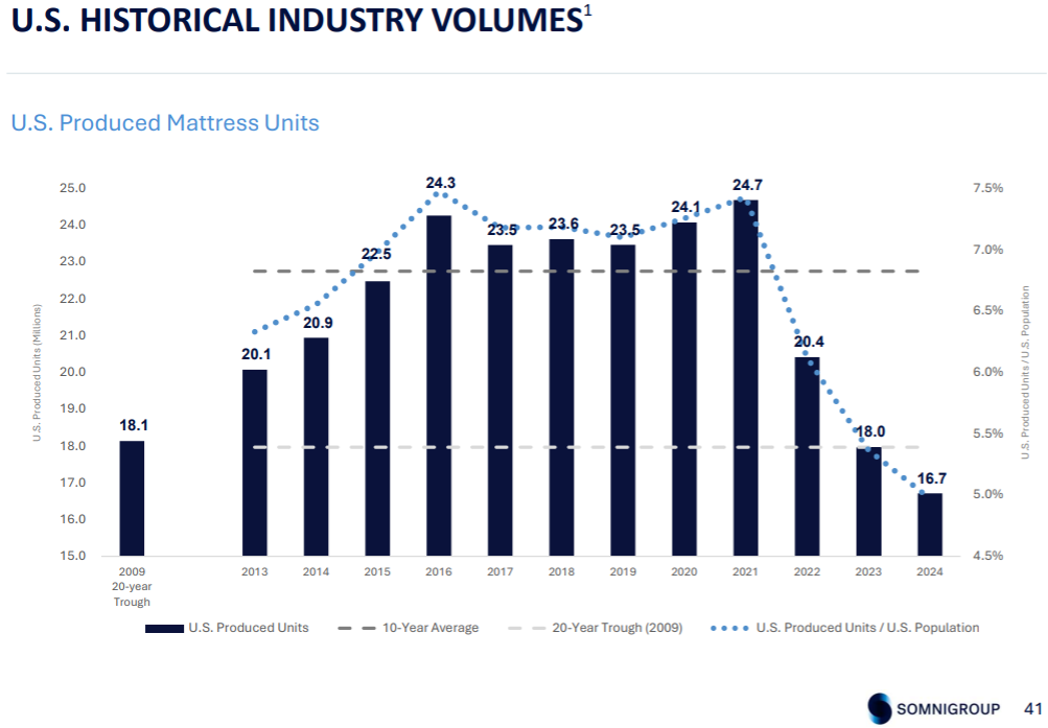

As readers know well, anything housing-related has been in the dumps since 2022. Mattress retail has been especially in the dumps, with production volumes well below the levels of 2009 and the Great Financial Crises. However, the trend now appears to be slightly improving despite the 30-year mortgage rate still at 6.5%, based on early reports; what gives?

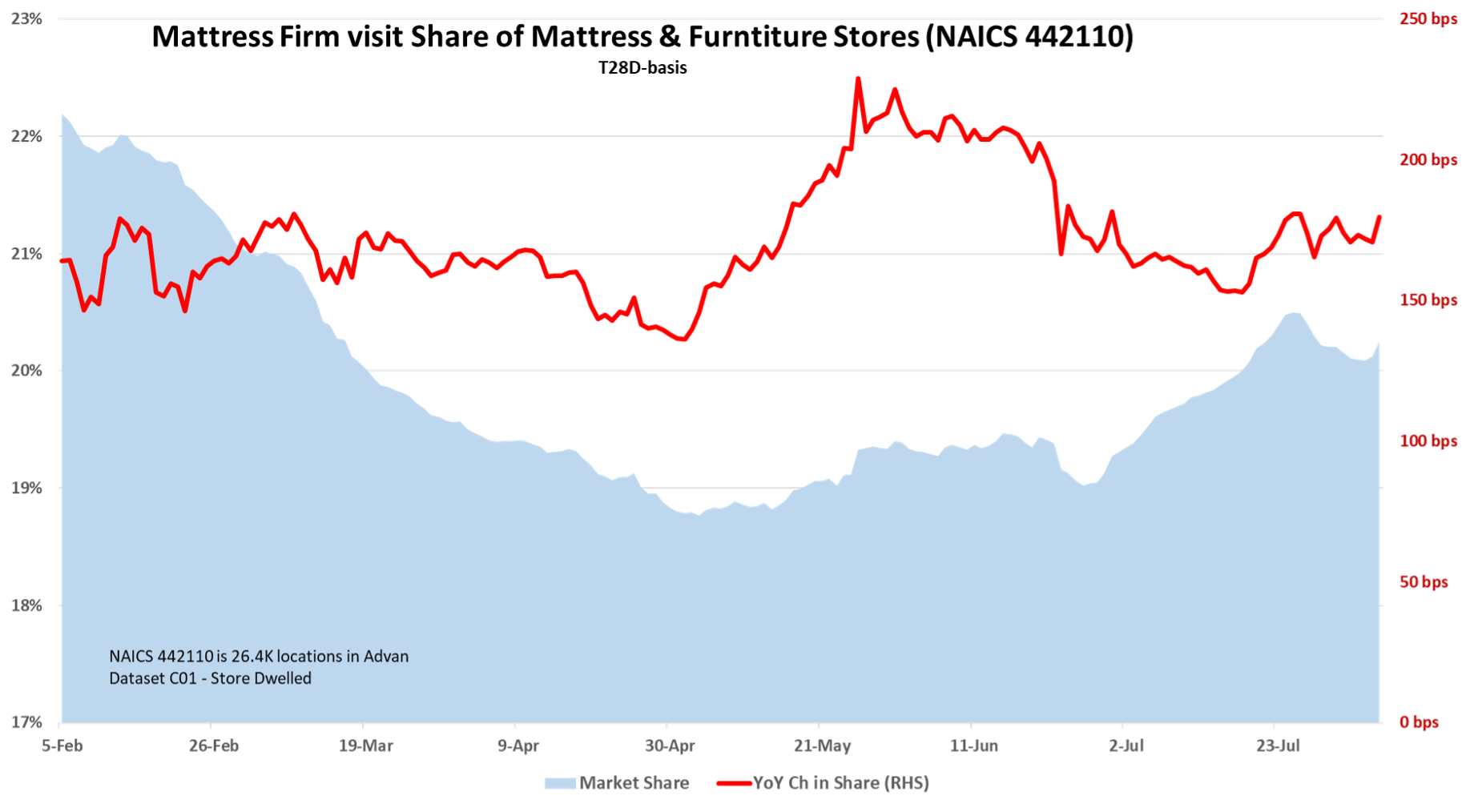

Somnigroup (the rebranded Tempur Pedic company, along with its purchase of Mattress Firm) reported better top-line results today. Mattress Firm’s comp-sales declined by -1% in a market that management says was down high-single-digits. Observed visits (Advan) to Mattress Firm locations were down only -1.5% and as shown in the chart below, Mattress Firm’s market share of visits to furniture stores (which includes mattress stores) is up appreciably in Q2 and it’s consistently gaining 170 bps YoY visit-share. For Q2, units for the Tempur Sealy North American business (the manufacturer side of the house) were down -2% vs. -3% in Q1, i.e. “less bad.” CEO Scott Thompson said, “Early third quarter like-for-like trends are encouraging with indication of potential solid growth. It’s too soon to call a turn in the market we serve, but we are encouraged with what we are experiencing. We’ll know more after the third quarter.” And so, is it a turn, or just Somingroup’s outperformance?

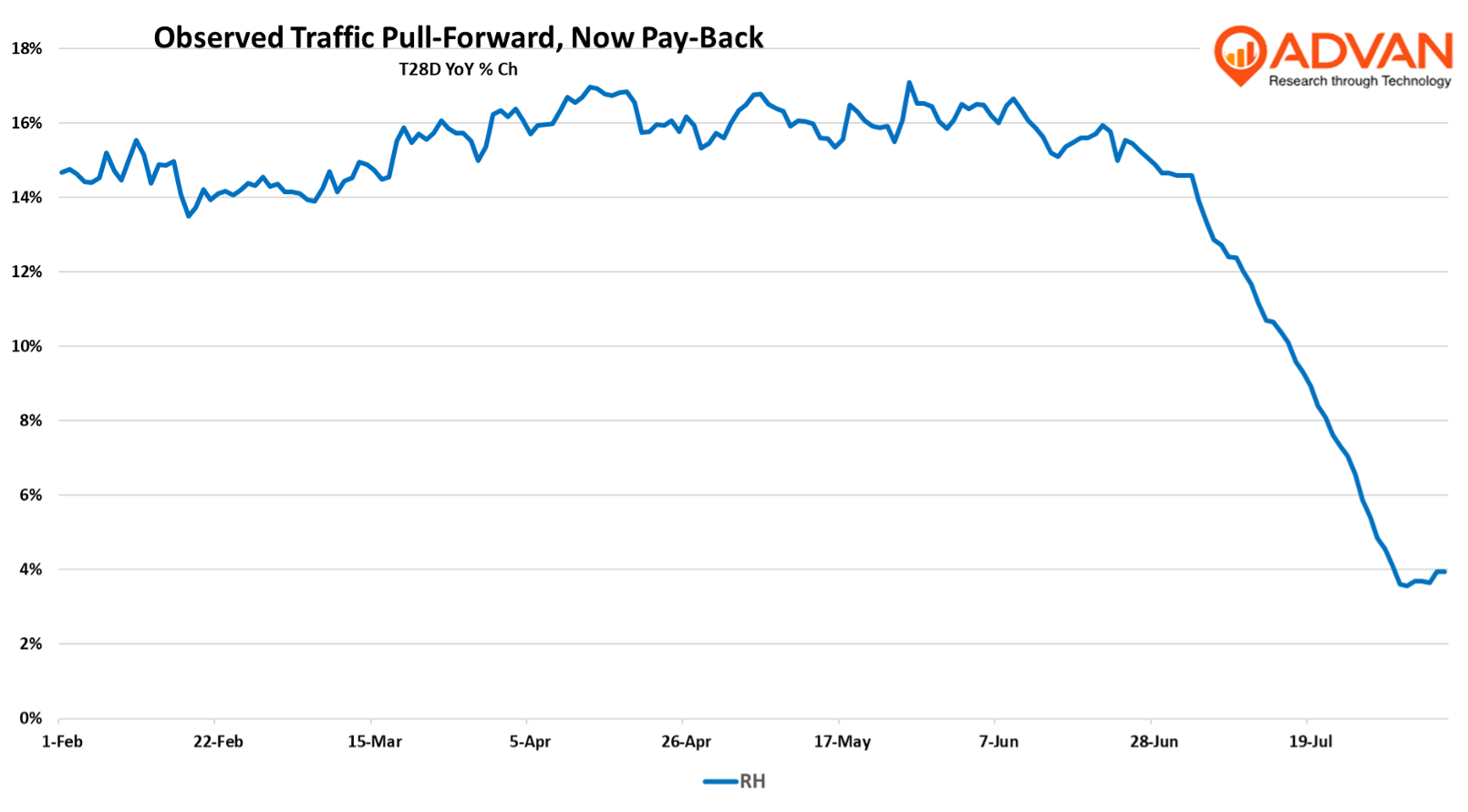

Should housing-related continue to firm up, that would be a broad tailwind for retailers and the economy; as such, it would be a big deal (maybe even call it a Beautiful Big Deal). Last week, Wayfair reported better-than-expected results with revenue from the US accelerating from 1.6% to 5.3% growth. Today, Arhaus reported on a strong upswing in demand during July, following a soft Q2 in terms of orders taken. (Revenue was strong due to orders taken in late Q1.) Advan is tracking Pottery Barn to also be above last quarter’s growth rate. However, Q2 was also boosted by a pull-forward of orders before tariffs hit. That can be seen clearly in the acceleration and then the “payback” at RH, in the chart below. (Recall, visits match orders and not revenue.) Pottery Barn and LoveSac show a similar trend up, then down trend. As such, it looks like 2025 will be a “bouncy” year for all things housing-related, and potentially not yet “beautiful.“

LOGIN

LOGIN