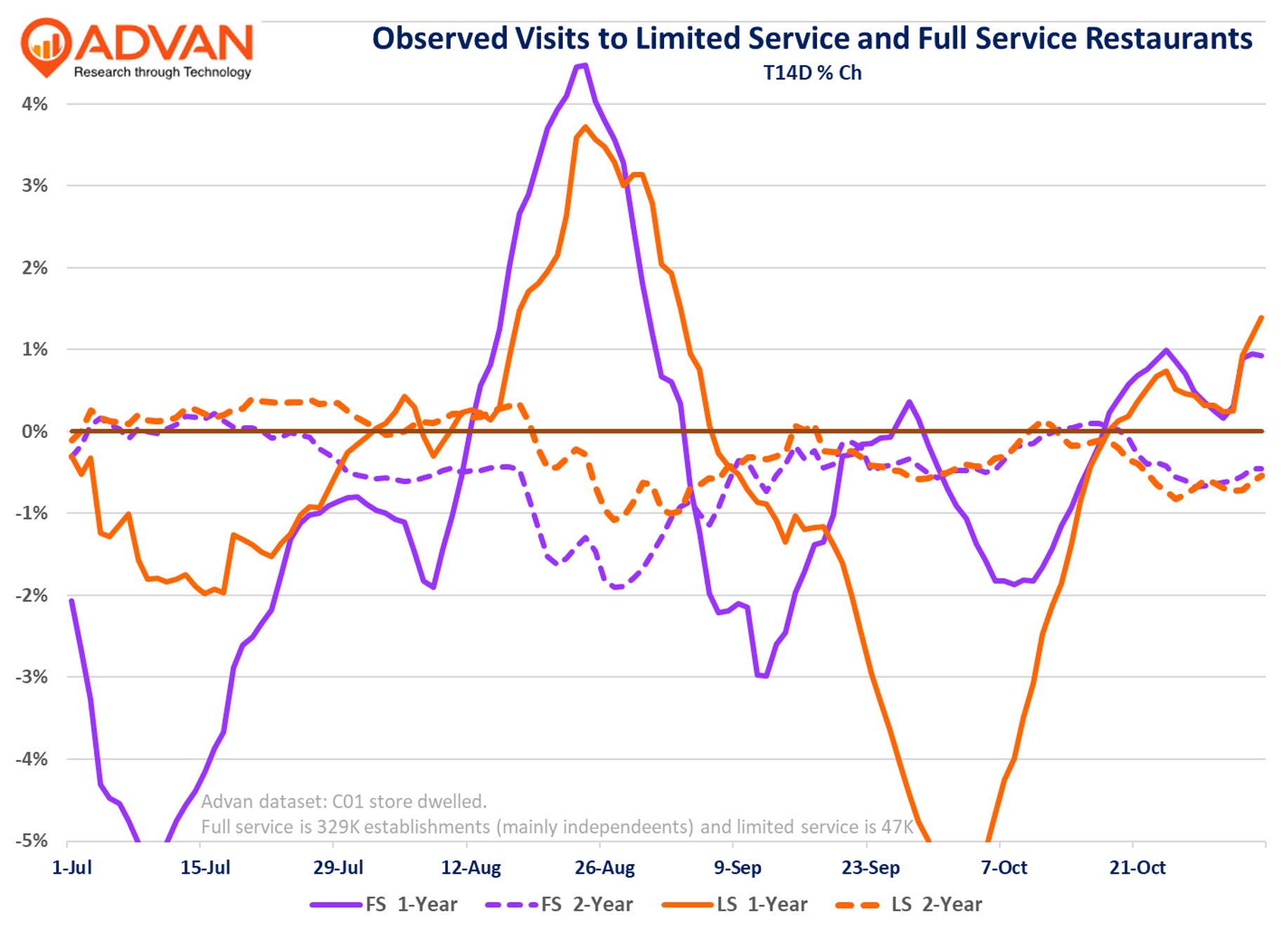

After a quarter of controversy on the pace of sales for limited-service operators, the results have spoken; comp-sales did not slow overall. As shown in our restaurant industry indexes, observed visits on a 2-year CAGR basis have largely been flat since July. The 1-year figures are boosted by activity resulting from Hurricane Erin, whereas the depression in September results from lapping Hurricane Helene.

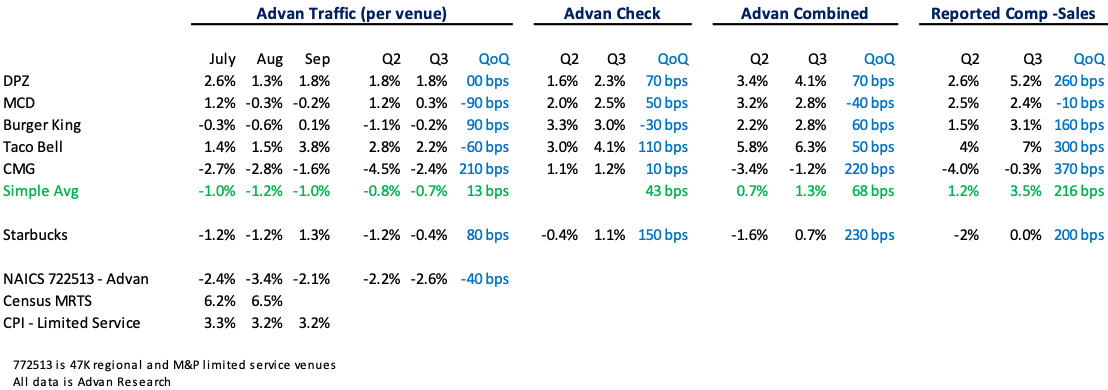

Also as a reminder, local / independents are taking traffic share, a topic of our story on Sysco’s earnings; industry peer Performance Food Group is experiencing the same trend with COO Scott McPherson saying, “Starting with Foodservice, the segment built upon its momentum by accelerating independent case growth compared to FQ4 and maintaining chain case growth in the low single digits… On an organic basis, Foodservice cases grew 5.1%, fueled by 6.3% organic independent case growth. Our chain business grew cases 4.4% in the quarter.” In other words, independents grew faster than chains. Moreover, management said that the trend was consistent throughout the quarter and that October was “very strong.” Next, the summary table of reported results for limited-service national brands shows that comp sales improved by +200bpys QoQ. Per Advan’s data, the acceleration was driven 2/3rds by average-check and 1/3rd by traffic. Others were pointing to a deterioration in traffic and sales, and that was not the case. Moreover, the table shows national brands, whereas the above chart is mostly independents; independents in full-service are outperforming which we wrote about in our analysis of Sysco / Chili’s results. And so again, no underlying slowdown.

However, this is not to imply that the environment is not without challenge, as one can see in the bottom-line results and management commentary. Brands such as Cava and Chipotle can’t pass the full extent of cost and expense inflation onto the consumer, leading to margin pressure. Moreover, both complained about younger consumers cutting trip frequency and weakness in traffic. These customers are trading down in lower-cost calories, be it QSR, prepared food, or home cooking; this is macro-related and cyclical. And this not just younger consumers, it’s the entire non-affluent population (<$100K in household income). Then there are the secular challenges to limited service, namely the very rapid take-up of GLP-1 drugs for weight loss (a frequent topic of ours and one that is sure to intensify as prices decline and formulations improve). And then there is the pseudo cyclical/secular – the eating/drinking trend of better for you AND too much unit expansion in limited-service, which establishment count growth ahead of demand. Yum Brands decision to sell Pizza Hut is kind of the culmination of all of these. For the quarter and near-term, to drive traffic, national brands are increasing limited time offers (LTO), loyalty promotions, and advertising.

Chipotle CEO Scott Boatwright: Earlier this year, as consumer sentiment declined sharply, we saw a broad-based pullback in frequency across all income cohorts. Since then, the gap has widened, with low- to middle-income guests further reducing frequency. We believe that this guest with household income below $100,000 represents about 40% of our total sales. And based on our data is dining out less often due to concerns about economy and inflation. A particularly challenged cohort is the 25- to 35-year-old age group. We believe that this trend is not unique to Chipotle and is occurring across all restaurants as well as many discretionary categories. This group is facing several headwinds including unemployment, increased student loan repayment and slower real wage growth. We tend to skew younger and slightly over-indexed to this group relative to the broader restaurant industry. Finally, the promotional environment has intensified with value as a price point and menu innovation escalating throughout the year. Chipotle CFO Adam Rymer: So towards the end of July and into August, we experienced a step down like we talked about in our prepared comments. And that was somewhere around the 200 to 300 basis point range. And then as Scott mentioned in his prepared comments, we increased spend on our media as well as our promotions that helped offset some of the softness that we were seeing, specifically in August and September. And we also saw a strong reaction when we launched Carne Asada and even Red Chimichurri in early October. However, during this whole time, the underlying transaction trend remained under pressure and in recent weeks it softened even further. So when you account for this recent trend as well as the ongoing uncertainty in the economy, the way that we’re kind of looking at Q4 is really with a much more conservative view. And right now, at this point, we expect comps in Q4 to decline somewhere in the low to mid-single-digit range. (This cadence is clear in Advan’s observed visits data.)

And then in terms of this mid-single-digit inflation that we alluded to, which is driven mostly by cost of sales, that number is much higher than what we have seen in the past. I mean, typically we’ve seen a low single-digit inflation of around 2%. And so that’s giving us some caution with the consumer environment to not go that high to offset that, like we typically have in the past, so we’ll be more patient with that over time.”

Performance Food Groups Scott McPherson: I think for the last year, you’ve seen some of these fast casual concepts, I’d call them the high flyers that we’re seeing double-digit same-store comps. They’ve kind of come back or normalized**. And we’ve also seen some others sprout up**. And I think really, right now, what we’re seeing is that value proposition is what’s really making the day for concepts. If they’ve got a really good value proposition that resonates, they’re seeing reasonable same-store sales comps.

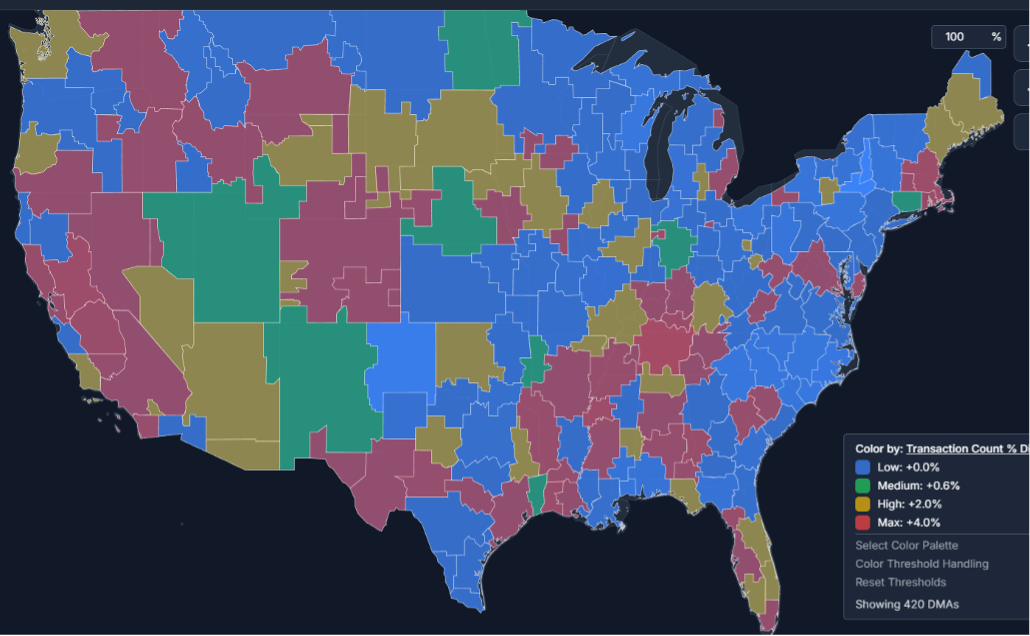

Performance’s CEO George Holm: But just to give you an idea where it’s slower and where it’s done better. the shutdown, of course, has affected our Virginia and Maryland company the most, and both of those were on extremely good growth rates going into that. Not much anywhere else. The international tourism, it’s been … the Upper New England area, where we’ve seen the total market slow. But actually, our companies there have been gaining significant share. So, it hasn’t had much of an impact on us. And of course, Florida and then Vegas has been affected quite a bit, and we do very little business in Vegas so that hasn’t had much impact. Where we’ve seen market slowness the most has been the Midwest, the upper Midwest. And we have markets there where we’re negative to last year and gaining share, which is a really unusual situation for us. So that’s how I would put it. But we don’t want to overdo this. I mean, we’re still running good independent growth. And if the – I think, if we didn’t have the shutdown and the slower business in a couple of markets, we would be just as we were in the first quarter. This characterization of regional trends is also clear in the graphic below. This is a heat map of where spending (transaction counts) is stronger (red) vs. weaker (blue), for our limited-service NAICS index for August. The northern border, the Midwest, and the Mid-Atlantic are generally all weaker. New York City, Connecticut, Florida, Colorado, Idaho, and the Sierra region are all doing better.

LOGIN

LOGIN