Two weeks back, we wrote about the weak set of Q1 sales results from McDonald’s , Domino’s , Chipotle , Wendy’s, Shake Shack, and others. Last week, the wipeout in fast food (called limited service in industry lingo) broadened to include Sweet Green, Papa John’s, and Restaurant Brands International (i.e. Burger King). We wrote in our earlier articles that the softness was the result of consumer fatigue following compounding inflation and too many price increases by limited-service which has resulted in share-of-stomach shifting from away-from-home consumption to at-home (or grocery). However, nationally-branded packaged (General Mills, etc.) food volumes have deteriorated as well. Given that both categories of consumption have been notably weaker, maybe it’s just that a certain group of consumers are just eating less, specifically those taking weight-loss drugs (namely GLP-1s). Last week, the legacy weight loss brand Weight Watchers filed for bankruptcy having been disrupted by the GLPs.) Another example of GLPs’ impact, Albertson’s reported a +2.3% comp-store revenue increase for its February-end quarter, or +$403M YoY; however, pharmacy growth (mainly GLP-s) contributed $344M of that $403M, or 85%. Excluding grocery inflation, grocery volume declined -1.6%. These dynamics are across grocery and pharmacy, and not just at Albertson’s. CVS’ Q1 comp-store pharmacy sales rose +18% (front-end comp-sales were flat, i.e. the pharmacy gains are largely GLPs); pre-Covid and -GLPs, the pharmacy comp trended in the +4-5% range.

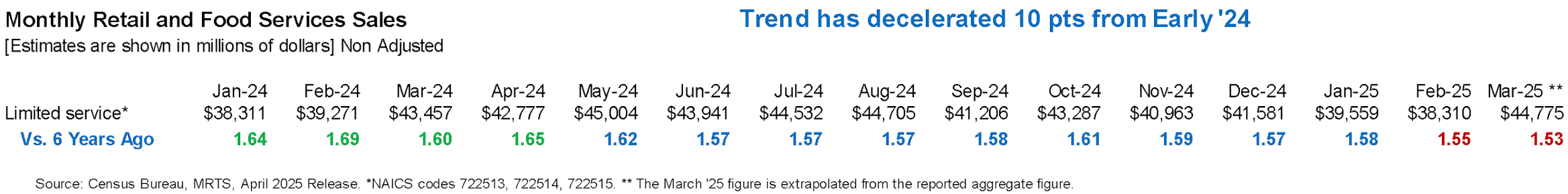

We explore d the hypothesis and think we are on to something. A point of confusion for the slowdown is the **perceived **abruptness of it. However, that’s likely due to “hazy comparisons” with multiple layers of unprecedent-ness (pandemic, pandemic-recovery, high inflation, etc.) along with very volatile weather in January and February and the precipitous fall in the consumer confidence readings. Combined, these obfuscated the intensifying impact of GLPs and led management to blame weather and cyclical factors rather than a secular impact (i.e. a cohort of consumers was just eating less food). The table below shows that sales for limited-service have been on a sustained decelerating path since early ’24 when compared to pre-Covid levels, with the likely causes being GLPs and away-from-home gaining share-of-stomach.

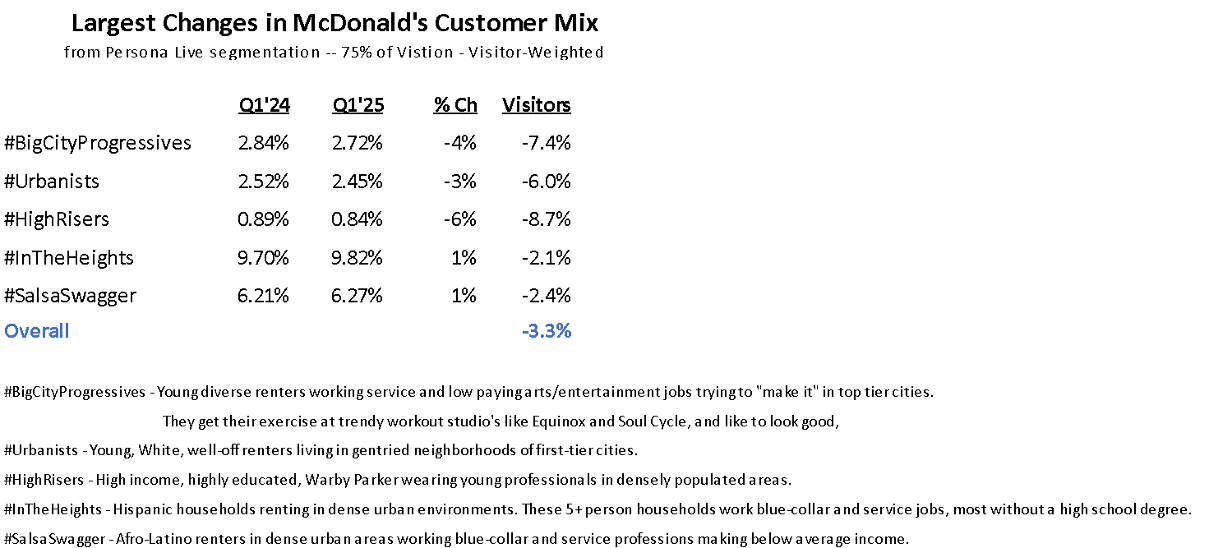

To further delve into the postulation, we looked at **who is cutting trips to limited service **at McDonald’s; it’s the younger college-educated consumer, and not the lower-income consumer that McDonald’s management claimed. Looking at the Southern California region* for McDonald’s, visitors / visits for Q1 were down by -3.3% / -4.8%. (We picked SoCal because the weather has been less disruptive and because it’s a fast adopter market.) Shown in the table below, for McDonald’s in SoCal, are psychographic segments for the last quarter and the prior year’s quarter. This segmentation into visitor cohorts comes from Spacial.ai / Persona Live and it creates 80 cohorts of visitors based upon behavioral traits and expressed interests. #BigCityProgressives* went from 2.84% of total visitors last year to 2.72% this past quarter – that works out to a -7.4% YoY visitor decline for the cohort. Similarly, #Urbanists* went from 2.52% of visitors to 2.45%, representing a -6.0% visitor decline for the cohort. In terms of the wealthy, their percentage of the visitor mix is little changed and their cohorts declined at the average rate, or -3.3%; by contrast, the lower-income visitors were stronger. The lower-income cohorts #InTheHights* and #SalsaSawger* visitors (which are 16% to total visitors) declined only -2.2%, or 130 bps less. We also looked at the Phoenix market, visits / visitors were down -3.1% / -1.1% for Q1, and the cohort trends are very similar to those in SoCal.

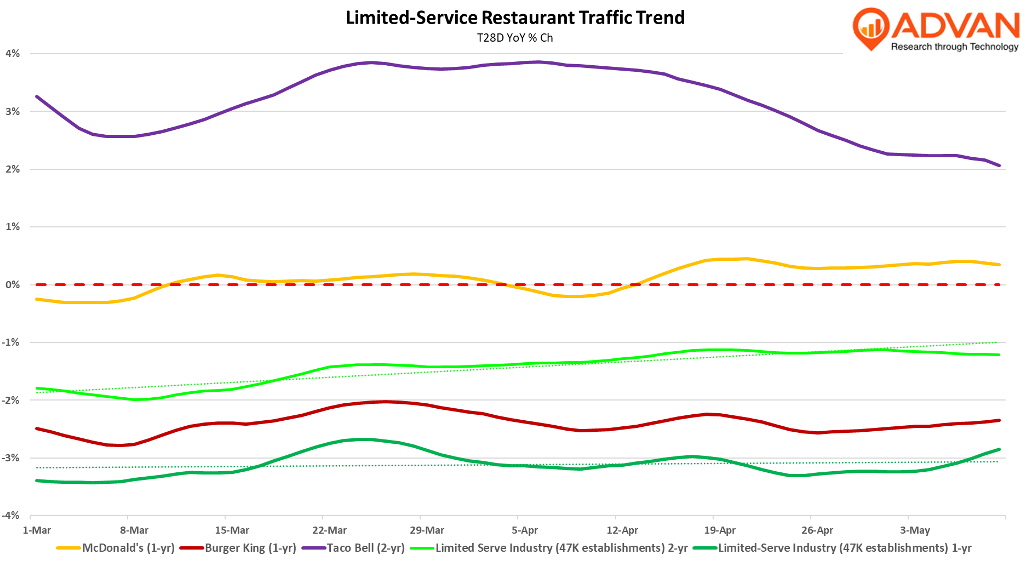

Looking forward, the chart below shows trending traffic for the industry (which is 47K locations in Advan data) and three prominent brands. The industry’s trend has improved modestly since the start of March, going from a -3.4% decline to -2.9% in the most recent 24-days on a 1-year basis and going from a -1.8% decline to a -1.4% recently on a two year basis, i.e. things are slightly “less bad.” McDonald’s has improved by a similar level on a 1-year basis. By contrast, Burger King’s trend has changed little. On a 2-year basis, Taco Bell’s trend has deteriorated. As more consumers treat their obesity with GLPs (more insurance coverage, lower prices, pill forms, etc), the impact on limited-service will intensify. In our exploration , we shared that according to a report by Goldman Sachs, the size of the GLP prescription market in the U.S. had increased threefold from Q1’24 to Q1’25. Looking forward, Goldman estimates that the prescribed market over the next two years will double from current levels, with the treated non-diabetic population hitting 6M, up from 1.3M last year and compared to 76M non-diabetic obese (BMI >30) adults population in the US, i.e. a lot more to go after that doubling.

As to the other macro headwinds for the industry, too much pricing and budgetary pressures on less-affluent households, a calming of those winds seems a ways off; moreover, a bout of higher inflation resulting from tariffs will intensify the winds. What can the limited-service industry do? More menu innovation, more deals, and sharper execution – all topics on the earnings calls over the past two weeks. We are defining the region as 90 miles around Irvine.

LOGIN

LOGIN