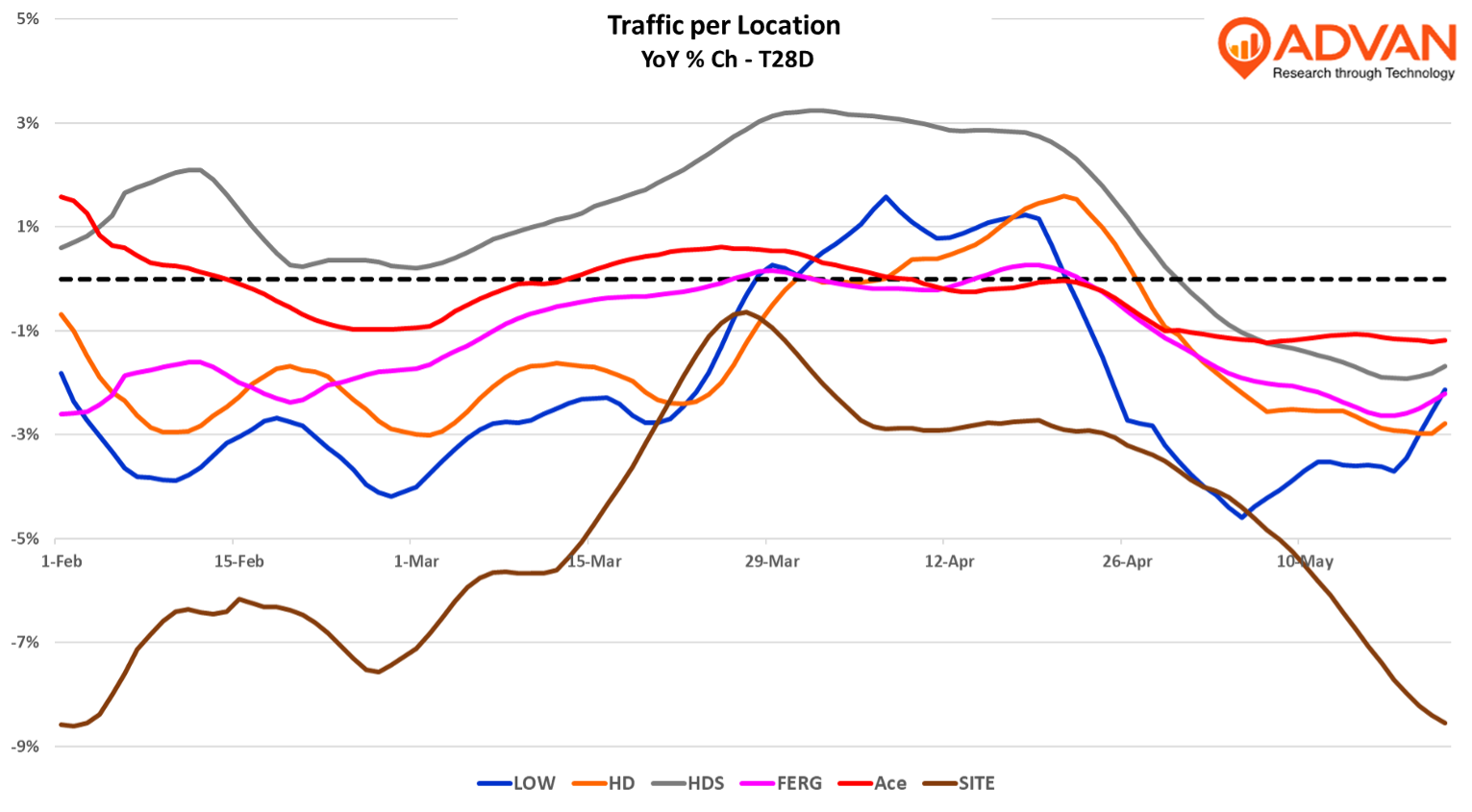

Lowe’s and Home Depot reported relatively stable results in what is a downbeat housing and home improvement market, as is shown by industry traffic in the chart below. Of note, both benefited from a pull-forward of larger ticket durable goods (appliances) ahead of any price increases resulting from tariffs; the other big-ticket categories like flooring, kitchen, and bath remain in a slump. Commercial building was the strongest end-market as demonstrated by Home Depot Supply (HDS) outperformance. Additionally, HDS competitor Ferguson reported +3% organic volume growth in the US for Q1. Ferguson also benefited from pull-forward as its HVAC sales increased by +17%. SiteOne (1/3 commercial maintenance,1/3 new construction, and 1/3 repair and upgrade) reported only flat organic volume growth, citing a later start to spring and softer repair and remodel end-markets. Ace Hardware reported a 1% decline in comp-transactions and flat comp-sales, but that was better than the small ticket-DIY business for Lowe’s (-3.4%) and Depot (down). Ace’s consumer proposition is slightly different being near-the-home, immediate-need fix-it supplies; that market is less cyclical and certainly not kitchen remodels and the like.

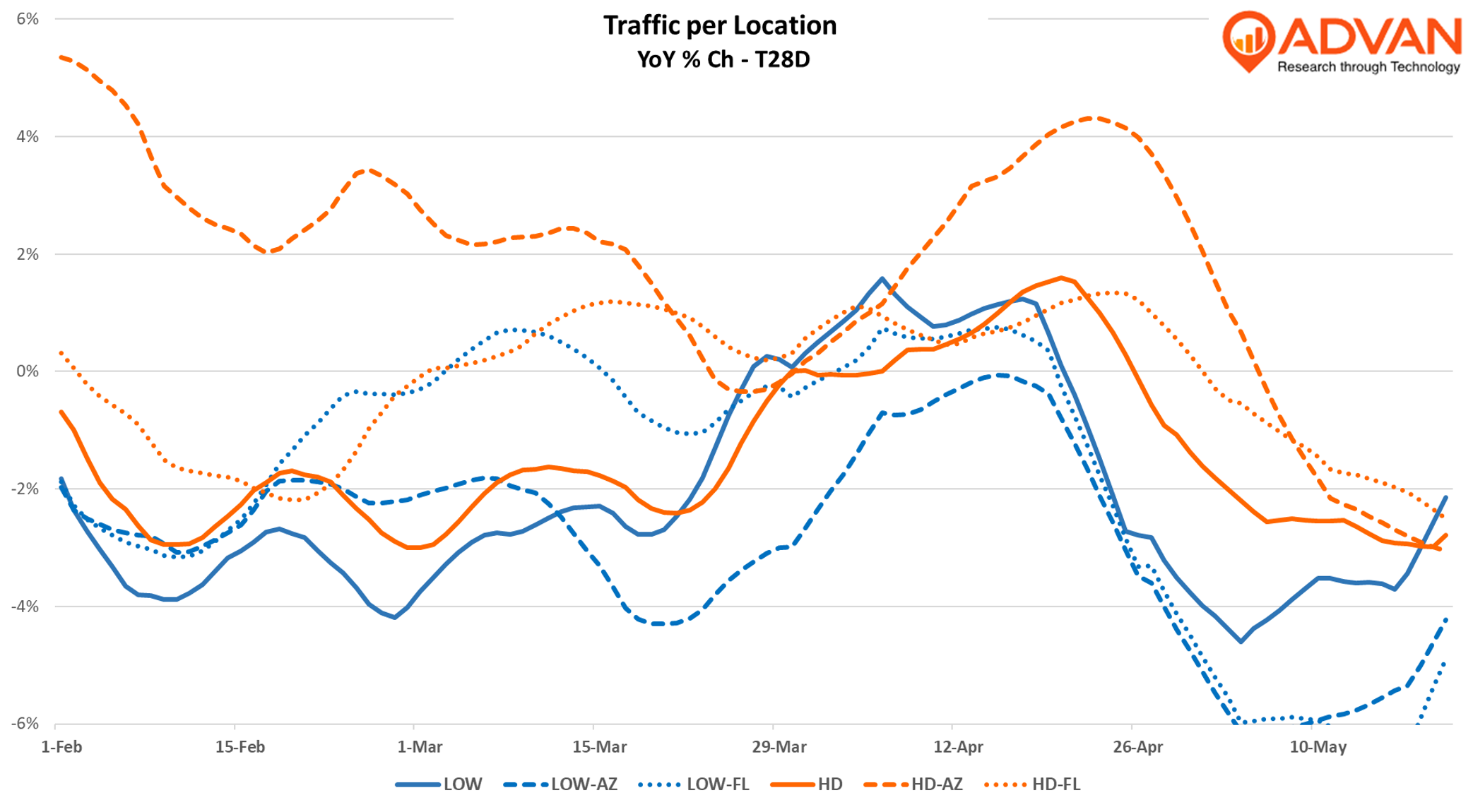

In describing the state of the home improvement consumer and big-ticket, Depot CEO Ted Decker said, “With interest rates and mortgage rates remaining stubbornly high, housing turnover has remained at decades-long lows and starts are flat. So you would think you’ve heard us talk before with so much home equity built up, our consumer has a job increasing wages, increases of home equity are up as much as 50% since the end of ‘19. Why haven’t we seen the larger remodeling cycle, particularly as people stay in their homes. And again, we’ve cited the increased engagement in Q4 of 2024 and how that continued into the first quarter of 2025. But we’ve yet to see that large project. The large project generally requires some sort of financing. And while there are literally trillions of dollars of equity available to be tapped in the homes, I think there’s still enough macro uncertainty. And again, those stubbornly high interest rates that – people are painting again and working in their yards and doing smaller projects but just have not engaged in the larger projects. Now obviously, we think that will increase. We cited last quarter that we’re now a net cumulative shortfall of about $50 billion of home improvement spend on housing. So we’re very much looking forward to it as much as you are when people tap their equity, gain the stronger macro confidence and engage in those bigger projects.” In the context of Lowe’s underperforming (-1.7% comp-sales) Depot (a +0.2% increase in the US), the chart below shows that Lowe’s traffic was generally behind Depot’s, save the March 21st to April 16th period when spring hit. For this time period when prompted, Google’s AI agent returned, “the US spring weather from March 21st to April 16th, 2025, was generally warmer than normal, especially in the South and Southeast. However, the Inland Northwest and parts of the West may have experienced below-average temperatures and above-average precipitation.” That’s a favorable pattern for Lowe’s over Depot given their respective footprints. Outside of that window, one can see that Depot’s Arizona and Florida markets far outperformed Lowe’s. Said differently, when spring came, it drove the two to similar levels of activity, outside of that window, Lowe’s business was “heavy” given its greater exposure to DIY (75% vs. 40%). The above note time period is also when there was a pull-forward in appliance sales. The Bureau of Economic Analysis Personal Expenditure report shows that real expenditure on major appliances increased +8.1% in March, up from February’s +3.9%. (The same happened with autos.) We expect to see another strong month for April when the statistics are released.

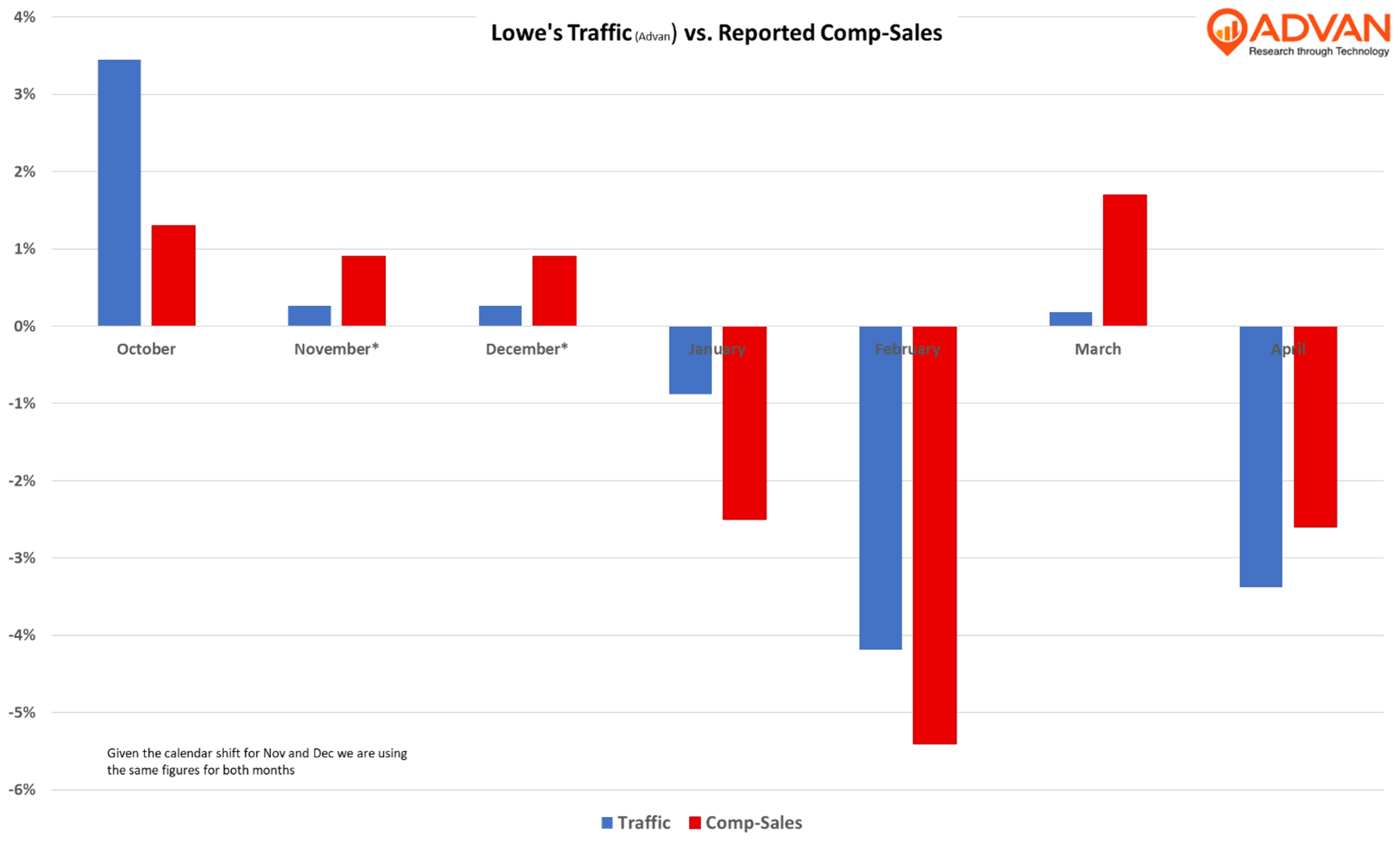

Lowe’s comp-transactions slowed by -250bps QoQ, right in line with traffic (-200bps) per Advan. March was the strongest month given the weather, the pull-forward, and Easter timing. Late April and early May were again hit by unseasonable cool and wet conditions, and the closure for Easter day. The quarter’s traffic decline reflects ongoing softness in the DIY customer, partly offset by strength in the Pro (+mid-single-digits). To spur the DIY business, Lowe’s started its loyalty program a year ago, and since then, 30M+ members have signed up and the cadence of member shopping events has quickened. For example, an amplified and extended “SpringFest at Lowe’s” promotional event helped drive a +6.2% YoY increase in shopper frequency during April (per Advan).

LOGIN

LOGIN