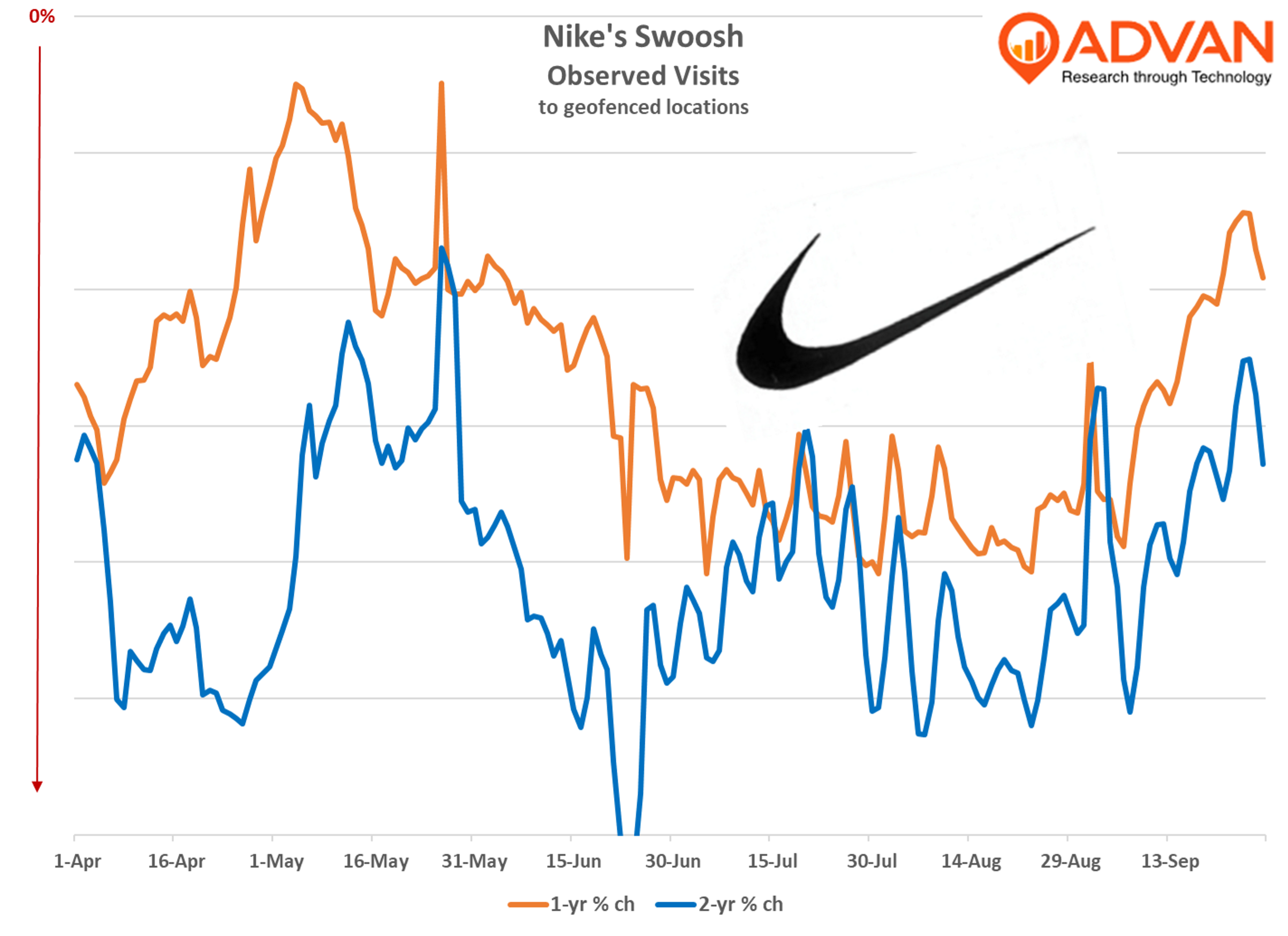

Turnarounds are messy and non-linear, and that’s clear in Nike’s store foot traffic, as shown. A lot of the traffic decline is centered on weaker consumer spending by the non-affluent, which especially hits Nike’s classic styles (Air Force 1, Air Jordan 1, and Dunk), and Nike’s ongoing challenges in athleisure sportswear, in what is a weaker category overall vs. its post-pandemic upsurge. However, in the foot traffic pattern we see a firming up occurring given the moderating volatility and the favorable direction of the “swoosh.” We also see evidence of that in the longer dwell time at the stores, which in August increased by +2.2% YoY.

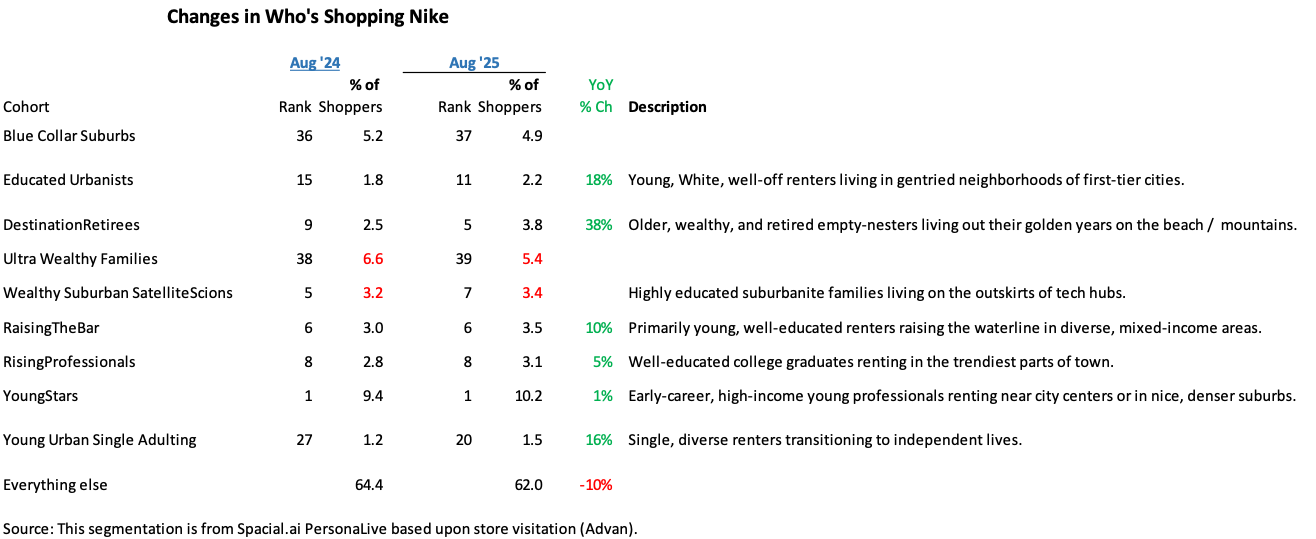

The following table demonstrates which psychographic consumer segments are trending favourably for Nike, and where the gains are is telling. The two segments experiencing declines Ulta-Wealthy Families and “Wealthy Suburban Scions” are not known as trend setters; they are trend followers that are late(ly) on OnRunning, HOKA, and New Balance, and not onto the new Nike, yet. By contrast, visitation by the trend setter cohorts are up double-digits. The young, well-off renters living in gentried neighbourhoods in first-tier cities went from Nike’s 15th (out of 80) most important segment to 11th. The athletic boomer – Destination Retirees, when from 9th to 5th. Young Urban Singles from 27th to 20th. Young Stars (early-career, high-income young professionals renting near city centers, or in nice, denser suburbs) remained #1 and outperformed substantially.

For Nike’s fiscal Q1 period (June – August) in its North America region, the 2-year trend for footwear sales improved by 400bps and the apparel, by 300bps. (We are using a 2-year analysis because last year, they withheld product flowing into the marketplace to clear excess inventories.) DTC sales improved by 700 bps (2-year) and wholesale slightly; as such, the most notable change in the business is the improvement at Nike’s stores (which was flat on a 1-year basis).

CEO Elliot Hill (now in the job for 11 months) said, “Our running business gives us an early window into the kind of impact we expect out of the Sport Offense (his named product/marketing turnaround plan, which was first directed on the running category given its market share losses to HOKA, OnRunning, etc). Our running team moved fastest into our new formation and was the first to get sharper on the insights of their athletes. It turns out, runners mostly want three things from the running shoes, big cushioning, stability, or an everyday shoe that returns energy. In response, we’ve moved with a sense of urgency and completely redesigned the Vomero, the Structure, and the Pegasus to solve for these three insights. Integrating our industry-leading innovation platforms like Nike Air, Flyknit, ZoomX and React X. Having a consistent structure of silos and price points allows us to introduce at least one new major running footwear style each season. Our running business continues to be a strong proof point of progress. We’re getting back to delivering a relentless flow of innovation that serves real athlete needs and we’re pulling it all the way through the marketplace in consumer-friendly ways. The early results have been positive, with** Nike running growing over 20% this quarter**. Our opportunity is to quickly seize the benefits of a Sport Offense and apply them to more sports and sport culture, including global football, basketball, training, and sportswear.”

On North America, CFO Matt Friend said, “North America is building momentum through sustained brand activity across sports, leveraging our leading portfolio of sports marketing assets. North America is furthest ahead in taking steps to elevate and transform the marketplace for future growth. Running, training and basketball each delivered double-digit growth. Sportswear grew in the quarter, but there is still work to do with momentum in apparel and looks of running footwear, while managing a -30% decline in our classic footwear franchises.” (The current quarter has much easier comparisons in classics, and so, the rate of decline should be less when results are reported in late December. From that point, the following two quarters should be lifted by the 2026 Olympics and World Cup.)

LOGIN

LOGIN