high price point. Advan estimates an average check amount of $21.80 for Cava. By contrast, brands known for low price points are showing stronger sales. Chili’s reported an increase of +23.7% in comp-sales and +16.3% in comp-transactions. Readers will also recall that McDonald’s reported a comp-sales acceleration.

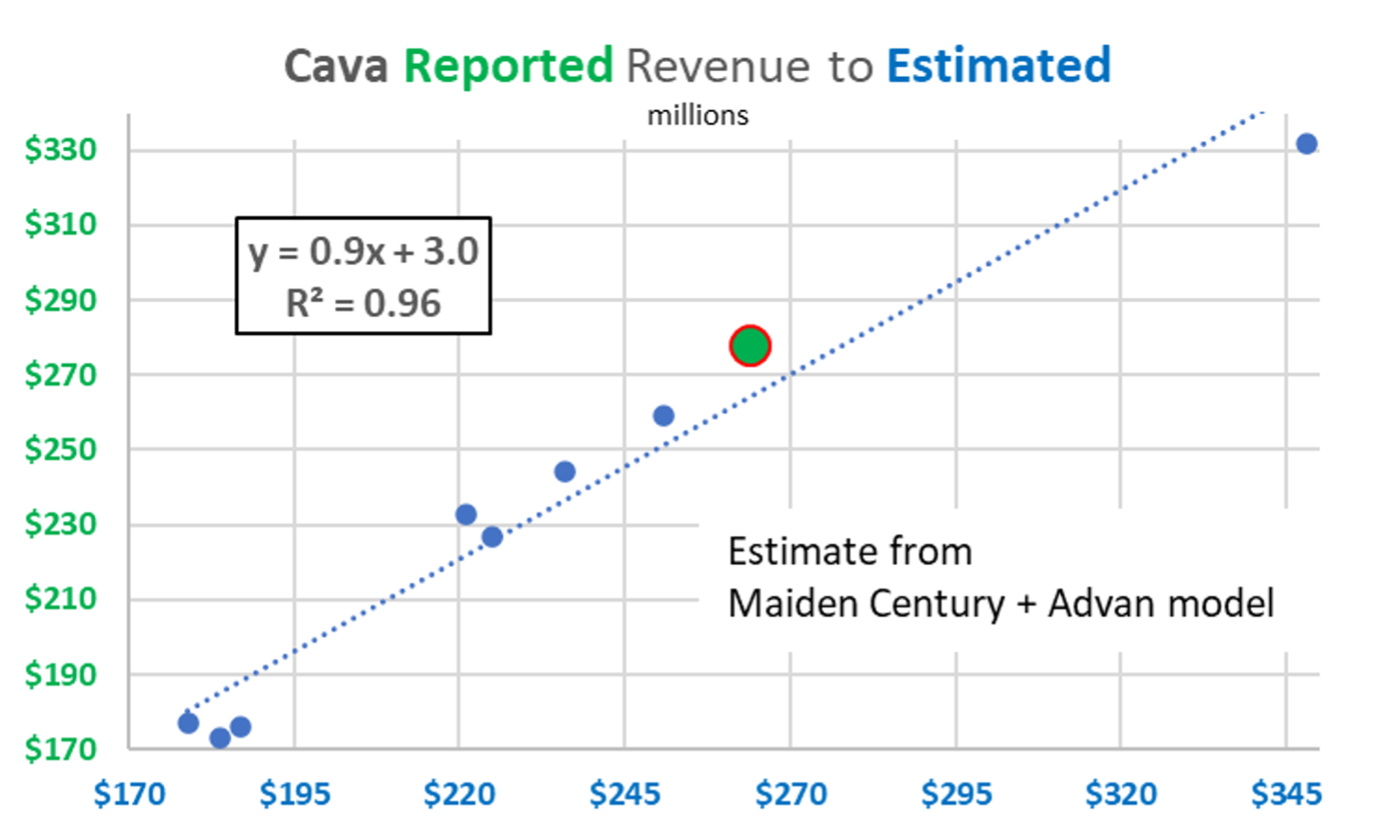

Due to the softness in trend, Cava’s stock lost 20% of its value. The economic pressure looks to be a large factor to Cava’s slower trend. Advan estimates that its average check increased +5% YoY in Q2, implying a 3% decrease in comp-transactions. The scatter plot below is between reported revenue and a fitted model created by Maiden Century using Advan’s observed visitation. The fit at 0.96 is very high; the green dot is Q2, and as shown, the reported model was above the model’s estimate by 5% (or $18M), which exceeds the model’s error range of +/-3.3%. That said, the result was still $8M short of Wall Street consensus expectations. And so, while the result was “less bad” than what our model was projecting, it was worse than investor expectations. Why did the model miss? Well, as shown below, the model more frequently underestimates total revenue. Separately, new store productivity was very strong in the quarter, with sales growth less the comp equal to 18.2%, which is 150 bps ahead of the 16.7% increase in units. Last quarter, it lagged by 90bps, giving a large +250bps QoQ swing. Absent that, the model would have been about 2.5% the reported figure, i.e. in-line with the historical trend. As to Cava’s plans, given still improving store-level returns and new store performance, management logically increased their opening plans from 65-66 to 69. However, comps will need to return to a higher level to soothe concerns about its price points.

LOGIN

LOGIN