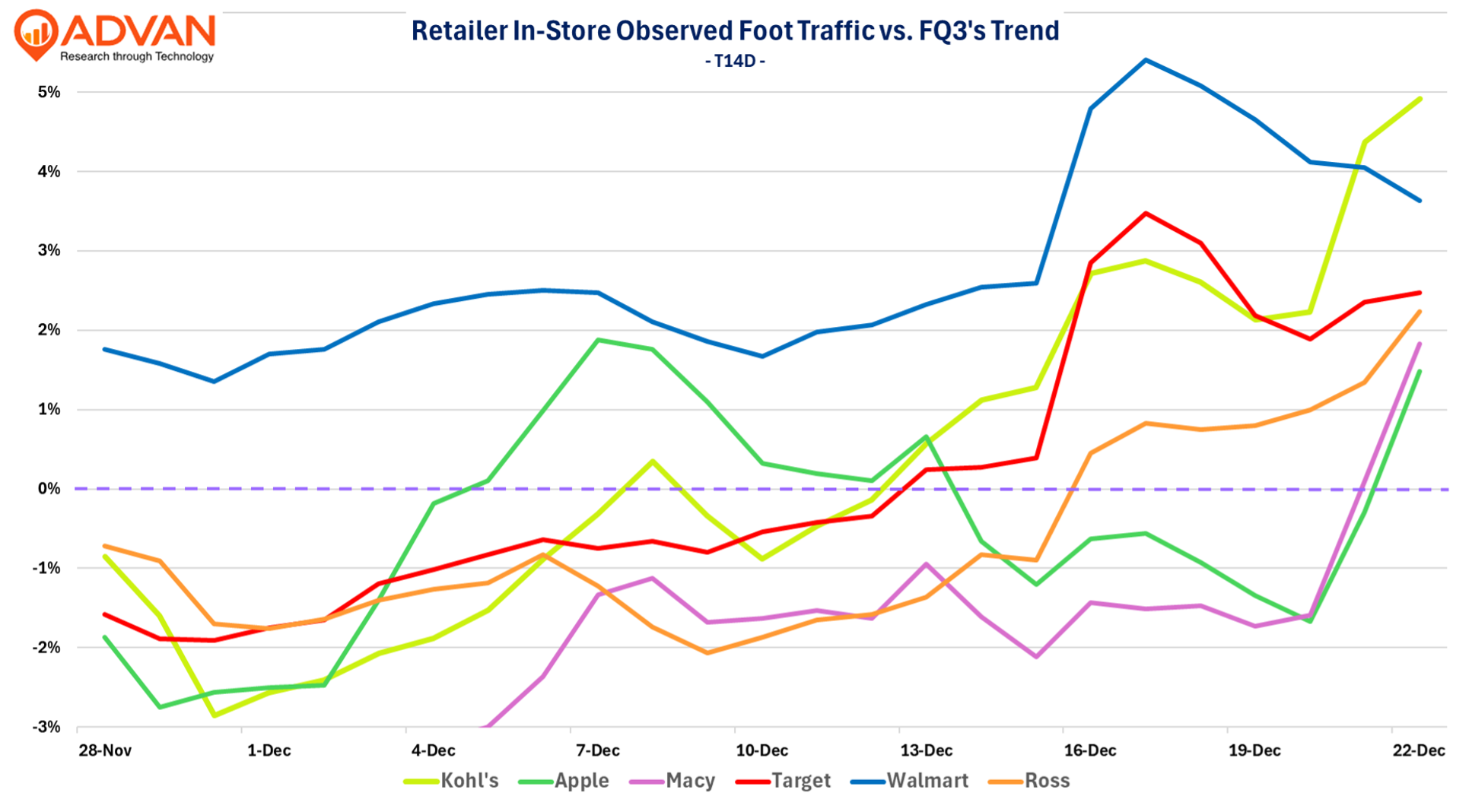

- Amazon, Walmart, Five Below, and Ross Dress for Less have continued to outperform in traffic and spend. Most brands have shown a stronger trend than last week, especially Kohl’s and Ross.

- Store spend has been less vibrant than traffic due to more shopping around for deals, i.e. some average ticket pressure, and online wallet taking share.

Last week, we wrote that we expected the pace of holiday foot traffic to accelerate going into Christmas day, and as shown below, that has happened; however, Advan’s transaction data shows that store spending has not, save department stores and off-price. The only segments where we observe average transaction size increasing are off-price, Dick’s Sporting Goods, and** Apple**. By contrast, Best Buy’s average ticket shows a lot of compression. We offer three possible explanations for the shallower store spending trend:

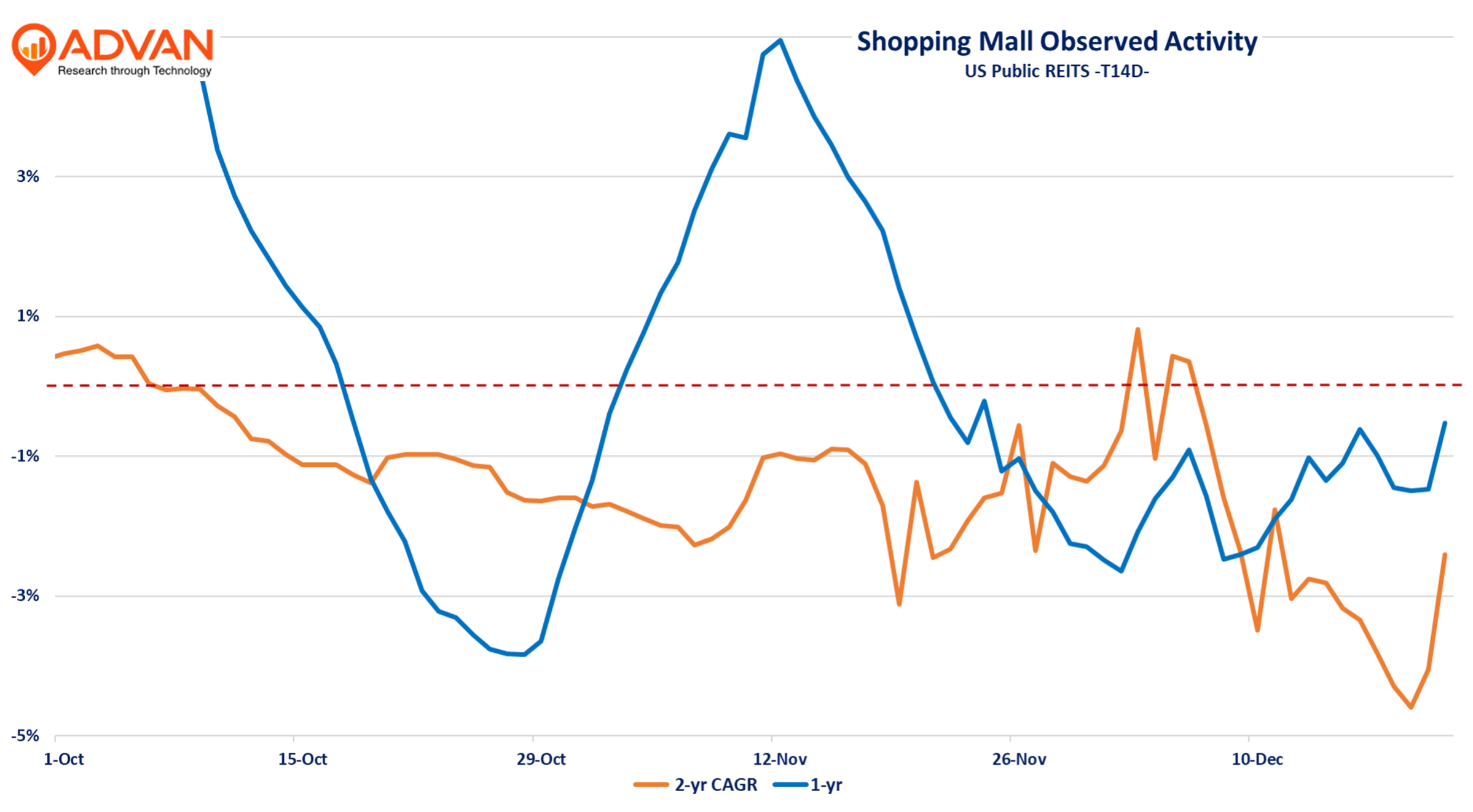

- Difficult comps – Holiday 2024 was a gangbuster season; the Census Bureau reported December ’24 core retail sales to have increased +5.2%, up +170bps from November’s +3.5%. That difference reflected the shift of Thanksgiving to the last week of November, which pushed holiday spending into December. That shift also creates distortions to the 2-year figure, shown below (more of the 2023’s season’s traffic and sales were pulled into November).

- Stronger online sales – In last week’s report noted that observed activity at Amazon’s fulfillment centers and delivery stations has significantly accelerated in November / December - the pace has further quickened over the past week.

- A fatigued consumer – We think consumer fatigue is less of factor, but a lot of choicefulness is. We expect to hear that word used often at the upcoming ICR company / investor conference in January.

As shown in the chart below, the momentum in traffic has picked up across most brands, with Kohl’s and Ross Dress for Less showing the most dynamic improvements in performance. The chart shows the FQ4 trend relative to FQ3’s rate; on an absolute basis, Walmart observed store traffic (per location) has the most “festive” performance at +3.5%. Complementing that level of growth will be Marketplace, store delivery, and curbside.

In terms of observed spend, Five Below and Dick’s continue to have a gangbuster season. We’ve also read a lot of enthusiasm for Macy’s in the trade press; Macy’s pace of observed spend is exceeding Dillard’s, which suggests that they may out-comp them for the quarter given the high weight of December.

LOGIN

LOGIN