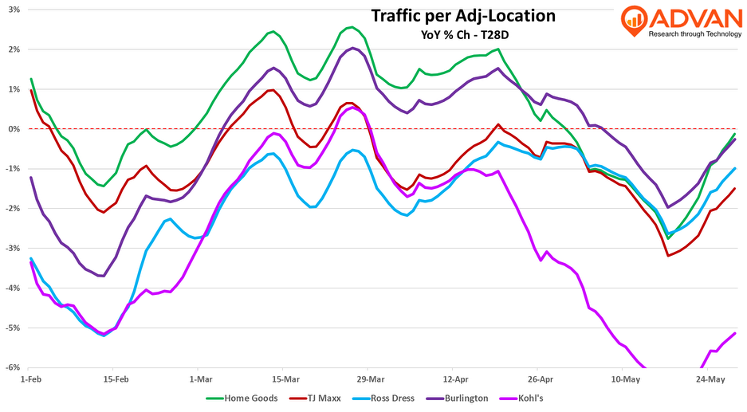

Fiscal Q1 comp-sales results for off-price retailers were softer across the board due to a moderation in traffic. Traffic per location was slightly up for Burlington and HomeGoods and slightly down for TJ Maxx and Ross Dress for Less (per Advan). Results for the traditional department stores were less bad. In sum, this demonstrates that the share transfer from traditional to off-price slowed. In our view, this is the result of the traditional department stores executing better, rather than off-price brands executing “less well.” While that’s interesting, it’s also during a seasonally slow period and in a very noisy backdrop. As such, one really needs to see fiscal Q2 results before marking this as an “inflection point” vs. a “blip.” Per the quarter’s traffic, one can see that the brands’ cadence generally matched one another; moreover, the soft February, followed by a better March, as well as April, matches the Census Bureau’s retail sales report. May’s softness is weather-related and likely a slowdown again as it’s a shoulder period, like what was experienced in February. Moreover, April may have benefited from a pull-forward as consumers rushed to buy items ahead of any tariff-induced price increases, making May a payback period. When Census reports on May in a few weeks, we expect the report to show a larger decline for departments stores, and slower results for retail in general. Lastly, the sharp decline in Kohl’s traffic also suggests some discombobulation following the abrupt firing of its CEO; moreover, they closed 24 locations (2%) at the end of March. (Their guidance is for a 4-6% comp-sales decline for the year.)

On the current trend, Kohl’s CFO Jill Timm said, “In terms of the quarter-to-date trends, I would say our quarter really was a pretty consistent performance. We did see our reg price selling improve as the quarter progressed, and we saw that actually into May. I’ll call it one exception last week. It was pretty cold across the country. So we did see a little bit of a step back in our spring seasonal business. But I would say very much attributed to weather one week, and we felt really good with the momentum that we had been building in our regular price business. And a lot of that was driven with the newness that we’re flowing in.” In contrast to Kohl’s worse results, Macy’s Inc. and Dillard’s reported better-than-plan. Macy’s brand comp-sales declined only -2.1% (taking the two-year stack to -2.5% from Q4’s 5.6%), Bloomingdale’s comp-sales increased +3.8%. Dillard’s comps declined only -1%, taking the two-year comp stack to -3% from Q4’s -6%. For Q2, Macy’s inc expects comp sales to be in an even better range at -1.5% to +0.5%. As an outsider, examining Macy’s traffic and visitors as of late is complicated by all the recent store closures. However, Advan’s REI product produces traffic / visitors for the currently open locations on a per-location basis, as shown below, visitors to Macy’s on average and our Macy’s (Wayzata Blvd in Minnesota) have shown better results over the past 6+ months vs. the prior trend. A similar trend, but less pronounced, can be seen for Dillard’s in the second chart. Dillard’s earnings release quotes CEO William Dillard, II saying, “We turned in a relatively good first quarter in light of the prevailing economic uncertainty. We kept expenses under control and reported a healthy gross margin.”

In discussing the Macy’s turnaround, CEO Tony Spring said, “In the first quarter, Macy’s NPS continued to improve year-over-year. Customers appreciate our renewed emphasis on the shopping experience and a commitment to providing relevant fashion and newness at a compelling value across the good, better and best price spectrum. Recently introduced contemporary apparel brands, Good American, Fieri and NIC+ZOE, have been well received. And Coach and Donna Karan continue to resonate.” In contrast to the improvement at these traditional department stores, comp-sales for the off-price brands were about 2 to 3 pts slower QoQ. TJX shared that the home category led its US business and that’s a larger category for the company, than it is for Burlington and Ross. That’s one reason for Marmaxx’s stronger showing than these two. (HomeGoods comp-sales grew by +4%.) More coveted brands, better merchandising, and more impactful advertising are other reasons. Affluence wasn’t a reason as Burlington shared that its locations in lower-income markets outperformed. Ross shared that performance by different trade-area consumer incomes showed no differences, and that DDs led Ross. These characterizations demonstrate that TJX is just better at getting spenders on brands into their stores. CEO Ernie Hermann said, “Marmaxx, which got better as the quarter went on, I think we’ve been very happy when we saw the more recent Marmaxx comps” (i.e. the back-half of May). Marmaxx’s comp slowed by- 200 bps to +2%; Advan shows traffic-per-location slowing by -300 bps, which implies a slight improvement in the conversion rate. Better conversion means strong merchant and store-level execution. Average ticket also contributed to the comp increase; that likely stemmed from stronger sales in the home category and better sales of better and best brands. Ross Inc. reported comp-sales at flat, which was a -300 bps QoQ slowdown. The slowdown was at both DDs, where traffic slowed by -190 bps and the Ross brand, where traffic slowed and declined by 1.4% on a per-location basis. Average unit retail (AUR) also slowed. As shown in the above chart, most of Ross’ traffic decline was from February. Incoming CEO James Conroy said, “Despite the slower start to the spring selling season in February, our monthly sales performance improved sharply month after month for the balance of the quarter.” Ross’s basket size increased due to more items. Additionally, the commentary suggested a relatively stable conversion rate. These metrics demonstrate good merchandise execution in a tougher environment. Burlington’s comp-sales slowed from +6% to flat; however, the +6% was an upside surprise to them, and so, to say that the business slowed by -600bps would be an overstatement. The 3-year comp CAGR was similar QoQ. Traffic per-adjusted-location increased +0.4%, and as shown in the chart, it led Ross and TJ Maxx in March, April, and May. CEO Mike O’Sullivan shared, “The quarter started off slowly, with the trend in February being negatively impacted by unfavorable weather and a slower pace of tax refunds versus last year. We were pleased that the sales trends picked up in the March and April period once these factors began to normalize…. We have analyzed our own internal sales data. This shows that the slowdown from Q4 to Q1 was broad-based across trade areas with different demographic characteristics. This is just one quarter, so it is too early to say if the slowdown that we saw in our trend from Q4 to Q1 is the start of a broader pullback in consumer spending.” On tariffs, O’Sullivan said, “The tariffs that were announced in early April were of a scope and a scale well beyond the expectations of most analysts. The initial effect of these tariffs was to effectively shut down the flow of merchandise from China. If that had continued, then it would have been bad for consumers and bad for retailers, and that includes off-price retailers. For the past two weeks since the tariffs on imports from China were cut from 145% to 30%, merchandise vendors have been scrambling to catch up. This stop-start surge volatility is likely to lead to shortages in some merchandise categories, but it might also create excess supply in others.” And so, when Q2 reports come in, in addition to traffic and visitors, Advan will be closely looking at conversion rates and UPTs to see which off-price brands were short.

LOGIN

LOGIN