As previewed , June retail sales increased at a slower pace than May, which itself was down from April’s; additionally, CPI showed the beginning of tariff costs being passed through to the consumer. Both were modest shifts, and so far in July, things have broadly firmed up, which we suspect is early back-to-school activity. This back-&-forth in momentum has been a persistent pattern since 2022, with seasonal periods picking up nicely (last Christmas was a blow-out holiday, for example) followed by broader and deeper troughs in between. That’s what we suspect was behind the dip in May and June.

Per June and the retail segments that outperformed, consumer electronics (+0.7%) benefited from the new Nintendo Switch. Building materials & garden supply (+0.2%) was also an improvement; for the segment we show June traffic as only modestly softer, which is what Census’ seasonally adjusted figures also show. The one segment that really stands out in the report is “miscellaneous store retailers” which was up +11.5% and stronger MoM by +230 bps. Driving that segment are two sub-segments, “gift, novelty, & souvenir stores” which increased +23% in May and “used merchandise stores” which increased +7.4% in May. We have to wait to July’s release to get these sub-segment details for June; however, given the +230bps acceleration for the entire segment, we expect the acceleration for these two sub-segments to be far greater. What’s driving that? Less Temu. See our analysis on this dynamic in our note on Five Below.

“Slowing” not “stalling” consumer spending is what we heard from bank executives in their earnings reports over the past two weeks. More importantly, what we saw in the reported figures was improving credit metrics and favorable loan growth. Looking forward, should middle-income+ households feel better about the economy in the months ahead, we should see that exhibit itself in stronger sales of big-ticket categories (home improvement?), with a drawdown on credit lines, and the return to a little bit of frivolity. The way we judge “frivolity” in spending is better sales for aspirational luxury brands (Coach, Gucci, Revolve, etc.) and a higher sales mix of better and best (positive mix).

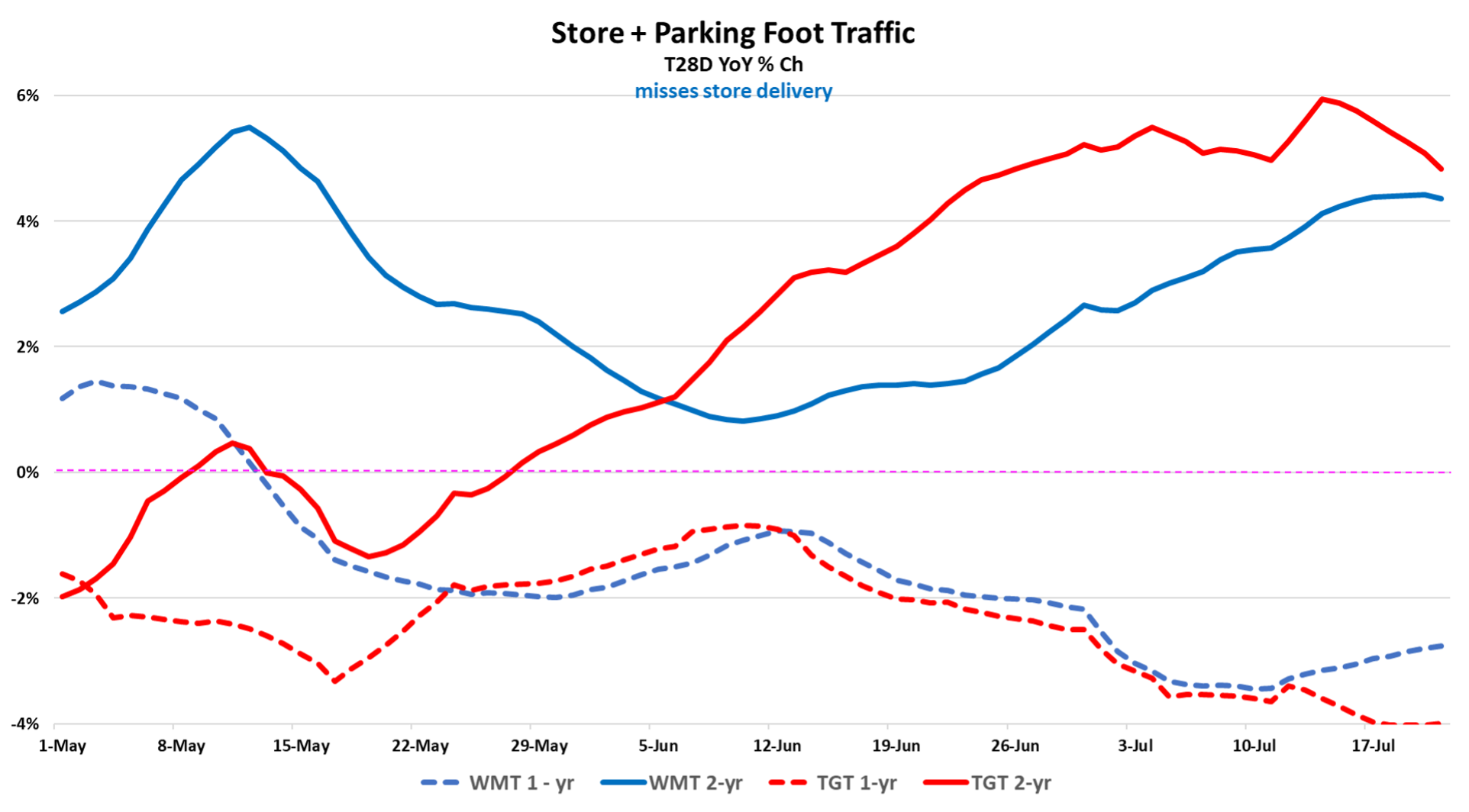

The tightening in bank lending standards that happened in late 2023 and the 1H’24 really impacted discretionary spending by the less-affluent. However, that too is starting to reverse, which will be a tailwind for the 2H and 2026. The CEO of Synchrony Financial, which serves the less-affluent, said on its earnings call, “We started to loosen up a little bit around the margin starting in the second quarter. I think there’s more we can do in the second half. But it does take time for those credit actions to kind of work their way into the growth metrics. So I would think about most of those things, including Walmart OnePay, Pay Later, some of those things, leaving into the balance sheet in the first half of 2026, so really benefiting full year ‘26. So it does take a little bit of time, but we are optimistic that not only do we have a good pipeline of growth opportunities, things that are launched and things that will be launched, but also the opportunity around opening up on credit. So we see plenty of positive dynamics as we think about 2026, but it will take a little bit of time to unfold.” Turning back to July’s traffic and spend data, the biggest improvement was in off-price brands, Kohl’s, Academy, Dick’s Sporting Goods, and Five Below – all names that are strongly associated with back-to-school. While foot traffic is softer for Walmart and Target, that’s largely the comparisons as demonstrated by the strengthening 2-year trend. (Additionally, Walmart would be 100 bps+ stronger per year when including store delivery.) Non back-to-categories like dollar stores, home improvement, and beauty were mixed so far in July. By contrast, used goods (NAICS #453310) and gifts, novelty, & souvenir (NAICS #453220) both strengthened, reflecting less-Temu. (Advan has visits data on over 700 NAICS codes.)

LOGIN

LOGIN