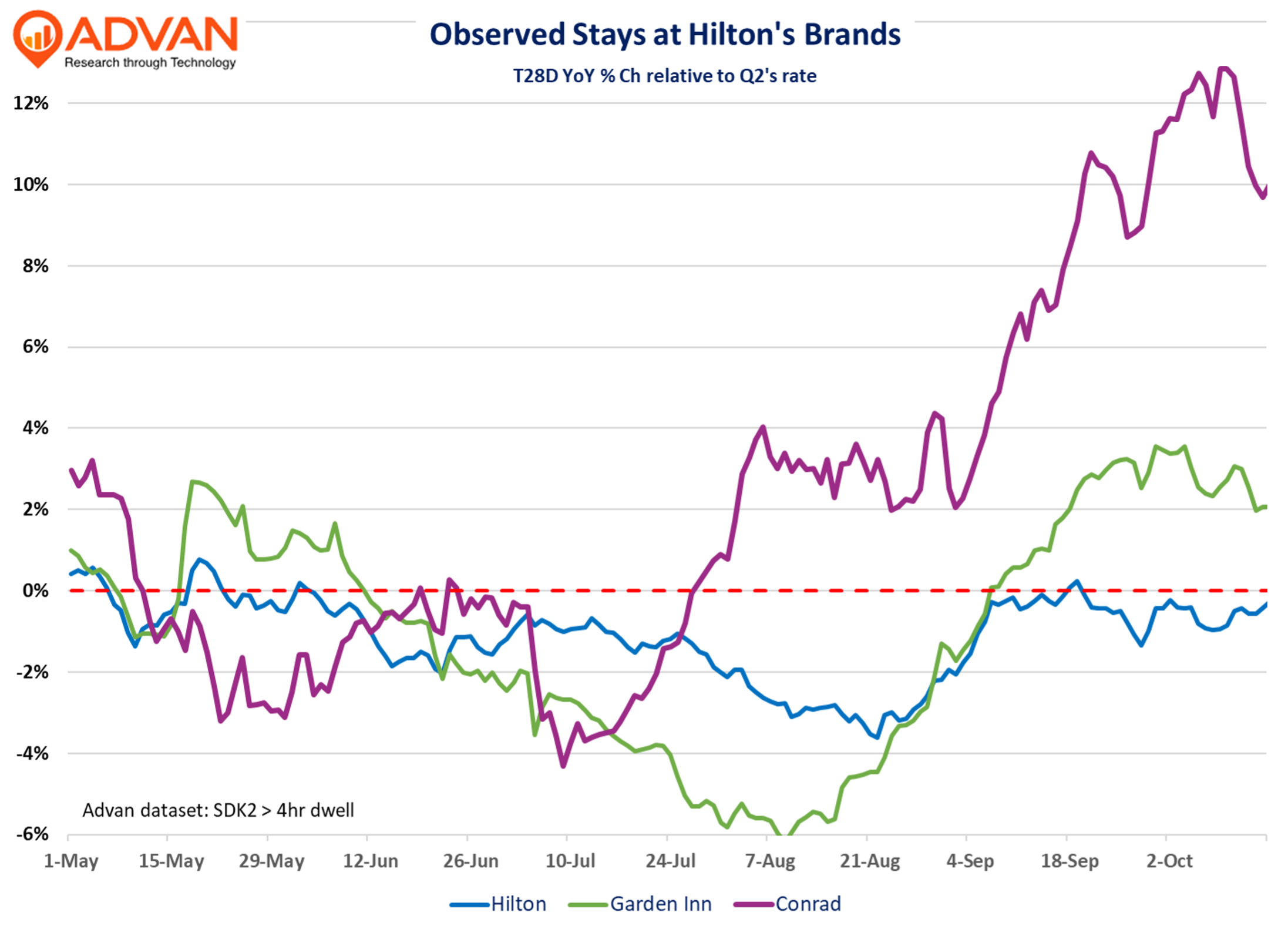

Last week, we had the opportunity to present our views and data on the US consumer at the National Association for Business Economics’ Annual Meeting (the Chair Jerome Powell event). We shared that the “right upward arm” of our K-shaped economy had picked up sharply since early August (presentation here ) and we expected that to continue through year-end should the stock market carry on strongly. (Our loyal readers will know that the high-end is why we believe that September retail sales were stronger as well.) Last week, we got affirmation of that with LVMH’s stronger Q3 results . This week, we got more of that with the results from Hilton and Hermés. As shown in the chart below and relative to each brand’s Q2 pace, high-end Conrad has picked up the most (we also saw that with Four Seasons, which is in the presentation). By contrast, Hilton Garden Inn and Hilton experienced a modest softening, but ended Q3 similar to Q2’s pace.

Hilton CEO Chris Nassetta saying, “We continue to believe that in the U.S., lower interest rates, a more favourable regulatory environment, certainty on tax policy, and a significant investment cycle will result in accelerated economic growth and meaningful increases in travel demand… So I would bet a lot of money, that ‘26 is going to be better than ‘25, and I bet a lot of money ‘27 is going to be better than ‘26. The exact slope of that is difficult to determine…Obviously**, the luxury business has been performing really well**, and we like that, my own belief is it will continue to perform well.”

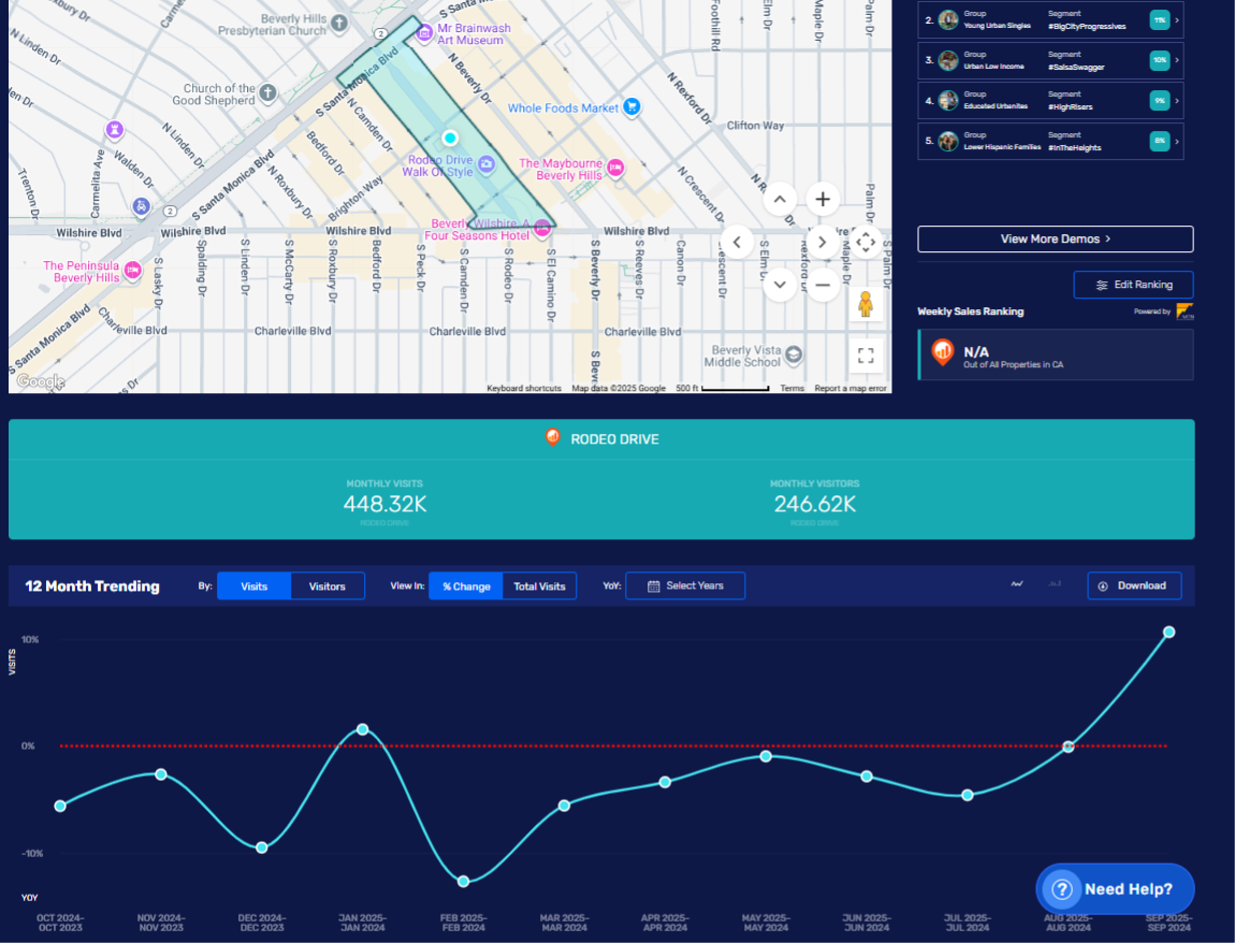

Turning to Hermès, organic sales in its Americas region accelerated to +14.1% growth, +180bps stronger QoQ and placing the business 90% above 2019’s level (similar to last quarter’s level). Globally, organic sales growth also picked up to +9.6% growth. The graphic below is from our REI platform and it shows that visits to the Rodeo Drive area / geofence from US consumers increased a robust +10.7% during September. If we filter for visits that exceeded 30 minutes, which are more likely to be shopping and dining visits, the figure is similarly strong at +9.4%.

On Hermès’ earnings call, CFO Eric du Halgouë said, “We had very good Q3 in the U.S. growth that was driven by jewellery, silk, shoes, watches by pretty much all of the divisions, an increased footfall and also a growth that is well distributed between the East and the West Coast… And also a reminder, the U.S. is a country where we’ll be focusing our development. And in October, we opened a store in Nashville, Tennessee. And so we’re going to continue to focus the development of our network in the US.” (i.e. Hermès is after the US affluent consumer)

Turning to 2026 macro and whether our economy will continue to be K-shaped, and what I said at the economics conference . To add more nuance, I describe 2025 as an “extended and thinning thrifty K-shaped economy” where the rightward arms are extending. That means that the upward right arm is extending as we described above, and that the downward right arm is growing because it’s capturing more less-affluent households (or those who are more careful in their spending, think retired baby boomers) who are trading down into that arm. It is for this reason that value retailers and dollar stores have seen a stronger 2025, i.e. more shoppers. That did not happen in ’23 and ’24, which were devastating years for the dollar stores given the spending crunch on its core consumer. (See our last write-up .)

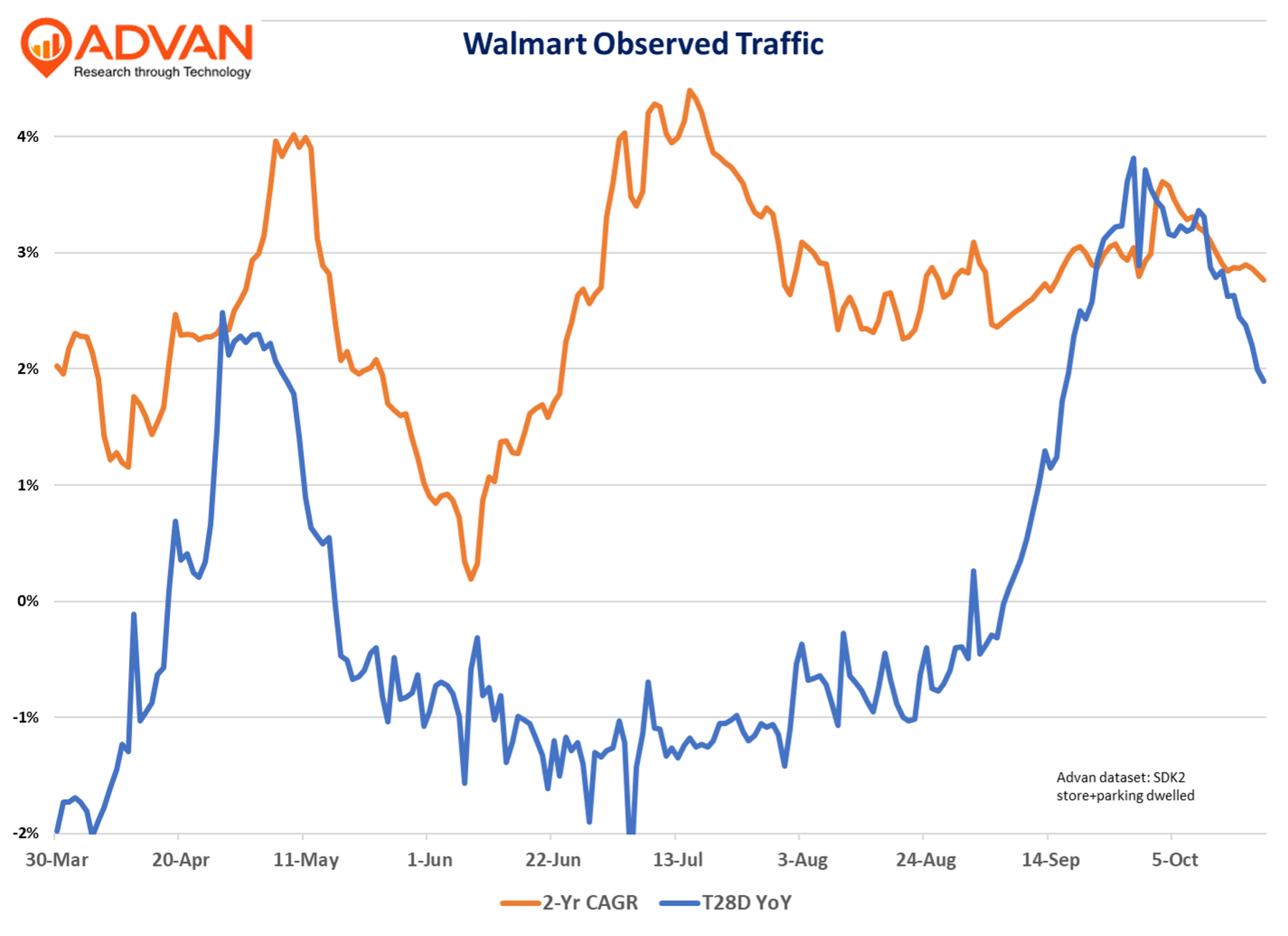

Given our sluggish employment market and the slow drip of higher prices due to tariff pass-through, I see little reason why 2026 will be any different than 2025. If employment worsens, or the pass-through accelerates, especially for consumables, then the “extending and thinning” will become more pronounced. When asked at the conference if I was closely watching high-end spending for signs that consumer spending and the economy were slowing, I answered, “No. I’m watching Walmart. If traffic and sales slow for a broadly shopped brand known for EDLP and value, then we know that we have a pronounced slowdown afoot.”

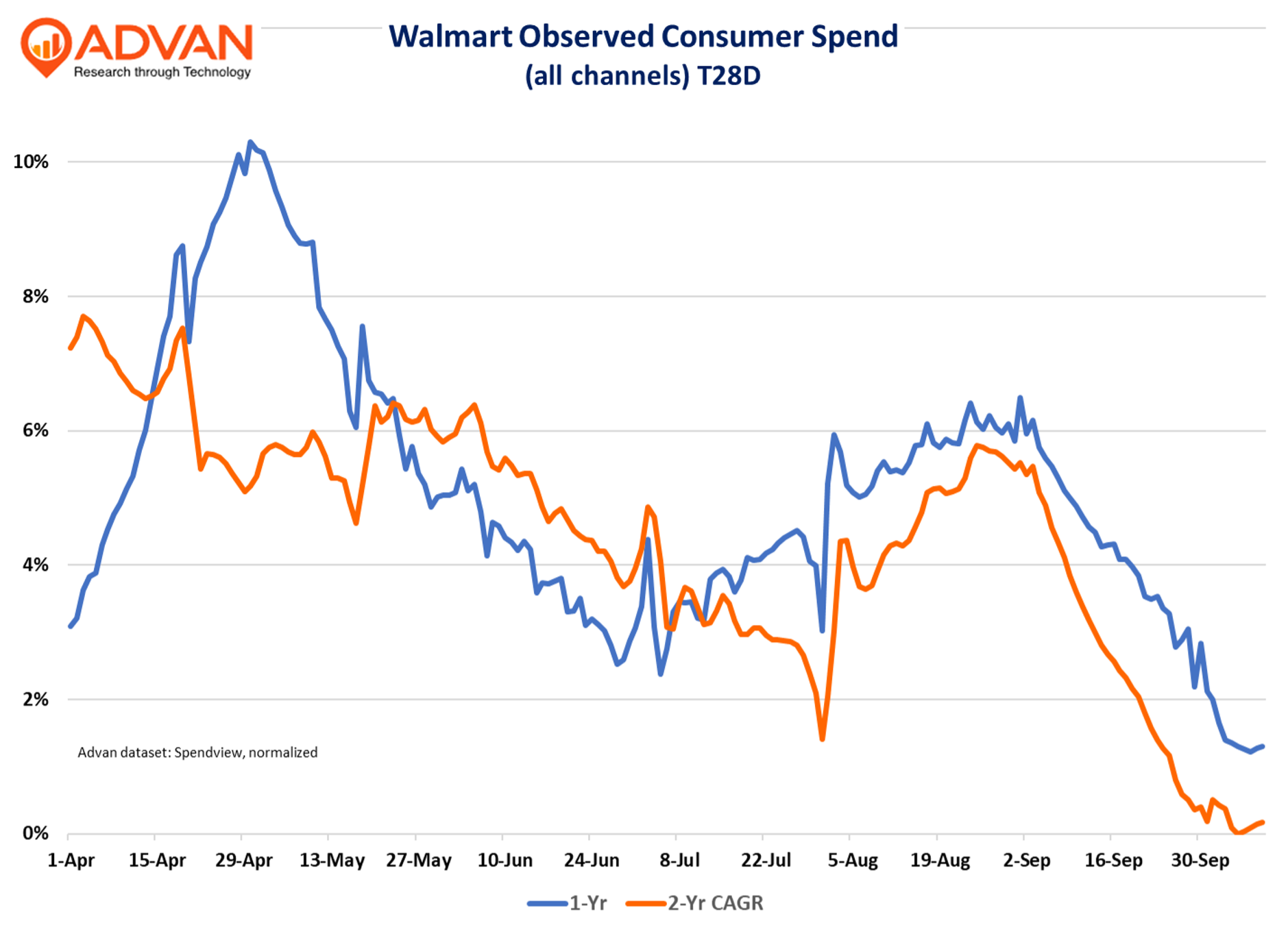

As demonstrated in the chart below, Walmart’s traffic has remained stable and solid on a 2-year basis; the 1-year trend is strongly influenced by last year’s hurricane. However, the second chart of spending at Walmart shows a deeper deceleration in September following a blow-out back-to-school period . When we look at the transaction data by channel, we see consistent growth for Walmart.com, whereas the in-store shows deceleration. That implies that the higher-end Walmart customer continues its strong engagement with the retailer, but for the less-affluent, there is a curtailment in the amount spent, more shopping around, and more “pay check cycle.” We see evidence of the last two in the deceleration in Walmart’s average check size since early September. (Last year’s significant hurricane also creates noise.) Softer non-holiday periods have been the pattern across retail since 2022, and so, we are not surprised by the slowdown; however, that puts the onus on Halloween and Black Friday to break the trend. Stay tuned.

LOGIN

LOGIN