Grocery comp-sales are picking up and our hypothesis is that it’s driven by more share-of-stomach coming from restaurants (out-of-home). Inflation is also a contributor; Q2 CPI for at-home was +2.3%, up from Q1’s +1.8%. Added convenience may be a driver. We’ve been surprised by the ongoing strength in store delivery. Instacart reported a +17% increase in orders for Q1, up from the Q1 rate of +14%. Walmart has shared that store-delivery is growing substantially, especially by more affluent households. (See our note .) As such, greater convenience is also supporting the comp increase. Lastly, higher promotions via loyalty programs and rising effectiveness are supporting traffic; however, that is also leading to cherry picking and pressure on average unit retail (AUR) and units-per-transaction (UPT). A strong private label program is a differentiator between those that are gaining share from those that are not. Costco continues to report mid-single-digit comp-sales increases in food & sundries and high-single-digit increases in fresh, on top of similar increases in the base period, including the latest report for the month of July. Similarly, Trader Joe’s consistently grows visits counts +5-6% month after month.

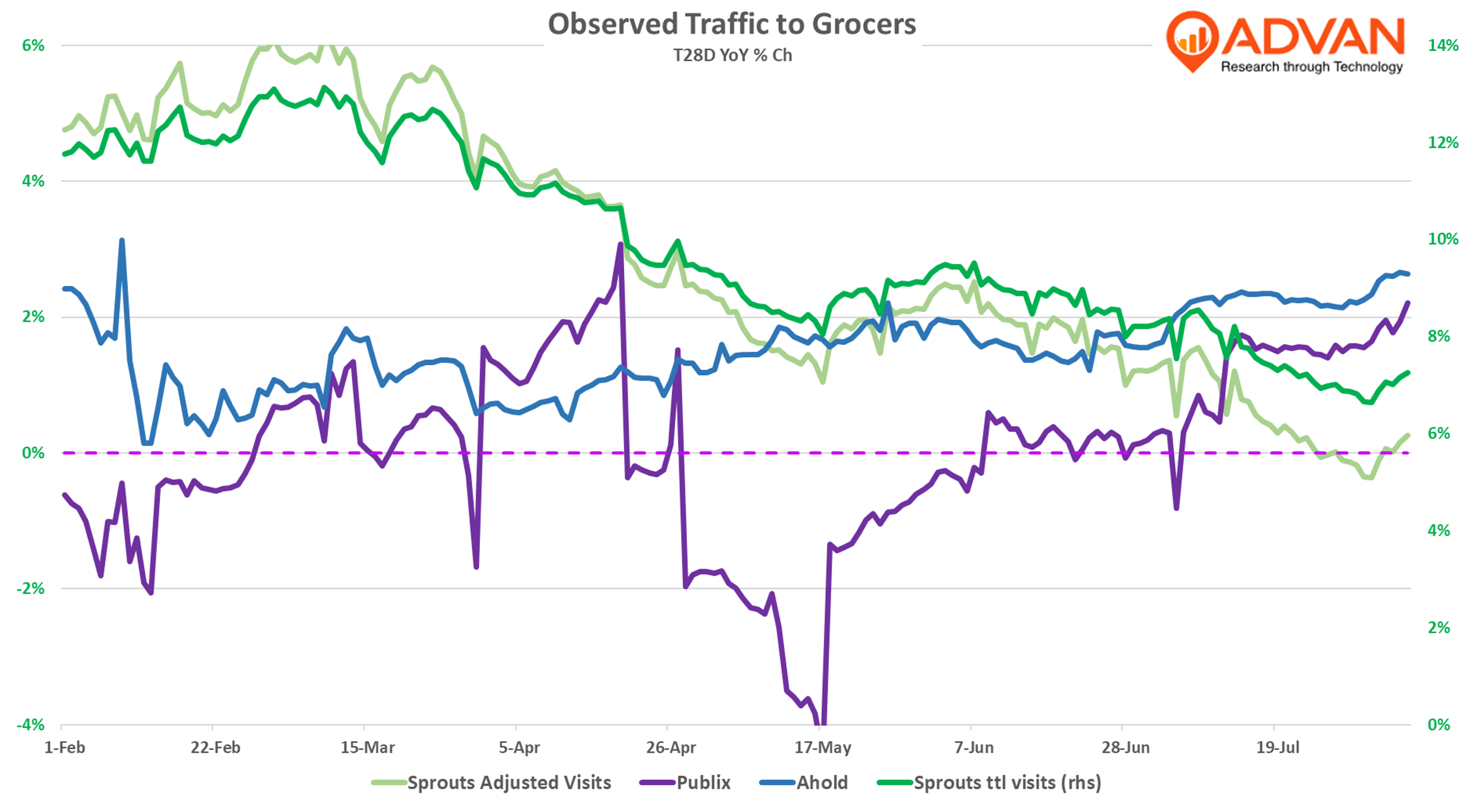

In terms of the grocers, Publix reported a 6% comp-sales increase (5% excluding Easter’s timing); that’s 1 ppt stronger than Q1’s rate. Ahold Delhaize, which owns Food Lion, Stop & Shop, Giant, and Hannaford, reported a 1.1 ppt improvement in its 2-year comp-sales (adjusted for Easter). Sprouts reported a 1.4 ppt improvement in its 2-year. (All three have a June quarter end.) While Sprouts visits have slowed in July, that’s largely the result of lapping large gains in prior years; comp-sales on a 3-year basis are up +21% for Q2. It’s Q2 sales increase of +17% was driven by more locations and a +10.2% comp-sales increase. The comp was driven my more shoppers and increases in the conversion rate, AUR (due to mix and inflation), and UPT (new customer maturation and surprise & delight). Gross margin increased by + 91bps due to improved sell-throughs and the favorable mix (more specialty items that have a higher margin rate).

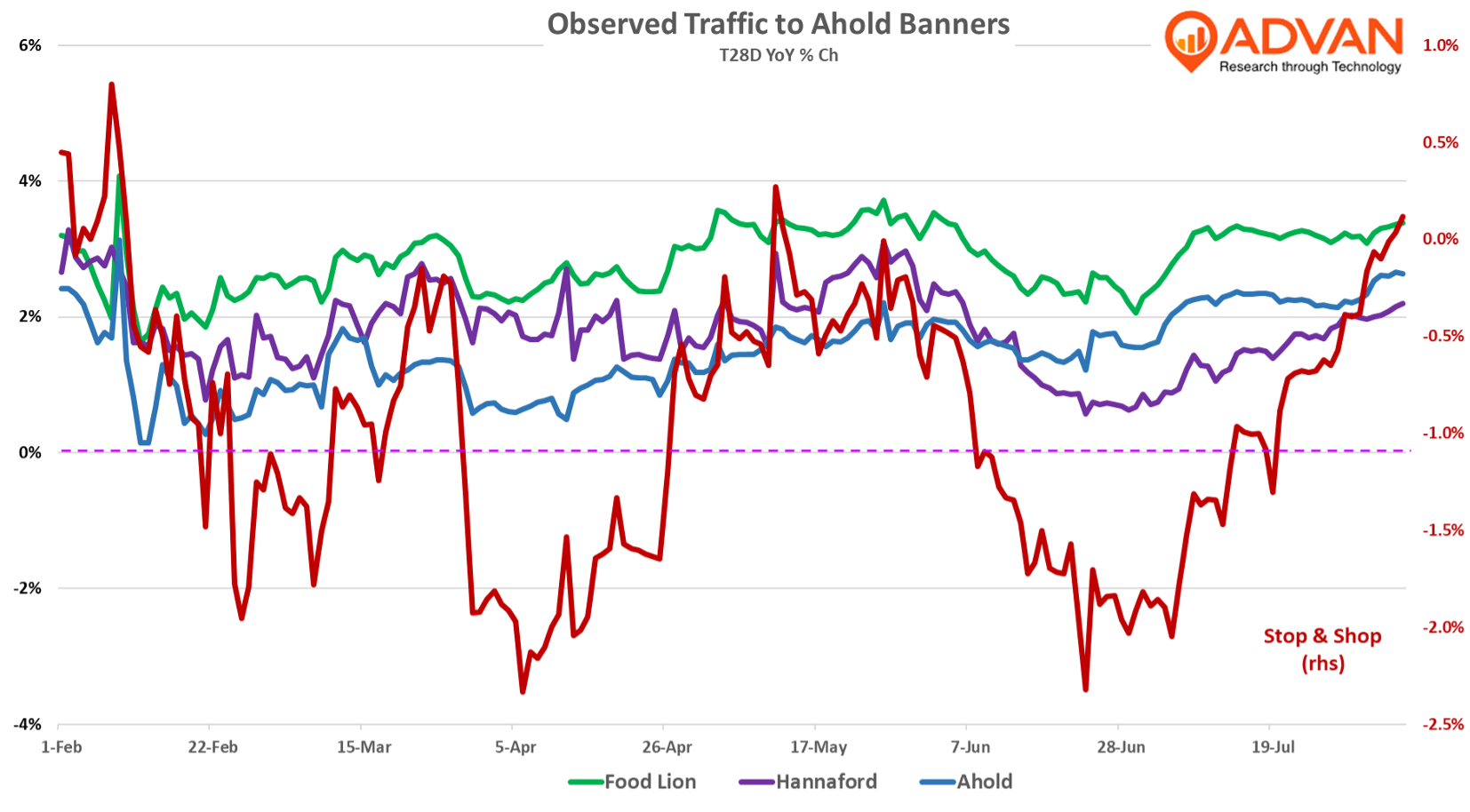

Ahold is in the midst of rebuilding its business momentum, that’s centered around offering greater value and convenience. On its progress, CEO Hans Muller said, “As you know, we are backing this up with several investment commitments, including a $1 billion price investment in the U.S. over the coming four years, own brand assortment expansion and digital personalization programs, just to name a few. All our U.S. brands have now launched price investments, while also strategically leveraging the strength of our own brand portfolio. An example of this is Hannaford, and that’s in the Northeast. In May, the brand launched a strategic price investment across all our stores in Massachusetts, lowering prices on approximately 2,500 center store own-brand products. The initiative was bolstered by a targeted omnichannel marketing campaign and leveraged the strength of the Hannaford My Rewards local – loyalty program. The investment is showing promising results, with center store own brand unit sales outpacing the rest of the store. As a key differentiator, own brand assortments are products that customers can only get in our stores. And in our weekly customer data, we also know the power of a well-executed own brand product has in driving customer loyalty. While we already offer thousands of own brand products in both regions, what also matters is ensuring we continuously innovate and that our own-brand products early stand out on shelves and in our marketing for the quality and value they have been designed for… Customers in our DoorDash channel grew 300% over the last year, with half of that growth coming from customers that had not shopped online with any of our brands before. With e-commerce market share expansion in both regions, our store omnichannel proposition will continue to be a differentiator for our brands, as we look to densify and grow our markets.”

As the chart below demonstrates, Food Lion and Hannaford are driving outperformance in Ahold’s brand portfolio; for Food Lion both frequency of visit and dwell time increased YoY. (The increase in dwell time implies an increase in UPT.) By contrast, Stop & Shop remains volatile and an anchor; its visit decline is the result of fewer visitors, i.e. it is being dropped from consideration and peoples’ routines. Muller, “It has been one year since we announced decisive and deliberate actions to ensure a stable and thriving future for the brand. And since the announcement, we have closed 32 underperforming stores, started price investments with regularly recalibrating based on customer response, continued store models focusing on a more efficient use of capital and a broader store reach, improved store execution and on-shelf availability and deployed communication tactics to maximize customer awareness and emphasize own brands. We are encouraged by customers’ response to the initiatives, which we have implemented so far. And where we have made investments, we are attracting new customers, seeing increased volumes and seeing an improved Net Promoter Score. While we are celebrating the wins, we continue to focus on executing the plan, driving sales and finding sustainable and substantial efficiencies. This includes a strong focus on supply chain optimization as well as maximizing promotional effectiveness. In the second half of the year, we will expand our price investments to additional markets, further optimize our assortment and continue our store remodels.”

LOGIN

LOGIN