As previewed (Housing-Related Retail – Are Things Improving? It depends upon your neighborhood, if pricey, then yes), the comp-sales results of Home Depot and Lowe’s improved slightly on a 2-year basis, but softened on a 1-year basis (lapping hurricanes). Comp-ticket and big-ticket are accelerating, driven by stronger growth in big-ticket items (appliances, power tools, etc.) and bigger Pro-oriented projects. Home Depot CEO Ted Decker said, “While underlying demand in the business remained relatively stable sequentially, **an expected increase in demand **in the [fiscal] third quarter did not materialize. We believe the consumer uncertainty and continued pressure in housing are disproportionately impacting home improvement demand.” CMO Billy Basket said, “Our [sales] results were below our expectations, largely due to a lack of storms relative to historic norms, which most notably impacted areas of the business such as roofing, power generation, and plywood, to name a few.”

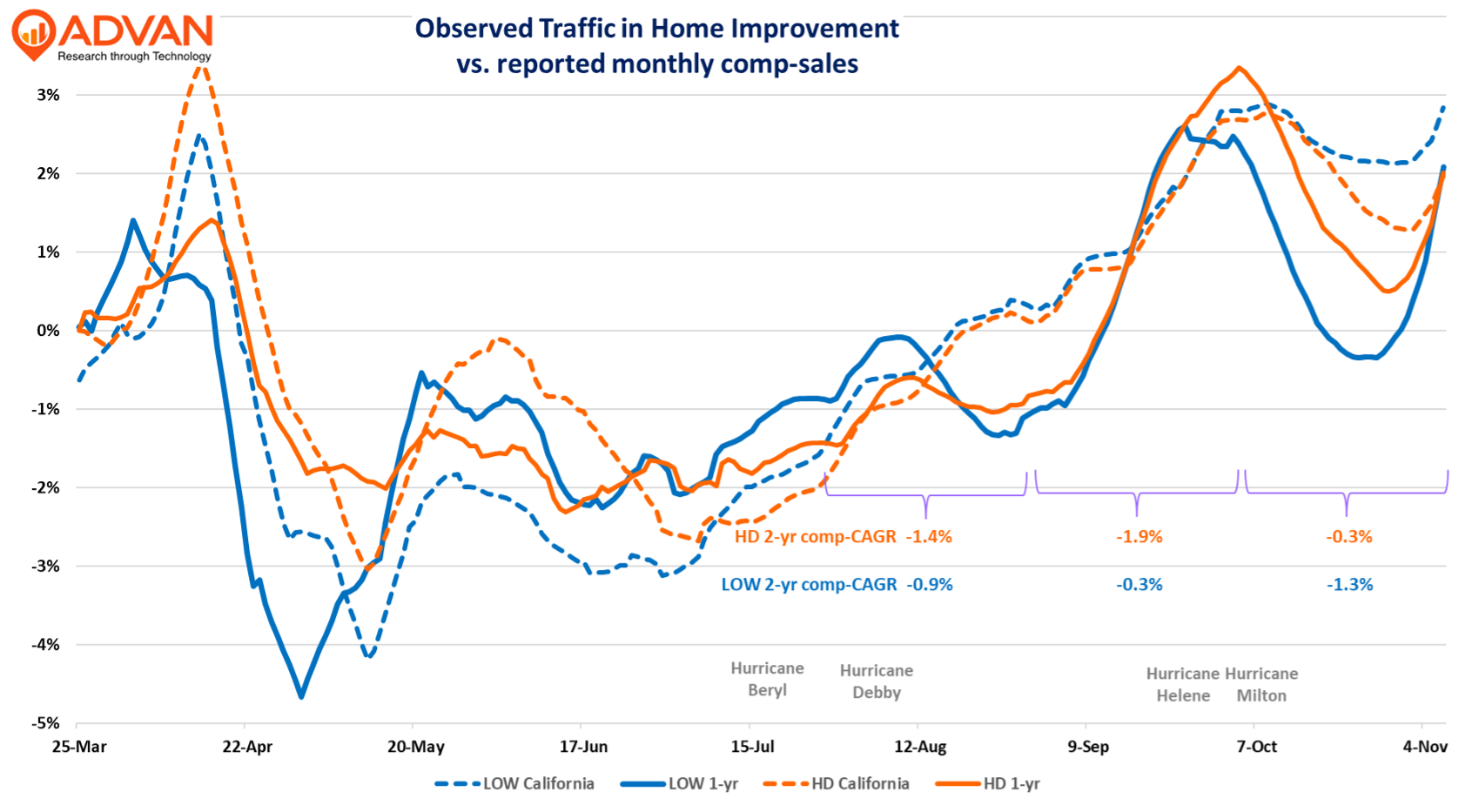

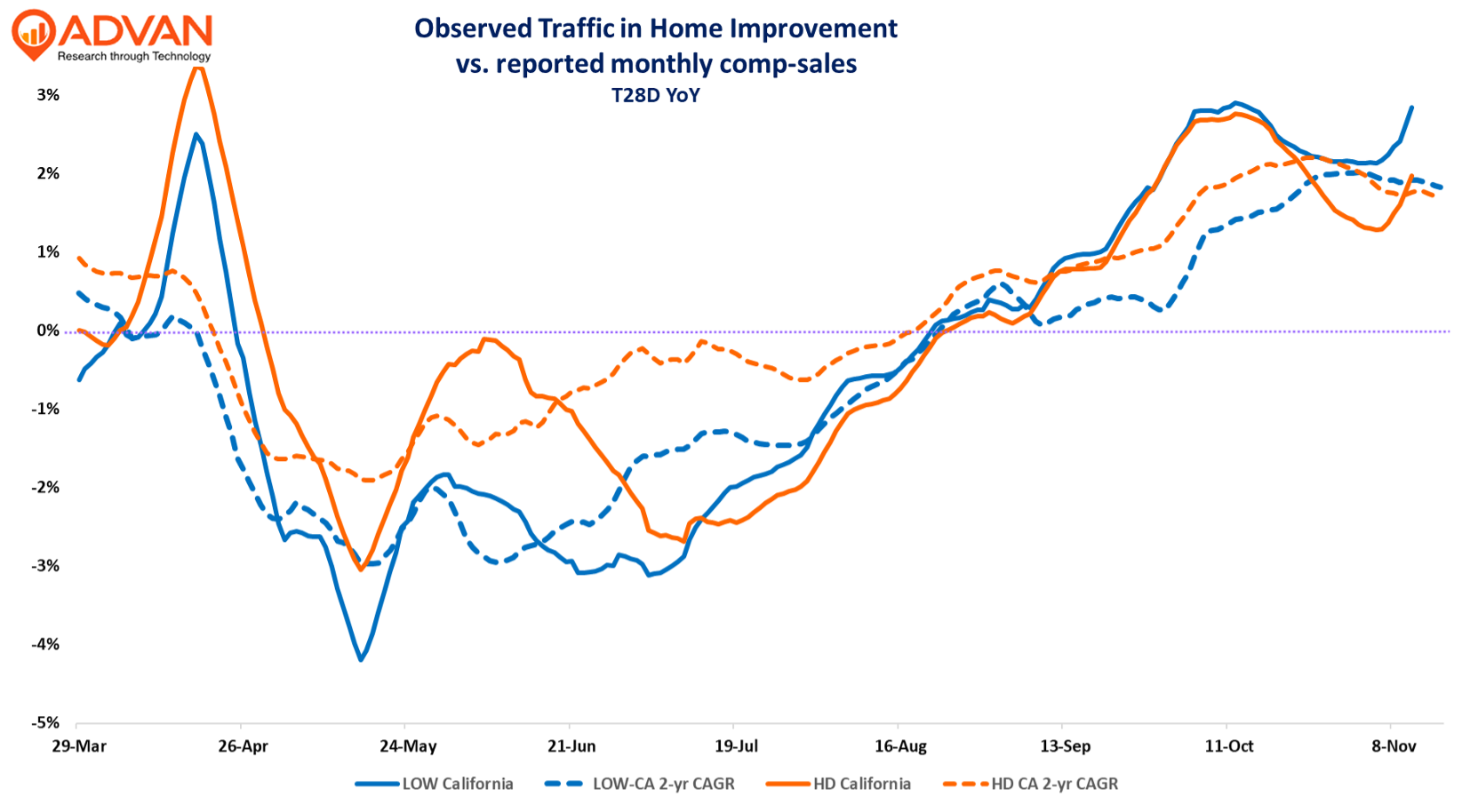

To untangle the storm noise from the underlying trend, we created the two charts below, which compare trends on a 1- and 2-yr basis and the nationwide to California (thankfully no hurricanes). Notable for the period, there were four major hurricanes in FQ3’24 and versus none in ’25; as such, this was an idiosyncratic quarter and a poor read on the health of the home improvement market. The first chart shows the nationwide traffic levels being pulled higher than California due to an easy comp to the disruption from the storms, followed by a deep deceleration due to comping cleanup activities. The second chart, just California, shows a clear improvement in the traffic trend since mid-August, with Home Depot slightly leading on a 2-year basis. Lowe’s management noted being pleased with the performance of its West division.

For Lowe’s, both DIY and Pro contributed to the +0.4% overall comp-sales increase. Large ticket (>$500) comp-sales increased 2.9% and overall comp-ticket increased +3.4% - driven by ongoing strength in Pro and appliances, mix shift into larger ticket purchases, and modest price increases. On Lowe’s earnings call, CEO Marvin Ellison said, “Relative to November, look, we’re very pleased with the positive comp performance to start the quarter in spite of storm overlaps from last year. We’ve seen improvements in the top-line since exiting October. And we just believe that some of the key elements of our toll strategy are working and we’re excited about November because there are some great things on tap.” Executive Bill Boltz said, “We’re excited about kind of the early start to the quarter, obviously, coming off of October. Strength for us really broad-based across the store, but particular strength within our seasonal categories, holiday, trimer tools, appliances and other gift-related businesses that are getting off to an early start…. And we’re seeing some early excitement around some key areas of the store. So whether it’s “buy now and installed by the holidays” within our flooring and cooking areas or you look at cobalt and some of the strength that we’re seeing there with some new products in workstations, the “buy and get offers” within our tool business…. So we’re excited about how things are progressing. And in our appliance business, we’ve had really since last year, four straight quarters now of comp growth and unit growth, which is telling us the health of that business and that consumer responding to the offers and the innovation and the new products that the team has put up.” And CFO Brandon Sink, “We’re seeing acceleration on 1-year comps when you exclude storm-related activity for Q3 and what’s implied in our Q4, also 2-year comps accelerating nicely as we’ve moved through the year.”

On Lowe’s Pro business, Ellison said, “Our small to medium Pro business remains very stable. And roughly 75% of our Pros are very confident in their job prospects. And also, this segment of the Pro consumer continues to work on smaller ticket repair and maintenance projects, and that’s been very consistent with what we’ve been saying all year long. So when we look at our Pros, when we talk to our Pros, they feel very confident in their business. They feel confident in their access to credit and even feel a little more confident about their ability to hire and attract labor.” And executive Joe McFarland said, “We’re really pleased with the flywheel effect that we’re seeing from the Transform Pro offering. And when you think about where we’ve been headed with the loyalty through MyLowe’s Pro Rewards, a relaunch there, we have just a wonderful enhanced digital experience that pro extended aisle we have made investments in fulfillment. The last thre years, our inventory investments are really beginning to pay off. The order modifications of fulfillment flexibility in the in-store experience. So we’re excited to see this flywheel effect all come together with the great product offerings that we have. And we have good confidence that when this does bounce back, we’re well positioned to capture the share.

Circling back to Advan data, by visit type and the month of October. We consider longer visits to be aligned with bigger projects and bigger ticket consideration; overall dwell time improved by +3% for both Lowe’s and Home Depot. And visits longer than 30 minutes strongly outperformed the average; these data points thus align in the improvement in comp-ticket. Looking at visits by frequency, visits by visitor that frequented the brand 4X in October, were much stronger for both retailers (Pro > DIY), but Lowe’s outperformed. This makes intuitive sense given their positioning as Home Depot is after the larger Pro and enterprise business (MRO); these sales are generally delivered vs. the Lowe’s “Pickup Truck Pro,” who is still picking the product themselves.

Ellison also shared on Pro, “I would say we feel great about the current strategy with the smaller medium pro is working. We’ve had quarter-over-quarter growth. We think it hinges on our MyLowe’s Pro rewards loyalty platform. It’s resonating well where our customers we think it hinges well on the products that Bill’s team brings to the table every day, and that was a huge gap in deficit for us 7 years ago, and that is no longer the case. We also think it’s important that we maintain a very competitive credit portfolio. We have a best-in-class, 5% off every day for our Lowe’s credit cardholders, and that also extends to the Pro customer that resonates exceptionally well.”

Going back to our preview and its conclusion, the home improvement industry is stable, but growth is driven by the more-affluent (that can pay for the pro’s service) and the non-affluent DIY remains cautious in their discretionary / home upgrade spending.

LOGIN

LOGIN