Luxury brands such as Louis Vuitton, Hermes, and Gucci remain symbols of status and exclusivity, drawing a loyal customer base that prioritizes quality and heritage over price. Over the past two years, these brands have navigated shifting consumer trends and global economic uncertainties. As we approach the end of 2024, year-over-year foot traffic data from Advan Research provides a clearer picture of how these iconic brands are performing.

## Year-Over-Year Monthly Foot Traffic Highlights

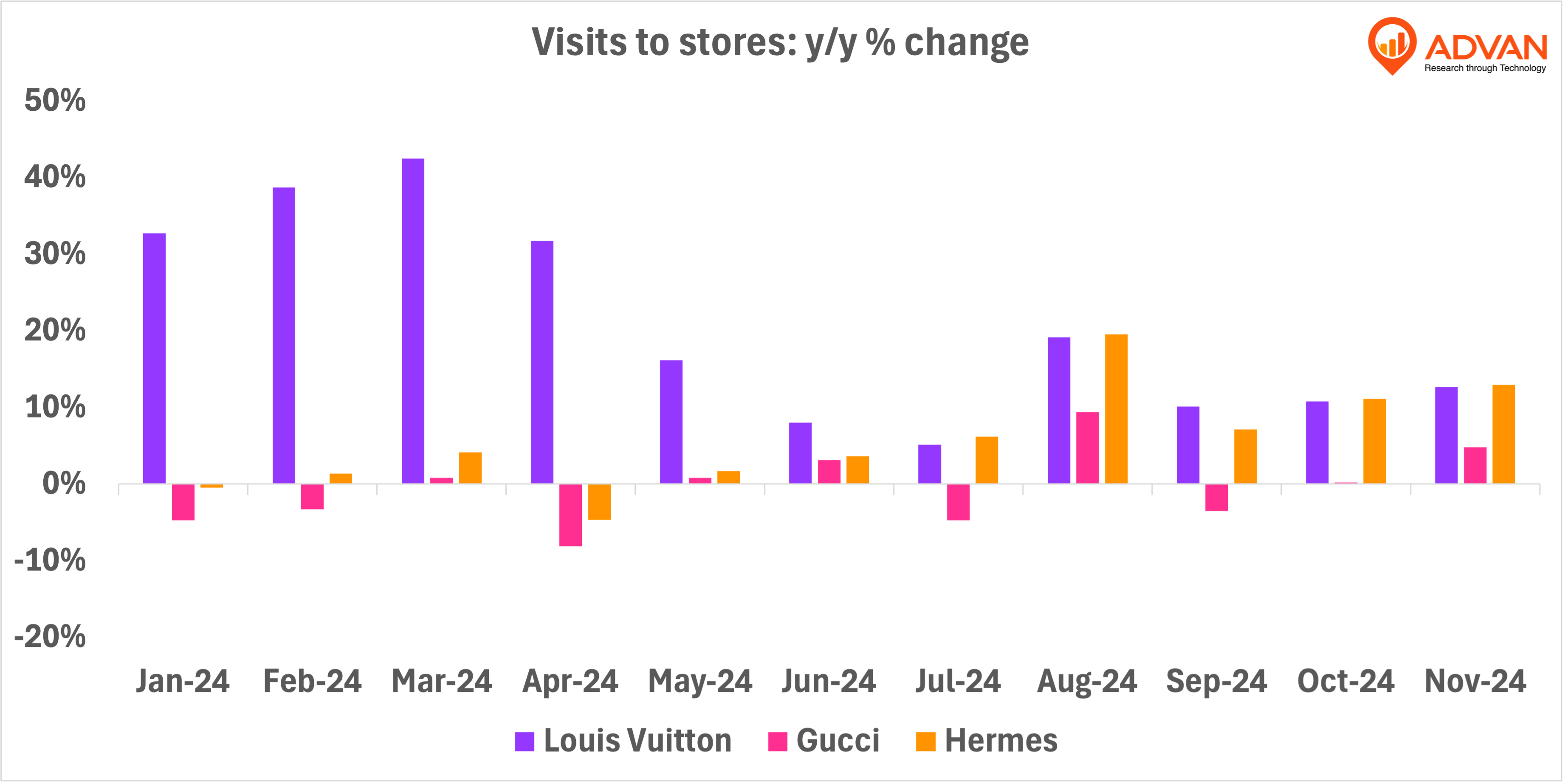

Q1-24 (Jan-Mar): Louis Vuitton posted exceptional year-over-year growth, with +32.7% in January, +38.7% in February, and +42.5% in March. This strong start to the year reflects the enduring appeal of the brand, boosted by robust post-holiday demand and successful marketing campaigns targeting affluent consumers. Hermes also showed steady growth in March (+4.15%), while Gucci’s performance remained mixed during this period.

August 2024: Louis Vuitton (+19.1%) and Hermes (+19.5%) saw notable year-over-year growth, reflecting a strong summer season bolstered by tourism and pre-holiday shopping. Gucci also posted a positive rebound (+9.4%), signaling a shift in consumer sentiment.

November 2024: As the holiday shopping season peaked, Hermes led with a 13% year-over-year increase in store visits. Louis Vuitton followed with a 12.7% increase, while Gucci achieved a 4.8% gain, an improvement after mixed performance earlier in the year.

These highlights underscore the resilience of the luxury market, with Hermes consistently outperforming its peers, while Louis Vuitton and Gucci displayed varying strengths throughout the year.

## Foot Traffic Growth Since September 2024

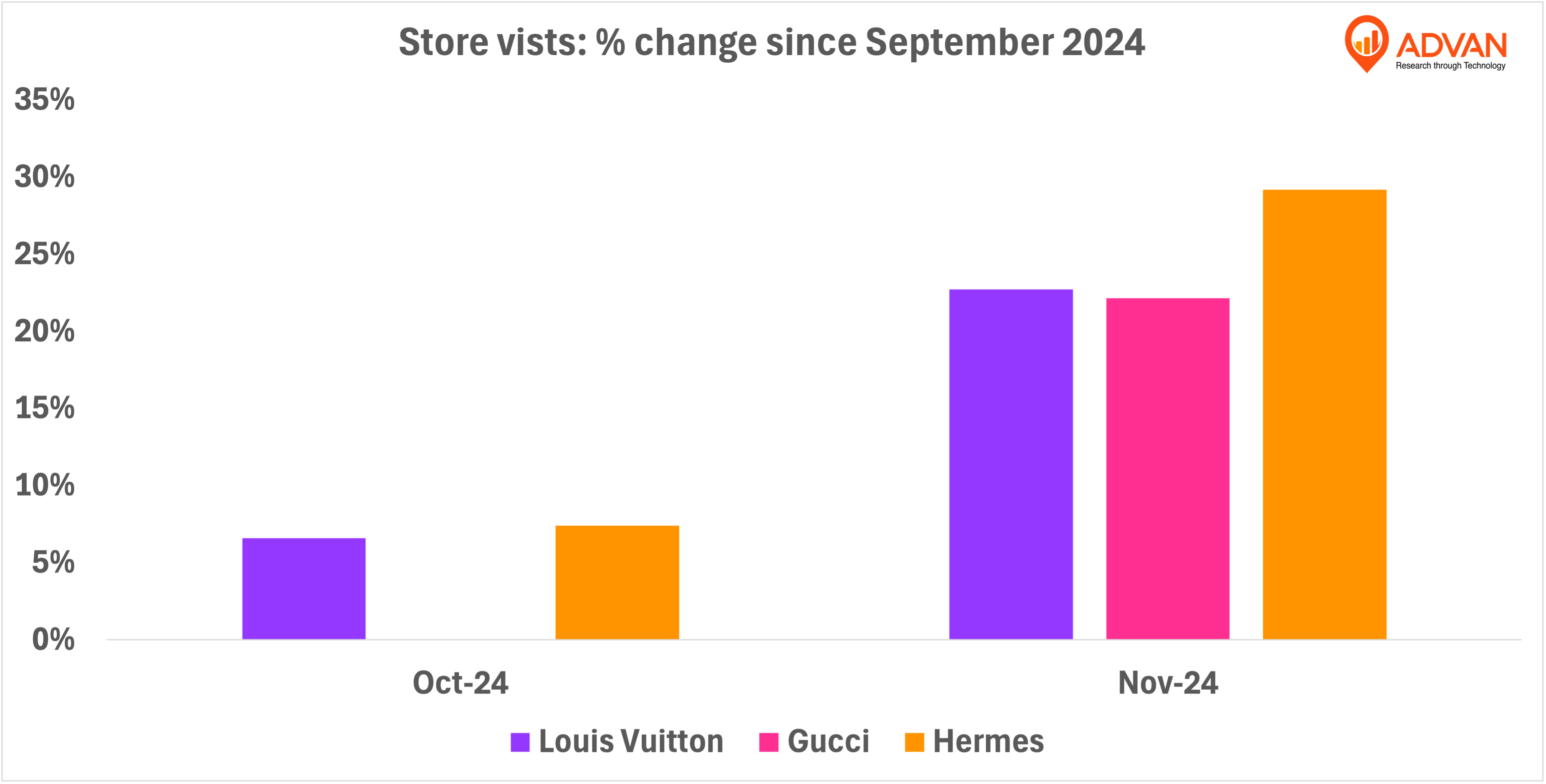

Advan’s data also reveals percentage changes in store visits since September 2024, reflecting momentum in the lead-up to the holiday season:

November Surge: Hermes saw the largest growth (+29%) since September, followed by Louis Vuitton (+23%) and Gucci (+22%). This significant uptick highlights the strength of holiday shopping demand for luxury brands, even without Black Friday promotions.

## Black Friday Insights

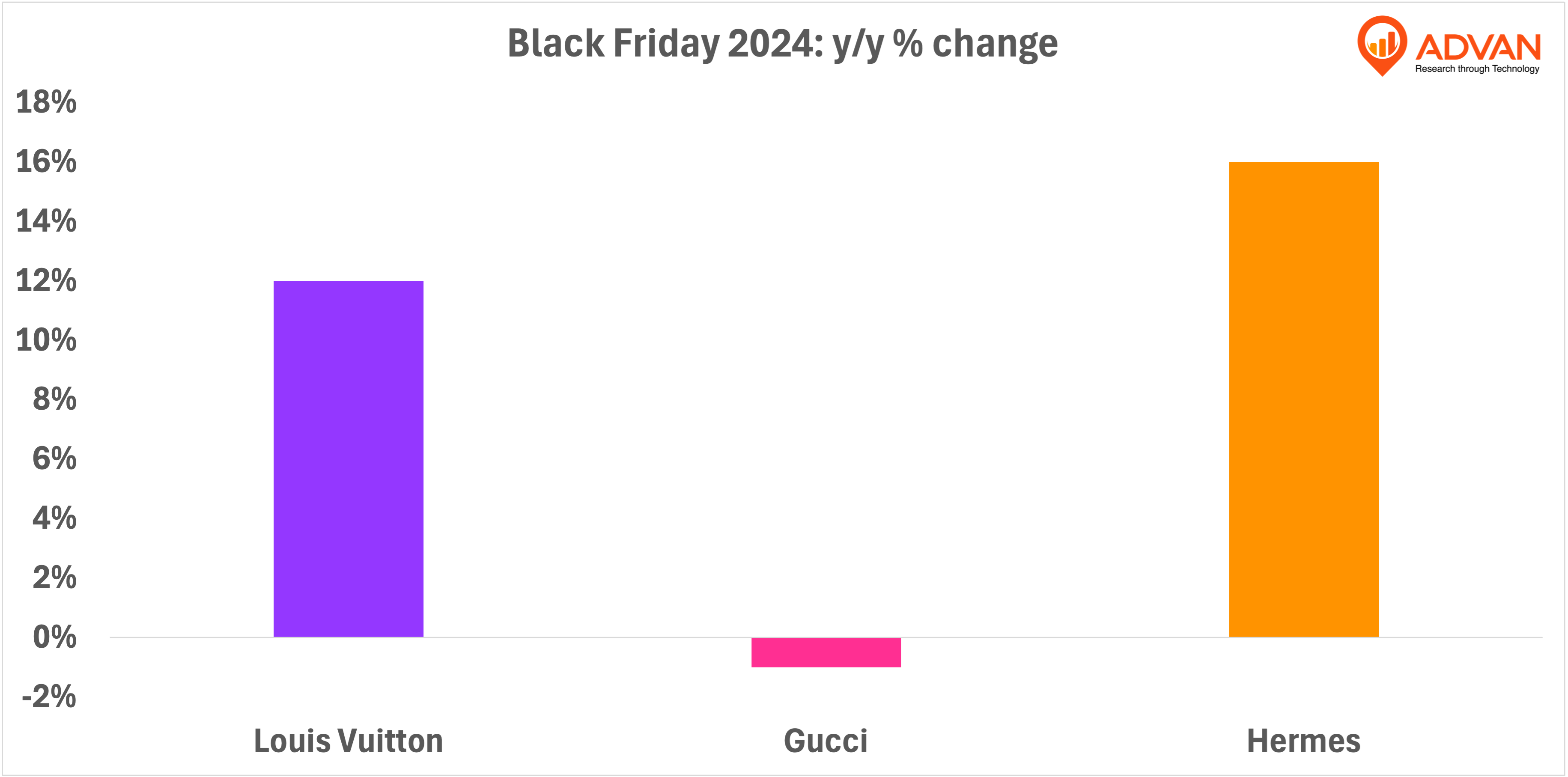

While luxury brands traditionally abstain from Black Friday discounts, the day remains a key indicator of consumer behavior. Year-over-year Black Friday foot traffic data reveals:

Hermes Leads Again: Hermes saw the highest year-over-year growth (+16%), driven by its exclusivity and brand equity.

Louis Vuitton Holds Strong: With a 12% increase, Louis Vuitton demonstrated its ability to draw consumers even without discounts.

Gucci Faces Challenges: A 1% decline highlights areas where Gucci may need to refine its strategies to better compete.

As 2024 draws to a close, Hermes, Louis Vuitton, and Gucci remain strong players in the luxury market. Hermes continues to set the pace, delivering impressive growth in both year-over-year and monthly foot traffic. Louis Vuitton maintains consistent performance, while Gucci shows signs of recovery despite some challenges. Advan’s data highlights how these brands thrive on distinction, heritage, and exceptional customer experiences proving that in the world of luxury, value is found not in discounts, but in the power of the brand.

LOGIN

LOGIN